The Caribbean is home to several tax-friendly jurisdictions that attract individuals seeking to relocate to the Caribbean or enjoy tax residency benefits. Countries like The Bahamas, Cayman Islands, and St Kitts and Nevis offer zero or low personal income tax, capital gains tax, and wealth tax, making them ideal tax havens.

Through Caribbean citizenship through investment programs, foreign investors can obtain citizenship and legal residency tax-free islands in the Caribbean by purchasing approved real estate or making non-refundable contributions to a government fund. While tax residency rules vary, most require physical presence or a minimum stay requirement of at least 183 days to qualify.

What is a tax haven?

A tax haven refers to a jurisdiction or country that offers favorable tax benefits and financial incentives to individuals and businesses. Tax havens normally have low or no income tax, no estate or inheritance tax, minimal reporting requirements, and strict privacy laws attracting individuals and companies from other countries who want to minimize their tax liabilities.

Tax havens often provide offshore financial services, such as local and offshore banking, asset protection, and company formation, making them attractive for wealth management, international monetary or asset transfers, and tax planning purposes.

While legitimate reasons exist for utilizing pure tax havens, such as international business transactions, they have also been criticized for facilitating tax evasion, money laundering, and illicit financial activities. Investors should review their country’s tax regulations for definitions of tax avoidance and other illegal financial activities. However, some countries with no income tax or property tax align with international standards.

1. Cayman Islands

The Cayman Islands offers a variety of benefits to optimize Caribbean taxes that make it an attractive destination for expats and businesses and those who want to decrease their tax liability:

- There is no income tax imposed on income generated in the islands or foreign income, so residents can enjoy tax-free earnings.

- There are no capital gains taxes, inheritance taxes, or wealth taxes in the Cayman Islands, meaning people can keep more of their income and wealth.

- For businesses, the absence of corporate income tax and capital gains tax makes the Cayman Islands an appealing place for establishing offshore companies and conducting international business activities.

- Through a strong legal and financial infrastructure, these benefits on taxes contribute to the Cayman Islands’ reputation as a prominent offshore financial center.

2. Panama

Benefits on taxes in Panama:

- The country follows a territorial tax system, which means that only income earned within Panama by individuals living in the country or on and offshore Panamanian companies is subject to taxation.

- Foreign-source income is generally tax-exempt.

- Panama also offers various incentives for retirees, providing tax exemptions on various sources of income.

- There are no capital gains taxes, inheritance tax, or wealth tax >in Panama, making it a favorable environment for financial growth and wealth preservation.

- Panama has double tax treaties with key nations, including France, the UK, Ireland, and Portugal.

3. The Bahamas

- There are no income taxes, capital gains taxes, or inheritance taxes in the country, meaning residents and those with offshore accounts enjoy tax-free earnings and investment returns.

- There are no taxes on wealth or dividends, creating a favorable financial environment for tax residents.

4. British Virgin Islands

Benefits on taxes for those living in the British Virgin Islands include the following:

- Protect private wealth with no personal income or corporate tax, capital gains taxes, inheritance taxes, or wealth taxes.

- Residents can enjoy tax-free earnings, investment returns, and wealth accumulation.

- The country offers strict banking secrecy laws, attracting individuals seeking asset protection and wealth management opportunities.

5. Dominica

Dominica’s tax benefits are as follows:

- Only income earned within Dominica is subject to taxation.

- Dominica taxes do not include capital gains tax, inheritance tax, or wealth tax.

- Dominica offers attractive tax incentives for individuals who successfully apply for its citizenship by investment program.

- There is zero tax on interest earned in offshore bank accounts, and information about account holders is not shared with foreign tax authorities.

- There is no universal annual property tax on Dominica real estate.

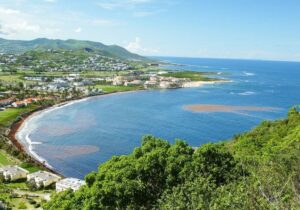

6. Saint Kitts and Nevis

Saint Kitts and Nevis offers some attractive benefits on taxes:

- Financial privacy at banks in St Kitts and Nevis by maintaining confidentiality regarding the owners and directors of offshore companies.

- Incorporating a company in Saint Kitts and Nevis requires only one director and one shareholder, allowing for a streamlined process.

- Saint Kitts and Nevis Trusts are not subjected to stamp duty on transactions.

- There are no local St Kitts taxes on income earned outside of Saint Kitts and Nevis.

- Offshore companies and their owners are exempt from withholding taxes, capital gains taxes, estate taxes, corporate taxes, payroll taxes, and local taxes on income generated outside of Saint Kitts and Nevis.

7. Anguilla

From water sports to exquisite cuisine, this idyllic place in the Caribbean is ideal for expats to unwind and indulge in pure tropical bliss, and investors need not worry about income or capital gains generated in the country or abroad.

Anguilla offers the following tax benefits:

- Protect private wealth with no personal income taxes, real estate taxes, capital gains taxes, or inheritance taxes.

- There are no wealth or property taxes.

8. Antigua and Barbuda

Antigua and Barbuda offers some enticing tax benefits for business owners:

- Barbudan businesses have the flexibility to conduct business both domestically and internationally.

- Individuals do not pay capital gains, inheritance, wealth, or gift taxes.

- The country’s offshore banking act does not require International Business Companies to pay taxes.

- Antigua and Barbuda trusts are not subjected to Antigua taxes like stamp duty on transactions or estate taxes.

9. Belize

Belize has some great tax benefits on offer and is one of many fantastic tax free Caribbean islands:

- Opportunities for offshore banking and the convenient establishment of offshore companies, trusts, and foundations.

- Offshore businesses incorporated in Belize enjoy tax exemptions on foreign income.

- Belize-incorporated companies and trusts are not required to pay stamp duty.

- Offshore bank accounts in Belize are not taxed on earned interest and are not subject to repatriation or capital gains taxes.

- The country’s banking legislation ensures strict confidentiality for offshore banking.

- Belize has established double tax treaties with CARICOM nations, the UK, and Switzerland.

10. Barbados

About Barbados’ tax benefits:

- Barbados is not considered a pure Caribbean tax haven.

- It is known for being a highly favorable tax environment for offshore corporations.

- Taxes on offshore company profits in Barbados typically range from 0 percent to 5.5 percent, with the tax rate decreasing as profits increase.

- Offshore companies are exempt from paying import duties on machinery and business equipment.

- It also offers the advantage of no withholding taxes or capital gains taxes.

- Barbados has established double taxation treaties with several countries, including Canada and the United States.

Caribbean Tax Haven Comparison Table

Country | Personal Income Tax | Corporate Taxes | Wealth, Inheritance, Capital Gains Tax | Annual Property Tax |

Cayman Islands | No | No | No | No |

Panama | Foreign Income (0 to 25 percent) | Foreign Income 25 percent) | No | 0 to 1 percent |

Antigua | No | Foreign income (25 percent) | No | 0.1 to 0.5 percent |

Bahamas | No | No - Foreign income (15 percent) | No | 0.625 to 1 percent (0 for properties valued up to $300,000) |

British Virgin Islands | No | No | No | No |

Dominica | Foreign Income (0 to 35 percent) | Foreign income (25 percent) | No | No (1.25 percent municipal tax for properties in Roseau and Canefield) |

St Kitts and Nevis | No | Foreign income (25 percent) | No | 0 to 0.75 percent |

Anguilla | No | No | No | No |

Costa Rica | Foreign income (0 to 25 percent) | Foreign income (5 to 30 percent) | Capital gains | 0.25 percent |

Belize | Foreign income (25 percent) | Foreign income (25 percent) | No | 0.75 to 1.5 percent |

Barbados | 0 to 28.5 percent | 0 to 5.5 percent | No | 0 to 0.75 percent |

Overview of Tax Residency in the Caribbean

The Caribbean is home to several tax-friendly jurisdictions that attract individuals seeking to relocate to the Caribbean or enjoy tax residency benefits. Countries like The Bahamas, Cayman Islands, and St Kitts and Nevis offer zero or low personal income tax, capital gains tax, and wealth tax, making them ideal tax havens.

Through Caribbean citizenship through investment programs, foreign investors can obtain citizenship and legal residency tax-free islands in the Caribbean by purchasing approved real estate or making non-refundable contributions to a government fund. While tax residency rules vary, most require physical presence or a minimum stay requirement of at least 183 days to qualify.

For expert guidance on relocation to the region, explore our comprehensive Caribbean Immigration Services designed to simplify visa and residency processes.

Why use Global Citizen Solutions?

Global Citizen Solutions is a multidisciplinary firm offering bespoke residence and citizenship solutions in Europe and the Caribbean. In a world where the economy and politics are unpredictable, having a second citizenship opens up opportunities and creates flexibility for you and your family.

So, why work with Global Citizen Solutions to obtain Caribbean citizenship?

- Global approach by local experts: We are corporate members of the Investment Migration Council, with local expertise in all five Caribbean CBI programs.

- 100 percent approval rate: We have never had a case rejected and will offer you an initial, free-of-charge, due diligence assessment before signing any contract.

- Independent service and full transparency: We will present to you all the investment options available, and all expenses will be discussed in advance, with no hidden fees.

- An all-encompassing solution: A multidisciplinary team of immigration lawyers, investment specialists, and tax experts will take into consideration all your and your family's mobility, tax, and lifestyle needs.

- Confidential service and secure data management: All private data is stored within a GDPR-compliant database on a secure SSL-encrypted server.

Frequently Asked Questions about the Tax Havens in the Caribbean

What Caribbean countries are tax havens?

Countries considered tax haven countries in the Caribbean include the Cayman Islands, Bahamas, British Virgin Islands, Dominica, Nevis, Anguilla, and Barbados.

Which Caribbean island has the lowest taxes?

The Caribbean island with the lowest taxes depends on tax structure and the individual’s financial activities. The Cayman Islands, the British Virgin Islands, and the Bahamas are often considered favorable tax environments with relatively low tax rates for certain entities.

Is the Bahamas a tax haven?

Yes, the Bahamas is considered a Caribbean tax haven due to its favorable tax regime, which includes no income taxes, no capital gains taxes, and no inheritance tax. It offers financial privacy and a range of offshore services, making it attractive to individuals and businesses seeking tax optimization and asset protection.

Is Turks and Caicos a tax haven?

The Turks and Caicos Islands has no income tax, no capital gains taxes, and no inheritance tax. It also offers opportunities for individuals and businesses to optimize their tax obligations and enjoy financial privacy. It’s therefore considered a Caribbean tax haven.

Is St Maarten a tax haven?

St Maarten is not a Caribbean tax haven as it imposes taxes on personal income, corporate profits, and capital gains.

Which Caribbean country has no inheritance tax?

Caribbean nations that do not require tax residents to pay taxes on inheritance include:

- Anguilla

- Antigua and Barbuda

- Turks and Caicos Islands

- Dominica

- Grenada

- Panama

- St Lucia

Are tax havens illegal?

Although criticized by some foreign governments and entities such as the Tax Justice Network, tax havens themselves are not inherently illegal. They are jurisdictions that impose low taxes or zero taxes. However, tax havens can sometimes be associated with illicit activities such as tax evasion, money laundering, and other financial crimes. It is up to the individual to comply with their country’s tax regulations, submit financial reports, and avoid allegations of tax abuse by providing accurate financial reports and tax returns.

Can US citizens benefit from Caribbean tax havens?

US citizens can benefit from tax havens in the Caribbean by establishing tax residency in a pure tax haven and utilizing tax reduction measures such as the Foreign Earned Income Exclusion (FEIE), Foreign Tax Credit (FTC), and double tax treaties between the US and Caribbean countries.

Which Caribbean island is tax free?

Tax-free Caribbean islands include:

- Cayman Islands

- Panama

- The Bahamas

- British Virgin Islands

- Dominica

- St. Kitts and Nevis

- Anguilla

- Costa Rica

- Belize

What are the potential risks and considerations for businesses operating in Caribbean tax havens?

International businesses operating in tax havens in the Caribbean benefit from low taxes, privacy, and business-friendly laws. However, they also face scrutiny as offshore financial organizations like the OECD and FATF continue to strengthen compliance measures and due diligence requirements.

What is the best tax haven in the Caribbean?

The Cayman Islands is widely regard as the best Caribbean tax haven. It’s the most famous tax-free country in the Caribbean and zero taxation is a strongly supported national policy.

Which Caribbean island has no taxes?

Caribbean islands with no taxes include the Turks and Caicos Islands, the Cayman Islands, the British Virgin Islands, the Bahamas, and Anguilla.

Which Caribbean island has no property tax?

Caribbean countries with no property tax include the Turks and Caicos Islands, the Cayman Islands, and the British Virgin Islands. Property owners can also avoid property tax in Dominica and the Bahamas, depending on the property’s location and its use.