The Portugal Golden Visa program enables foreigners to obtain residency in Portugal through qualifying investments, with the investment funds route being the most popular option.

Currently, Portuguese Golden Visa funds account for 30% of the total permits issued. Unlike the previous real estate investment option, investing in these funds incurs fewer fees and taxes. Depending on the fund’s structure and the investor’s tax situation, choosing the Portuguese Golden Visa fund option may provide significant tax advantages.

As the Portuguese investment funds route takes center stage, we’ve curated an ultimate guide breaking down all the information you should know before committing to this investment option. You’ll learn more about:

What are the key elements of the Portugal Golden Visa Investment Fund?

The Portugal Golden Visa investment fund option allows you to invest in a qualifying fund to obtain residency and, eventually, citizenship in Portugal. To qualify, you must make a minimum investment of €500,000 in a Portugal Golden Visa fund registered and regulated by the Portuguese Securities Market Commission (CMVM).

This article is an in-depth breakdown of the Portugal Investment Fund Golden Visa. However, below we provide an outline of the essential things you need to know about the Portuguese Golden Visa Investment Fund option.

- Minimum Investment: €500,000 in a qualifying investment fund

- Eligible funds: The funds must be registered and regulated by the Portuguese Securities Market Commission (CMVM)

- Investment holding period: The investment must be held for at least five years to be eligible for permanent residency and potential citizenship

- Fund investment: The funds can invest in various sectors, including venture capital, private equity, and hospitality

- Qualifying funds: Several funds are considered eligible, including sustainable investment funds, migration projects, and bitcoin and cryptocurrencies

- Diversification: Investors can choose to diversify their investment across multiple eligible options within the fund

- Exit strategy: It’s important to inquire about the fund’s exit strategies, as they can impact the investor’s ability to redeem their investment after obtaining residency or citizenship

Portugal Golden Visa Overview

The Portugal Golden Visa program—formerly the Portugal Golden Residence Permit Program—is a five-year residency by investment initiative for non-EU nationals. With it, qualifying investors and their family members are granted the right to live, work, and study in Portugal.

The scheme was introduced by the government in 2012 as part of Portugal’s immigration move to boost foreign capital and benefit the Portuguese economy. Applicants simply transfer capital into a qualifying Golden Visa fund to acquire Portuguese residency.

After five years of legal residency in Portugal, a Golden Visa holder can apply for permanent residency and Portuguese citizenship (provided they meet the requirements). Once you have citizenship, foreigners can obtain a Portuguese passport.

Portuguese citizenship grants foreigners the benefits of being a European Union (EU) citizen, including the ability to live and work in any EU member state. Moreover, the Portuguese passport offers visa-free access to 188 countries worldwide.

The Golden Visa investment program is among the most popular, with investors worldwide making contributions. Since its inception, over 20,000 Golden Passports have been awarded to families worldwide, and over €7 billion in funds have been raised.

In addition to the investment fund, there are several other investment opportunities, such as:

- Investment or donation in the arts or reconstruction of national cultural heritage with a donation of at least €250,000

- Scientific research: Science or Technology research contribution of at least €500,000

- Creation of ten jobs: Creation and maintenance of ten jobs during the required period

- Share capital and job creation: Venture capital funds for a commercial company in the national territory or reinforcement of a company’s share capital. This company must have its head office in the national territory. The minimum investment of €500,000 is combined with the creation of five or maintaining ten jobs (five of them permanent).

The minimum investment amounts for options 2 and 3 may be reduced by 20% when the investment activity is carried out in low-density areas. These regions have fewer than 100 inhabitants per square kilometer or GDP per capita of under 75% of the national average.

What Is Portugal's Golden Visa Investment Fund?

Of all the pathways for investors, Golden Visa Investment Funds are becoming increasingly popular for obtaining residency through investment. The scheme requires a minimum investment of €500,000 in a qualifying venture capital fund and allows non-European Union citizens to obtain a residence permit in Portugal.

These funds are typically focused on sectors like technology or startups, and they must be registered with the Portuguese regulatory body, the Comissão do Mercado de Valores Mobiliários (CMVM). The objective is to use capital transfer to fund the capitalization of Portuguese companies.

These funds must adhere to strict criteria set by Portuguese regulations, including a commitment to maintain the investment for a minimum of five years and investing at least 60% of the fund’s capital in companies based in Portugal.

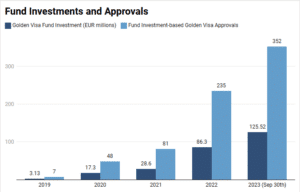

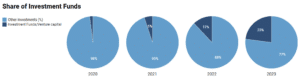

Overall, the shift towards investment funds to obtain Golden Visas reflects changes in the ARIs law, which eliminated other options like capital transfers and real estate acquisitions. According to data obtained from AIMA, venture capital and investment funds started gaining traction in 2020 and have steadily grown in the share of total investments.

This legislative adjustment contributed to the surge in foreign investment through national equity investment funds, ultimately driving growth in Portugal’s investment fund industry, and positively contributing to the Portuguese economy.

Who can Invest in the Golden Visa Investment Funds?

- Be a non-EU/EEA citizen or a non-Swiss citizen

- Have a clean criminal record

- Be over 18 years old

- Have sufficient legal funds to invest

In some instances, specific Golden Visa funds have additional requirements, such as:

- Having experience with a financial instrument such as company stock, government bonds, company bonds, funds, etc.

- Submitting proof of having enough money in their bank account

- Providing a legitimate source of funds

Can a US citizen invest in a Portuguese Investment Fund?

Yes, American citizens qualify for the investment fund pathway under the Golden Visa scheme. However, the IRS requires foreign financial institutions and certain non-financial foreign entities to report on the foreign assets held by their US account holders. Therefore, any bank, fund, and fund manager in Portugal who has an American client or investor must abide by the US government’s legislation.

American investors can also use their Individual Retirement Account (IRA) funds to invest in Portuguese funds, particularly if they are interested in qualifying for Portugal’s Golden Visa program. This strategy requires careful navigation of both the Golden Visa requirements in Portugal and IRS regulations. It may allow investors to leverage their retirement savings without incurring withdrawal penalties or immediate tax consequences.

Although IRA investment structures for Portuguese funds are relatively new, our team is diligently researching implementation strategies and regulatory implications for our clients’ applications.

How are the Portuguese investment funds regulated?

The Portugal Golden Visa Fund is regulated by CMVM (The Portuguese Securities Market Commission), which requires funds to comply with including, but not limited to, the following requirements:

- Report the valuation of their net assets on a semi-annual basis. That means investors may have their participation unit price revised every six months

- Employ independent accredited accounting firms such as PwC, KPMG, or EY for annual audits.

- They should disclose their fees in the PPM/management regulation document. That means investors should know the management entities’ fees and custodian bank charges.

Advantages of the Portuguese Golden Visa Investment Fund

There are a number of benefits to picking the Golden Visa investment funds, including:

Low fees and taxes | Investment fund investments do not lead to large fees and taxes, such as the real estate option did. Purchasing a property in Portugal requires an IMI transfer tax (average 6%), stamp duty (0.8%), and annual municipal taxes (ranging from 0.3-0.5% annually). In contrast, the investment fund route has none of these taxes. |

A safe and secure investment | The funds are regulated and must comply with the rules stipulated by the Portuguese Securities Market Commission (CMVM), which means that fund managers are regularly audited by third parties. Alongside being registered by the CMVM, the Bank of Portugal, and the external Fund Management company also regulate the fund. In addition, the Portuguese Tax Authorities audit the fund. The thorough and high levels of regulation mean that the fund must comply with the Portuguese legislation and tax laws. |

Tax-efficiency | While all real estate rental income is subject to a fixed 28% taxation, venture capital funds are a tax-efficient vehicle — dividends and capital gains returned to investors may be tax-exempt. Some cases allow for exemptions to withhold tax on income generated through the fund, especially if the investors are not tax residents in the country. |

Diversification | It is possible to invest €500,000 in several funds, depending on their minimum “tickets.” Also, Portuguese legislation governs the funds to obtain a certain level of diversification. There are quotas on what percentage a particular asset or investment in the fund may constitute of the total fund portfolio. This allows for the diversification of investments within the fund and alleviation of risk for the participating investors. |

Potential earnings | The annual yields and eventual capital gains may be significantly higher than other investment routes related to the Golden Visa program, depending on the focus of the investment fund. |

Management delegation | The investment fund Golden Visa is professionally managed by experts in each specific sector. While being a real estate landlord can be a hassle, owning a participation unit in an investment fund is much more straightforward. The management burden is delegated to the fund managers, that are motivated to bring returns to investors in order to access performance fees |

Disadvantages of the Portuguese Golden Visa Investment Fund

The Portugal Golden Visa fund investment also has some disadvantages, such as:

Lack of control | While also an advantage, in that the fund manager does all the work, the investment fund route requires the investor to trust his or her funds with an external fund manager that will determine the investment decisions and steer the strategy. Some investors may not like this lack of control. |

Exit issues | Most investment funds will contractually ensure the participants that the fund will not be dissolved before a minimum number of years to make sure that the participant can achieve the time period when he or she is able to apply for permanent residency in Portugal. There can be some issues with this: (1) the resale of the participation unit before the fund dissolves is difficult in most cases; (2) funds normally have extension periods, but sometimes these are unilaterally decided by the fund managers (and not subject to the investors’ vote); (3) if the ultimate objective of the investment fund is to sell the portfolio at a target appreciation, then there will be no guarantee of what the corresponding market will be when the fund decides to sell. |

Sharing the earnings | The potential yield and ultimate capital appreciation are shared between the investors and the managers of the fund. The management and performance fees will vary from fund to fund. |

KYC burden | Participants will need to share some documents and critical information with the managers of the fund, including proof of income and source of income. Such Know-Your-Client (KYC) burden does not exist in real estate acquisitions. |

What is the minimum investment required?

For the investment fund option, a capital transfer into Portuguese investment funds or venture capital funds to the amount of or greater than €500,000 is needed to procure legal residency in Portugal.

Prerequisites for the Golden Visa fund investment include:

- Funds must be focused on the capitalization of companies, registered under Portuguese law

- A minimum maturity of five years at the time of investment

- At least 60% of the investment value is made in commercial companies on Portuguese-owned territories

Portugal Golden Visa statistics point to an influx of investors rushing to invest in the Golden Visa, with growing interest in the fund investment Golden Visa option – particularly amongst American citizens.

We’ve created the chart below to show you a comparison of the Portuguese investment funds to other investment options.

Fund

Subscription

€500,000

Investment or donation

€250,000

Scientific

Research

€500,000

Creation of ten jobs

Project dependent

Company

set-up

€500,000

Fund Investment Profile and Diversification

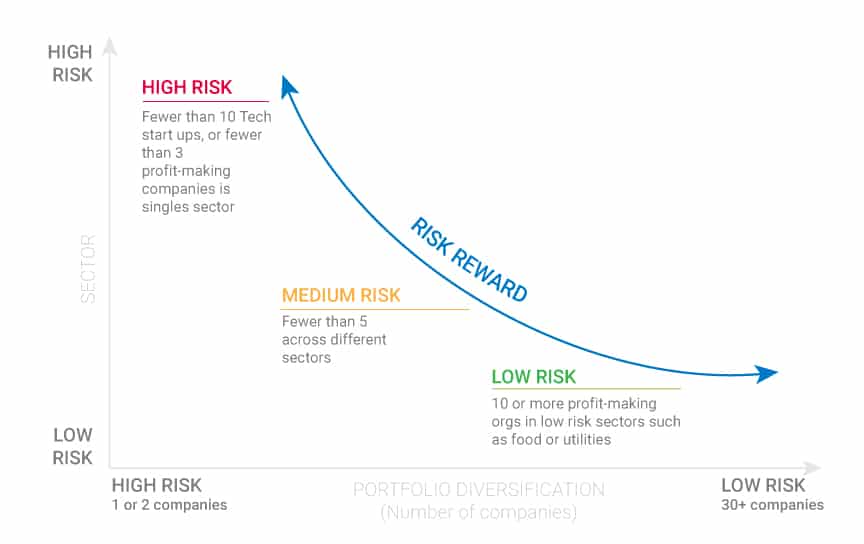

The level of security of risk of a Portuguese VC fund or Golden Visa Portugal investment fund depends on several factors, including (but not limited to) investment mandate, managers’ credentials, leverage and liquidity, exposure to the stock market, the economic cycle, and legal documents.

Some funds may offer limited potential for capital appreciation with a safer investment profile, while others may have a more leveraged approach aiming to provide Golden Visa investors with multiples of the capital invested. For example, high-growth companies focused on technology have a different profile from property development projects that tend to have a more predictable cash-flow curve.

Some Portuguese Golden Visa Investment Fund programs may offer the opportunity of an early exit, but generally, the investor should expect to realize all gains after five to ten years.

The risk-return profile of these funds will vary according to the sector exposure and portfolio diversification (i.e., how many companies comprise the fund portfolio).

Examples of risk-return levels based on sector exposure and investment portfolio diversification

List of Funds that Qualify for Portuguese Golden Visa

Portugal has long been recognized for its rich investment landscape, characterized by steady economic growth and a welcoming environment for foreign investors. While the country’s real estate sector has historically been a magnet for international capital, Portugal’s investment horizon extends far beyond.

However, it’s important to note that recent regulatory changes have excluded real estate-related funds from eligibility for the Portuguese Golden Visa program. While this adjustment may affect some investors, the program still extends its welcome to a variety of other investment fund categories, such as Growth/Buy-out funds, and Venture Capital (VC).

Below, we’ll provide a Portugal Golden Visa investment fund list to explore some of the attractive fund options that qualify for the Portuguese Golden Visa.

Growth/buy-out funds (Private Equity funds)

Growth/buy-out funds (Private Equity funds)

Private Equity funds allow investment in established companies like SMEs or mid-caps with proven market performance and positive operational results. Their goal is to acquire, restructure, and improve these companies, ultimately selling them for a profit to major industry players or other Private Equity firms.

Some funds are sector-agnostic, while others focus on specific areas like renewable energy, agriculture, healthcare, and hospitality, which is thriving in Portugal. Family businesses make up 70% to 80% of Portuguese companies, providing significant opportunities for growth and consolidation.

Although Portugal currently sees lower Private Equity investment relative to GDP compared to France and Spain, it has substantial growth potential. Spanish Private Equity and VC firms are now establishing operations in Portugal to capitalize on this.

The Development Bank of Portugal, funded by the EU, co-invests with private investors like pension funds and foreign investors, matching their contributions up to €30-50 million per fund. This collaboration helps fund managers access larger sums for growth while enhancing corporate governance.

Venture Capital funds (VC)

Venture Capital funds (VC)

Venture capital funds (FCR – Fundo de Capital de Risco or “Capital at Risk Funds”) are qualifying investments for Portugal’s Golden Visa. These funds, managed by corporate experts, invest in startups or medium-sized projects with strong growth potential. Some funds may also operate as private equity, focusing on more established companies.

VC funds invest in early-stage startups, which carry inherent risks, but successful ventures can yield significant returns. Portugal’s appealing standard of living, weather, and talent make it an attractive destination for entrepreneurs and contribute to its growing startup ecosystem.

Investors should be aware of each fund’s investment focus, as some are sector-agnostic while others target specific areas. Additionally, several funds qualifying for the Golden Visa prioritize sustainability, investing in projects that promote environmental, social, and governance (ESG) best practices.

The Golden Visa fund offers a variety of options, each catering to different investor preferences and risk tolerance. Here are the key categories:

Sustainable Investment Funds

Sustainable Investment Funds

Sustainable investment options have become increasingly popular among Golden Visa applicants. These funds focus on environmental, social, and governance (ESG) best practices. For example, the Pela Terra fund and the AIM Forest fund are renowned for their sustainable agriculture projects, which invest in under-developed rural regions in Portugal and promote organic farming practices.

Migration Projects

Migration Projects

Investment in migration projects is another emerging option under the Golden Visa scheme. These projects focus on the integration and support of immigrants, aligning with Portugal’s values of social responsibility and inclusivity. By investing in such projects, investors not only contribute to the welfare of new immigrants but also qualify for the Golden Visa.

Bitcoin and Cryptocurrencies

Bitcoin and Cryptocurrencies

Portugal may become the first European country to offer residency in exchange for investment in decentralized cryptocurrencies like Bitcoin. By holding Bitcoin worth €500,000, investors can gain residency in Portugal via the Golden Visa Program under certain conditions. This innovative approach aligns with the growing trend of integrating digital assets into mainstream financial and economic systems, offering a fresh pathway for crypto enthusiasts to secure residency in one of Europe’s most sought-after destinations.

Open-ended Funds

Open-ended Funds

Unlike traditional closed-end funds with fixed maturity dates, open-ended funds offer more flexibility, allowing investors to enter and exit more easily. This provides greater liquidity while still meeting the five-year Golden Visa holding requirement. For Golden Visa applicants—especially those who want more flexibility in accessing capital—open-ended funds can offer peace of mind through their redemption options. However, investors should carefully review the specific redemption terms, fees, and notice periods.

Guide To The Exit Market

When investing in a fund, it’s crucial to put some thought into the exit of the investment fund.

Minimum lock-up period

Most investment funds that qualify for the Golden Visa will ensure that they do not liquidate within a minimum of six years. This ensures that your investment will remain valid for the required time period to apply for permanent residency and citizenship.

Resale or transfer of participation fund units

For most Portuguese investment funds, participation units can be transferred or sold between participants, but it is usually difficult to find a demand for a participation unit in a fund that is suited to Golden Visa timelines unless traded around the incorporation of the fund.

This makes Portuguese investment funds rather illiquid until the fund reaches its maturity or is dissolved by the fund manager. Although uncommon, some funds have longer terms but offer the possibility of buying back the investor’s participation units once the participants complete the required time for the GV, these funds usually have low returns compared to others.

Extension periods

Most investment funds have a specific exit target in terms of timing. The majority of the Portugal investment funds are set for a six-to-eight-year period.

The majority of investment funds have the option to extend, and this option can be triggered at the six-year mark. In some cases, the fund manager will make the decision on this, not the investors, meaning that you may be locked in a bit further than the time required to apply for citizenship. In other cases, the extension of the fund is subject to the investors’ vote, and those who vote against it may be able to redeem their shares. We recommend checking with the fund, as this could be a crucial detail.

Extension period options can be favorable, as the expected exit year might not be ideal due to an economic downturn, for example, or because the project returns will be higher if the fund holds certain businesses for a while longer.

Exit market

The primary objective of the Portugal investment funds is to exit the portfolio by eventually selling it at a profit.

Fund managers are generally highly incentivized with a performance fee based on a percentage of the appreciation in value. This is beneficial to Golden Visa investors because incentives between investors and fund managers are aligned.

With this said, they are splitting your profit but not your potential loss, so the downside risk will fall on the investors’ shoulders.

Portugal Golden Visa Fund Requirements

If you are interested in applying for the Portuguese Golden Visa through a Venture Capital Fund (FCR), you should carefully make your decision based on two important criteria:

- Fund eligibility for the Portuguese Golden Visa

- Fund credentials, including fund strategy, management pedigree, and legal obligations

Not all Portugal private equity funds qualify for the Golden Visa program. You need to make sure the chosen fund fulfills all the necessary technical requirements as listed by the Portuguese immigration authorities, AIMA, and that the investment fund is regulated by the Portuguese CMVM.

Portugal's Golden Visa Investment Funds Required Documents

When applying for the Portuguese Golden Visa, you must submit numerous documents to the Agency for Integration, Migration and Asylum (AIMA).

Note that if any document is missing or incomplete, your application for the Portugal Golden Visa can be significantly delayed. That’s why it’s important to stay informed about all the paperwork you must prepare beforehand.

Note that the documents listed below are not exhaustive, and the authorities may request additional documentation requirements.

Golden Visa Portugal required documents

- Passport or another valid travel document

- Proof of entry and legal stay in Portugal

- Proof that you are covered by health protection, namely:

- A document certifying that you are covered by the National Health Service or;

- A document showing that you are an internationally recognized health insurance holder for the period of legal residence requested

- Criminal record certificate from the country of origin or the country (or countries) where you have resided for more than one year (certified by diplomatic representation or Portuguese consular office). The certificate cannot be older than three months and must be translated into Portuguese;

- Proof of your tax identification number, or equivalent, of the country of origin, of residence, or fiscal residence;

- Completion of Application (using the approved model) containing the authorization for consultation of the Portuguese Criminal Registry;

- Declaration on Commitment to Honor, by which the applicant declares that he will fulfill the minimum quantitative and time requirements (five years) for the investment activity in Portugal;

- Present a negative statement debt issued, with a maximum advance of 45 days, by the Tax Authority and Customs and Social Security or, if not possible, declaration of the non-existence of registration with these entities;

- Receipt of payment of the ARI application analysis fee.

Golden Visa investment funds required documents

To apply for the fund investments, you must demonstrate that you’ve made the investment with the minimum required amount and must submit the following documents:

- Declaration by the credit institution authorized or registered in the national territory with the Banco de Portugal, attesting to the effective transfer of an amount equal to or greater than what is required;

- Certificate proving ownership of the participation investment fund units, free of charge and charges (issued by the entity responsible for maintaining a registered updated version of the holders of participation units, under the terms of Portuguese legislation, of the respective management regulation or contractual instrument);

- Declaration issued by the management company of the respective Golden Visa fund investment, attesting the viability of the capitalization plan, the maturity of at least five years, and application of at least 60 percent of the investment in commercial companies based in Portugal;

- Certificate of commercial registration, if the investment is made through a company single shareholder, demonstrating that the applicant is the partner, cf. Article 65a (13) of Regulatory Dec. 84/07, of 11/05, in its current wording.

Application Process for Portugal Golden Visa

The length of time the Golden Visa process takes depends on many different factors, including how long your decision-making process takes, how quickly you are able to provide the correct documents, the experience of the law firm, and the schedule of the AIMA office, amongst other things.

Here is a step-by-step guide to the Portuguese Golden Visa Investment Fund process:

Step 1: Choose an appropriate Golden Visa Investment fund or Golden Visa funds |

Step 2: Appoint a law firm |

Step 3: Get a NIF number (tax identification number (NIF) in Portugal) and open a Portuguese bank account |

Step 4: Sign and complete the necessary fund subscription documents |

Step 5: Fund managers evaluate and approve you as an investor |

Step 6: Transfer the funds from your bank account to the fund account |

Step 7: The fund manager issues the fund subscription declaration |

Step 8: Provide all the Golden Visa documents to the law firm and pay the AIMA application fee |

Step 9: AIMA Biometrics appointment scheduled, and you visit AIMA in person |

Step 10: AIMA issues a residence permit that is valid for an initial two years |

Step 11: Golden Visa residence permits are renewed every two years, and you are well on your way to Portuguese citizenship |

Step 12: Portuguese citizenship and passport can be granted after five years |

Fees and Costs for Portugal's Golden Visa Investment Fund

When applying for a Portugal Golden Visa through an investment fund, you’ll encounter various fees and costs. Here’s a breakdown:

Mandatory fees:

- Government fees:

- Processing fee: €533 per applicant (increased to €83 for dependents) at application and renewal.

- Initial application fee: €5,325 per applicant.

- Renewal application fee: €2,663 per applicant at each five-year renewal.

- Minimum investment: €500,000 in a qualified Private Equity or Venture Capital fund.

Variable fees:

- Fund management fees: Usually range between 1 and 2 percent of the invested amount annually. This covers the fund manager’s costs for managing the fund and its investments.

- Performance fees: Some funds charge additional fees based on their performance exceeding a certain benchmark. These fees vary greatly depending on the fund and its structure.

- Legal fees: These can vary depending on the complexity of your case, the experience of the lawyer you choose for legal representation, and the number of family members included in your application. Expect to pay between €5,000 and €20,000.

- Due diligence fees: Some funds might charge a separate fee for conducting due diligence on your application. This typically falls within the €1,000-€3,000 range.

- Translation and certification fees: Depending on the volume and complexity of the documents, translating and certifying them for the application can incur additional costs.

- Travel and accommodation: Consider potential travel and accommodation costs if required for interviews or document submission in person.

Please note that fund management fees and performance fees are deducted from the fund’s pooled capital, while the subscription fees are charged on top of your investment. These subscription fees range between 2-4% from the €500,000. The amount is charged to account for the due diligence, KYC, and marketing costs.

Questions To Consider Before Investing in Portuguese Golden Visa Funds

Considerations to take into account when choosing the fund investment Portugal option:

- Is my selected Portugal yield fund eligible for the Golden Visa?

- What is my fund investment strategy, and what are my legal obligations?

- Do the Portuguese authorities regulate the fund?

As an investor in Portugal’s Golden Visa, you must keep your investment for a minimum of five years before applying for permanent residence and citizenship in Portugal. In this context, it’s essential to have an investment strategy in mind and ask about the exit strategy for the Golden Visa funds.

In terms of due diligence and compliance checks, it’s important to consider the following questions:

- Are the Portugal Golden Visa funds regulated by the Portuguese authorities?

- Is the fund fully eligible for the Portuguese Golden Visa, according to AIMA?

- Does the fund have the right attributes to safeguard the investor’s Golden Visa status? As a Golden Visa investor, you must maintain your investment in the Golden Visa fund for a minimum of five years, after which you can apply for permanent residency and citizenship in Portugal.

Questions to ask the fund managers

- How will the fund assure diversification? If so, how often and based on what?

- What will the fund specialize in?

- What is the expected target return?

- Does the fund distribute dividends (how often and how much)?

- What fees (subscription fee, management fee, performance fee) will the fund investment involve?

Portugal Golden Visa Fund Investment: Considerations for American Citizens

If you’re an American citizen thinking of investing in Portugal Golden Visa Fund Investment, you must adhere to specific regulations.

US citizens and US tax residents are subject to specific rules for the Portugal Golden Visa fund investment. This section of the article provides American citizens with further information regarding certain tax details that they should be aware of. Below, we’ve outlined some key considerations to take into account.

FATCA Compliant Bank

One of the first steps toward acquiring a Portugal Golden Visa is opening a bank account in Portugal. We strongly recommend that you consider a FATCA-compliant bank.

FATCA stands for Foreign Account Tax Compliance Act. It’s the US government’s attempt to combat tax evasion by Americans holding accounts and other financial assets overseas.

FATCA has a set of rules that influence how overseas financial institutions directly report to the IRS on assets owned by Americans.

As an American considering a Portuguese Golden Visa investment fund, picking a FATCA-compliant bank will decrease the risk of being non-compliant with US tax authorities.

PFICs

What is a PFIC?

A foreign corporation is a PFIC if it meets either:

- Passive Income Test – A foreign corporation is a PFIC if greater than or equal to 75 percent of its gross income is passive income, for example, dividends, payment in lieu of dividends, interest, rents, royalties, and annuities.

- Passive Asset Test – A foreign corporation is a PFIC if the average annual percentage of the fair market value of all passive income-producing assets is greater than or equal to 50 percent of the value of the entity’s assets. This is determined on a quarterly basis, and it is considered passive if it generates passive income or is reasonably expected to generate such income in the foreseeable future.

Almost all foreign mutual funds are PFICs. In other cases, possible examples of PFICs include:

- Passive investments in offshore hedge funds, including VC funds, stocks, annuities, or income producing property

- Foreign brokerage accounts with bond funds, and equity funds

- Foreign retirement accounts

- Foreign cash value life insurance policies

What is Form 8621?

Form 8621 is the form that a US person must file if they are a direct or indirect shareholder of a passive foreign investment company (PFIC) under some specific criteria.

Who must file Form 8621?

According to the IRS, any US person who is a direct or indirect shareholder of a PFIC must file Form 8621 for each tax year if they:

- Receive certain direct/ indirect distributions from a Passive Foreign Investment Company or Qualifying Electing Fund (PFIC).

- Recognize a gain on a direct/indirect disposition of PFIC stock.

- Are reporting information with regards to section 1296 mark-to-market election or a QEF

- In Part II of the form are making an election reportable

- Will need to file an annual report pursuant to section 1298(f)

Each PFIC must have a separate Form 8621 in which stock is held. All interests in PFICs must be reported annually.

Who is considered a US Person?

United States Person means:

- A citizen or resident of the United States: This includes individuals born in the United States, naturalized citizens, individuals born abroad with a U.S. citizen parent, and individuals who meet the Substantial Presence Test for green card holders.

- A domestic partnership: This refers to a legally recognized partnership between two individuals, similar to marriage, that is treated as a married couple for tax purposes. However, this category may have specific requirements depending on the state/jurisdiction.

- A domestic corporation: This includes any corporation created or organized under the laws of the United States or any of its states or territories.

- Any estate other than a foreign estate: This encompasses estates of deceased individuals who were U.S. citizens or residents at the time of death.

- Any trust if: This category involves two conditions:

- A court within the United States is able to exercise primary supervision over the administration of the trust: This means that a U.S. court has the authority to make decisions regarding the trust’s administration and assets.

- One or more United States persons have the authority to control all substantial decisions of the trust:This implies that U.S. individuals have ultimate control over the trust’s investments, distributions, and other significant actions.

When must Form 8621 be filed?

The investor must annually calculate their pro rata share of the investment’s earnings, regardless of whether they have received any distribution, as it will be considered taxable income for that year.

By doing this, you will maintain the beneficial capital gain rate. Otherwise, you would be subject to a considerably higher capital gain tax rate.

Nonetheless, one must be aware that you can only make this selection in the first year of holding. It is highly complex to retroactively make a QEF election.

Portuguese Investment Funds and PFIC

This means that, due to the schedule difference between the date by which investment funds in Portugal issue their reporting and the US’ date of submission of tax return, US investors may consider filing for a tax extension deadline of 15 October to secure enough time to be able to appropriately file their taxes.

Any information contained in this communication is not intended as or to be construed as tax advice. We advise our clients and readers to seek professional tax consultancy from a trusted partner in their jurisdiction.

Tax treatment as a US citizen

Although there is a Double Taxation Agreement between Portugal and the United States, if you are a U.S. citizen or a resident in another country, the rules for filing income, estate, and gift tax returns, plus paying estimated tax, are generally the same whether you are in the US or Portugal.

Your worldwide income is subject to U.S. income tax, regardless of where you live. However, even though Portugal’s Non-Habitual Resident Tax regime has ended, you might still be able to apply if you meet specific conditions.

Expert Takeaway on the Promising Return of Investment Funds

According to Lourenço Álvares, Business & Product Specialist at Global Citizen Solutions, funds provide investors with genuine financial opportunities and not only a pathway to residency (and citizenship in the long run). “Investment funds constitute a great asset class to own, especially in countries like Portugal, where the economy and respective companies will benefit from that investment to unlock their full potential,” he adds.

Additionally, Álvares recognizes that €500,000 is a substantial amount of money to invest in a country/region that foreign citizens might not know. However, when investing in funds in Portugal, investors will be able to ensure geographical diversification in a still-emerging but stable economy.

Overall, the positive side of investing in Portugal is that foreigners can have potential returns as well as residency as a by-product and even European citizenship down the line. So, why not combine this residency investment program with potential and interesting returns?

“Investment Funds in Portugal have been around for a while, and we haven’t heard about a fund that (went) burst. On the contrary, we’ve been witnessing and hearing about success stories and funds that performed or are performing quite well”, says Álvares.

Portuguese Golden Visa Investment Fund Credentials

Once you’ve established that the fund is appropriately regulated and is an eligible Golden Visa instrument, the second phase of due diligence is required on the fund credentials.

The three main aspects of analyzing a Portuguese Golden Visa-qualified investment fund include:

Fund investment strategy: Does the fund investment strategy make sense? For instance, what is the fund’s term? How does the fund plan to pay back investors?

Fund manager credentials: Do fund managers have the right experience and credentials? Are they regulated fund managers?

Regulated fund managers are those who hold specific licenses issued by the Portuguese Securities Market Commission (CMVM) based on their roles and investment strategies. These licenses ensure they meet specific professional qualifications and adhere to strict regulations, offering an added layer of protection for investors.

Fund legal protections: Are the legal documents appropriately drafted to safeguard the investor’s investment?

Glossary and Acronyms for the Portuguese Golden Visa Investment Fund

- Serviço de Estrangeiros e Fronteiras (SEF) – Portuguese immigration services, since dissolved

- Agency for Integration, Migration, and Asylum (AIMA) – The new immigration agency in Portugal

- Investment Fund Managers – People appointed by government bodies to strategize, regulate, and control all investments.

- Comissão do Mercado de Valores Mobiliários (CMVM) – The Portuguese equivalent of the SEC (Securities and Exchange Commission). The CMVM is a legal entity governed by public law and is part of the European System of Financial Supervisors (ESFS) and the National Council of Financial Supervisors. (Chapter 1, articles 1 – 3).

Regarding the terms, it would be useful to understand some Portuguese-specific acronyms used in this industry, such as:

- UP (Unidade de Participação)

- PU (Participation Unit), in English, is the equivalent of stocks or shares.

- FCR (Fundo de Capital de Risco) – Private Equity Fund or Venture Capital Fund

- SCR (Sociedade de Capital de Risco) – Venture Capital Fund

- RG (Regulamento de Gestão) – Management Regulation, also known as PPM (Private Placement Memorandum)

Why choose Global Citizen Solutions for your Immigration Visa?

GLOBAL APPROACH BY LOCAL EXPERTS

- GCS has offices located across Portugal.

- Members of the US-Portugal and UK-Portugal Chambers of Commerce in Portugal, and the Investment Migration Council (IMC).

- Our expert team can help you throughout your journey to secure your Visa.

100% APPROVAL RATE

- Our successful track record in applications provides reassurance to applicants.

- We have helped clients from more than 35 countries secure residency in Portugal.

ALL-ENCOMPASSING SOLUTION

- With a single channel of communication, our approach ensures that you have complete clarity on your application.

- Our BeGlobal® Onboarding System allows for a total flow of information.

TRANSPARENCY AND PRIVACY

- Our pricing is clear and detailed, you will not face any hidden costs.

- All data is stored within a GDPR-compliant database on a secure SSL-encrypted server.

Frequently Asked Questions about the Portuguese Investment Fund for the Golden Visa

What is an investment fund?

An investment fund is a financial product that utilizes money from different investors, for pre-established assets and strategies such as stock market equities. In Portugal, these fund units are controlled and regulated by the investment fund managers at CMVM – Portuguese Securities Market Commission – which supervises the financial instruments market and helps to protect investors.

Can I get residency in Portugal through investment funds?

Yes, it is possible to get a residency permit in Portugal through the Golden Visa investment funds. You must make a minimum investment of €500,000 and ensure the investment fund is accepted for the Portugal Golden Visa.

Does Portugal have citizenship by investment?

The Portugal Golden Visa program doesn’t automatically lead to citizenship. However, it is possible to apply for Portuguese citizenship if you hold your respective investment for five years, maintain your residency visa and meet the citizenship eligibility criteria. This would enable you to apply for citizenship by naturalization.

How will Portugal Golden Visa changes affect the investment fund option?

Recently, the Portugal Golden Visa underwent extensive changes. For the investment fund option, the investment amount increased. Specifically, a capital transfer in Portuguese investment funds to the amount of or greater than €500,000 will be needed to apply for legal residency in Portugal.

Real estate investments are no longer eligible for a Golden Visa application, so the investment fund option has become increasingly popular, particularly among American investors.

What are the benefits of the Portugal investment fund Golden Visa?

Getting a Golden Visa by investing in a fund has several benefits: Funds are specifically managed by experts in each sector, you can obtain residency with a Portuguese fund investment, and there are tax benefits; many investors are exempt from paying tax in Portugal.

Funds are also regulated by the Portuguese Securities Market Commission, which can provide peace of mind.

Are all Portuguese investment funds eligible for the Portuguese Golden Visa?

Not all investments are eligible for the Golden Visa. It is crucial to consult an expert before investing in funds.

Can I invest in more than one fund for the Golden Visa application?

Yes, you may invest in more than one fund if the sum of your investment is €500,000 or more. For example, you can invest €200,000 in fund X and €300,000 in fund Y. Since the total sum is €500,000, you would meet the minimum investment requirement and be able to apply for the Golden Visa.

Theoretically, you could invest in three or more Golden Visa eligible funds (subject to their minimum ticket).

Would I lose my Golden Visa if my participation unit's total value depreciates?

No, if you invested the minimum required (€500,000), you should not lose your Golden Visa, regardless of the price fluctuations on shares during and at the end of the fund term.

Can I exit my investment prematurely for the Portugal Golden Visa?

It may be possible to exit, although investors should consider the following:

- You would not be able to renew your Golden Visa or acquire permanent residency if you exit before the five-year minimum term required for the Golden Visa, as you would not meet the renewal criteria.

- Traditionally, venture capital funds are not liquid investments, and you should expect to sell your shares back to the fund or to another investor at a discount.

Is Portugal's Golden Visa worth it?

The Portugal Golden Visa is worth it if you’re comfortable with the minimum investment amount and you’re looking to widen your opportunities, procure EU residency, and even Portuguese citizenship, which also ensures EU citizenship, after five years.

What rules do I need to be aware of as an American applying for the Portugal Golden Visa qualified investment fund?

Because one of the first steps in the Portugal Golden Visa program is to open a bank account, Americans interested in the investment fund route should consider a FATCA compliant bank, on top of tax considerations.

What does PFIC mean?

PFIC stands for Passive Foreign Investment Company. For the sake of income tax accumulated in the United States, a Portugal Golden Visa qualified investment fund will usually be considered a PFIC.

What is a FATCA compliant bank?

FATCA stands for Foreign Account Tax Compliance Act. It’s the US government’s attempt to combat tax evasion by Americans holding accounts and other financial assets overseas. Some Portuguese banks are FATCA compliant, meaning they’re in touch with the US authorities and can help you properly account for all your tax activities.

What are the eligible funds for Portugal Golden Visa?

Portuguese investment or venture capital funds focus on capitalizing companies legally registered in Portugal. They must have a minimum maturity of five years at the time of the investment, and at least 60 percent of the value of the investments must be made in commercial companies on Portuguese territory.

Are Portuguese investment funds safe?

A Portugal investment fund is a relatively safe investment because it is regulated by the Portuguese Securities Market Commission (CMVM), the Bank of Portugal, and the external fund management company. The Portuguese Tax Authorities also audit it.

Though these well-regulated Portuguese investment routes are low risk, it’s advisable to do your research and seek investment advice before you commit.

What is the minimum investment required for the Portugal Golden Visa through an investment fund?

The minimum investment for the Golden Visa eligible funds is €500,000 in a qualifying venture capital investment fund. As real estate and capital transfers can no longer be used, this is the next best option for international investors looking for a residence permit in Portugal.

Why are more Americans choosing to move to Portugal?

Americans are choosing to move to Portugal for several reasons, including the country’s high quality of life, affordability, and safety. Portugal offers a lower living cost compared to many cities in the United States, especially in terms of housing and daily expenses.