The Spain Digital Nomad Visa, also called the Spain Telework Visa, allows non-EU citizens to live and work remotely in Spain. This visa offers digital nomads the opportunity to work for foreign companies or as freelancers while enjoying the lifestyle, culture, and benefits that Spain offers, such as access to healthcare and the chance to reside in an EU country.

This guide article will highlight everything you need to know about the Spain Digital Nomad Visa, including the application process, income requirements, eligibility criteria, the benefits of being a remote worker in Spain and more.

This is more of what we will cover:

- What is the Spain Digital Nomad Visa?

- Quality of Life for a Digital Nomad in Spain

- Who can apply for the Spain Digital Nomad Visa?

- Spain Digital Nomad Visa Requirements

- Benefits of the Spain’s Digital Nomad Visa

- Required documents for the Digital Nomad Visa Spain

- How to Apply for Spain’s Digital Nomad Visa

- Spain Digital Nomad Visa Processing Time

- The Cost of the Spain Digital Nomad Visa

- How long is the Digital Nomad Visa Spain valid for?

- Alternative Routes to Spanish Residency

- Living in Spain

Quality of Life for a Digital Nomad in Spain

Spain is also a top choice for digital nomads in Europe because of its warm weather, low cost of living, good healthcare, and high internet speed. The overview of the quality of life aspects in Spain below is based on trusted reports, such as the Healthcare Index, which reflects user experiences and considers factors like quality, accessibility, cost, and responsiveness of the system. It also draws from sources like the Global Peace Index, the Global Digital Nomad Report, and the Global Passport Index, which contributes to Spain’s top-five ranking on the Quality of Life Index.

Spain's Quality of Life Aspects |

|

Quick Visa Facts

Quick Visa Facts |

What is the Spain Digital Nomad Visa?

To qualify, you must show you have the right skills with a university degree, a professional certificate, or at least three years of work experience in your field. You must also prove your job is stable by showing you’ve worked with your current employer or clients for at least three months.

Unlike many other digital nomad visas, Spain’s version lets freelancers and self-employed people earn up to 20% of their income from Spanish clients, while the rest must come from clients or companies outside Spain. This flexibility, along with Spain’s lower cost of living, sunny weather, and easy travel across Europe, makes it a popular choice for remote workers.

Another highlight is that Spain ranked first in the Global Citizen Solutions Digital Nomad Report as the best country for digital nomads. The ranking reflects Spain’s strengths in areas that matter most to remote workers, such as accessible visa policies, reliable internet and tech infrastructure, and a safe, stable living environment.

Who can apply for the Spain Digital Nomad Visa?

- Non-EU/EEA citizens over 18

- Clean criminal record

- Interested in working remotely in Spain

- Spouse or unmarried partner

- Children under 18

- Financially dependent children over 18

- Dependent parents

Spain Digital Nomad Visa Requirements

As set out by the Spanish government, applicants must meet the following requirements to get Spain’s Digital Nomad Visa:

- The main applicant must be at least 18 years old.

- No criminal record.

- Not listed as undesirable or sanctioned in Spain.

- No previous visa or entry refusal to the Schengen zone.

- Valid private health insurance from a provider authorized in Spain.

- A certificate of Social Security coverage from your home country or registration in Spain’s social security system.

- Suitable accommodation in Spain (either renting or owning property).

- You must live in Spain for at least 183 days a year to renew the visa.

- Sufficient financial means or a regular income. In 2024, you need to earn at least €2,763 per month (200% of Spain’s minimum wage). If you have dependents, additional amounts are required.

- A degree from a recognized university or 3 years of experience in your field.

- Ability to work remotely using computers and telecommunication.

- For employees: Must have been with the same company for at least 3 months before applying and must have a remote work agreement.

- For self-employed applicants: Must have a commercial relationship with non-Spanish companies for at least 3 months before applying and a remote work agreement.

- If self-employed for a Spanish company: No more than 20% of your work can be with that company, and you need a remote work agreement.

- Payment of required fees.

Benefits of the Spain's Digital Nomad Visa

- Extended stay: Spain’s Digital Nomad Visa enables remote workers to reside and work in Spain for a prolonged period.

- Family inclusion: This Spanish visa provides the opportunity to bring along family dependents.

- Schengen zone travel: Visa holders enjoy travel freedom within the Schengen Zone, comprising 27 European countries.

- Tax benefits: Digital Nomad Visa holders, if employed or entrepreneurs, can opt for more favorable taxation under the special Non-Resident Income Tax Regime.

- Cultural experience: Spanish digital nomads can immerse themselves in the country’s rich cultural heritage, benefit from affordable living costs, and enjoy a high quality of life.

- Permanent residence pathway: After five years of continuous residence in Spain, the Spain Digital Nomad visa holders may be eligible to apply for permanent residence.

- Citizenship eligibility: With a decade of continuous residence, Spain Digital Nomad Visa holders may qualify for Spanish citizenship.

Required Documents for the Digital Nomad Visa Spain

To successfully apply for the Spain remote work visa, you must provide several documents proving your eligibility. Below are the documents you’ll need to prepare for your application:

- Completed application form.

- A valid passport (or ID/residence permit if you are a legal resident but not a citizen).

- Two passport-style photos.

- Proof of residence in your consular district.

- Proof of no criminal records.

- Proof of qualifications: A university degree or professional certificate showing at least three years of experience. Some consulates accept employment history.

- Proof of employment: Employment contract (at least 3 months) or certificate of professional relationship if self-employed.

- Proof of permission to work remotely: A letter from your employer or company stating that you’re allowed to work remotely from Spain, as well as your role, salary, and terms.

- Employer’s business status: If employed, show the company has been active for at least 1 year with a certificate from the official register.

- Proof of income: At least €2,763 per month per month through means like bank statements, payslips, or employment contracts.

- Social Security registration: If you’re registered with your home country’s social security, you must make a declaration confirming that you will comply with social security obligations before working in Spain.

- Spanish Social Security registration: If registered with Spanish Social Security, provide a registration certificate.

- Health insurance: A certificate of health insurance coverage with an authorized provider in Spain. If registered with Spanish social security, this is accepted.

How to Apply for Spain's Digital Nomad Visa

The Spain Digital Nomad Visa underwent several changes to iron out the details initially, but the government eventually set out a timeline and application process.

The time it takes to apply for the Spanish Digital Nomad Visa can depend, but what can take time is the criminal background check. In the U.S, applicants can do this through the FBI, which can take three to five working days. In the UK, it can be done online or by post and can take about 12 days.

Step 1. Gather all required documents

Collect all required documents, including proof of income, remote work, health insurance, a clean criminal record, and a completed application form.

Step 2. Choose where to apply

You have two options:

- From abroad: Apply at a Spanish consulate or embassy in your home country. You’ll receive a 1-year Digital Nomad Visa.

- From within Spain: Enter Spain on a tourist visa and apply for the 3-year Digital Nomad Residence Permit at the immigration office.

Step 3. Submit your application and biometrics

Submit your application along with your biometrics (fingerprints and photograph).

- If applying abroad, this is done at the Spanish consulate.

- If applying in Spain, this is done at your local immigration office (Extranjería).

Step 4. Enter Spain and apply for the residence permit (if needed)

If you applied from abroad and received the 1-year visa, travel to Spain and apply for the residence permit (TIE) within 30 days of arrival.

Step 5. Submit biometrics again in Spain

Visit the police station, Policía Nacional, to submit your fingerprints and photo for the TIE card. Bring your passport and residence approval.

Step 6. Wait for and collect your TIE Card

After biometrics, wait up to 30 days for your TIE (Tarjeta de Identidad de Extranjero). You’ll receive a pick-up date to collect it.

Step 7. Register your address (Empadronamiento)

Go to the local municipal office (Ayuntamiento) to register your address. Bring your passport, lease or rental contract, and your TIE or residence approval. This step is required for access to health care and other local services.

Spain Digital Nomad Visa Processing Time

The processing time for the Spain Digital Nomad Visa is one to three months, whether you apply through the Spanish consulate or from within Spain. However, processing times may vary depending on the consulate or the volume of applications, so applying early is recommended to avoid delays.

The Cost of the Spain Digital Nomad Visa

These are the costs associated with the Spain Digital Nomad Visa:

- Application through the Consulate (for the one-year visa): The fee is €90. Different rates may apply for nationals of Australia, Bangladesh, Canada, the USA, and the UK due to reciprocity. Check with the Consular Office for exact fees.

- UGE Application (for the 3-year residence permit): First application is €73.26 per applicant, and the renewal of the residence permit is €78.67

- TIE Request (Residence Card): The first card costs €16.08, and the renewal of the card is €19.30

How long is the Digital Nomad Visa Spain valid for?

To apply for a residence permit renewal, applicants must do so 60 days before or within 90 days after the card’s expiration date. The main applicant must gather documents similar to the initial application, including a certificate of payment of social security contributions.

Family members must submit separate applications and provide certificates of no criminal record from all countries where they have lived in the last two years.

Taxes for Digital Nomads in Spain

If you live in Spain for more than 183 days a year, you’ll be considered a tax resident, meaning you must pay Spanish taxes on your worldwide income. This applies whether you’re a remote employee working for a non-Spanish company, a freelancer, or a contractor.

Remote workers must report income and any additional benefits, like stock options. Freelancers must register as “Autónomo” (self-employed), contribute to Social Security, charge VAT, and submit quarterly tax returns, which can affect your visa status. Since the Spain Digital Nomad Visa requires you to stay in the country for at least 183 days per year, this makes you a tax resident by default. As a result, you’ll be subject to progressive income tax rates, which can reach nearly 50% in some regions.

Spain’s Beckham Law

Under Spain’s special expat tax regime, the Beckham Law, you can pay a flat 24% tax on your income (up to €600,000/year), instead of the high progressive rates.

To qualify, you must:

- Not having been a Spanish tax resident in the last 5 years.

- Move to Spain for work.

- Have Spain as your main work base.

- Apply within 6 months of registering for Spanish Social Security.

How to get Spain Citizenship and Permanent Residency through the Digital Nomad Visa

After five years of living in Spain on the Digital Nomad Visa, remote workers may qualify for permanent residency as long as they continue to meet the requirements set by the Spanish government. To qualify for permanent residency, you must have spent at least 183 days per year in Spain during those five years. Permanent residency is indefinite, but the resident card must be renewed every five years.

If you wish to apply for Spanish citizenship, you must have lived in Spain for more than 10 years. Along with meeting the residency requirement, applicants must pass two exams: a Spanish language proficiency test at a minimum of the A2 level and a test on Spanish culture and laws.

Alternative Routes to Spanish Residency

The Spain Non-Lucrative Visa offers another possible route to permanent residency. It is ideal for retirees, investors, or those with sufficient passive income who want to live in Spain without working for a Spanish company. The visa is valid for one year and renewable for up to two more years, totaling three years.

Cost of Living in Spain

Expense Category | Estimated Monthly Cost (€) (Single person) |

Rent (1-bedroom apartment) | €700 – €1,200 |

Utilities (electricity, water, internet) | €100 – €150 |

Groceries | €200 – €300 |

Eating Out | €100 – €200 |

Public Transport | €40 – €60 |

Coworking Space (optional) | €100 – €250 |

Health Insurance | €50 – €100 |

Leisure/Gym & Other | €100 – €200 |

Total Estimated Cost | €1,390 – €2,460 |

Best Cities for Digital Nomads in Spain

Spain offers a range of vibrant cities catering to digital nomads’ needs and preferences. These Spanish cities not only provide conducive environments for remote work but also offer unique cultural experiences and a welcoming atmosphere for those seeking a fulfilling lifestyle.

Here are some of the best cities for remote work in Spain:

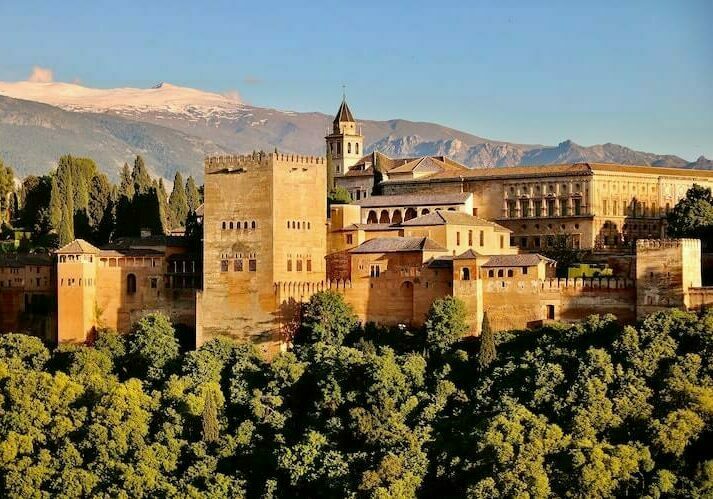

Barcelona

Barcelona is a popular place for digital nomads because it offers both busy city life and beautiful beaches. The city has a growing tech industry, lots of co-working spaces, and a lively cultural scene. The amazing buildings designed by Antoni Gaudí make the city even more special, giving you a great place to work and explore.

Madrid

Madrid, Spain’s capital and economic center, blends modern life with rich traditions. It offers excellent public transportation, diverse food options, and plenty of cultural attractions. With many co-working spaces and networking events, it’s a great spot for remote workers.

Valencia

Valencia, situated on the southeastern coast, offers a more relaxed pace of life. The city boasts a mild climate, beautiful parks, and stunning futuristic architecture. With affordable living costs and a growing startup ecosystem, Valencia provides an excellent balance of work and leisure.

Seville

Seville is known for its historic charm and vibrant energy, making it a great choice for digital nomads. With famous landmarks like the Alcazar and Giralda, plus the winding streets of the Santa Cruz district, it’s a beautiful place to explore during work breaks.

Palma de Mallorca

Palma de Mallorca in the Balearic Islands offers a refreshing alternative for those craving a blend of work and island life. With picturesque beaches, a Mediterranean climate, and a growing digital nomad community, Palma provides a relaxed setting for remote work, allowing professionals to enjoy the island’s natural beauty during their downtime.

How Can Global Citizen Solutions Help You?

Global Citizen Solutions is a boutique migration consultancy firm with years of experience delivering bespoke residence and citizenship by investment solutions for international families. With offices worldwide and an experienced, hands-on team, we have helped hundreds of clients worldwide acquire citizenship, residence visas, or homes while diversifying their portfolios with robust investments.

We guide you from start to finish, taking you beyond your citizenship or residency by investment application.

Frequently Asked Questions about the Spain Digital Nomad Visa

What is the Spain Digital Nomad Visa?

The Spain Digital Nomad Visa allows remote workers and freelancers to live and work in Spain while earning income from foreign sources. It offers an initial stay of one year, with the possibility of renewal for up to five years. Applicants must meet income requirements and have health insurance, among other criteria.

How long can I stay in Spain on a digital nomad visa?

Spanish Digital Nomad Visa is valid for one year and you can extend it for up to five years. You can also apply for a shorter time.

How much does the Spain Digital Nomad Visa fee cost?

The cost of the Spanish Digital Nomad Visa fee is around $90 per application (Consulate) or $73.26 (Within Spain). This may vary on relevant exchange rate and currency.

Do digital nomads pay taxes in Spain?

Yes. In Spain, you are considered a tax resident if you spend more than 183 days in the country within a calendar year or if your main professional activities or economic interests are based in Spain. However, if you elect to be taxed as a non-residents, you’ll pay a flat rate of 24% on your Spanish-sourced income up to €600,000 (as of the last update) and 47% on income above this threshold.

What is Spain's minimum wage?

The Spanish minimum wage is €1,260 per month for full-time workers, based on a 14-payment system. This brings the annual total minimum wage to approximately €18,640.

How can I get residency in Spain?

The Spain Golden Visa is a residency-by-program that grants qualifying individuals renewable residency rights in Spain in exchange for an investment in the nation’s economy, starting at a minimum of €500,000.

How much income do you need to be a digital nomad in Spain?

To qualify, the digital nomad minimum salary is at least 200% of the monthly Spanish national minimum wage, which is about €2,763.

Can I work remotely in Spain for a company based in the US?

Yes, you can. You are not limited to the amount of work you do for companies outside of Spain. However, if you work for a Spanish company, it can’t make up more than 20 percent of your income.

Can I travel to other European Union countries with a Spain digital nomad visa?

Yes, any non-EU/EEA national who holds a Spanish Digital Nomad Visa can travel across the European Union freely. This means you can visit other European countries that are part of the European Union. In case you want to visit countries in Europe that are not part of the EU, you still need a visa for those.

How does Spain's digital nomad visa compare to Portugal?

There are several similarities between Spain vs Portugal Digital Nomad Visas. However, the biggest difference is the income requirement and the source of the income.