The Portuguese government removed real estate as an investment option for the hugely popular Golden Visa in 2023, leaving potential investors looking at other avenues for residency.

As a result of the removal, the Portugal Golden Visa Investment Fund became one of the main ways to get residency through investment in the country. These funds direct foreign investment into key areas of the Portuguese economy, including technology, healthcare, renewable energy, and private equity.

For applicants, this route offers a straightforward and professionally managed way to meet Golden Visa requirements. It is a good choice for those who want diversification, regulatory oversight, and a straight shot at EU citizenship.

In this Portugal Investment Fund Golden Visa guide, we’ll take a look at how it works, how you can qualify, and how it fits into the overall Golden Visa scheme.

Portugal Golden Visa Investment Fund: Key Takeaways

⚠️ Portugal Nationality Law Changes 2025

On June 23, 2025, the Portuguese Government announced plans to amend the Nationality Law and the legal framework governing immigration. The proposals have passed the plenary vote on October 28, 2025, which marks a significant step forward in the legislative process.

Among the measures under discussion are an increase in the residence requirement for nationality from five years to ten years – seven years for nationals of CPLP and EU countries – and a change to how residency time is calculated, so that the clock would start when residency is issued rather than when the application is submitted.

These changes are not yet law. They must still undergo Presidential review. At that stage, the President may promulgate the law, issue a veto, or request a review by the Constitutional Court. The final text may still be amended, including any transitional provisions or possible grandfathering rules, but they might not be enacted because the law is not final until its promulgated.

For the latest information regarding these changes, read Portugal Nationality and Citizenship Changes 2025

Portugal Golden Visa Overview

The Portugal Golden Visa program is a five-year residency by investment option for non-EU nationals. Through this program, eligible investors and their families can live, work, and study in Portugal.

After five years (for now) of legal residency in Portugal, Golden Visa holders can apply for permanent residency and, if they meet the requirements, Portuguese citizenship. With citizenship, you can also apply for a Portuguese passport. In our Global Passport Index 2025, Portugal ranks 28th and comes in 12th place for quality of life and enhanced mobility.

The Golden Visa is one of the most popular residency programs in Europe, attracting investors from all over the world. Since it began, more than 20,000 families have received Golden Visas, and the program has brought in over €7 billion in investment.

In addition to the investment fund, there are several other investment opportunities, such as:

- Investment or donation in the arts or reconstruction of national cultural heritage with a donation of at least €250,000

- Scientific research: Science or Technology research contribution of at least €500,000

- Creation of ten jobs: Creation and maintenance of ten jobs during the required period

- Share capital and job creation: Venture capital funds for a commercial company in the national territory or reinforcement of a company’s share capital. This company must have its head office in the national territory. The minimum investment of €500,000 is combined with the creation of five or maintaining ten jobs (five of them permanent).

The minimum investment amounts for options 2 and 3 may be reduced by 20% when the investment activity is carried out in low-density areas. These regions have fewer than 100 inhabitants per square kilometer or GDP per capita of under 75% of the national average.

What Is Portugal’s Golden Visa Investment Fund?

If you’re looking for a way to gain residency in Portugal through investment, Golden Visa Investment Funds are quickly becoming a top choice. By investing at least €500,000 in an approved venture capital fund, non-EU citizens can secure a Portuguese residence permit.

These Portuguese investment funds are managed and regulated, and they work by pooling money from different investors to buy a mix of assets such as real estate, stocks, bonds, or infrastructure projects. Many people use these funds to meet the Golden Visa requirements by investing directly in Portuguese businesses.

How are the Portuguese investment funds regulated?

The Portugal Golden Visa Fund is regulated by CMVM (The Portuguese Securities Market Commission), which requires funds to comply with including, but not limited to, the following requirements:

- Report the valuation of their net assets on a semi-annual basis. That means investors may have their participation unit price revised every six months

- Employ independent accredited accounting firms such as PwC, KPMG, or EY for annual audits.

- They should disclose their fees in the PPM/management regulation document. That means investors should know the management entities’ fees and custodian bank charges.

Investors need to keep their money in the fund for at least five years, and at least 60% of the fund’s capital must be invested in companies that are based in Portugal.

Who can invest in the Golden Visa Investment Funds?

The following applicants are eligible to qualify for the Golden Visa fund option:

- Be a non-EU/EEA citizen or a non-Swiss citizen

- Have a clean criminal record

- Be over 18 years old

- Have sufficient legal funds to invest

In some instances, specific Golden Visa funds have additional requirements, such as:

- Having experience with a financial instrument such as company stock, government bonds, company bonds, funds, etc.

- Submitting proof of having enough money in their bank account

- Providing a legitimate source of funds

Can a US citizen invest in a Portuguese Investment Fund?

Yes, American citizens qualify for the investment fund pathway under the Golden Visa scheme. However, the IRS requires foreign financial institutions and certain non-financial foreign entities to report on the foreign assets held by their US account holders. Therefore, any bank, fund, and fund manager in Portugal who has an American client or investor must abide by the US government’s legislation.

Portugal Golden Visa Investment Fund Requirements

For the investment fund option, a capital transfer into Portuguese investment funds or venture capital funds to the amount of or greater than €500,000 is needed to procure legal residency in Portugal.

Prerequisites for the Golden Visa fund investment include:

- Funds must be focused on the capitalization of companies, registered under Portuguese law

- A minimum maturity of five years at the time of investment

- At least 60% of the investment value is made in commercial companies on Portuguese-owned territories

For a slightly more affordable Golden Visa route, there is the Portugal Cultural Golden Visa. It requires a donation of of €250,000, which can be reduced to €200,000 if the cultural production occurs in a designated low-density area.

If you are interested in applying for the Portuguese Golden Visa through a Venture Capital Fund (FCR), you should carefully make your decision based on two important criteria:

- Fund eligibility for the Portuguese Golden Visa

- Fund credentials, including fund strategy, management pedigree, and legal obligations

Not all Portugal private equity funds qualify for the Golden Visa program. You need to make sure the chosen fund fulfills all the necessary technical requirements as listed by the Portuguese immigration authorities, AIMA, and that the investment fund is regulated by the Portuguese CMVM.

Required documents

To apply for the fund investments, you must demonstrate that you’ve made the investment with the minimum required amount and must submit the documents below. This is in addition to the required documents for the Portugal Golden Visa.

- Declaration by the credit institution authorized or registered in the national territory with the Banco de Portugal, attesting to the effective transfer of an amount equal to or greater than what is required;

- Certificate proving ownership of the participation investment fund units, free of charge and charges (issued by the entity responsible for maintaining a registered updated version of the holders of participation units, under the terms of Portuguese legislation, of the respective management regulation or contractual instrument);

- Declaration issued by the management company of the respective Golden Visa fund investment, attesting the viability of the capitalization plan, the maturity of at least five years, and application of at least 60 percent of the investment in commercial companies based in Portugal;

- Certificate of commercial registration, if the investment is made through a company single shareholder, demonstrating that the applicant is the partner, cf. Article 65a (13) of Regulatory Dec. 84/07, of 11/05, in its current wording.

Advantages of the Portuguese Golden Visa Investment Fund

There are a number of benefits to picking the Golden Visa investment funds, including:

Disadvantages of the Portuguese Golden Visa Investment Fund

The Portugal Golden Visa fund investment also has some disadvantages, such as:

Fund Investment Profile and Diversification

The level of security of risk of a Portuguese VC fund or Golden Visa Portugal investment fund depends on several factors, including (but not limited to) investment mandate, managers’ credentials, leverage and liquidity, exposure to the stock market, the economic cycle, and legal documents.

Some funds may offer limited potential for capital appreciation with a safer investment profile, while others may have a more leveraged approach aiming to provide Golden Visa investors with multiples of the capital invested. For example, high-growth companies focused on technology have a different profile from property development projects that tend to have a more predictable cash-flow curve.

Some Portuguese Golden Visa Investment Fund programs may offer the opportunity of an early exit, but generally, the investor should expect to realize all gains after five to ten years.

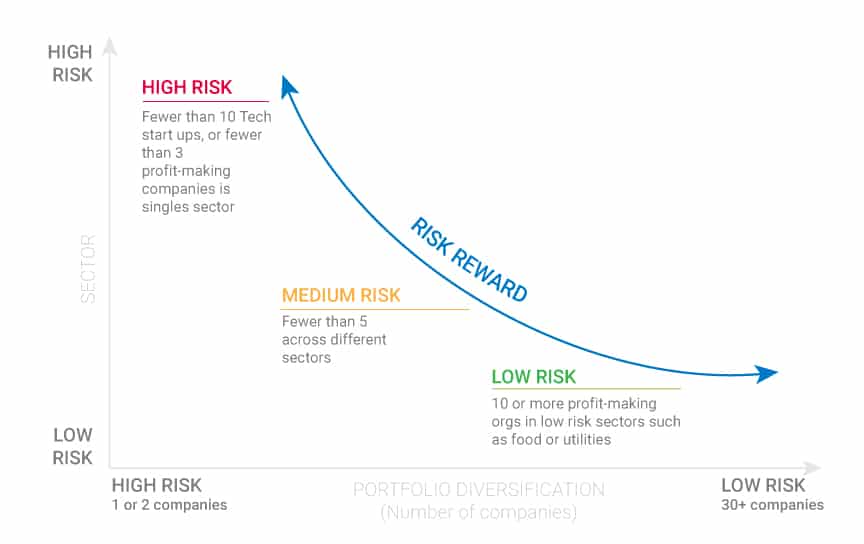

The risk-return profile of these funds will vary according to the sector exposure and portfolio diversification (i.e., how many companies comprise the fund portfolio).

Example of risk-return levels based on sector exposure and investment portfolio diversification:

Fees and Costs for Portugal’s Golden Visa Investment Fund

When applying for a Portugal Golden Visa through an investment fund, you’ll encounter various fees and costs. Here’s a breakdown:

Mandatory fees:

- Government fees:

- Processing fee: €533 per applicant (increased to €83 for dependents) at application and renewal.

- Initial application fee: €5,325 per applicant.

- Renewal application fee: €2,663 per applicant at each five-year renewal.

- Minimum investment: €500,000 in a qualified Private Equity or Venture Capital fund.

Variable fees:

- Fund management fees: Usually range between 1 and 2 percent of the invested amount annually. This covers the fund manager’s costs for managing the fund and its investments.

- Performance fees: Some funds charge additional fees based on their performance exceeding a certain benchmark. These fees vary greatly depending on the fund and its structure.

- Legal fees: These can vary depending on the complexity of your case, the experience of the lawyer you choose for legal representation, and the number of family members included in your application. Expect to pay between €5,000 and €20,000.

- Due diligence fees: Some funds might charge a separate fee for conducting due diligence on your application. This typically falls within the €1,000-€3,000 range.

- Translation and certification fees: Depending on the volume and complexity of the documents, translating and certifying them for the application can incur additional costs.

- Travel and accommodation: Consider potential travel and accommodation costs if required for interviews or document submission in person.

Please note that fund management fees and performance fees are deducted from the fund’s pooled capital, while the subscription fees are charged on top of your investment. These subscription fees range between 2-4% from the €500,000. The amount is charged to account for the due diligence, KYC, and marketing costs.

List of Funds that Qualify for Portuguese Golden Visa

Portugal is known for its strong investment opportunities, steady economic growth, and friendly approach to foreign investors. While real estate has always attracted international buyers, there are many other ways to invest in Portugal.

Recent rule changes mean that real estate-related funds are no longer eligible for the Portuguese Golden Visa. This affects some investors, but the program still allows investment in other types of funds, including Growth and Buy-out funds, as well as Venture Capital.

Below, we’ll provide a Portugal Golden Visa investment fund list to explore some of the attractive fund options that qualify for the Portuguese Golden Visa.

Growth/buy-out funds (Private Equity funds)

Private Equity funds allow investment in established companies like SMEs or mid-caps with proven market performance and positive operational results. Their goal is to acquire, restructure, and improve these companies, ultimately selling them for a profit to major industry players or other Private Equity firms.

Some funds are sector-agnostic, while others focus on specific areas like renewable energy, agriculture, healthcare, and hospitality, which is thriving in Portugal. Family businesses make up 70% to 80% of Portuguese companies, providing significant opportunities for growth and consolidation.

Although Portugal currently sees lower Private Equity investment relative to GDP compared to France and Spain, it has substantial growth potential. Spanish Private Equity and VC firms are now establishing operations in Portugal to capitalize on this.

The Development Bank of Portugal, funded by the EU, co-invests with private investors like pension funds and foreign investors, matching their contributions up to €30-50 million per fund. This collaboration helps fund managers access larger sums for growth while enhancing corporate governance.

Venture capital funds

Venture capital funds (FCR – Fundo de Capital de Risco or “Capital at Risk Funds”) are qualifying investments for Portugal’s Golden Visa. These funds, managed by corporate experts, invest in startups or medium-sized projects with strong growth potential. Some funds may also operate as private equity, focusing on more established companies.

VC funds invest in early-stage startups, which carry inherent risks, but successful ventures can yield significant returns. Portugal’s appealing standard of living, weather, and talent make it an attractive destination for entrepreneurs and contribute to its growing startup ecosystem.

Investors should be aware of each fund’s investment focus, as some are sector-agnostic while others target specific areas. Additionally, several funds qualifying for the Golden Visa prioritize sustainability, investing in projects that promote environmental, social, and governance (ESG) best practices.

The Golden Visa fund offers a variety of options, each catering to different investor preferences and risk tolerance. Here are the key categories:

Sustainable investment funds: Sustainable investment options have become increasingly popular among Golden Visa applicants. These funds focus on environmental, social, and governance (ESG) best practices. For example, the Pela Terra fund and the AIM Forest fund are renowned for their sustainable agriculture projects, which invest in under-developed rural regions in Portugal and promote organic farming practices.

Migration projects: Investment in migration projects is another emerging option under the Golden Visa scheme. These projects focus on the integration and support of immigrants, aligning with Portugal’s values of social responsibility and inclusivity. By investing in such projects, investors not only contribute to the welfare of new immigrants but also qualify for the Golden Visa.

Bitcoin and Cryptocurrencies: Portugal may become the first European country to offer residency in exchange for investment in decentralized cryptocurrencies like Bitcoin. By holding Bitcoin worth €500,000, investors can gain residency in Portugal via the Golden Visa Program under certain conditions. This innovative approach aligns with the growing trend of integrating digital assets into mainstream financial and economic systems, offering a fresh pathway for crypto enthusiasts to secure residency in one of Europe’s most sought-after destinations.

Open-ended funds: Unlike traditional closed-end funds with fixed maturity dates, open-ended funds offer more flexibility, allowing investors to enter and exit more easily. This provides greater liquidity while still meeting the five-year Golden Visa holding requirement. For Golden Visa applicants—especially those who want more flexibility in accessing capital—open-ended funds can offer peace of mind through their redemption options. However, investors should carefully review the specific redemption terms, fees, and notice periods.

Exit Strategy and Capital Recovery

When investing in a fund, it’s crucial to put some thought into the exit of the investment fund.

Minimum lock-up period

Most investment funds that qualify for the Golden Visa will ensure that they do not liquidate within a minimum of six years. This ensures that your investment will remain valid for the required time period to apply for permanent residency and citizenship.

Resale or transfer of participation fund units

For most Portuguese investment funds, participation units can be transferred or sold between participants, but it is usually difficult to find a demand for a participation unit in a fund that is suited to Golden Visa timelines unless traded around the incorporation of the fund.

This makes Portuguese investment funds rather illiquid until the fund reaches its maturity or is dissolved by the fund manager. Although uncommon, some funds have longer terms but offer the possibility of buying back the investor’s participation units once the participants complete the required time for the GV, these funds usually have low returns compared to others.

Extension periods

Most investment funds have a specific exit target in terms of timing. The majority of the Portugal investment funds are set for a six-to-eight-year period.

The majority of investment funds have the option to extend, and this option can be triggered at the six-year mark. In some cases, the fund manager will make the decision on this, not the investors, meaning that you may be locked in a bit further than the time required to apply for citizenship. In other cases, the extension of the fund is subject to the investors’ vote, and those who vote against it may be able to redeem their shares. We recommend checking with the fund, as this could be a crucial detail.

Extension period options can be favorable, as the expected exit year might not be ideal due to an economic downturn, for example, or because the project returns will be higher if the fund holds certain businesses for a while longer.

Exit market

The primary objective of the Portugal investment funds is to exit the portfolio by eventually selling it at a profit.

Fund managers are generally highly incentivized with a performance fee based on a percentage of the appreciation in value. This is beneficial to Golden Visa investors because incentives between investors and fund managers are aligned.

With this said, they are splitting your profit but not your potential loss, so the downside risk will fall on the investors’ shoulders.

Is the Portuguese Golden Visa Funds option right for you?

Considerations to take into account when choosing the fund investment Portugal option:

- Is my selected Portugal yield fund eligible for the Golden Visa?

- What is my fund investment strategy, and what are my legal obligations?

- Do the Portuguese authorities regulate the fund?

As an investor in Portugal’s Golden Visa, you must keep your investment for a minimum of five years before applying for permanent residence and citizenship in Portugal. In this context, it’s essential to have an investment strategy in mind and ask about the exit strategy for the Golden Visa funds.

In terms of due diligence and compliance checks, it’s important to consider the following questions:

- Are the Portugal Golden Visa funds regulated by the Portuguese authorities?

- Is the fund fully eligible for the Portuguese Golden Visa, according to AIMA?

- Does the fund have the right attributes to safeguard the investor’s Golden Visa status? As a Golden Visa investor, you must maintain your investment in the Golden Visa fund for a minimum of five years, after which you can apply for permanent residency and citizenship in Portugal.

Questions to ask the fund managers

- How will the fund assure diversification? If so, how often and based on what?

- What will the fund specialize in?

- What is the expected target return?

- Does the fund distribute dividends (how often and how much)?

- What fees (subscription fee, management fee, performance fee) will the fund investment involve?

Once you’ve established that the fund is appropriately regulated and is an eligible Golden Visa instrument, the second phase of due diligence is required on the fund credentials.

The three main aspects of analyzing a Portuguese Golden Visa-qualified investment fund include:

Fund investment strategy: Does the fund investment strategy make sense? For instance, what is the fund’s term? How does the fund plan to pay back investors?

Fund manager credentials: Do fund managers have the right experience and credentials? Are they regulated fund managers? Regulated fund managers are those who hold specific licenses issued by the Portuguese Securities Market Commission (CMVM) based on their roles and investment strategies. These licenses ensure they meet specific professional qualifications and adhere to strict regulations, offering an added layer of protection for investors.

Fund legal protections: Are the legal documents appropriately drafted to safeguard the investor’s investment?

Expert Takeaway on the Promising Return of Investment Funds

According to Lourenço Álvares, Business & Product Specialist at Global Citizen Solutions, funds provide investors with genuine financial opportunities and not only a pathway to residency (and citizenship in the long run). “Investment funds constitute a great asset class to own, especially in countries like Portugal, where the economy and respective companies will benefit from that investment to unlock their full potential,” he adds.

Additionally, Álvares recognizes that €500,000 is a substantial amount of money to invest in a country/region that foreign citizens might not know. However, when investing in funds in Portugal, investors will be able to ensure geographical diversification in a still-emerging but stable economy.

Overall, the positive side of investing in Portugal is that foreigners can have potential returns as well as residency as a by-product and even European citizenship down the line. So, why not combine this residency investment program with potential and interesting returns?

“Investment Funds in Portugal have been around for a while, and we haven’t heard about a fund that (went) burst. On the contrary, we’ve been witnessing and hearing about success stories and funds that performed or are performing quite well”, says Álvares.

Why choose Global Citizen Solutions for your Portugal Golden Visa?

- Global approach by local experts: A team of experienced local case executives, immigration lawyers, and investment specialists based in Portugal.

- Independent service:We are not a marketing agency for any projects. You will access all eligible routes for the Golden Visa, with over 40 vetted qualifying investment options, so you can decide on the best option for you.

- 100% approval rate: We have the unique distinction of never having had a Golden Visa case rejected and have helped hundreds of clients from more than 35 countries.

- All-encompassing solution: Our dedicated onboarding and immigration teams will assist you throughout the process and beyond with a single channel of communication.

- Transparency: Our fees are clear and detailed, covering the entire process with no hidden costs.

- Privacy: Your personal data is stored within a GDPR-compliant database on a secure SSL-encrypted server.

To see the full list of reasons why to work with Global Citizen Solutions for your Portugal Golden Visa, you can find out more here: Why Work with Global Citizen Solutions for Your Golden Visa Portugal Application?