With Portugal’s Golden Visa program, it’s possible for expats to acquire residency by investment and even Portuguese citizenship, allowing successful candidates to enjoy a high quality of life and European Union residency, with visa-free travel throughout the Schengen Area, among many other benefits. One of the most popular ways to apply in 2024 is via the Portugal Golden Visa investment fund pathway.

In this Portugal investment fund Golden Visa Guide, we’ll cover the following:

- Benefits of the Portugal investment funds

- Key considerations to take into account before investing in Portuguese Golden Visa funds

- Portugal Golden Visa fund eligibility criteria

Portuguese Golden Visa Investment Fund: An Overview

About The Golden Visa Program

The Portuguese Golden Visa Program is a five-year residency by investment scheme. Qualifying applicants must invest a significant amount into the Portuguese economy to obtain a Portuguese residence permit. Portuguese citizenship is attainable for Golden Visa holders after five years of keeping their investment, provided they meet all the requirements under Portuguese nationality law, such as passing a Portuguese language test known as CIPLE.

According to data from the former SEF, since October 2012, since Portugal Golden Visa’s inception, 12,718 ARIs have been granted to investors and their families through more than €7.3 billion in investments.

The program rewards foreign applicants with a Golden Visa residency permit, unlimited visa-free travel access to the European Union, and the opportunity to live, work, or study in Portugal.

Known for its flexible application requirements, relatively straightforward timeline to residency, and affordable investment options, the Portugal Golden Visa scheme is particularly popular among American, Brazilian, Chinese, and Russian investors. There are many different Golden Visa investment options available, and the minimum investment required depends on the route chosen.

The Portuguese Golden Visa program is also an excellent way for UK citizens to secure European Union residency following Brexit. For further information, you can read our article on the Portugal Golden Visa for UK citizens.

For more information about the Golden Visa benefits, investment routes, and requirements, consult our Golden Visa Portugal Guide here.

What Is The Portuguese Golden Visa Investment Fund?

According to an amendment in Portuguese Law 23/2007 on July 4th, people can make contributions to the Portugal investment funds to get the Portugal Golden Visa.

For the investment fund option, a capital transfer into Portuguese investment funds or venture capital funds to the amount of or greater than €500,000 is needed to procure legal residency in Portugal.

The Portuguese funds must be focused on the capitalization of companies registered under Portuguese law, with a minimum maturity of five years at the time of the investment and at least 60 percent of the value of the investments made in commercial companies on Portuguese territory.

Portugal Golden Visa statistics point to an influx of investors rushing to invest in the Golden Visa, with growing interest in the fund investment Golden Visa option – particularly amongst American citizens.

Why is the Portugal Golden Visa fund option so popular?

Real estate was the preferred route for investment in Portugal when it came to applying for the Golden Visa, but the option of investing in the Portuguese real estate market is no longer available for the Golden Visa process.

Now that it’s no longer possible to invest in real estate to apply for the Golden Visa, the investment fund option has emerged as an increasingly popular route to obtain temporary residence and, ultimately, citizenship in Portugal. In the first nine months of 2023, 352 Golden Visas were issued to fund investors, representing about 30 percent of the total number granted during that period.

Among the Golden Visa funds pathway’s benefits are its low taxes and fees and its reputation as a relatively secure investment because of auditing and regulation from bodies such as the Portuguese Securities Market Commission, the Bank of Portugal (which is the nation’s central bank), and the Portuguese tax authorities.

Another advantage of the Portuguese Golden Visa funds is that the annual yields are typically higher than other investments for the Golden Visa program, meaning that there is potential for substantial investment return. Capital appreciation can vary depending on the focus of the fund, which, of course, will affect the amount of investment income you are able to obtain.

Golden Visa funds are regulated by Portugal’s regulator, the CMVM (which has a similar framework to the US Securities and Exchange Commission), and the FCA in the UK.

How are the Portuguese investment funds regulated?

The Portugal Golden Visa Fund is regulated by CMVM (The Portuguese Securities Market Commission), which requires funds to comply with the following requirements, including but not limited to:

- Report the valuation of their net assets on a semi-annual basis. That means investors may have their participation unit price revised every six months

- Employ independent accredited accounting firms such as PwC, KPMG, or EY for annual audits.

- Disclose their fees in the PPM/management regulation document. That means investors should have clarity on the management entities’ fees and custodian bank charges.

Things to Consider Before Committing to the Fund Investments

Additional considerations must be considered when choosing the fund investment Portugal option:

- Is my selected Portugal yield fund eligible for the Golden Visa?

- What is my fund investment strategy, and what are my legal obligations?

- Do the Portuguese authorities regulate the fund?

As an investor for Portugal’s Golden Visa, you must keep your investment for a minimum of five years, when you can then apply for permanent residence and citizenship in Portugal. In this context, it’s essential to have an investment strategy in mind and ask about the exit strategy for the Golden Visa funds.

Golden Visa Investments Boom in Portuguese Funds

In 2023, the Immigration and Borders Service (SEF) data showed a notable rise in foreign investment through investment funds and venture capital funds aimed at obtaining Residency Permits for Investment (ARI) in Portugal. Over 125 million euros were invested in these funds from January to September, representing a significant increase compared to previous years. This investment route became increasingly popular, with 30% of golden visas issued in 2023 being linked to national funds.

The impact of this investment trend was substantial, with a 45.4 percent increase in investment compared to 2022, and 2.6 times more investment than in the previous three years combined. Notably, for every 10 ARIs granted, 3 were obtained through investment fund acquisitions, showcasing the attractiveness of this option for foreign investors.

Sara Sousa Rebolo, president of the Portuguese Association of Immigration, Investment, and Relocation (PAIIR), highlighted the appeal of venture capital funds in particular, noting their strong advertising and diversification strategies. The changes introduced to the ARI program in 2023 further encouraged investment through collective investment bodies, such as investment funds, leading to positive prospects for the growth of this segment.

Overall, the shift towards investment funds as a means of obtaining Golden Visas reflects changes in the law governing ARIs, which eliminated other options like capital transfers and real estate acquisitions. This legislative adjustment contributed to the surge in foreign investment through national equity investment funds, ultimately driving growth in Portugal’s investment fund industry, and positively contributing to the Portuguese economy.

Who can invest in the Golden Visa fund?

- Be a non-EU/EEA citizen or a non-Swiss citizen

- Have a clean criminal record

- Be over 18 years old

- Have sufficient legal funds to invest

Depending on the fund and the fund management company, the Golden Visa fund investment may have extra requirements.

In some cases, the investor must:

- Have some experience with a financial instrument such as company stock, government bond, company bond, fund, etc.

- Submit proof of having enough funds

- Show where the source of funds comes from

Can a US citizen invest in a Portuguese Investment Fund for a Golden Visa?

Yes, an American citizen can certainly qualify for the investment fund pathway under the Golden Visa scheme. However, the IRS requires foreign financial institutions and certain non-financial foreign entities to report on the foreign assets held by their US account holders. So, any bank, fund, and fund manager in Portugal who has an American client or investor must abide by the US government’s legislation.

While some banks and funds shy away from working with American investors, there are banks and funds in Portugal that are open to accepting Americans and can provide the necessary reporting for the US tax authorities.

Benefits of the Portuguese Golden Visa Investment Fund

There are a number of benefits to picking the Golden Visa investment funds, including the following:

Low fees and taxes | Investment fund investments do not lead to large fees and taxes, such as the real estate option did. Purchasing a property in Portugal requires an IMI transfer tax (average 6%), stamp duty (0.8%), and annual municipal taxes (ranging from 0.3-0.5% annually). In contrast, the investment fund route has none of these taxes. |

A safe and secure investment | The funds are regulated and must comply with the rules stipulated by the Portuguese Securities Market Commission (CMVM), which means that fund managers are regularly audited by third parties. Alongside being registered by the CMVM, the Bank of Portugal, and the external Fund Management company also regulate the fund. In addition, the Portuguese Tax Authorities audit the fund. The thorough and high levels of regulation mean that the fund must comply with the Portuguese legislation and tax laws. |

Tax-efficiency | While all real estate rental income is subject to a fixed 28% taxation, venture capital funds are a tax-efficient vehicle — dividends and capital gains returned to investors may be tax-exempt. Some cases allow for exemptions to withhold tax on income generated through the fund, especially if the investors are not tax residents in the country. |

Diversification | It is possible to invest €500,000 in several funds, depending on their minimum “tickets.” Also, Portuguese legislation governs the funds to obtain a certain level of diversification. There are quotas on what percentage a particular asset or investment in the fund may constitute of the total fund portfolio. This allows for the diversification of investments within the fund and alleviation of risk for the participating investors. |

Potential earnings | The annual yields and eventual capital gains may be significantly higher than other investment routes related to the Golden Visa program, depending on the focus of the investment fund. |

Management delegation | The investment fund Golden Visa is professionally managed by experts in each specific sector. While being a real estate landlord can be a hassle, owning a participation unit in an investment fund is much more straightforward. The management burden is delegated to the fund managers, that are motivated to bring returns to investors in order to access performance fees |

Disadvantages of the Portuguese Golden Visa Investment Fund

The Portugal Golden Visa fund investment also has some disadvantages, which are outlined below:

Lack of control | While also an advantage, in that the fund manager does all the work, the investment fund route requires the investor to trust his or her funds with an external fund manager that will determine the investment decisions and steer the strategy. Some investors may not like this lack of control. |

Exit issues | Most investment funds will contractually ensure the participants that the fund will not be dissolved before a minimum number of years to make sure that the participant can achieve the time period when he or she is able to apply for permanent residency in Portugal. There can be some issues with this: (1) the resale of the participation unit before the fund dissolves is difficult in most cases; (2) funds normally have extension periods, but sometimes these are unilaterally decided by the fund managers (and not subject to the investors’ vote); (3) if the ultimate objective of the investment fund is to sell the portfolio at a target appreciation, then there will be no guarantee of what the corresponding market will be when the fund decides to sell. |

Sharing the earnings | The potential yield and ultimate capital appreciation are shared between the investors and the managers of the fund. The management and performance fees will vary from fund to fund. |

KYC burden | Participants will need to share some documents and critical information with the managers of the fund, including proof of income and source of income. Such Know-Your-Client (KYC) burden does not exist in real estate acquisitions. |

Golden Visa Investment Options

Fund

Subscription

Investment or donation

Scientific

Research

Creation of ten jobs

Company

set-up

IMPORTANT UPDATE: PORTUGAL GOLDEN VISA – OCTOBER 2023

The Portugal Golden Visa program has recently undergone substantial changes. The new legislation is now in effect, and real estate investments are no longer a valid qualifying option within the program. At the same time the real estate investment option was eliminated, the capital transfer route was also discontinued. The Portugal Golden Visa Ultimate Guide offers more detailed information, including several attractive investment routes that remain eligible options for the program.

For more information, including continuous updates on this visa category, please refer to our articles: Portugal Golden Visa Ending: Everything We Know So Far and Golden Visa Changes.

- Fund subscription: Make a contribution to a qualified investment fund worth at least €500,000

- Investment or donation in the arts or reconstruction of national heritage with a donation of at least €250,000 (the minimum investment is €200,000 in a low density area). Read more: Portugal’s Cultural Production Golden Visa

- Scientific research: Science or Technology research contribution of at least €500,000

- Creation and maintenance of ten jobs: Creation and maintenance of ten jobs during the required period

- Share capital and job creation: Incorporation of a company or reinforcement of a company’s share capital, in either case with an investment of €500,000, combined with the creation of five or maintaining ten jobs (five must be permanent)

Portugal Golden Visa Program: Fees and Costs for the Investment Fund Pathway in 2024

When applying for a Portugal Golden Visa through an investment fund in 2024, you’ll encounter various fees and costs. Here’s a breakdown:

Mandatory fees:

- Government fees:

- Processing fee: €533 per applicant (increased to €83 for dependents) at application and renewal.

- Initial application fee: €5,325 per applicant.

- Renewal application fee: €2,663 per applicant at each five-year renewal.

- Minimum investment: €500,000 in a qualified Private Equity or Venture Capital fund.

Variable fees:

- Fund management fees: Usually range between 1-2 percent of your invested amount annually. This covers the fund manager’s costs for managing the fund and its investments.

- Performance fees: Some funds charge additional fees based on their performance exceeding a certain benchmark. These fees vary greatly depending on the fund and its structure.

- Legal fees: These can vary depending on the complexity of your case, the experience of the lawyer you choose for legal representation, and the number of family members included in your application. Expect to pay between €5,000 and €20,000.

- Due diligence fees: Some funds might charge a separate fee for conducting due diligence on your application. This typically falls within the €1,000-€3,000 range.

- Translation and certification fees: Translating and certifying documents for the application can incur additional costs depending on the volume and complexity.

- Travel and accommodation: Consider potential travel and accommodation costs if required for interviews or document submission in person.

Please note that fund management fees and performance fees are deducted from the fund’s pooled capital, while the subscription fees are usually charged on top of your investment. These subscription fees range between 2-4% from the €500,000. The amount is charged to account for the due diligence, KYC, and marketing costs.

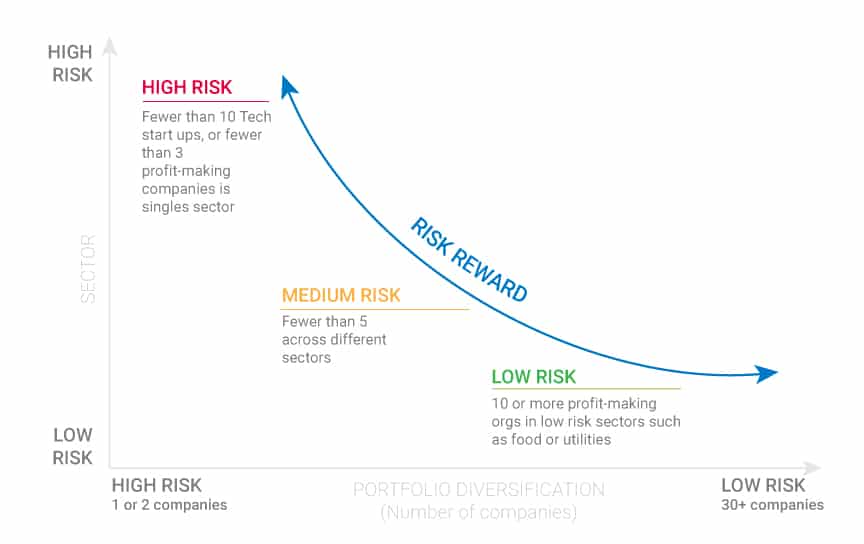

Fund Investment Profile and Diversification

The overall level of security of risk of a Portuguese VC fund or Golden Visa Portugal investment fund will depend on many factors, including (but not limited to) investment mandate, managers’ credentials, leverage and liquidity, exposure to the stock market, the economic cycle, and legal documents.

Some funds may offer limited potential for capital appreciation with a safer investment profile while others may have a more leveraged approach with an aim to provide Golden Visa investors multiples of the capital invested. For example, high-growth companies focused on technology have a different profile to property development projects that tend to have a more predictable cash-flow curve.

Funds may offer the opportunity of an early exit, but generally, the investor should expect to realize all gains after five to ten years.

The risk-return profile of these funds will vary according to the sector exposure and portfolio diversification (i.e., how many companies comprise the fund portfolio).

Examples of risk-return levels based on sector exposure and investment portfolio diversification

List of funds that qualify for Portuguese Golden Visa

Portugal has long been recognized for its rich investment landscape, characterized by steady economic growth and a welcoming environment for foreign investors. While the country’s real estate sector has historically been a magnet for international capital, Portugal’s investment horizon extends far beyond.

However, it’s important to note that recent regulatory changes have excluded real estate-related funds from eligibility for the Portuguese Golden Visa program. While this adjustment may affect some investors, the program still extends its welcome to a variety of other investment fund categories, such as Growth/Buy-out funds, and Venture Capital (VC).

Below, we’ll provide a Portugal Golden Visa investment fund list to explore some of the attractive fund options that qualify for the Portuguese Golden Visa.

Note: In late 2023, the Portuguese Government passed the “Mais Habitaçao” legislation. The Portuguese government eliminated the following investment options from being eligible for a Golden Visa: All real estate acquisitions (€500,000, €400,000, €350,000, €280,000), real estate-focused funds of €500,000, and capital transfer of €1,500,000.

You can also keep up to speed with any changes to the program in our article: Portugal Golden Visa Changes, Updates, and New Rules.

Growth/buy-out funds (Private Equity funds)

With Private Equity funds, you can invest in more established companies, like SMEs or mid-caps, that are already market-proven and very often have positive operational results.

The goal of these funds is to acquire companies (or majority stakes), restructure, improve systems, expand to other markets, consolidate, and eventually sell these companies at a multiple to a main player of the industry or to other international Private Equities.

There are Private Equity funds that are sector agnostic, investing in businesses across different industries, depending on the respective growth potential and opportunistic timing. And then you have those Private Equities that are more sector-specific or niche-oriented investing in areas such as renewable energy, agri-business, healthcare/LS, and hospitality (which is a thriving industry in Portugal as you might know), among others.

In Portugal, it is estimated that family businesses may represent between 70% to 80% of the total national companies (99% are SMEs), employing 50% of the workforce and contributing to 2/3 of the GDP – such figures present opportunities for funds to help grow and consolidate these businesses and participate in their profits.

Although Portugal currently exhibits lower Private Equity investment as a percentage of GDP compared to the more established and dynamic markets of France and Spain, this suggests significant growth potential and an opportunity for Portugal to catch up and eventually consolidate its position among them.

In fact, we now see Spanish Private Equity and VC fund managers establishing their businesses in Portugal to take advantage of the higher growth potential in Portuguese businesses.

The Development Bank of Portugal, subsidized by the European Union, invests in these funds together with private investors, such as pension funds, family offices, and foreign private investors such as the Golden Visa investors. The Development Bank contributes 2x the capital of private investment capped to an amount that may vary between €30-50mm per fund. That helps fund managers to consolidate large sums to develop their growth plans and the private investor benefits from a larger bank requiring a stronger level of corporate governance.

Venture Capital funds (VC)

Venture capital funds (or FCR – Fundo de Capital de Risco, dubbed “Capital at Risk Funds”) are considered a qualifying investment for those wishing to apply for Portugal’s Golden Visa.

The term ‘venture capital’ may sound daunting and complicated, but it is simply a designation of investment funds that are managed by corporate experts in the field who seek to invest in start-ups or medium-sized projects with strong growth potential. Some of the eligible investment funds are managed as private equity funds, which usually invest in more established and revenue-generating companies (later stage than VC).

Each fund has a specific, well-defined investment mandate and may focus on sectors such as energy, industry, technology, and healthcare, or even have an agnostic approach.

VC funds invest in early-stage startups with high growth potential. VC investments are inherently risky, as many startups fail, but successful investments can yield substantial returns. Portugal has become an attractive destination for entrepreneurs not only for the standard of living, weather, and specialized talent but also for its strategic location and renowned Portuguese talent, which is considered a critical element for the accelerating growth of its startup ecosystem.

Investors should understand the areas of focus and sectors the fund intends to invest in. Some funds structure themselves as sector-agnostic, while others are more sector-specific or niche-oriented. Naturally, each sector will entail different risk levels, considering the economic circumstances and trends at the time of investment. For example, funds with a growth/buy-out policy invest in established companies with proven market products and positive EBITDA, typically involving larger investments compared to VC funds that invest smaller amounts in several startups and early-stage companies, where growth is less certain (but potential can be high).

For those looking for sustainable investment options, it’s worth noting that there are several funds that qualify for the Portugal Golden Visa program and focus on various sustainablity themes. These funds invest in companies or projects that promote environmental, social, and governance (ESG) best practices.

The Exit

When investing in a fund, it’s crucial to put some thought into the exit of the investment fund.

Minimum lock-up period

Most investment funds that qualify for the Golden Visa will ensure that they do not liquidate within a minimum of six years. This ensures that your investment will remain valid for the required time period to apply for permanent residency and citizenship.

Resale or transfer of participation fund units

For most Portuguese investment funds, participation units can be transferred or sold between participants, but it is usually difficult to find a demand for a participation unit in a fund that is suited to Golden Visa timelines unless traded around the incorporation of the fund.

This makes Portuguese investment funds rather illiquid until the fund reaches its maturity or is dissolved by the fund manager. Although uncommon, some funds have longer terms but offer the possibility of buying back the investor’s participation units once the participants complete the required time for the GV, these funds usually have low returns compared to others.

Extension periods

Most investment funds will have a specific exit target in terms of timing, and many of the Portuguese Golden Visa investment funds are set for a six-to-eight-year period.

The majority of investment funds have the option to extend, and this option can be triggered at the six-year mark. In some cases, the fund manager will make the decision on this, not the investors, meaning that you may be locked in a bit further than the time required to apply for citizenship. In other cases, the extension of the fund is subject to the investors’ vote, and those who vote against it may be able to redeem their shares. We recommend checking with the fund, as this could be a crucial detail.

Extension period options can be favorable, as the expected exit year might not be ideal due to an economic downturn, for example, or because the project returns will be higher if the fund holds certain businesses for a while longer.

Exit market

The primary objective of most Portuguese Golden Visa investment funds is to exit the portfolio by eventually selling it at a profit.

Fund managers are generally highly incentivized with a performance fee based on a percentage of the appreciation in value. This is beneficial to Golden Visa investors, meaning that incentives between investors and fund managers are aligned.

With this said, they are splitting your profit but not your potential loss, so the downside risk will fall on the investors’ shoulders.

Documents and Requirements For The Portugal Golden Visa

When applying for the Portuguese Golden Visa, there are numerous documents you must submit to AIMA, the Portuguese immigration authorities (former Serviço de Estrangeiros e Fronteiras or simply SEF). Note that if any document is missing or incomplete, your application for the Portugal Golden Visa can be significantly delayed. That’s why it’s important to stay informed about all the necessary paperwork you must prepare beforehand.

Note that the documents listed below are not exhaustive, and additional documentation requirements may be requested by the authorities.

List of Required Documents

- Passport or another valid travel document

- Proof of entry and legal stay in Portugal

- Proof that you are covered by health protection, namely:

- A document certifying that you are covered by the National Health Service or;

- A document showing that you are an internationally recognized health insurance holder for the period of legal residence requested

- Criminal record certificate from the country of origin or the country (or countries) where you have resided for more than one year (certified by diplomatic representation or Portuguese consular office). The certificate cannot be older than three months and must be translated into Portuguese;

- Proof of your tax identification number, or equivalent, of the country of origin, of residence, or fiscal residence;

- Completion of Application (using the approved model) containing the authorization for consultation of the Portuguese Criminal Registry;

- Declaration on Commitment to Honor, by which the applicant declares that he will fulfill the minimum quantitative and time requirements (five years) for the investment activity in Portugal;

- Present a negative statement debt issued, with a maximum advance of 45 days, by the Tax Authority and Customs and Social Security or, if not possible, declaration of the non-existence of registration with these entities;

- Receipt of payment of the ARI application analysis fee.

Golden Visa Portugal Investment Fund: Documents & Application Process

Portugal Golden Visa fund requirements

If you are interested in applying for the Portuguese Golden Visa through a Venture Capital Fund (FCR), you should carefully make your decision based on two important criteria:

- Fund eligibility for the Portuguese Golden Visa

- Fund credentials, including fund strategy, management pedigree, and legal obligations

Not every private equity fund in Portugal qualifies for the Golden Visa program. You need to make sure the chosen fund fulfills all the necessary technical requirements as listed by the Portuguese immigration authorities, AIMA, and that the investment fund is regulated by the Portuguese CMVM.

Required documents

To apply for the fund investments, you must demonstrate that you’ve made the investment with the minimum required amount and must submit the following documents:

- Declaration by the credit institution authorized or registered in the national territory with the Banco de Portugal, attesting to the effective transfer of an amount equal to or greater than what is required;

- Certificate proving ownership of the participation investment fund units, free of charge and charges (issued by the entity responsible for maintaining a registered updated version of the holders of participation units, under the terms of Portuguese legislation, of the respective management regulation or contractual instrument);

- Declaration issued by the management company of the respective Golden Visa fund investment, attesting the viability of the capitalization plan, the maturity of at least five years, and application of at least 60 percent of the investment in commercial companies based in Portugal;

- Certificate of commercial registration, if the investment is made through a company single shareholder, demonstrating that the applicant is the partner, cf. Article 65a (13) of Regulatory Dec. 84/07, of 11/05, in its current wording.

Step-by-Step Process & Timeline

The length of time the Golden Visa process takes depends on many different factors, including how long your decision-making process takes, how quickly you are able to provide the correct documents, the experience of the law firm, and the schedule of the AIMA office, amongst other things.

Here is a step-by-step guide to the Portuguese Golden Visa Investment Fund process:

Step 1: Choose an appropriate Golden Visa Investment fund or Golden Visa funds |

Step 2: Appoint a law firm |

Step 3: Get a NIF number (tax identification number (NIF) in Portugal) and open a Portuguese bank account |

Step 4: Sign and complete the necessary fund subscription documents |

Step 5: Fund managers evaluate and approve you as an investor |

Step 6: Transfer the funds from your bank account to the fund account |

Step 7: The fund manager issues the fund subscription declaration |

Step 8: Provide all the Golden Visa documents to the law firm and pay the SEF application fee |

Step 9: SEF Biometrics appointment scheduled, and you visit SEF in person |

Step 10: SEF issues a residence permit that is valid for an initial two years |

Step 11: Golden Visa residence permits are renewed every two years, and you are well on your way to Portuguese citizenship |

Step 12: Portuguese citizenship and passport can be granted after five years |

Questions To Consider Before Investing in Portuguese Golden Visa Funds

In terms of due diligence and compliance checks, it’s important to consider the following questions:

- Are the Portugal Golden Visa funds regulated by the Portuguese authorities?

- Is the fund fully eligible for the Portuguese Golden Visa, according to AIMA?

- Does the fund have the right attributes to safeguard the investor’s Golden Visa status? As a Golden Visa investor, you will need to maintain your investment in the Golden Visa fund for a minimum of five years, after which you will be able to apply for permanent residency and citizenship in Portugal.

Questions to ask the fund managers

- How will the fund assure diversification? If so, how often and based on what?

- What will the fund specialize in?

- What is the expected target return?

- Does the fund distribute dividends (how often and how much)?

- What fees (subscription fee, management fee, performance fee) will the fund investment involve?

Portuguese Golden Visa Investment Fund Credentials

Once you’ve established that the fund is appropriately regulated and is an eligible Golden Visa instrument, the second phase of due diligence is required on the fund credentials.

The three main aspects of analyzing a Portuguese Golden Visa qualified investment fund include:

Fund investment strategy: Does the fund investment strategy make sense? What is the term of the fund? How does the fund plan on paying back investors?

Fund manager credentials: Do the fund managers have the right experience and credentials? Are they regulated fund managers?

Regulated fund managers are those who hold specific licenses issued by the Portuguese Securities Market Commission (CMVM) based on their roles and investment strategies. These licenses ensure they meet specific professional qualifications and adhere to strict regulations, offering an added layer of protection for investors.

Fund legal protections: Are the legal documents appropriately drafted to safeguard the investor’s investment?

Useful Industry Acronyms for the Portuguese Golden Visa Investment Fund

Regarding the terms, it would be useful to understand some Portuguese-specific acronyms used in this industry, such as:

- UP (Unidade de Participação)

- PU (Participation Unit), in English, is the equivalent of stocks or shares.

- FCR (Fundo de Capital de Risco) – Private Equity Fund or Venture Capital Fund

- SCR (Sociedade de Capital de Risco) – Venture Capital Fund

- RG (Regulamento de Gestão) – Management Regulation, also known as PPM (Private Placement Memorandum)

Also, an important entity to have in mind is CMVM. This is the Portuguese equivalent of the SEC (Securities and Exchange Commission).

CMVM is a legal entity governed by public law and is part of the European System of Financial Supervisors (ESFS) and the National Council of Financial Supervisors. (Chapter 1, articles 1 – 3).

The Importance of an Informed Decision

It is important that investors exercise careful consideration when selecting the correct fund investment. Legal documents, as well as the caliber of the fund managers, must be thoroughly scrutinized. Check out additional information on investing in Portugal for citizenship.

If you are interested in applying for the Golden Visa in Portugal through investing in a fund, we can help.

Portugal Golden Visa Fund Investment: Requirements for American Citizens

If you’re an American citizen thinking of investing in Portugal Golden Visa Fund Investment, it’s advisable to about various rules and regulations.

US citizens and US tax residents are subject to specific rules for the Portugal Golden Visa fund investment. This section of the article is aimed at providing American citizens with some further information regarding certain tax details that they should be aware of. Below we’ve outlined some key considerations to take into account.

FATCA Compliant Bank

One of the first steps toward acquiring a Portugal Golden Visa is to open up a bank account in Portugal. As such, we strongly recommend you consider a FATCA-compliant bank.

FATCA basically stands for Foreign Account Tax Compliance Act. It’s the US government’s attempt to combat tax evasion by Americans holding accounts and other financial assets overseas.

FATCA has a set of rules that influence how overseas financial institutions directly report to the IRS on assets owned by Americans.

As an American considering a Portuguese Golden Visa investment fund, picking a FATCA-compliant bank will decrease the risk of being non-compliant with US tax authorities.

PFICs

What is a PFIC?

A foreign corporation is a PFIC if it meets either:

- Passive Income Test – A foreign corporation is a PFIC if greater than or equal to 75 percent of its gross income is passive income, for example, dividends, payment in lieu of dividends, interest, rents, royalties, and annuities.

- Passive Asset Test – A foreign corporation is a PFIC if the average annual percentage of the fair market value of all passive income-producing assets is greater than or equal to 50 percent of the value of the entity’s assets. This is determined on a quarterly basis, and it is considered passive if it generates passive income or is reasonably expected to generate such income in the foreseeable future.

Almost all foreign mutual funds are PFICs. In other cases, possible examples of PFICs include:

- Passive investments in offshore hedge funds, including VC funds, stocks, annuities, or income producing property

- Foreign brokerage accounts with bond funds, and equity funds

- Foreign retirement accounts

- Foreign cash value life insurance policies

What is Form 8621?

Form 8621 is the form that a US person must file if they are a direct or indirect shareholder of a passive foreign investment company (PFIC) under some specific criteria.

Who must file Form 8621?

According to the IRS, any US person who is a direct or indirect shareholder of a PFIC must file Form 8621 for each tax year if they:

- Receive certain direct/ indirect distributions from a Passive Foreign Investment Company or Qualifying Electing Fund (PFIC).

- Recognize a gain on a direct/indirect disposition of PFIC stock.

- Are reporting information with regards to section 1296 mark-to-market election or a QEF

- In Part II of the form are making an election reportable

- Will need to file an annual report pursuant to section 1298(f)

Each PFIC must have a separate Form 8621 in which stock is held. All interests in PFICs must be reported annually.

Who is considered a US Person?

United States Person means:

- A citizen or resident of the United States: This includes individuals born in the United States, naturalized citizens, individuals born abroad with a U.S. citizen parent, and individuals who meet the Substantial Presence Test for green card holders.

- A domestic partnership: This refers to a legally recognized partnership between two individuals, similar to marriage, that is treated as a married couple for tax purposes. However, this category may have specific requirements depending on the state/jurisdiction.

- A domestic corporation: This includes any corporation created or organized under the laws of the United States or any of its states or territories.

- Any estate other than a foreign estate: This encompasses estates of deceased individuals who were U.S. citizens or residents at the time of death.

- Any trust if: This category involves two conditions:

- A court within the United States is able to exercise primary supervision over the administration of the trust: This means that a U.S. court has the authority to make decisions regarding the trust’s administration and assets.

- One or more United States persons have the authority to control all substantial decisions of the trust:This implies that U.S. individuals have ultimate control over the trust’s investments, distributions, and other significant actions.

When must Form 8621 be filed?

The investor must annually calculate their pro rata share of the earnings of their investment, regardless of having received or not any distribution, as it will be considered taxable income for that year.

By doing this, you will maintain the beneficial capital gain rate. Otherwise, you would be subject to a considerably higher capital gain tax rate.

Nonetheless, one must be aware that you can only make this selection in the first year of holding. It is highly complex to retroactively make a QEF election.

Portuguese Investment Funds and PFIC

This means that, due to the schedule difference between the date by which investment funds in Portugal issue their reporting and the US’ date of submission of tax return, US investors may consider filing for a tax extension deadline of 15 October to secure enough time to be able to appropriately file their taxes.

Any information contained in this communication is not intended as or to be construed as tax advice. We advise our clients and readers to seek professional tax consultancy from a trusted partner in their jurisdiction.

Tax treatment as a US citizen

Although there is a Double Taxation Agreement between Portugal and the United States, if you are a U.S. citizen or a resident in another country, the rules for filing income, estate, and gift tax returns, plus paying estimated tax are generally the same whether you are in the US or Portugal.

Your worldwide income is subject to U.S. income tax, regardless of where you live. Having said that, though, you still may be eligible for Portugal’s special Non-Habitual Resident Tax regime and enjoy certain tax benefits.

For more information, consult our NHR Portugal tax regime guide.

Important Note: The Prime Minister of Portugal has recently announced his intention to eliminate the Non-Habitual Resident (NHR) regime starting in 2024. Read more here: Is The Portugal NHR Program Ending?

Why choose Global Citizen Solutions for your Portugal Golden Visa?

- Global approach by local experts: A team of experienced local case executives, immigration lawyers, and investment specialists based in Portugal.

- Independent service:We are not a marketing agency for any projects. You will access all eligible routes for the Golden Visa, with over 40 vetted qualifying investment options, so you can decide on the best option for you.

- 100% approval rate: We have the unique distinction of never having had a Golden Visa case rejected and have helped hundreds of clients from more than 35 countries.

- All-encompassing solution: Our dedicated onboarding and immigration teams will assist you throughout the process and beyond with a single channel of communication.

- Transparency: Our fees are clear and detailed, covering the entire process with no hidden costs.

- Privacy: Your personal data is stored within a GDPR-compliant database on a secure SSL-encrypted server.

To see the full list of reasons why to work with Global Citizen Solutions for your Portugal Golden Visa, you can find out more here: Why Work with Global Citizen Solutions for Your Golden Visa Portugal Application?

Frequently Asked Questions about the Portuguese Investment Fund for the Golden Visa

Can I get residency in Portugal through investment funds?

Yes, it is possible to get a residency permit in Portugal through the Golden Visa investment funds. You must make a minimum investment of €500,000 and ensure the investment fund is accepted for the Portugal Golden Visa.

Does Portugal have citizenship by investment?

The Portugal Golden Visa program doesn’t automatically lead to citizenship. However, it is possible to apply for Portuguese citizenship if you hold your respective investment for five years, maintain your residency visa and meet the citizenship eligibility criteria. This would enable you to apply for citizenship by naturalization.

How will Portugal Golden Visa changes in 2022 affect the investment fund option?

On 1 January 2022, the Portugal Golden Visa underwent extensive changes. For the investment fund option, the investment amount increased. Specifically, a capital transfer in Portuguese investment funds to the amount of or greater than €500,000 will be needed to apply for legal residency in Portugal.

As real estate investments are no longer eligible for a Golden Visa application, the investment fund option has become increasingly popular, particularly among American investors.

What are the benefits of the Portugal investment fund Golden Visa?

Getting a Golden Visa by investing in a fund has several benefits: Funds are specifically managed by experts in each sector, you can obtain residency with a Portuguese fund investment, and there are tax benefits; many investors are exempt from paying tax in Portugal.

Funds are also regulated by the Portuguese Securities Market Commission, which can provide peace of mind.

Are all Portuguese investment funds eligible for the Portuguese Golden Visa?

Not all investment funds are eligible for the Golden Visa. It is crucial to consult an expert before investing in funds.

Can I invest in more than one fund for the Golden Visa application?

Yes, you may invest in more than one fund if the sum of your investment is €500,000 or more. For example, you can invest €200,000 in fund X and €300,000 in fund Y. Since the total sum is €500,000, you would meet the minimum investment requirement and be able to apply for the Golden Visa.

Theoretically, you could invest in three or more Golden Visa eligible funds (subject to their minimum ticket).

Would I lose my Golden Visa if my participation unit's total value depreciates?

No, if you invested the minimum required (€500,000), you should not lose your Golden Visa, regardless of the price fluctuations on shares during and at the end of the fund term.

Can I exit my investment prematurely for the Portugal Golden Visa?

It may be possible to exit, although investors should consider the following:

- You would not be able to renew your Golden Visa or acquire permanent residency if you exit before the five-year minimum term required for the Golden Visa, as you would not meet the renewal criteria.

- Traditionally, venture capital funds are not liquid investments, and you should expect to sell your shares back to the fund or to another investor at a discount.

Is Portugal's Golden Visa worth it?

The Portugal Golden Visa is worth it if you’re comfortable with the minimum investment amount and you’re looking to widen your opportunities, procure EU residency, and even Portuguese citizenship, which also ensures EU citizenship, after five years.

What rules do I need to be aware of as an American applying for the Portugal Golden Visa qualified investment fund?

Because one of the first steps in the Portugal Golden Visa program is to open a bank account, Americans interested in the investment fund route should consider a FATCA compliant bank, on top of tax considerations.

What does PFIC mean?

PFIC stands for Passive Foreign Investment Company. For the sake of income tax accumulated in the United States, a Portugal Golden Visa qualified investment fund will usually be considered a PFIC.

What is a FATCA compliant bank?

FATCA stands for Foreign Account Tax Compliance Act. It’s the US government’s attempt to combat tax evasion by Americans holding accounts and other financial assets overseas. Some Portuguese banks are FATCA compliant, meaning they’re in touch with the US authorities and can help you properly account for all your tax activities.

What are the eligible funds for Portugal Golden Visa?

Portuguese investment funds or venture capital funds focused on the capitalization of companies legally registered in Portugal are eligible for the Portugal Golden Visa. They must have a minimum maturity of five years at the time of the investment, and at least 60 percent of the value of the investments must be made in commercial companies on Portuguese territory.

Are Portuguese investment funds safe?

A Portugal investment fund is a relatively safe investment because all funds are regulated by the Portuguese Securities Market Commission (CMVM), the Bank of Portugal, and the external fund management company. They’re also audited by the Portuguese Tax Authorities. Though these well-regulated Portuguese investment funds are low fairly low risk, it’s advisable to do research and due diligence and seek investment advice before you commit.