What is Crypto Citizenship?

Crypto citizenship is a way to use cryptocurrencies like Bitcoin to gain citizenship or residency in certain countries. For example, places like Antigua and Barbuda or Vanuatu accept crypto payments for their citizenship by investment programs. This means you can use your digital assets to meet the investment requirements for legal citizenship.

Some people use the term crypto citizenship to refer to blockchain-based communities that provide online identities for individuals, but these don’t give real citizenship. It’s simply a modern way to connect cryptocurrency with global travel and living.

Global Citizen Solutions’ (GCS) Intelligence Unite developed a detailed Crypto Friendly Nations report highlighting 75 countries every investor should know. According to Laura Madrid, the Global Intelligence Unit research lead, the report “takes a multi-dimensional approach.”

The report analyzes 75 regions based on 13 factors like tax policies and green energy use. It uses publicly available data and expert opinions to examine how each region handles cryptocurrency, focusing on adoption rates, cybersecurity, and internet speeds. The findings show how different regions compare in crypto infrastructure, regulation, and tax friendliness, providing valuable insights for investors, consultants, clients, and policymakers. You’ll find the best crypto countries list in the sections below.

Can you use Bitcoin or other cryptocurrencies to get citizenship?

Yes, you can use Bitcoin or other cryptocurrencies to obtain citizenship in some cases. However, transactions must comply with anti-money laundering (AML) and know-your-customer (KYC) regulations and most payments must be converted to fiat currency.

Are there citizenship by investment programs that accept cryptocurrency as an investment?

Yes, some citizenship-by-investment programs accept cryptocurrency as part of the investment process. However, as mentioned, this involves converting the cryptocurrency into fiat currency, such as U.S. dollars or Euros, through a regulated intermediary.

For more clarification, fiat currency is government-issued money that is widely accepted for transactions, unlike cryptocurrencies. This conversion makes it easier for CBI programs to handle the investment, as fiat currencies are universally recognized and regulated, simplifying the process.

Benefits of Crypto Citizenship

Global mobility

Global mobility

Dual citizenship offers the freedom to live and work in more countries. It’s especially useful for crypto investors interested in investment migration to places with favorable regulations.

Tax incentives

Tax incentives

Depending on the country, crypto citizenship can potentially help optimize how you pay tax. Some countries offer favorable tax policies for crypto investors, including exemptions on crypto profits or lower tax rates.

Access to crypto-friendly markets

Access to crypto-friendly markets

Being a citizen of a country with a crypto-friendly environment opens up opportunities in global markets. Many countries that accept crypto investments for citizenship also have progressive regulatory frameworks, offering a safer and more stable environment for crypto trading and investments.

Diversification of assets

Diversification of assets

Acquiring a second citizenship through crypto provides diversification in assets and political risk. Investors can protect their assets and wealth from instability in their home country by holding citizenship in a country with a more stable or beneficial regulatory framework for digital assets.

Legal protection and regulatory frameworks

Legal protection and regulatory frameworks

Some countries offering crypto citizenship have strong legal frameworks that protect crypto holders’ legal rights. These regulations make it easier for investors to run their businesses without worrying about sudden regulatory changes or penalties.

Understanding Citizenship by Investment

Crypto citizenship, or what some might call “Bitcoin citizenship,” can be obtained through Citizenship by Investment, a process that allows individuals to obtain a country’s citizenship in exchange for a significant financial investment. This can involve investing in government-approved businesses, real estate investments, or other forms of capital.

Crypto citizenship programs are attractive for those looking for second citizenship for personal, tax, or travel reasons.

Eligibility & requirements:

- Must be at least 18 years old.

- Applicants should not have a criminal background or a clear history of legal conduct.

- Financial investment is required, which can be through:

- – Real estate purchase

- – Donation to a national development fund

- – Direct investment in government bonds or business ventures

- Applicants must be in good health and often provide a medical certificate.

- Proof of the legal source of the funds used for the investment is needed.

- Some programs may require applicants to live in the country briefly before gaining citizenship, though this is often not a long-term requirement.

12 Crypto-Friendly Countries

Determining the best countries to get citizenship is not only about finding a country that accepts crypto investment. Many other factors could still help several crypto investors consider other nations for residency or citizenship, like their crypto-friendly regulatory frameworks, tax benefits, and more.

1. Vanuatu

Vanuatu stands out as a country that accepts Bitcoin and other cryptocurrencies in its Vanuatu citizenship by investment program. Investors can make their qualifying donation of $130,000 in cryptocurrency. The country also has no income, capital gains, or inheritance tax, making it very appealing for crypto investors. The lack of taxation on crypto transactions means that crypto enthusiasts and businesses can operate with minimal tax implications. Vanuatu’s tax system is designed to attract foreign investment, and crypto is treated as an asset rather than currency.

2. Antigua and Barbuda

Antigua and Barbuda’s citizenship by investment is the only Caribbean country that allows the use of cryptocurrency like Bitcoin for investment purposes. Applicants can either contribute $230,000 to the National Development Fund (NDF) or purchase real estate worth at least $300,000. These investments are made easier through a regulated intermediary, allowing individuals to gain citizenship and enjoy benefits like visa-free travel to numerous countries. The flexibility of using digital currencies makes Antigua and Barbuda an appealing option for crypto investors seeking citizenship.

3. Portugal

Portugal has long been considered one of the most crypto-friendly countries in Europe, offering significant tax benefits for crypto investors. It earned 6th place in the Crypto-Friendly Nation’s Report due to its high exchange availability and favorable tax regimes. Portugal does not tax capital gains on cryptocurrencies for individual investors, which makes it an ideal location for crypto traders. While Portugal doesn’t have a citizenship program that directly accepts cryptocurrency, it does offer a Portugal Golden Visa scheme with a minimum investment of €250,000. It is an attractive option for crypto investors looking to secure European residency. Additionally, the country’s regulatory stance on cryptocurrencies is clear and actively promotes blockchain technology.

4. Malta

Malta is a crypto-friendly country with clear rules for blockchain and cryptocurrency. In 2018, it introduced laws to make the crypto industry safe, covering things like exchanges, initial coin offerings (ICOs), which are ways to raise money for new crypto projects, and digital wallets. Malta also has a special testing space for new blockchain projects.

Additionally, the country offers Malta Citizenship by Investment, where individuals can obtain citizenship by making a minimum investment of €350,000 in real estate or renting property with an annual rent of at least €16,000. With its favorable tax system and blockchain-friendly laws, Malta is an attractive destination for crypto investors seeking citizenship and a clear legal framework for cryptocurrency.

5. Switzerland

Switzerland is home to “Crypto Valley” in Zug, which is renowned as a global center for blockchain and cryptocurrency innovation. While Switzerland does not offer a CBI program, it is still worth mentioning because it offers favorable tax treatment for crypto investors, such as no capital gains tax for individuals on cryptocurrencies held for more than one year. Short-term crypto traders are taxed on their income, but generally, the tax environment for crypto investors remains highly favorable in Switzerland.

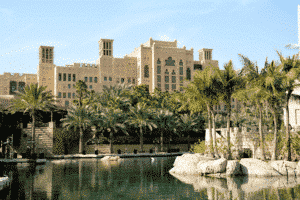

6. United Arab Emirates (UAE)

The UAE, particularly Dubai, is an emerging global hub for cryptocurrency. It provides attractive options for long-term residency through the UAE Golden Visa, which grants long-term residency to investors and entrepreneurs.

According to the Global Intelligence Unit, “the UAE has been one of the fastest-growing and well-established crypto markets with a tax system that is highly favorable for crypto holders, with zero income tax and no capital gains tax.” The UAE’s open regulatory approach to cryptocurrencies, including zero personal income tax and no capital gains tax, and a supportive regulatory environment, make it a key destination for crypto investors.

7. Singapore

Singapore ranks second in the Crypto Friendly Nations Report because it has quickly enhanced its crypto ecosystem and developed favorable tax regimes. The country has a clear and favorable regulatory environment for cryptocurrencies, making it one of the most attractive places for crypto businesses. Singapore offers no capital gains tax, and crypto trading is treated as goods and services subject to Goods and Services Tax (GST). Its tax-friendly environment and proactive position on blockchain technology make it an appealing country for crypto entrepreneurs and investors.

8. El Salvador

El Salvador became the first country in the world to adopt Bitcoin as legal tender, which provides a unique opportunity for crypto investors. The country does not tax Bitcoin transactions or capital gains, making it a tax-free environment for Bitcoin holders. According to GIU, El Salvador was among the countries highlighted for making significant strides in improving legislation, exchange availability, and favorable tax regimes for crypto investors in Latin America. The country has taken an open approach to cryptocurrency, and its commitment to Bitcoin adoption makes El Salvador an attractive place for crypto investors.

9. Germany

A key player in the European Union, Germany is known for its favorable treatment of cryptocurrency holders, especially those holding their crypto assets for over a year. For long-term investors, Germany does not impose capital gains tax. For crypto traders, however, crypto is taxed as income. Germany has one of the most stable and transparent legal environments for crypto investors in Europe, which marks it as another country for crypto investors to consider when looking for a place to settle their cryptocurrency assets.

10. Grenada

Grenada’s Citizenship by Investment program allows individuals to obtain citizenship through real estate or a government donation. Although Grenada does not directly accept cryptocurrencies for CBI investments, it is a crypto-friendly country. It is known for its tax-friendly environment, with no capital gains or inheritance tax. Crypto-related businesses are also encouraged in Grenada, which is perfect for investors interested in both tax benefits and a route to Caribbean citizenship.

11. Cayman Islands

The Cayman Islands offers a tax-free environment, with no capital gains, inheritance, or income tax. The country is worth noting because it welcomes Crypto businesses, and the jurisdiction provides a secure environment for crypto-related companies. The Cayman Islands are known for their ease of doing business, and their tax system is highly attractive for crypto investors and entrepreneurs.

12. United States

According to the GCS intelligence unit, the United States is one of the largest markets for cryptocurrency due to its wide adoption, many crypto exchanges, and strong blockchain innovation. It remains a major hub for institutional and retail investors, with high levels of crypto activity nationwide.

Various states, such as Wyoming and Texas, have favorable tax policies, and the U.S. is at the forefront of blockchain development, with institutions and projects being regulated by the U.S. Securities and Exchange Commission (SEC) and other authorities.

What is the process of getting a crypto citizenship?

The process of obtaining citizenship through cryptocurrency or digital assets generally follows the citizenship by investment programs framework, where digital assets such as Bitcoin or Ethereum can be used as part of the investment process.

Almost no government accepts cryptocurrency directly in exchange for citizenship. However, digital assets can be converted into conventional currency through a regulated intermediary and then used for investment. Antigua is currently the only country that offers roundabout pathways for cryptocurrency investors to obtain citizenship using assets like Bitcoin.

Here’s an easy-to-follow outline of the process:

Choose a country with a CBI program

Look for countries offering Citizenship by Investment (CBI) programs that allow cryptocurrency or digital assets as qualifying investments.

Convert digital assets into fiat

Since most CBI programs do not directly accept digital assets, you’ll need to work with a regulated intermediary, such as a cryptocurrency exchange, to convert your assets into fiat currency like USD or EUR.

Meet investment requirements

Each CBI program will have specific investment requirements, such as a donation to the government or a real estate purchase. The value of the digital assets you convert must meet the country’s set criteria.

Submit required documentation

Along with your investment, you will need to submit documentation, including proof of identity, a clean criminal record, proof of the origin of your digital assets, and health certification.

Wait for approval

After submission, authorities will review your application, including verifying the source of the assets used for the investment. If approved, you will receive the citizenship.

Obtain citizenship

Upon approval, you will be granted citizenship, which may come with benefits such as visa-free travel, tax advantages, and the ability to live and work in the country.

Global Citizen Solutions is a boutique migration consultancy firm with years of experience delivering bespoke residence and citizenship by investment solutions for international families. With offices worldwide and an experienced, hands-on team, we have helped hundreds of clients worldwide acquire citizenship, residence visas, or homes while diversifying their portfolios with robust investments. We guide you from start to finish, taking you beyond your citizenship or residency by investment application. How Can Global Citizen Solutions Help You?

Frequently Asked Questions about Buying Citizenship with Cryptocurrency

Where can I buy citizenship with cryptocurrency?

Vanuatu and Antigua and Barbuda are the only countries where you can buy citizenship with cryptocurrency. However, it’s crucial to note that the existing regulations concerning the acceptance of cryptocurrency as payment for citizenship through investment programs are subject to potential revisions.

What is the best citizenship for crypto investors?

The best citizenship for crypto investors is in crypto-friendly nations, such as Vanuatu, home to Satoshi Island, an intended crypto tax haven designed to attract blockchain pioneers and enthusiasts worldwide. Other valuable citizenships for crypto investors seeking a second passport include Antigua and Barbuda, Malta, Portugal, Singapore, and Switzerland.

What is the most used cryptocurrency?

The most used cryptocurrency is Bitcoin, the pioneering cryptocurrency created by an anonymous individual or group known as Satoshi Nakamoto.

Is Portugal a crypto-friendly country?

Yes, Portugal is considered crypto-friendly. It has no capital gains tax on cryptocurrency for individual investors, making it an attractive destination for crypto enthusiasts. However, businesses dealing with cryptocurrencies are subject to taxation.

What are the most crypto-friendly countries?

Some of the most crypto-friendly countries are Vanuatu, Antigua and Barbuda, Malta, El Salvador, Portugal, Switzerland, Canada, Singapore, and Estonia.

Do you need to be a citizen to buy cryptocurrency?

No, you do not need to be a citizen to buy cryptocurrency. Anyone can purchase crypto, as long as they meet the age and legal requirements of the country they reside in.

In what country can I buy citizenship with cryptocurrency?

You can buy citizenship with cryptocurrency in Vanuatu, Antigua, and Barbuda. Both countries allow cryptocurrency payments for their citizenship-by-investment programs.

Can immigrants buy crypto?

Yes, immigrants can buy crypto as long as they meet the legal requirements in their country of residence.

Can you buy citizenship with Bitcoin directly?

So far, Vanuatu is the only country where you can buy citizenship with Bitcoin. In 2017, the Vanuatu government announced that it would accept Bitcoin as payment for its citizenship by investment program.