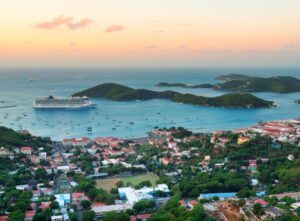

All the reasons to invest in the Caribbean emerge from the region’s outstanding record of economic and political stability, openness to international trade, favorable taxes, and appeal as a tourist destination. A strategic geographic location provides the perfect gateway to markets in North America, Central America, and South America, and its many thriving industries offer a wealth of profitable investment opportunities.

The Caribbean’s impressive 12.7 percent annual GDP growth rate from 2022 to 2023 is the highest among the 19 regions evaluated by the International Monetary Fund’s (IMF) World Economic Outlook for 2024. With access to the largest markets and a ready supply of skilled workers, international investors are increasingly looking at the best Caribbean investment opportunities.

This guide dive into the list of ten compelling reasons to invest in the Caribbean economy, covering:

Why invest in the Caribbean?

The Caribbean receives little media attention besides being a popular tourism destination, so the reasons to invest in business opportunities in the Caribbean are not as apparent as they are in other regions.

With an unmatched investment ecosystem driven by an optimal location, favorable taxes, and significant growth potential, the Caribbean offers an opportunity to lock in long-term profits and personal benefits like citizenship and asset protection.

1. Strategically Located

$270 billion in consumer goods and over 14,000 container ships pass through the Panama Canal annually, and the Caribbean islands are crucial anchorage points for ships to refuel, restock, and undergo repair.

Most Caribbean countries have international airports, and prominent airlines such as American Airlines, Lufthansa, British Airways, and Virgin Atlantic provide daily direct flights to Canada, the UK, the US, several European countries, and South America.

If you’re considering the best Caribbean islands to buy property, here’s a detailed guide to help you make the right choice.

2. Favorable Tax Environment

- Anguilla

- Antigua and Barbuda

- The Bahamas

- Bermuda

- British Virgin Islands

- Cayman Islands

- St Kitt and Nevis

- Turks and Caicos Islands

3. Openness to Trade

Many countries in the Caribbean have preferential access to the world’s largest markets, according to the World Bank Group’s most recent study. Regional Free Trade Agreements include:

- CARIFORUM-EU Economic Partnership Agreement, which grants preferential access to international Caribbean market and European markets

- Caribbean-Canada Trade Agreement (CARIBCAN)

- Caribbean Basin Initiative, which provides beneficiary Caribbean territories with duty-free access to US markets for most goods

- Dominican Republic-Central America FTA (CAFTA-DR), which facilitates increased trade and investment among five countries in Latin America, the Dominican Republic and the US

- CARICOM, which enables access to the 15 Caribbean markets at preferential rates

- Haitian Hemispheric Opportunity through Partnership Encouragement (HOPE)/Haiti Economic Lift Program (HELP), which grants access to the US market

Discover the benefits of a Caribbean bank for your financial security and global investments.

4. Modern Infrastructure

Telecommunications, broadband internet access, and, if necessary, natural gas supplies are easily accessible. Land and office space are available and cost-effective. World-renowned regional ports facilitate international trade and easy movement between most Caribbean countries.

Discover the benefits of Buying property in the Caribbean through our Citizenship by Investment program.

5. Economic and Political Stability

The Caribbean is known for its stable democracies, providing a secure location to capitalize on new investment opportunities. When evaluating European citizenship and Caribbean citizenship, according to the World Bank Group’s Political Stability and Absence of Violence/Terrorism report for 2022, the Cayman Islands ranked number one, and Aruba also ranked in the top ten above countries in the European Union.

6. Educated and Skilled Labor Supply

The Caribbean education system produces a highly skilled and knowledgeable labor supply who speak several key languages, including English, Spanish, and French. An additional advantage is the free movement agreement among members of the Organisation of Eastern Caribbean States (OECS) and the unrestricted movement of skilled labor across CARICOM nations through the CARICOM Skilled Workers Program (CSWP).

7. Diverse Investment Options

Caribbean real estate investment presents a prime opportunity for investors. Buyers can approved property developments like resorts, villas, and short-term accommodations tailored to the needs of the region’s growing tourism industry. Approved real estate projects include Nevis Peak Residences in St Kitts and Nevis, and Colibri Court Luxury Apartments in Antigua and Barbuda.

Various expanding industries, including renewable energy and sustainable development, mean diverse business investment opportunities in the Caribbean and profitable returns.

8. Obtain Citizenship by Investment

Each program allows foreign nationals from retirees to high-net-worth individuals to obtain Caribbean citizenship by contributing to the country’s economic growth through investments such as purchasing real estate, donations, or large or small business investments.

These nations recognize dual citizenship and provide the best opportunity for applicants to include family members in their citizenship applications. Investing in the Caribbean offers the added advantage of Caribbean citizenship by investment, providing you and your family with multiple citizenships alongside a profitable investment opportunity.

The Global Crypto-Friendly Nations Report, produced by Global Citizen Solutions’ Global Intelligence Unit, underlined the value of digital currencies and investor-friendly structures. Countries like St Kitts and Nevis, which now partially accept crypto assets to fund CBI, are positioning themselves as go-to destinations for investment.

9. Ease of Doing Business

Caribbean economies have carried out record reforms that make it easier for enterprises to do business. The Doing Business 2020 study by the World Bank Group revealed that these improvements were centered around starting a business, acquiring electricity, paying taxes, and enforcing contracts.

Regional agreements such as OECS and CARICOM enable starting a business in Caribbean country easily for Caribbean citizens in member states, alleviating the burden of substantial fees typically faced by foreign investors.

10. Responsive Investment Promotion Experts

The Caribbean Association of Investment Promotion Agencies has been recognized for its excellent websites and competent inquiry-handling services, making it a straightforward process to invest in Caribbean islands.

As you can see, there are many reasons (and opportunities) to invest in the West Indies. Whether you want to be a part of the Caribbean’s economic development, take advantage of the beneficial tax policies, or become a citizen, the right investment opportunity is waiting for you in the Caribbean.

Investment Opportunities in the Caribbean

Hi-tech agribusiness

Between 2003 and 2020, the Caribbean had 26 agribusiness projects, with foreign direct investment amounting to $919.1 million. There are great opportunities to leverage technology in high-growth, high-value agro-industries.

The Caribbean is a $369 billion market with 30 million citizens and 30 million affluent visitors annually. Strong local demand for agricultural products and tourist demand for specialty products like strawberries and mushrooms create diverse investor opportunities. 300 days of sunshine, various microclimates, and rich soil conditions mean the Caribbean is well-prepared for agribusiness growth.

Renewable energy

Sustainable energy investors can bring their projects to the Caribbean to meet their investment goals while helping to preserve one of the most beautiful regions on earth.

With 300 days of sunshine, the Caribbean’s solar insolation is significantly higher than that of some of the world’s largest solar power markets, like Germany. Wind and hydropower are other opportunities for renewable energy endeavors. For example, the region’s minimum proven hydropower potential of over 6,280 MW offers vast opportunities for production, interconnection, and international trade between member states and investors.

Citizenship by investment

Several Caribbean countries offer foreign investors and entrepreneurs the opportunity to gain Caribbean citizenship by investing in their economies. Investment opportunities include donating to state funds, purchasing approved property, and establishing businesses.

St Lucia offers the unique investment opportunity of acquiring government bonds, which are fully refundable after five years. Antigua and Barbuda provides attractive incentives, including a university scholarship for one family of investors who contribute to the University of the West Indies Fund.

The benefits of Investing in Caribbean citizenship extend beyond the financial returns of regular investments. They include a short timeline of as little as four months to obtain citizenship, the security of a plan B, and enhanced visa free travel.

Technology and support

These investments created over 43,600 local jobs, which the Caribbean can support given the region’s highly educated and multilingual workforce. After all, the Caribbean boasts 95 higher-education institutions that graduate over 80,000 students annually, with 38 percent graduating in social sciences and economics.

Itel, Xerox, Scotiabank, KPMG, Vistaprint, HGS, Teleperformance, and KM2 Solutions are just a few of the international corporations with outsourced business operations in the Caribbean, capitalizing on the Caribbean’s unique advantages, including:

- Over 200 delivery centers with more than 100,000 workers

- A 95 percent staff retention rate, making Caribbean BPO companies highly productive

- Local-cost BPO office space, which is 28 to 90 percent cheaper than in the US

- A strong fiber network connecting BPO companies across the Caribbean to their HQ and the world

Niche tourism

The Caribbean’s tourism industry attracts over 30 million visitors each year. Beautiful beaches, great food, outdoor activities, and a cultural affinity with the US, the UK, and Europe have made the Caribbean a top destination for families, honeymooners, world travelers, retirees, and others.

The market has moved beyond traditional vacation tourism to include niche tourism sectors like medical tourism, ecotourism, agrotourism, adventure tourism, and wellness tourism. These are great opportunities for investors to expand or establish new businesses in the Caribbean. Caribbean islands have European education standards, rapidly developing infrastructure, Caribbean hospitality, and sunshine.

Real estate and property development

Besides sales profit, governments often cut tax for properties used for tourism purposes, with one of the most common reductions being reduced value-added tax. Countries like St. Kitts and Nevis, Antigua and Barbuda, and the Dominican Republic are especially appealing, offering relatively low entry costs and simplified foreign ownership regulations.

Real estate developers can also collaborate with Caribbean countries like St Kitts and Nevis and Antigua and Barbuda to develop approved real estate projects for citizenship by investment. An approved project provides a steady flow of capital as its government endorsement enhances visibility and credibility.

Identifying the Best Caribbean Investment Opportunities

Market analysis: Research Caribbean countries to understand their economies, including political stability, growth potential, and critical industries.

Pinpoint key sectors: Focus on Caribbean sectors with high return potential, such as approved real estate, tourism, agriculture, renewable energy, and finance.

Regulatory environment: Evaluate each Caribbean country’s regulatory environment to ensure it is easy to remain compliant and mitigate risks.

Government incentives: Investigate government incentives, such as granting citizenship in exchange for foreign investment.

Local knowledge: Engage with local experts to consider their insights into relevant markets and the local business environment.

Risk assessment: Evaluate the risks associated with Caribbean investments, including natural disasters, currency fluctuations, changes in government policies, and external pressure from outside organizations and governments.

Seven Best Caribbean Islands to Invest in

Country | Unique Selling Point |

St Kitts and Nevis | Renowned for its citizenship by investment program, the world's oldest. Political stable with a growing tourism industry. |

The Bahamas | Just over 300 miles from the US mainland. Favored among American tourists and receives a lot of visitors annually. |

Antigua and Barbuda | Has the region’s most business-friendly policies. Investors can contribute to the country through business investments or fund donations to get second citizenship. |

Grenada | Strong economy and citizenship program to attract foreign investors. Investors can get citizenship and qualify for the US E-2 Visa program. |

The Cayman Islands | A tax haven providing unbeatable financial services. Individuals and legal entities pay zero income tax. |

Dominica | Budget-friendly investment options tob obtain cheapest Caribbean citizenship, through affordable real estate. The new Dominica International Airport project will boost the country’s economy. |

St Lucia | Investor-friendly policies and options to make business investments in tourism and gain Caribbean citizenship. |

How to Invest in the Caribbean

- Begin by researching the specific Caribbean country you’re interested in, consulting with local experts, including real estate agents, financial advisors, and legal professionals who understand the local market and regulations.

- Determine which Caribbean investment opportunity best aligns with your investment goals, whether it’s luxury resorts in the tourism sector or a unique opportunity in a sustainable energy project.

- When you’ve chosen a country and established which investment you’d like to make, consult local professionals in your chosen industry on the legal steps to make the investment.

- Obtain the necessary documentation or licenses to make the investment. This could be a business permit and company incorporation for business investments or applying for an Alien Landholding License (ALHL) for real estate investments.

One of the most straightforward ways to invest in Caribbean islands is through Authorized Agents for Caribbean citizenship by investment (CBI) countries. Agents licensed to provide Caribbean immigration services for CBI applicants streamline investment processes, providing universal expertise in local laws, regulations, and requirements for each country.

This assists with accessing authorized investments and navigating complex bureaucratic procedures from documentation and due diligence to government approvals.

Caribbean Statistics

Advanced education: 82.3 percent of the Caribbean’s workforce have received advanced higher education (World Bank 2020).

Affluent visitors: The Caribbean is the world’s second most popular travel destination among affluent individuals, with 30 million visiting the region each year (World Bank 2020).

Tourism GBP: The total GDP contribution of travel and tourism to the Caribbean was $62.7 billion in 2022 (Statista 2022).

Economic growth: The Caribbean’s finance market is expected to expand at an annual growth rate of 11.15 percent until 2027 (Statista 2022).

Challenges and Risks of Investing in the Caribbean

The Caribbean’s vulnerability to natural disasters such as hurricanes can cause significant infrastructure damage and economic disruption, especially in the tourism.

- While the Caribbean region’s territories offer incentives and stable economies, some are prone to political instability or abrupt changes in government policies, which could be detrimental to impact business operations.

- Economic dependence on tourism and agriculture exposes the region to such global recessions or shifts in demand.

- Bureaucratic process can be a headache in Caribbean nations and regulatory environments vary across the region, creating confusion with compliance and legal requirements.

- Though Caribbean markets are growing, most small compared to western countries, limiting scalability and economic diversity.

- The Caribbean is one of the strongest regions for tax incentives, but most tax-free Caribbean jurisdictions do not have double tax treaties with the USA, the UK, and other key economies, leading to protentional tax complications.

Frequently Asked Questions about Investing in the Caribbean

What are the main opportunities for investing in the Caribbean?

The best Caribbean investment opportunities are under the citizenship by investment programs. Investment options include donating to a government fund, buying real estate, purchasing government bonds, or making a business investment to qualify for a Caribbean passport.

What sectors offer the best investment prospects in the Caribbean?

According to the Caribbean Association of Investment Promotion Agencies, industries with opportunities for significant growth in the Caribbean include high-tech agribusiness, renewable energy, Caribbean property investment, niche tourism, technology, and business support, among other competitive sectors.

Are there any tax incentives for foreign investors in the Caribbean?

Caribbean countries offer a variety of tax incentives for individuals and companies. The best Caribbean island to invest in has special incentives, regimes, and policies aimed at attracting and retaining foreign investment in the country, including no income tax.

What is the greatest asset in most of the Caribbean islands?

With tourism being the Caribbean’s number one industry, Caribbean real estate can be considered the region’s number one asset.

Why are foreign businesses willing to invest in Caribbean islands?

The Caribbean region offers stable democracies, secure locations, and sustainable financial growth, which has encouraged many foreign businesses to invest in the Caribbean.

Which Caribbean island offers the best value for money?

Dominica offers the best value for money concerning investment in the Caribbean. The island is known for its affordable citizenship by investment program, providing an excellent opportunity for foreign investors to obtain a second passport at a low cost.

How stable are Caribbean economies for long-term investments?

Caribbean economies like the Cayman Islands, Barbados, and St Kitts and Nevis are stable options for long-term investments to their political stability and linear economic growth over the last two decades.

How do I invest in the Caribbean?

How you can invest in the Caribbean depends on the industry and country you want to invest in. For example, you can invest in Caribbean citizenship by submitting a citizenship application through an Authorized Agent licensed by the country’s program and making the necessary investing after receiving Approval in Principal. For real estate investments, you’ll need to apply for an Alien Landholding License, which typically costs five to ten percent of the property’s market value.

The Caribbean’s vulnerability to natural disasters such as hurricanes can cause significant infrastructure damage and economic disruption, especially in the tourism.

The Caribbean’s vulnerability to natural disasters such as hurricanes can cause significant infrastructure damage and economic disruption, especially in the tourism.