Please be aware that the Ireland Golden Visa program was terminated on 14 February 2023, and the information provided in this article does not reflect the current immigration policy. You can find alternative options for active EU Golden Visas in our article: Golden Visas Europe – Invest in EU Residency & Citizenship

The Irish Golden Visa scheme is a residency by investment program that offers a plethora of benefits to those who want to expand their financial and personal freedom, and gain entry into one of Europe’s most sought-after nations. The program provides qualifying investors and their immediate family members with the opportunity of obtaining their resident status in Ireland, and grants them the right to live and conduct business in the nation without the need for an employment permit. They must first meet the minimum investment threshold, and abide by the scheme’s requirements.

In this guide to Ireland’s Golden Visa, you’ll learn about:

- The Irish Golden Visa: A Brief Overview

- Key reasons to invest in Ireland

- Benefits of the Ireland Investor Visa Program

- Eligibility requirements for the Ireland Golden Visa

- Investment options for the Irish Golden Visa

- Step-by-step guide to Irish residency and citizenship

- Ireland Golden Visa Application Processing Time

- Taxes to consider

- Document checklist for the Irish Golden Visa

- Irish citizenship by birth or descent

- Irish citizenship by naturalization

The Irish Golden Visa: A Brief Overview

While many individuals have the common misconception of the program being a direct route to citizenship, the scheme does not provide an option for Irish citizenship by investment. However, it does grant successful applicants temporary residency rights in Ireland through a renewable residency permit.

Successful applicants who become holders of the Irish Investment Visa are issued a renewable residency permit that is initially valid for a period of two years, during which they have the right to live, work, and study in Ireland. After the commencement of that period, holders of the Irish Investment Visa are able to renew their permits for an additional three years, provided they maintain their investment and are still considered financially stable. However, they must apply for a renewal three months before the validity of their permit expires.

As long as individuals are able to prove their sufficient financial means, and that they have not been indicted, investigated, or convicted with any criminal offense, they may continue to renew their residency permits. All renewals that occur past the first five years are valid for five-year periods, and may lead to citizenship by naturalization.

Key Reasons to Invest in Ireland

While there are many Golden Visas out there like the Golden Visa Portugal, Golden Visa Spain and Golden Visa Greece, Ireland is the only English-speaking country that offers unique investor visa advantages – from a one day stay requirement per year, to access to a thriving business environment. The Irish economy is actually the fastest-growing in Europe, and the sixth best performing globally according to Worldometer, which means that opportunities for investments are ripe, especially with the country being highly open to foreign capital.

Ireland boasts a steady reputation for protecting foreign investment and investor funds, and holds a reputable international risk management country profile. Not only can you rest assured knowing that your investment will be safeguarded against risk, you will discover that it is easy to find a low risk investment fund. Moreover, if you choose to live in Ireland, you will have access to incredible living standards, and be swept away by the country’s beautiful scenery, quaint villages, and friendly locals.

Benefits of the Ireland Investor Visa Program

There are plenty of benefits to be reaped by those who succeed in their Irish Golden Visa application, starting with family reunification and access to incredible business and employment opportunities, and leading to potential citizenship by naturalization. The main benefits that can be enjoyed by successful applicants to the Immigrant Investor Program are:

Leading Irish higher-education institutions, like the University College Dublin | |

Diverse range of industries to invest in | |

Fantastic quality of life | |

A thriving European hub for technology, business, and investment | |

Visa-free access to the Europe’s Schengen Area and the United Kingdom | |

Residency in four to six months | |

Eligibility for Irish passport and citizenship by naturalization after five years | |

Right to live, work and study in Ireland with the Ireland Investor Visa | |

Inclusion of immediate family members, including dependent children under 24 |

Eligibility Requirements for the Ireland Golden Visa

Other eligibility requirements for the Irish Golden Visa demand that applicants be at least 18 years of age to qualify for the program, and prove that the entire investment sum is independently sourced and held by them, as neither are loans accepted as a source of funding, nor are family members allowed to provide their contribution towards the total sum.

Investment Options for the Irish Golden Visa

Applicants who want to invest in Ireland are provided with four eligible investment options under the Irish Golden Visa program, each of which will satisfy their financial needs and long-term plans in its own right.

ENTERPRISE INVESTMENT

APPROVED INVESTMENT FUNDS

REAL ESTATE INVESTMENT TRUSTS (REIT)

ENDOWMENT

Enterprise Investment

To succeed in their eligibility for residency via the Irish enterprise investment option, business professionals must submit a comprehensive business plan with their application, demonstrating proof of their investment’s impact on the Irish economy – meaning they will have to explain how they will create jobs in Ireland, or maintain local full-time jobs through their investment.

Approved Investment Funds

Additionally, the investment fund will have to be a low-risk investment fund that is commissioned and regulated by the Central Bank of Ireland, and managed by an Irish-based, experienced fund manager in order to be approved by the Immigration Ireland Service Department. An example of an eligible fund would be the Irish Diaspora Loan Fund, however, you may ask the Investor Unit of the Irish Naturalization and Immigration Services department (INIS) for a comprehensive list of investment funds before coming to a definitive decision.

Real Estate Investment Trusts (REITs)

Applicants who choose this investment route will have to place a qualifying investment worth at least €2,000,000 into one or more Irish real estate investment trust/s, and hold their investment for at least three years. Any REIT they choose to invest in must be listed on the Irish Stock Exchange for a period no less than three to five years.

Applicants will be permitted to divest up to 50% of their shares after three years of holding their investment. After the fourth year, they may divest an additional 25%. After the fifth year has commenced, applicants will be permitted the option of cashing out with no risk of losing their residency permits.

Endowment

The endowment route permits applicants to invest in a pool of four or more people, provided they are all applying for the Irish Immigrant Investor scheme; in which case, each investor may contribute a minimum of €400,000 and still qualify for residency.

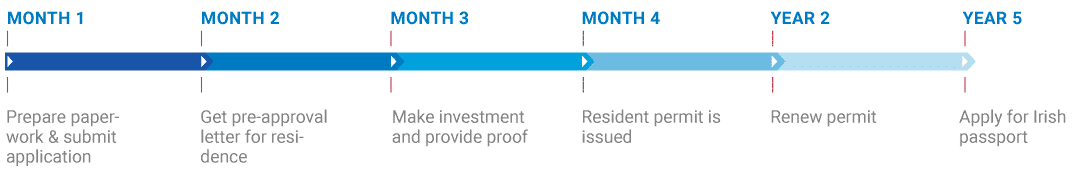

Step-by-Step Guide to Irish Residency and Citizenship

1. SUBMIT YOUR APPLICATION

2. GET YOUR APPLICATION APPROVED

3. PLACE YOUR INVESTMENT AND BECOME A RESIDENT

4. EXTEND YOUR RESIDENCE PERMIT

5. BECOME A NATURALIZED IRISH CITIZEN

1. Submit Your Application

Choose your preferred investment route and collect the necessary paperwork. You will have to include evidentiary documents pertaining to your net worth, source of your amassed wealth, and proof of your good character. Then pay the non-refundable application fee of €1,500, and submit your application to the Immigration Service Delivery (ISD) – perhaps with the help of an immigration service or licensed attorney.

Keep in mind that applications for the Irish Investor Visa have to be submitted within the official intake periods, which occur around five times in a year and last for 25 days each.

2. Get Your Application Approved

Once your application has been processed, you will get a response from the respective Irish government departments – namely the Independent Evaluation Committee of the ISD. Provided that you meet all the requirements and your personal profile fits the program criteria, your application should get approved.

3. Place Your Investment & Become A Resident

After you receive your Pre-Approval Letter from the Evaluation Committee, you will have to make your investment within a 90-day time period, and submit proof of your investment to the Minister for Justice and Equity. You and your family members must also submit proof of a sufficient private health insurance coverage policy, and acquire a new Affidavit of Good Character issued by an attorney at law who practices in Ireland to demonstrate that you have good moral standing.

Once you have submitted all the necessary supporting documentation and your investment has been officially confirmed, you will be granted a residency permit with a two-year validity. This permit, which is known as ‘Stamp 4’, will enable you and your family members to work, study, and live in Ireland without any issues. However, you are required to visit Ireland at least one day per year to maintain your permit, as per the Ireland Investment Visa requirements.

4. Extend Your Residence Permit

You may extend your Irish residency permit three months prior to its expiration date for an additional validity period of three years. You must first prove that your investment has not been divested and still qualifies, and demonstrate that you are still financially stable and have maintained your good character to succeed in this extension.

5. Become A Naturalized Irish Citizen

Once you have held your residency permit for five years, you will be able to extend it for five years every time thereafter, provided you are still able to demonstrate proof of your financial stability and good character. You may also apply for citizenship after having maintained your permit for five years, on the condition that you have been a tax resident in Ireland for that time period, and more specifically for a consecutive 12 months prior to lodging your application for citizenship.

This means that you cannot spend more than six weeks outside of Ireland if you want to be considered eligible for citizenship, as you must be an Irish tax resident and show proof of your residency to succeed in your application for citizenship.

Ireland Golden Visa Application Processing Time

Taxes to Consider

The Irish tax system is based on your residence and domicile status, and corporate tax is currently charged at a 12.5% rate. If you don’t plan on living in Ireland during your Golden Visa term, you won’t need to register for Irish tax residency. However, you will be subject to taxation on any and all income received and accrued in Ireland, including income accrued from your investment. If, on the other hand, you plan on applying for citizenship later down the line, you will be required to register for Irish tax residency and live in the country for a duration no less than five years.

Document Checklist for the Irish Golden Visa

The document checklist for the Ireland Investor Visa is quite extensive, and the requirements can be subject to change at the Irish government’s discretion. It is recommended to speak to an Irish citizenship consultant or a residency expert from an immigration service who can assist you with the application, just so you can guarantee that you have everything covered in accordance with the law.

General Document Requirements for the Ireland Golden Visa

- Proof of a minimum net worth of €2,000,000 declaring your business and investment activities from the past year, and stating your general income, financial investments, and loans.

- Proof of having the required funds for investment, and the ability to transfer them to Ireland.

- Proof of the source of your funds, demonstrating how you acquired the funds you intend to use for your investment.

- Deeds of Sale

- Inheritance and Gifts (if applicable)

- Divorce Settlement (if applicable)

- Evidence of good character, which can be demonstrated through statements of character obtained from the authorities of every country you have lived in for more than six months in the past ten years prior to your application.

- You must include the same type of statement of character for any of your children who are over 16 that you have included in your application.

Document Requirements Per Investment Route

Enterprise Investment

- A certified proof of the most recent audited accounts for an existing business/enterprise.

- A comprehensive business plan.

- The financial investments you are making.

- How your investment will help create or maintain jobs.

- How much equity you are acquiring.

- How you are planning on receiving your investment return.

- Letter from a solicitor which confirms that you have transferred the funds in the Irish business/enterprise.

- A letter from the business/enterprise which states how much you have invested.

- A payment remittance and bank statement which proves you have transferred the funds.

Approved Investment Funds

- Investment profile stating the investment strategy.

- Documents proving the fund is approved by the Central Bank of Ireland.

- Source of your funding for the investment.

- Investment pool for the fund.

- A target return on investment.

- Employment projections of the investments under the fund.

- Letter from a solicitor which confirms that you have transferred the funds in the investment fund in Ireland.

- A letter from the Investment Fund Managers confirming you have transferred the funds.

- A copy of your subscription certificate.

Real Estate Investment Trusts

- Proof you have the required funds for the investment.

- Letter from a solicitor which confirms that you have invested €2,000,000 in REITs.

- A letter from the REIT company which confirms the number of shares you have purchased, the date of purchase, prices of the purchased shares, as well as the total amount of your investment.

- Copy of your share certificate.

Endowment

- A business plan for the philanthropic project.

- Proof of how your donation will be used, and how it will improve the public benefit in Ireland.

- Letter from a solicitor which confirms that you have transferred the funds to the Irish registered charity.

- A letter from the registered charity which confirms you have transferred the funds.

- Payment remittance and bank statements proving you have transferred the funds.

- Proof that the solicitor who issues your letter is cleared to work in Ireland.

Regardless of the investment route you choose, you must pay a non-refundable application processing fee of €1,500 to the Evaluation Committee by an electronic funds transfer, and provide a receipt of the transaction along with your application form.

Irish Citizenship by Birth or Descent

If you were born outside of Ireland and one or more of your parents was an Irish citizen at the time of your birth, or even one or more of your grandparents was born in Ireland, you may qualify for citizenship by descent. You will only have to provide your birth certificates as evidentiary documents to the Foreign Birth Registration office in Ireland.

Irish Citizenship by Naturalization

To obtain citizenship by naturalization, you will need to prove that you have been a tax resident in Ireland for at least five years prior to your application, during which you cannot leave Ireland for more than six weeks per year. The eligibility requirement places heavy emphasis on you residing for one continuous, uninterrupted year before you submit your application for citizenship.

Moving to Europe

Frequently Asked Questions about the Irish Investor Visa

What is the Ireland Immigrant Investor Program?

The Ireland Immigrant Investor Program, also known as the Ireland Golden Visa, is a residency initiative that grants applicants and their immediate family members residency rights in Ireland in exchange for a significant investment in the nation’s economy. It is not a direct route to Ireland citizenship by investment, however, it may lead to citizenship by naturalization.

What are my options for the investment visa?

You have four investment routes to choose from to qualify for residency in Ireland. Either invest in an enterprise; place a contribution to an approved investment fund like the Irish Diaspora Loan Fund; make a charitable donation – or endowment – to a philanthropic project; or invest in an REIT.

Do I have to visit Ireland to keep my residency?

Yes, you are required to visit Ireland for at least one day out of every year to maintain your residency status. Nevertheless, if you are considering applying for citizenship by naturalization, you will have to be domiciled in Ireland for a period no less than five years prior to your application.

Can I apply for the residence permit myself?

Yes, you can apply for the Ireland Investment Visa to acquire a residence permit, but it’s recommended to look into an immigration service that can assist you with your application, considering how extensive and complex the documentation requirements are.

What is the Evaluation Committee?

The Evaluation Committee is the body that assesses Ireland Investor Visa applications, and decides whether or not an application satisfies the program criteria. It effectively grants you the Irish Golden Visa.

Can I become an Irish citizen with the Golden Visa?

While you cannot directly acquire an Irish passport or Ireland citizenship, you can definitely become a citizen via the Irish naturalization and immigration journey if you maintain your Ireland residency status for five years, are considered an Irish tax resident, and are compliant with the government’s naturalization requirements. You will also need to submit your own application for citizenship.

What is the most popular investment route to the golden visa?

By far, the Irish enterprise investment option is the most favorable way to secure the investor visa in Ireland, as it has potential for optimal investment returns. The second favorable route would be the Real Estate Investment Trust/s option.

How long until my Ireland Investor Visa application is approved?

Provided that everything goes smoothly, your Ireland Investor Visa application should take anywhere between four to six months to be approved.

Can my family qualify for the residency permit?

Absolutely. Your spouse, children under 18, and financially dependent children under the age of 24 all qualify for the Ireland residency permit under the investment scheme.

Does Ireland have a Golden Visa program?

Yes, the Irish Golden Visa Program provides foreign investors and their immediate family members – including financially dependent children up to the age of 24 – with the opportunity of obtaining Ireland residency by investment.

How much do I need to invest in Ireland to get PR?

While there is no direct route to permanent residency in Ireland, investors are provided with four different investment options that qualify them for a renewable residency permit. This permit is initially eligible for two years, can be renewed for three years after that, and then five years every time thereafter on the condition you continue to abide by the government’s requirements.

The minimum investment option starts at €500,000. However, since that amount only qualifies applicants through a philanthropic endowment, it will not yield them any returns. For investors to actually get a financial return on their investment, they will have to invest a minimum of €1,000,000 in the Irish economy.

How can I get Irish citizenship by investment?

You cannot actually purchase Irish citizenship, as there is no Ireland citizenship by investment scheme. You can only become eligible for naturalization after maintaining your Golden Visa residency permit for a period of five years, and on the condition that you are a registered tax resident domiciled in Ireland.

Can I get Irish citizenship if I buy a house?

Purchasing a property in Ireland does not grant the owner any residency or citizenship rights in Ireland. To qualify for residency under the Ireland Golden Visa scheme, you may invest at least €2,000,000 in Irish Real Estate Investment Trust/s (REITs), and maintain that investment for a period no less than three years. You may qualify for citizenship by naturalization after five years of maintaining your investment and Irish domicile status.

How do you become a citizen of Ireland?

You become eligible for Irish citizenship after being a domiciled tax resident in Ireland for a period no less than five years. You must first meet the Irish government criteria and residency requirements prior to lodging your application for citizenship by naturalization.

Is Ireland easy to get citizenship?

You can apply for Irish citizenship by naturalization as a holder of the Irish Golden Visa, provided that you have been a domiciled tax resident in Ireland for a period no less than five years, and fulfill government criteria.

How long does it take to get citizenship in Ireland?

You can apply for Irish citizenship by naturalization after being a domiciled tax resident in Ireland for a period no less than five years, provided you have first succeeding in your application to the Irish Investor Visa Program.

How much do you need to invest in Ireland to get citizenship?

You cannot buy Irish citizenship as there is no Ireland citizenship by investment program. Nonetheless, you can qualify for residency by investment which can later lead to citizenship by naturalization. The Irish Golden Visa scheme provides you with a renewable residency permit after placing a minimum investment of €500,000 in the nation’s economy, on the condition that you meet the program’s requirements.

Can you buy citizenship in Ireland?

No, you cannot buy Irish citizenship. You can only qualify for residency by investment through the Irish Golden Visa scheme. Should you meet the Irish Immigrant Investor Program’s requirements, as well as the government’s naturalization requirements, you may qualify for citizenship by naturalization after five years.

How much money do you need to immigrate to Ireland?

The minimum investment option provided under the Irish Golden Visa scheme starts at a philanthropic contribution of no less than €500,000.

Does Ireland give citizenship to foreigners?

Yes, but not through an Ireland citizenship by investment scheme, as that does not exist. Foreigners who are interested in acquiring citizenship in Ireland must apply to the Irish Immigrant Investor Program, and meet the residency and naturalization requirements stipulated by the government to acquire Ireland citizenship and the Irish passport.

How do I permanently move to Ireland?

The Irish Golden Visa program provides qualifying individuals and their immediate family members with renewable residency permits in exchange for a considerable investment in the nation’s economy. Holders of the Irish residence permit are allowed to live, work, and study in the country without need for an employment or student visa.

Can I move to Ireland without a job?

Yes, provided you make a considerable investment in the Irish economy via the Irish Golden Visa program, and obtain your Ireland residency permit.