What is a no income tax country?

In these countries, individuals are not required to pay tax on their salaries, dividends, interest, or other personal income, allowing them to legally keep more of what they earn.

This is very appealing but it’s important to understand that tax-free countries still need to generate revenue.

How do tax-free countries generate revenue?

Countries with no income tax often have highly developed industries that offset the need for income taxation. Here are some of the most common revenue models:

- Natural resources: Oil-rich nations like Qatar, Kuwait, and Brunei fund their budgets through oil and gas exports, which provide significant government income.

- Tourism and services: Destinations such as the Bahamas, Antigua and Barbuda, and St. Kitts & Nevis attract travelers and luxury investors, who contribute through hotel taxes, tourism fees, and VAT.

- Corporate and business taxes: Some countries apply taxes on foreign companies, banks, and large corporations. For example, the UAE applies a 9% corporate income tax on certain business profits and Brunei levies an 18.5% corporate income tax on companies.

- Import duties and customs fees: Island nations often impose significant import duties on goods to generate steady revenue without taxing personal income.

Low-tax vs. tax-free countries

It’s important to distinguish between no income tax countries and low-tax countries:

- Tax-free countries charge zero tax on personal income, regardless of where the income originates.

- Low-tax countries still levy income tax but at significantly reduced rates compared to global averages.

Why live in a no income tax country?

Relocating to a country with no income tax can have a transformative impact on your finances, lifestyle, and long-term wealth preservation. Many high-net-worth individuals, entrepreneurs, retirees, and remote workers are increasingly considering tax haven countries and no income tax countries to get:

- Maximum retention of earnings: No income tax means you keep 100% of your salary, dividends, or investment income.

- Favorable business environment: Many tax-free countries offer business-friendly policies, minimal reporting requirements, and simplified corporate structures.

- High quality of life: Tax-free countries like Monaco, the UAE, and Bermuda combine financial benefits with world-class infrastructure, safety, and amenities.

- Asset protection and privacy: Several tax havens also maintain strict privacy laws, protecting personal and corporate information. Some, like Vanuatu or Qatar, are non-extradition countries, offering additional confidentiality.

- Residency and citizenship opportunities: Many countries with no income tax have residency by investment or citizenship by investment programs, giving you a clear legal pathway to relocate and enjoy tax advantages.

15 Countries with No Income Tax in 2025

There are various income tax-free countries that you can choose to settle in. Most countries have a rule that once you spend 183 days of a year in their territory, it is classified as your country of tax residence and, therefore, your are liable to pay income taxes.

With a residence permit in a tax-free country, you can enjoy the benefits of what the country offers without paying income tax to live there. Here are the best countries to move to and enjoy a tax-free life:

1. Antigua and Barbuda

Tax structure

- Personal income tax: None

- Corporate tax: Registered International Business Companies (IBCs) pay no corporate income tax on property, securities, and other assets for up to 50 years.

- VAT or sales tax: Yes, applied to goods and services.

- Other taxes: No wealth tax, capital gains tax, or inheritance tax.

Residency or citizenship options

The Antigua and Barbuda Citizenship by Investment program enables foreign nationals to obtain citizenship through either:

- A minimum contribution of $100,000 to the National Development Fund or a real estate investment starting from $200,000.

Extradition policy snapshot

- Extradition treaty with the US: Yes, Antigua and Barbuda generally cooperates with US extradition requests.

- Privacy: While the country is tax-friendly, it does not have a reputation as a non-extradition haven.

2. UAE

Tax structure

- Personal income tax: None

- Corporate tax: 9% federal corporate tax for businesses with high net profits; oil companies and foreign banks pay separate corporate taxes.

- VAT: 5%

- Other taxes: Customs duties, property-related fees.

Residency or citizenship options

Foreigners can obtain long-term residency visas by:

- Investing in real estate

- Setting up a company

- Securing employment

To be considered a tax resident, you must remain in the UAE for over 180 days and apply for a Tax Residence Certificate.

Extradition treaty snapshot

- Extradition Treaty with the US: No formal treaty (considered a limited extradition country).

- Privacy: Strong privacy protections and limited cooperation on certain international requests.

3. Vanuatu

Tax structure

- Personal income tax: None

- Corporate tax: None for companies paying an annual fee.

- VAT: 15%

- Other taxes: Customs duties and business license fees.

Residency or citizenship options

You can obtain Vanuatu citizenship by investment with a minimum donation of $130,000 (one of the most affordable in the world). The program has fast processing times and global mobility benefits.

Extradition policy snapshot

- Extradition treaty with the US: No formal treaty (Vanuatu is often considered a non-extradition country).

- Privacy: Limited international agreements and strong confidentiality.

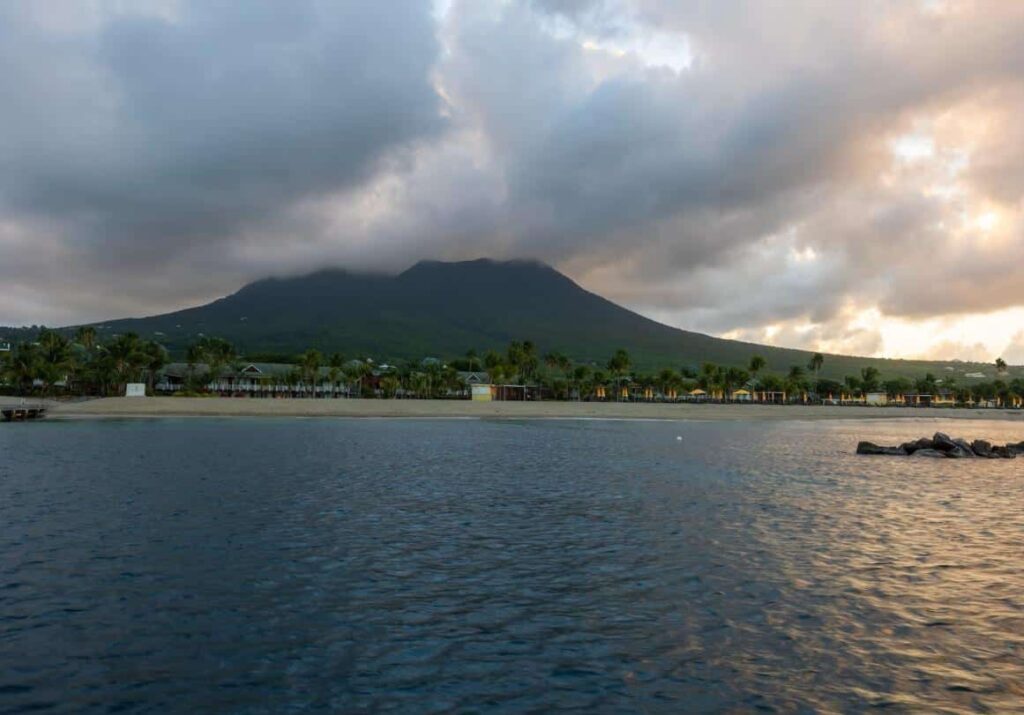

4. St. Kitts and Nevis

Tax structure

- Personal income tax: None

- Corporate tax: 33%

- VAT: 10 and 15%

- Other taxes: Property tax between 0.2 and 0.3%.

Residency or citizenship options

You can apply for citizenship through St. Kitts and Nevis citizenship by investment program through:

- A minimum donation of $250,000 or

- Qualifying real estate investment.

Extradition policy snapshot

- Extradition treaty with the US: Yes.

- Privacy: Reputation as a secure and discreet financial jurisdiction.

5. Monaco

Tax structure

- Personal income tax: None for residents.

- Corporate tax: 33% for companies earning over 25% revenue outside Monaco.

- VAT: 20%

- Other taxes: No property tax.

Residency or citizenship options

Residency requires:

- Proving substantial financial means, typically by depositing €500,000 in a Monaco bank.

- Securing long-term accommodation.

Extradition policy snapshot

- Extradition treaty with the US: Yes.

- Privacy: Discreet banking culture but subject to EU transparency standards.

6. Bahamas

Tax structure

- Personal income tax: None

- Corporate tax: License fee of ~3% of turnover.

- VAT: 0 to 12%

- Other taxes: Stamp duty and real property taxes.

Residency or citizenship options

Though the country has no formal citizenship by investment program, permanent residency by investment is possible via:

- Real estate purchase of at least $750,000.

Extradition policy snapshot

- Extradition treaty with the US: Yes.

- Privacy: Historically strong financial privacy laws.

7. Bermuda

Tax structure

- Personal income tax: None

- Corporate tax: No corporate tax, but employers pay payroll tax.

- VAT: None

- Other taxes: Import duties and property taxes.

Residency or citizenship options

There is no direct citizenship by investment program but residency can be obtained through:

- Real estate investment.

- Business ownership.

Extradition policy snapshot

- Extradition treaty with the US: Yes.

- Privacy: Established confidentiality laws.

8. Cayman Islands

Tax structure

- Personal income tax: None

- Corporate tax: None

- VAT: None

- Other taxes: Import duties and business licensing fees.

Residency or citizenship options

Residency options include:

- $2.4 million minimum investment for permanent residency.

- Approximately $500,000 investment for temporary residency.

Extradition policy snapshot

- Extradition treaty with the US: Yes.

- Privacy: Strong reputation as a tax haven.

9. Bahrain

Tax structure

- Personal income tax: None

- Corporate tax: 46% for oil companies.

- VAT: 10%

- Other taxes: Municipality and property taxes.

Residency or citizenship options

Residency by investment in Bahrain requires:

- A real estate investment of $270,000+.

- Proof of sufficient income if retiring in the country.

Extradition policy snapshot

- Extradition treaty with the US: No formal treaty (often treated as limited extradition).

- Privacy: Historically strong confidentiality.

10. Kuwait

Tax structure

- Personal income tax: None

- Corporate tax: 15% on foreign companies.

- VAT: Planned 5% implementation.

- Other taxes: Social security contributions (for nationals).

Residency or citizenship options

- Kuwait’s government does not offer citizenship by investment. Kuwait has strict laws regarding citizenship, and naturalization is tightly controlled.

- Residency can be obtained through business investments, which does not lead to citizenship.

Extradition policy snapshot

- Extradition treaty with the US: No formal treaty (often considered a non-extradition country).

- Privacy: Limited international cooperation.

11. Oman

Tax structure

- Personal income tax: None.

- Corporate tax: Applied on business profits.

- VAT: 5%.

- Other taxes: Customs duties.

Residency and citizenship options

The Omani government does not offer citizenship by investment, however it does offer Investor Residency:

- 5-year residency for a minimum investment of OMR 250,000 or 10-year residency for a minimum investment of OMR 500,000.

- Investments can be in businesses, real estate, or government bonds.

Extradition policy snapshot

- Extradition treaty with the US: Yes.

- Privacy: Generally cooperative with international standards.

12. Qatar

Tax structure

- Personal income tax: None

- Corporate tax: 10%.

- VAT: Planned 5%.

- Other taxes: Business-related fees.

Residency or citizenship options

Investment Visa (also known as a Golden Visa):

- Obtain residency by investing in real estate or specific businesses.

- Minimum investment around $275,000 (QAR 1 million).

Extradition policy snapshot

- Extradition Treaty with the US: No formal treaty (often viewed as a limited extradition country).

- Privacy: Strong confidentiality and neutrality.

13. Brunei

Tax structure

- Personal income tax: None.

- Corporate tax: 18.5%.

- VAT: None.

- Other taxes: Land rents in some cases.

Residency or citizenship options

Brunei does not offer a formal residency by investment program.

- Foreign nationals typically secure residency through long-term passes tied to family, employment, or business activities, rather than direct investment schemes.

14. Seychelles

Tax structure

- Personal income tax: None for foreigners.

- Corporate tax: 25% for resident companies.

- VAT: 15%.

- Other taxes: Import duties.

Residency or citizenship options

You can obtain Seychelles citizenship through:

- Minimum real estate investment of $1 million US.

Extradition policy snapshot

- Extradition treaty with the US: Yes.

- Privacy: Offshore privacy reputation.

15. British Virgin Islands (BVI)

Tax structure

- Personal income tax: None.

- Corporate tax: None for most companies.

- VAT: None.

- Other taxes: Modest property taxes.

Residency or citizenship options

Permanent residency:

- Minimum investment of $1 million in local businesses or real estate.

Extradition policy snapshot

- Extradition treaty with the US: Yes.

- Privacy: Strong confidentiality protections.

Frequently Asked Questions about Countries With No Income Tax

How many countries have no income tax?

In 2025, there are roughly 15 widely recognized countries and territories that do not impose income tax.

Which countries have no income tax?

The main zero-income-tax countries are the United Arab Emirates (UAE), Qatar, Kuwait, Bahrain, Oman, Saudi Arabia, Brunei, Monaco, the Bahamas, Bermuda, the Cayman Islands, St. Kitts and Nevis, Antigua and Barbuda, the British Virgin Islands, and Vanuatu.

What are the benefits of living in a tax-free country?

Living in a zero income tax country can help you legally reduce or eliminate your tax burden on personal earnings. Benefits include higher disposable income, simplified tax reporting, and often, access to modern infrastructure, excellent healthcare, and global mobility through residency or citizenship by investment programs.

Which Caribbean country has no earnings tax?

Several Caribbean countries have no income tax. The most popular include the Bahamas, St. Kitts and Nevis, Antigua and Barbuda and the Cayman Islands.

Are there European countries with no income tax?

In Europe, Monaco is the most notable example of a country with zero income tax for residents. There are, however, European countries with low taxes such as Andorra and Bulgaria.

How do I qualify for residency in a tax-free country?

To qualify for residency in a no income tax country, you typically need to:

- Invest in real estate or a business.

- Make a qualifying government contribution.

- Secure employment or demonstrate sufficient financial means.

Countries like the UAE, the Bahamas, and the Cayman Islands have specific residency by investment or long-term visa requirements.

What’s the easiest country with no income tax to relocate to?

The easiest tax-free countries to relocate to often have clear residency by investment pathways.

For example, the UAE offers long-term residency visas for property investors and business owners, while St. Kitts and Nevis and Antigua and Barbuda provide citizenship by investment programs with relatively straightforward processes.

Do countries with no income tax have other hidden taxes?

While zero income tax countries do not tax personal earnings, most still collect other types of taxes or fees. Common examples include VAT or sales tax, property taxes, import duties, and business license fees.