Making proper financial arrangements for purchasing a property in Portugal is essential. A mortgage should be one of the first things to consider before buying a property in Portugal.

In this article, we will discuss when to start thinking about taking out a mortgage in Portugal, the documentation required, and the criteria you need to meet to get financing for a property purchase in Portugal.

Taking Out a Mortgage in Portugal: An Overview

Regarding the Portuguese mortgage rates, the maximum that one can borrow will depend on the ratio of the loan amount to the value of the property pledged as collateral, which is known as loan-to-value.

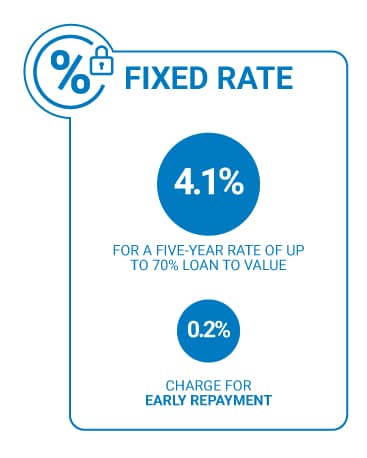

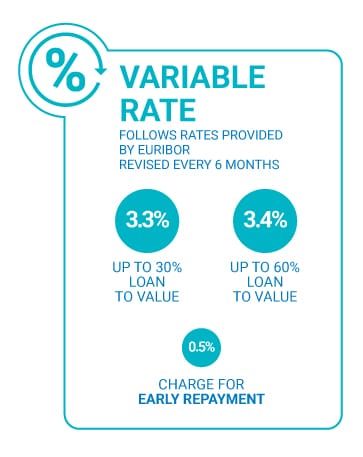

As per the date of this article, variable Portugal mortgage rates start at 3.3 percent per year based on a 30 percent LTV ratio. Such rates may increase if you require more credit, say 60 percent or 70 percent LTV ratio. Alternatively, fixed rates are available at 4.1 percent for up to five years based on LTV ratios of up to 70 percent.

Why should I take out a Portuguese loan?

If you already own a property in another country with sufficient equity, you may choose to take out an additional mortgage or even a new one on that property to finance your purchase in Portugal.

However, conditions in Portugal have improved over recent years, and there is increased interest from lenders in assisting foreigners with lending solutions.

Benefits of taking out a mortgage

The key benefit of taking out a Portuguese mortgage is that the lender will carry out legal checks on the property and arrange for a valuation.

Furthermore, it can be an opportunity for real estate investments. If you decide to let your property in short or long-term contracts, your rental income in euros may offset or cover the mortgage payments, in euros, from your Portuguese bank, which naturally alleviates any currency risk. Should you decide to use non-euro mortgage facilities abroad for your real estate investments, you would be exposed to foreign currency risks.

Some other benefits of getting a mortgage include:

- Mortgages have low rates

- Foreigners with no residency in Portugal can still get a mortgage from Portuguese banks.

- Properties purchased on credit can be rented out without restrictions

- Mortgage installment rates are generally low

At what stage should I apply for a mortgage in Portugal?

It is advisable to start the mortgage process as early as possible, even if you are still determining the kind of property you want to buy. Starting the process early helps you to understand what you can afford and how much you can access through credit financing.

This way, you streamline your property search and make quicker decisions on prices with the seller. Also, starting your mortgage search earlier rather than later may help you better negotiate the price of the property, as it will demonstrate that you are a serious buyer.

Compare mortgages from different banks

The first thing to do is to compare banks. In Portugal, there are over 15 banks that provide different mortgage loans and credit to buy a house. Some of these banks include BBVA, Santander, Bankinter, Banco Best, and Banco CTT, amongst several others.

Each bank in Portugal has different criteria, and you may not necessarily be offered the most suitable loan or the best deal available. You may also encounter some difficulties with language barriers.

Our specialist team at Global Citizen Solutions can introduce you to an English-speaking banker to match your profile, saving you a lot of time, cost, and hassle.

What types of mortgages are available in Portugal?

Fixed-rate mortgage

The fixed-rate mortgage basically allows borrowers to pay a constant rate for a certain period. It generally guards you against fluctuations in the European base rate. This rate is usually agreed upon with the financial institution when requesting financing.

For some lending institutions, this rate is fixed for the entire lifespan of the loan, while for some other financial institutions, it is usually for a certain period during the lifespan of the loan. If the latter is the case of the rate, then it reverts to a variable-rate mortgage (see below). Also, if you decide on early repayment, you may be charged a fine on repaid capital.

Variable-rate mortgage

With this type of loan, your monthly payment fluctuates depending on the indexer (the index that is normally used in housing loans is Euribor). Over the repayment period, the monthly payments are usually revised every six months based on Euribor rates. Also, if you decide on early repayment, you will be charged 0.5 percent on the repaid capital.

You should also be aware that the maximum loan-to-value mortgage in Portugal for non-residents is between 60 percent and 70 percent of the purchase price.

There’s also the option for a construction mortgage. You can usually borrow 50 to 60 percent of the combined costs of the land and construction. However, these mortgages are complex, and specialist advice from a mortgage broker is advisable.

Mortgage in Portugal for retirees

As a retiree in Portugal, you can also get a mortgage in Portugal, provided you have a regular pension income. You can also arrange a guarantor, which can be beneficial in terms of inheritance tax if they are also part-owners of the property.

Mortgage in Portugal for businesses

It is also possible to get financing if the property you intend to buy is for commercial use, such as a restaurant or a shop. The maximum mortgage is usually 50 percent of the price (or valuation, if lower).

How much do I need to deposit?

For a Portuguese mortgage, the minimum deposit is usually at least 30 percent of the purchase price for non-residents, which is because financing institutions only provide between 60 percent to 70 percent credit of the valuation price.

Mortgage Conditions

There are several Portugal mortgage requirements for those looking to make an application and obtain a foreign investor mortgage in Portugal.

- Interest rate: The rate used for home loans is Euribor, after which the bank applies its margins.

- Terms of mortgage: Most mortgages in Portugal for non-residents are between 25 to 30 years.

- Lending criteria: This usually depends on your financial position, which is determined by your current income, earnings, debts, and employment history. Also considered here is the property valuation by the bank.

- Insurance: When contracting a mortgage loan, you will also have to contract life insurance. In some cases, the banks usually require home insurance too.

Costs and fees for mortgages in Portugal

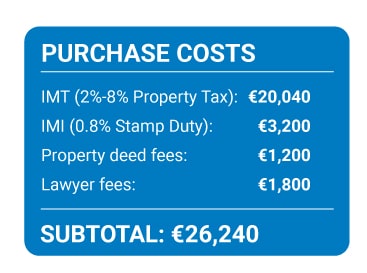

Cost of purchasing a house in Portugal

- Property tax (IMT): Ranges from 2 percent to 8 percent

- Stamp Duty Tax (IMI): 0.8 percent of the price of the property

- €1,200 notary, registry, and tax office fees for property deeds

- €1,800 estimate of legal fees

Cost of taking out a mortgage in Portugal

- €290 application fixed fee

- €280 bank valuation fixed fee

- Stamp Duty Tax (IMI): 0.6 percent of the amount of the mortgage

- €1,200 notary, registry, and tax office fees for mortgage deeds

Property specialists

Looking to Secure Your Dream Property in Portugal? Get in touch with our real estate division, Goldcrest Real Estate - Portugal´s buyer's agent, to kickstart your property search in Portugal.

As the first buyer’s agent in Portugal, Goldcrest has a clear understanding of the local market and has helped hundreds of people find their ideal property.

Working solely on behalf of the buyer, they secure the best price for you, saving you time and hassle.

Using a Portugal Mortgage Calculator

Portuguese lenders, such as banks and credit unions that offer mortgage products in Portugal, often have their own mortgage calculator on their websites. These mortgage calculators calculate an estimate for monthly repayments on mortgage rates in Portugal. The factors involved in calculating this estimate include:

- Your credit score: Of course, if you have a good credit score, you will get a favorable rate.

- Debt to income ratio: Your monthly debt payments divided by your gross monthly income

- Loan to value (LTV) ratio: The ratio of the loan amount to the property value

- Amortization schedule: A breakdown of your mortgage repayments over time, including the interest rate

- Insurance: The property insurance and life insurance requirements for getting a mortgage

- Early repayment charges: If you pay off your mortgage early, you will be charged a fee, typically 0.5 percent of the property value.

How to Apply for a Mortgage: A Step-by-Step Guide

1. INITIAL ASSESSEMENT

2. SUBMIT APPLICATION FORM AND NECESSARY DOCUMENTS

3. FORMAL OFFER

4. VALUATION OF PROPERTY

5. ARRANGEMENT OF COMPLETION OF SALE

6. COMPLETION OF SALE

The application process begins by approaching the bank or mortgage broker for a no-obligation estimate or preliminary analyses.

Following this initial assessment, the following process usually applies:

- Mortgage quote: After the initial assessment, if you wish to proceed, you will receive a full mortgage quote within 24-48 hours. There is normally a charge to prepare a formal quote.

- Submit application forms: The next step after receiving a formal quote is to complete the relevant application form and submit the necessary supporting documents.

- Mortgage offer: If the mortgage is approved, you will receive a formal offer. Your mortgage broker will confirm the conditions of the offer and assist with the proceedings.

- Valuation report: Once you have received a formal mortgage offer, the bank will carry out a valuation report of the property. If the valuation is at least the agreed purchase price and there are no legal issues relating to the property, the date and details regarding the completion of the property purchase will be confirmed.

- Completion arrangements: The funds for the property purchase must be available and transferred to the appropriate account before the completion date. Once you have proven the funds are available, the lender will proceed with the mortgage application, and a completion date will be arranged.

- Completion: The Portuguese mortgage lender will arrange the payment. Once the property and mortgage deeds are signed in front of the Portuguese Notary and all the associated fees and taxes have been paid, then you become the official new owner of the property.

Regarding the property and mortgage deeds and other important documentation, it is crucial that you provide the most up-to-date documents at once to avoid delays in the process.

Documents Required to Get a Mortgage in Portugal

If you are going to apply for a Portuguese mortgage, you may be asked to submit the following documents:

- Copy of passport

- Tax identification number (NIF) in Portugal – you will need to register for a Portuguese tax number, although this doesn’t mean that you will necessarily be a tax resident in Portugal and liable to pay income tax in the country.

- Proof of income

- Bank statements – last 60 days of incoming and outgoing cash flow

- Recent utility bill

- Recent mortgage statement

- Proof of any savings or investment accounts

- Bank reference letter

- Property details – purchase commitment or sales contract

These documents vary depending on your employment status, i.e., either employed, self-employed, or retired.

If employed

- Last year’s tax returns

- Last three months’ payslips

- Reference letter from employer (a simple letter stating how long you have been working with the company and your gross annual salary, bonus, etc.)

If self-employed (hold a 20 percent or more share in a limited company)

- Last year’s tax return

- Last three months of business bank statements

- Three years of company profit & loss and balance sheet

Other income

- Confirmation of pension income for the last three months

- Copy of tenancy agreement for rental properties

- Last three months of statements showing rent received

- Copy of investment certificates

Also, depending on the level of risk assessment, the bank may request additional documents.

Portuguese Mortgage Terminologies

When looking through your Portuguese mortgage contract, below are some terminologies you should watch out for:

- TAEG: This is known as the Effective Annual Rate (EAR) in English. The EAR varies from bank to bank, so you should consider this when comparing offers.

- Euribor: This is the basic rate of interest used as a reference for setting the interest rate on home loans in Portugal. This is important, especially on the variable-rate mortgage, as it is indexed to the Euribor (usually in a six-month period).

- MTIC: This represents the total amount you will have to pay for the credit (it already includes the capital and the interest).

How Can We Help You Find Your Dream Property?

Goldcrest Real Estate is the first buyer’s agent in Portugal, providing you with a tailor-made service to find your ideal property in Portugal. From sourcing to acquisition and aftercare, Goldcrest guides you throughout the buying process.

Here's how Goldcrest stands out in making your property dreams come true:

LOCAL KNOWLEDGE: Goldcrest has offices throughout Portugal, ensuring a strong presence from the mainland to the Azores and Madeira.

INDEPENDENT SERVICE: Goldcrest don’t represent any specific development or project, ensuring their advice remains impartial. By objectively analyzing every opportunity, Goldcrest focuses on maximizing your investment prospects. They partner with various agents, sellers, promoters, and developers, ensuring a broad spectrum of property options. The goal is straightforward: To help you find the best property at the most favorable price, whether you're buying or renting.

STREAMLINED PROCESS: Goldcrest provides a dedicated real estate consultant paired with a top-notch client management system for smooth information exchange. With the aid of advanced technology, like metasearch tools, they guarantee expansive market coverage. Goldcrest's viewing itineraries are tailored to your needs, and they're always ready to assist, be it in-person or on your behalf. When it comes to pricing, they use data-driven analysis to ensure you get the best deal. And, to make your journey smoother, Goldcrest assigns a dedicated onboarding account manager for every client.

ALL-ENCOMPASSING SOLUTION: Navigating financial aspects? Goldcrest is here to guide you through finance options and manage the required documentation. If you need property management solutions or connections to builders, architects, designers, and gardeners, they have you covered. Relocating? Their concierge services are designed to assist in everything, from securing accommodations to handling utility connections.

TRANSPARENCY AND PRIVACY: Goldcrest operates with a commitment to GDPR compliance, ensuring your data is protected. Expect a clear and detailed pricing model without any hidden surprises. Plus, they provide independent due diligence services to ensure every decision you make is informed.

Frequently Asked Questions about Mortgages in Portugal

What is the maximum loan-to-value for Portuguese mortgages?

The maximum loan-to-value for Portuguese mortgages for non-residents is between 60 percent to 70 percent of the purchase price of the property, although this can vary.

How much can I borrow for a mortgage in Portugal?

For a Portuguese mortgage, the minimum deposit is usually at least 30 percent of the purchase price for non-residents.

What are the lending criteria for a mortgage in Portugal?

The banks in Portugal usually take into consideration the borrower’s financial position and the property’s valuation when analyzing mortgage approval. You will need to have all your documents in order, including a valid ID, proof of home address, and proof of income (payslips/self-employed accounts or tax returns).

Should I buy property in Portugal?

Buying property in Portugal is a good investment. You can benefit from low mortgage rates and affordable property prices. You can find out more in our guide on Buying Property in Portugal.

What are the benefits of taking out a Portuguese mortgage for foreigners?

In Portugal, the cost of borrowing for a mortgage is normally less than the cost applicable to an equivalent UK mortgage, mainly because the Euro Interbank Offered Rate is historically lower than the London interbank offered rate.

Lending conditions in Portugal currently favor buyers, and there are many options available to foreign investors. Taking out a mortgage in Portugal also means that the bank will carry out legal checks on your property before you buy.

Can I add the IMT tax due to the total mortgage sum?

No, unfortunately, in Portugal, you must pay the property tax (IMT) separately.

Can you get a mortgage in Portugal as a foreigner?

Yes, you can get a mortgage in Portugal as a foreigner, and it can be easier to get a mortgage in Portugal if you intend to buy property in the country.

What is the age limit to take out a mortgage?

Many mortgage lenders impose an age cape at 65-70, but the mortgage can roll out into retirement provided that the person has a comfortable pension income.

Can retirees take out a mortgage in Portugal?

As a retiree, you can acquire a mortgage in Portugal, provided you have a stable pension income. Most banks will not offer a mortgage to individuals over 70 years old. However, some banks will extend this limit to 80.

How long does it take to buy a house in Portugal?

It typically takes around six months to land a property, including sorting out all the paperwork and signing the promissory contract.

Is it difficult to get a mortgage in Portugal?

Getting a mortgage in Portugal is quite straightforward. Portuguese banks offer mortgages to both residents and non-residents. If you plan well and have all your paperwork together, the whole process is smooth sailing.

What are the mortgages available in Portugal for non-residents?

Non-residents will face no restrictions when applying for a mortgage in Portugal. The maximum loan-to-value mortgage for non-residents is between 60 to 70 percent of the purchase price, and the minimum deposit is normally at least 30 percent of the purchase price.

Regarding the terms of mortgages for non-residents, most are for between 25 to 30 years.

What are the mortgages available in Portugal for residents?

Portuguese residents can easily apply for a mortgage from a Portuguese bank. For fiscal residents, the loan-to-value allowed is up to 90 percent for a permanent home and 80 percent for a holiday or second home. This ratio is considered on the lower value of either the purchase price or bank appraisal.

Can I get a mortgage in Portugal as a UK resident?

Yes, both non-residents and residents of Portugal can apply for a mortgage with a Portuguese bank.

What do you need to get a mortgage in Portugal?

It is quite straightforward to get a mortgage in Portugal. Some of the documents that you will need to present include a copy of your passport, a NIF number, bank statements from the past three months, proof of address, and a recent mortgage statement.

Other documents that are required include proof of savings or investment accounts, a bank reference letter, and a sales contract or purchase agreement for the property. You will also need to show other documents, which will vary depending on if you are employed, self-employed, or have other income sources.

How much deposit do you need for a mortgage in Portugal?

The minimum deposit for a mortgage in Portugal depends on whether you’re a resident or non-resident. Residents generally need a 20 percent deposit, while non-residents typically need a higher deposit of around 30 percent.

How much are mortgage rates in Portugal?

Mortgage rates in Portugal are currently around 4.2 percent on average, though they can vary depending on the specific loan and your creditworthiness.

What are the mortgage conditions in Portugal?

Mortgage conditions in Portugal involve factors like loan-to-value (LTV) ratio, terms, and early repayment fees. Expect LTVs around 60-70 percent, with terms lasting 25-30 years for residents (maximum age 70-80). Early repayment comes with fees (0.5 percent variable, 2 percent fixed).

What are the interest rates for mortgages in Portugal?

Interest rates for mortgages in Portugal currently average around 4.2 percent. This is a variable rate, meaning it can fluctuate based on the Euribor rate, a benchmark used in Europe. It’s important to note that your specific rate will depend on your creditworthiness and the loan details offered by your chosen lender.

What is the housing market in Portugal like in 2024?

In 2024, Portugal’s housing market continues to attract both domestic and international buyers, supported by factors such as affordable prices and a favorable climate. However, certain areas, particularly Lisbon and Porto, have experienced rising prices and increased demand, leading to concerns about affordability and gentrification. Overall, the market remains dynamic, with varying trends across regions and property types.