The Malta Citizenship by Naturalization for Exceptional Services by Direct Investment (CES or NESDI) program, also known as the Malta Citizenship by Investment scheme, offers a pathway for individuals and their families to acquire Maltese citizenship by making significant contributions to the country.

It is also often called the Maltese Exceptional Investor Naturalization (MEIN) program, which is designed to attract people who can help grow Malta’s economy and society.

Applicants must make contributions to the National Development and Social Fund, invest in property, and purchase government-approved financial instruments. The CES program also involves a comprehensive due diligence process, ensuring its credibility and security for obtaining citizenship in an EU member state.

In this guide, we’ll explore the Malta CES program, its benefits, and the various requirements for becoming a Maltese citizen.

- What is the Malta Citizenship by Investment program?

- Benefits of Malta Citizenship by Investment

- Investment Options for Malta MEIN

- Eligibility Requirements for the Maltese Exceptional Investor Naturalization (MEIN)

- Due Diligence Tiers and Seven Risk Categories

- Application Process for the Malta Citizenship by Investment (CES)

- What Are the Tax Implications of Malta Citizenship by Investment?

- Malta Citizenship by Naturalization Timeline

- Dual Citizenship Malta

- Alternative Route to Malta Citizenship by Investment

⚠️ ECJ Ruled Against Malta's Exceptional Investor Naturalisation (MEIN)

On April 29, the European Court of Justice (ECJ) ruled against Malta’s Exceptional Investor Naturalisation (MEIN) program.

The commission argued that citizenship should be based on more than just financial reasons and that there must be a genuine connection between the applicant and the EU member state.

Malta defended its program by arguing that granting citizenship is a national decision, which is supported under international law and the Treaty of the European Union.

What does this mean for the Malta Citizenship by Investment Program?

There is no information on what will happen with ongoing or future applications.

As soon as new details are available, more updates will be provided. For more details, read our article on the ECJ ruling against Malta’s MEIN program.

What is the Malta Citizenship by Investment program?

The program was updated in 2020, replacing the previous Malta Citizenship by Investment initiative with the Malta Citizenship by Naturalization for Exceptional Services by Direct Investment (CES or NESDI) program, also known as the Maltese Exceptional Investor Naturalization (MEIN).

Following the ECJ ruling against Malta’s MEIN program, Laura Madrid,Global Intelligence Unit lead at Global Citizen Solutions, offered insight into the economic impact of investment migration. “Citizenship is changing in today’s global world. Well-managed CBI programs can attract foreign investment and support economic growth, especially when there’s a real connection between the investor and the country. In 2022, these programs brought in over €20 billion worldwide, according to the OECD,” said Madrid.

Furthermore, while the ECJ’s decision raises important questions about citizenship in the EU, Patricia Casaburi, CEO of Global Citizen Solutions, emphasized that the European Commission still holds a responsibility to both Malta and the applicants of its Citizenship by Investment program.

“With the uncertainty around the MEIN program, protecting legal certainty and individual rights is crucial. People who applied in good faith should not be harmed. Without safeguards like transition plans, fair reviews, and the right to be heard, the EU risks violating its own Charter of Fundamental Rights and losing public trust,” added Casaburi.

Benefits of Malta Citizenship by Investment

- Freedom of Movement: With a Malta passport by investment, you gain full access to live, work, and do business across the EU and Schengen Zone, which also allows visa-free travel to multiple countries.

- Visa-Free Travel: A Malta passport grants visa-free access to 188 countries worldwide.

- Dual Citizenship: Malta’s investment citizenship program allows you to obtain dual citizenship and a European passport, provided you maintain residence in Malta.

- Family Passports: Your family members can also acquire Malta investment citizenship, allowing them to work and study within the EU. Your children born after you obtain citizenship will automatically gain it.

- Tax Efficiency: Malta offers favorable tax schemes for new citizens, including no tax on global income and assets, with a reduced 15% tax on income brought into Malta or a minimum of €15,000 for money brought into Malta.

- Stability and Security: Malta is a stable, safe country with one of Europe’s highest GDPs per capita and low unemployment rates.

- Quality of Life: Malta offers a beautiful Mediterranean climate, rich history, modern infrastructure, and excellent healthcare, making it a great place for family life.

- Access to Healthcare: Malta’s top-rated healthcare system is accessible to residents, offering comprehensive medical services, including hospitalization and specialist treatments.

- LGBTQ Friendly: Malta is one of the most LGBTQ-friendly countries, ranking first in Europe for LGBTQ rights and creating a safe, inclusive environment.

Investment Options for Malta MEIN

A Direct, non-refundable investment

An exceptional direct investment of a minimum value of €600,000 or €750,000 for the main applicant, depending on the residence period selected: 12 or 36 months (an extra €50,000 fee is required for each dependent).

Real estate investment

A lease for residential real estate for a minimum annual rent value of €16,000 per year for a period of five years or the purchase of real estate for a minimum value of €700,000 that must be kept for at least five years.

Philanthropic donation

A donation of €10,000 to a registered sport, cultural, scientific, philanthropic, welfare of animals, or artistic non-governmental organization or society as approved by the Community Malta Agency (CMA).

Eligibility Requirements for the Maltese Exceptional Investor Naturalization (MEIN)

- Applicants must be at least 18 years old.

- They must have global health insurance coverage of at least €50,000, be in good health, and not suffer from any contagious diseases.

- Applicants and their dependents must pass stringent due diligence checks to ensure they do not pose any risk to Malta’s national security or public policy.

- Not have been previously denied a visa to a country that has a visa waiver agreement with Malta

- Not be deemed a national security risk or a reputation risk

- Not be under a criminal investigation

- Not hold the following nationalities or be a non-national but reside, do business, or have significant ties or connections to the following countries: Afghanistan, Belarus, Democratic Republic of Congo, Iran, North Korea, Russia, Yemen,

- Not be a citizen from a country that’s on the US travel ban list.

Who qualifies as a dependent?

- Spouse

- Partners (recognized as a civil union/partnership in the country of application)

- Children under the age of 18

- Children aged between 18 – 29 who are unmarried and financially dependent on their parents (full-time education is a bonus, but not a strict requirement)

- Dependent parents and grandparents aged over 55

Due diligence

Each application undergoes a strict four-tier due diligence process by the Community Malta Agency (CMA). This process includes thorough background checks on the applicant’s character, source of funds, and other key factors. Applicants are also assessed across seven risk categories to ensure only top-quality candidates are approved.

Due Diligence Tiers and Seven Risk Categories

As mentioned, Malta has a strict due diligence process for every citizenship by investment application. This helps ensure that only trustworthy and qualified people are approved. For investors, this means greater security and confidence that their citizenship is respected worldwide and part of a safe and reliable program.

1. Initial Background Screening (Tier 1)

The agent checks the applicant’s identity, source of funds, and wealth. They look for criminal records, sanctions, or Politically Exposed Person (PEP) status. The agent ensures the application is complete before sending it to the CMA.

2. Government Checks (Tier 2)

The CMA verifies identity through international databases. They check sanctions lists and PEP databases, review financial records, and confirm the legitimacy of wealth. They also check for legal issues and links to high-risk countries.

3. International Due Diligence (Tier 3)

External firms carry out in-depth checks and visit the applicant’s home country. They interview business partners, assess their reputations, and verify assets and income sources. Any negative findings are reviewed for risks.

4. Final Government Review (Tier 4)

The CMA reviews all findings and rates the applicant on legal, financial, security, and reputation risks. The Minister makes the final decision. If everything is clear, the applicant gets a Letter of Approval to proceed with investment and residency.

Seven risk categories

Risk Category | Description |

1. Identity Risk | The applicant’s identity documents are checked for authenticity. It looks for fake identities, multiple passports, or name changes that could hide information. Nationality claims and personal details are also verified. |

2. Background Risk | The applicant’s criminal record, legal history, and connections to risky people or countries are reviewed to assess any security or reputational risks to Malta. |

3. Reputation Risk | The applicant’s community and industry reputation are checked. Media reports and online presence are reviewed for negative news or involvement in corruption, fraud, or money laundering. |

4. Source of Funds and Wealth Risk | The applicant’s wealth is verified to ensure it comes from legal sources. Financial records are checked to ensure investment money is lawfully obtained and not linked to illegal activities. |

5. Business Affiliations Risk | The applicant’s business interests are analyzed, including company ownership and past directorships. Links to risky countries or companies facing legal issues are checked. |

6. Political Exposure Risk | The applicant is checked for being a politically exposed person (PEP) or having ties to one. The risk of corruption or misuse of power is assessed, especially for applicants from unstable regions. |

7. Legal and Regulatory Compliance Risk | The applicant’s compliance with global laws, such as anti-money laundering and counter-terrorism rules, is confirmed. Their legal status in all countries of residence and business is also verified. |

Application Process for the Malta Citizenship by Investment (CES)

The process of obtaining Maltese Citizenship by Naturalization through Exceptional Services is broken up into four primary stages:

1. Residency

The main applicant, along with any dependents included in the application, must first apply for a Maltese residence card to gain a residency permit in Malta. To get the residence card, they must first pass the Community Malta Agency due diligence check.

Applicants need an address in Malta separate from the CES program’s lease requirement. GCS can help find a property for lease, costing around €9,000. Processing time takes 30-45 days. Once approved, a temporary residence card with 36-month validity is issued (regardless of the residency period of choice.) Applicants must visit Malta to submit biometric data and make the following payments.

- €10,000 for the Malta residence permit to secure your residency (deducted from the government contribution investment amount).

- Government residency application fees – €5,000 ($5,300) for the main applicant and €1,000 ($1,070) per dependent

- Residency card fees – €27.50 ($29.30) per applicant

2. Eligibility for citizenship

To prevent revocation, the application must be submitted to the Community Malta Agency within 12 months or 36 months of receiving the residency card. The Agency will perform due diligence and apply to the Minister for approval.

Applications take around 8 months to process. If eligible, applicants receive a Letter of Approval in Principle, allowing them to apply for citizenship at the end of their residency period (12 or 36 months).

Fee Type | Details | Amount | |

Due diligence fees | Main applicant | €15,000 | |

Benefactor (if applicable) | €15,000 | ||

Dependent (aged 12 and above) | Per dependent | €10,000 | |

Admin fees | Citizenship eligibility application | Per applicant | €1,000 |

Citizenship eligibility approval in principle | Per applicant | €500 | |

Balance of Exceptional Direct Investment | Main applicant | €740,000 | |

Real estate investment | Purchase price | €700,000 | |

Annual rental €16,000 | €700,000 | ||

Donation | €10,000 | ||

3. Citizenship

The applicant can apply for citizenship after completing 12 or 36 months of residency (depending on the choice). The Community Malta Agency (CMA) checks the due diligence and submits the results to the Minister. Once approved, citizenship is granted.

The citizenship process takes about six to eight months from approval to complete, and the Exceptional Investment, real estate purchase/lease, and donation must be completed before moving to Stage 4.

Stage 4: Naturalization

Once all requirements are met, the main applicant and their dependents must take the Oath of Allegiance in Malta within six months of receiving the Letter of Approval in Principle. After taking the oath, they will receive Maltese citizenship, a passport, and a Certificate of Naturalization. Their names will also be published in the Government Gazette. It is recommended that applicants spend 14-21 days in Malta during this process.

Once your Malta residency visa is approved, you’ll receive a 36-month residence card. To keep citizenship, live in Malta for at least five years after receiving the citizenship certificate.

What Are the Tax Implications of Malta Citizenship by Investment?

Malta’s tax system is based on residency, not citizenship. This means you may not need to pay tax in Malta even if you become a citizen. The country offers special tax schemes for new residents, which can provide significant tax benefits. To become a tax resident of Malta, you must spend at least 183 days in the country per year.

Malta Tax Rates:

- Personal Tax: Up to 35%

- Corporate Tax: 35% (but exemptions can reduce this to as low as 5%)

- Capital Gains Tax: 15% to 35%

Non-Dom Status:

There is no tax on global income or assets. If you bring money into Malta, it is taxed at a reduced rate of 15% (or a minimum of €15,000 / $16,000). Additionally, Malta does not have an inheritance tax and is considered very crypto-friendly. For example, long-term crypto capital gains are not taxed, and crypto transactions are exempt from VAT.

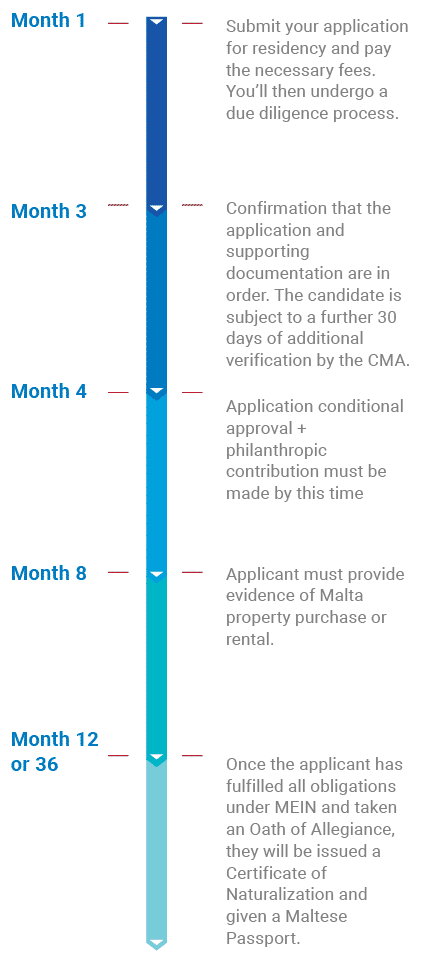

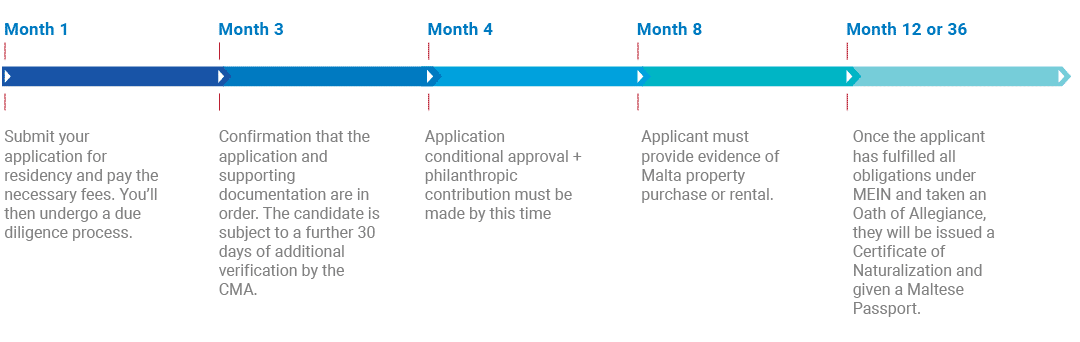

Malta Citizenship by Naturalization Timeline

Dual Citizenship Malta

Malta allows dual citizenship and has recognized it since February 10, 2000. This means individuals who acquire Maltese citizenship can retain their original nationality without having to renounce it.

The Maltese passport is one of the strongest in the world, ranking 34th on the Global Citizen Solutions Passport Index, and offers visa-free access to over 188 countries, including the United States, Canada, the United Kingdom, Hong Kong, Australia, New Zealand, Japan, and South Korea, among others.

Additionally, Malta has two official languages, Maltese and English, and there are no language requirements for applying for Maltese citizenship. This makes Malta an attractive option for those interested in a second passport, European Union residency, and enhanced global mobility.

Alternative Route to Malta Citizenship by Investment

If you are still deciding whether to commit to the Malta citizenship by investment application, Malta happens to run a Permanent Residence Program, too. The Malta Permanent Residency Program (MPRP) provides permanent residency status to foreign investors for a lower qualifying investment. Permanent residency is based on three qualifying investments and can be acquired by:

- A property purchase worth at least €375,000 or leasing a property with an annual rental agreement of €14,000.

- Making a government contribution of €30,000 if buying or €60,000 if leasing or renting a property in Malta

- Making a charitable donation worth €2,000 to an NGO registered in Malta.

Qualifying applicants can obtain permanent residence permits with no minimum stay requirements through the Malta residence permit program. The Malta Permanent Residency by Investment Program has many benefits, from residing in a country with a high quality of life and stunning climate to enjoying significant tax advantages.

As part of our commitment to providing transparent and reliable services, we are proud to be a licensed agent in Malta, holding the official license number AKM-AGEN. This certification demonstrates our dedication to the highest standards in the investment migration industry and further enhances our ability to offer expert guidance and support to our clients.

How Can Global Citizen Solutions Help You?

Global Citizen Solutions is a boutique migration consultancy firm with years of experience delivering bespoke residence and citizenship by investment solutions for international families. With offices worldwide and an experienced, hands-on team, we have helped hundreds of clients worldwide acquire citizenship, residence visas, or homes while diversifying their portfolios with robust investments.

We guide you from start to finish, taking you beyond your citizenship or residency by investment application.

Frequently Asked Questions about Malta Citizenship by Investment

What is Malta Citizenship by Investment?

Malta Citizenship by Investment, also known as Malta’s Exceptional Investor Naturalisation Program (MEIN), is a program that allows individuals to obtain Maltese citizenship through significant financial contributions. Applicants must invest in the country, including a donation to the National Development and Social Fund, real estate, and government bonds. It offers a fast track to citizenship for those meeting specific residency and investment requirements.

Is Malta dual citizenship allowed?

Yes, Malta allows dual citizenship. However, it requires individuals to demonstrate strong ties to the country, such as through residency or significant investment. Malta’s citizenship by naturalization program allows for dual citizenship, provided the applicant meets all legal requirements.

How can I get Malta citizenship?

You can obtain Malta citizenship through the Citizenship by Naturalization for Exceptional Services by Direct Investment program. By investing a minimum of €600,000 ($640,000), you can qualify for citizenship after three years, or after one year with a €750,000 ($800,000) investment. You must live in Malta during the eligibility period.

Is there a language test for the Malta Citizenship by Investment?

There is no language requirement for acquiring Maltese citizenship or Malta citizenship by investment. If you are a British, Canadian, or US expat, you may be pleased to know that one of Malta’s two official languages is English, and 88 percent of the population speaks it.

Do I need a lawyer for the Malta citizenship by investment?

While there is no Malta citizenship by investment program to become a Maltese citizen, the process leading up to citizenship eligibility must be carried out by a government-approved agent. You will need a lawyer that is familiar with Malta citizenship and real estate law.

Is Malta a member of the European Union?

Malta is a full member of the EU, and citizenship in Malta comes with European citizenship, entitling bearers to freedom of movement to live and work in member states of the Schengen Area and the European Economic Area.

How much does Malta citizenship cost?

The Maltese citizenship by naturalization program is not a direct route to citizenship but through naturalization. The Maltese citizenship by investment total cost involves investments amounting to around €690,000 [at the very minimum].

Can I rent out my property under the Malta Citizenship by Investment

As a non-EU citizen buying property in Malta, you must maintain residence for at least five years and cannot rent out the property during this period to avoid conflicting with your residency intention.

Can I pass on Maltese citizenship

Yes, you can pass on Maltese citizenship to your descendants. Children born to a Maltese citizen are automatically eligible for citizenship. However, citizenship may not be automatically granted to grandchildren or further generations unless they meet specific criteria, such as residency or descent.

Can my Maltese citizenship be revoked?

Yes, your Maltese citizenship can be revoked if it was acquired through fraud, misrepresentation, or concealment of facts. It can also be revoked if you voluntarily renounce it or serve in a foreign military without government approval. Additionally, under the Citizenship by Investment program, failing to fulfill the residency requirements can lead to revocation.

Is buying citizenship in Malta possible?

It is not possible to buy a passport to Malta but you can make an investment to start the process of citizenship as well as do so through naturalization.

Can I get residency in Malta if I buy a house?

Buying a house in Malta does not automatically grant you residency. However, you can apply for residency through programs like the Malta Residency and Visa Program (MRVP), which requires purchasing property worth at least €375,000 or renting a property for €14,000 annually. Additional financial requirements also apply

How can you get Malta Citizenship by investment?

You can get Malta citizenship by investment through the Exceptional Investor Naturalization (MEIN) program. This requires a minimum investment of €600,000 after 36 months of residency or €750,000 after 12 months, plus a property purchase or rental and a donation to a Maltese NGO. Background checks and residency are mandatory.