The tradition of investing in art can be traced back to the 17th century. From early on, prominent and affluent European families adopted a straightforward approach to building wealth: allocating one-third of their capital to stocks, bonds, and other financial instruments; one-third to real estate; and the remaining third to alternative assets such as fine art, precious metals, gemstones, and similar valuables((Jurevičienė, Daiva, and Jekaterina Savičenko. “Art Investments for Portfolio Diversification.” Mykolas Romeris University, 2016)).

While this historical context illustrates how cultural assets have long been associated with wealth and prestige, it is important to distinguish this from the contemporary framework in Portugal discussed in this analysis. Unlike traditional art investment, the cultural contribution under the Portugal Golden Visa program does not grant applicants ownership of any artworks or financial returns. Instead, beneficiaries receive intangible advantages such as public recognition, invitations to cultural events, or patron-specific benefits offered by the supported institutions.

Art has long been recognized for its intrinsic value, functioning as a mirror of cultural, political, and individual expression throughout history. Beyond its aesthetic and cultural importance, it has also attracted collectors and investors who value its historical relevance and uniqueness((Academic Block. “Is Art a Good Investment? How to Profit from the Art Market.” Academic Block, www.academicblock.com/science/finance/investments-in-art.)). Art is not solely a tangible investment. It is often perceived as a personal pursuit or hobby, as investors are generally expected to derive enjoyment from the work in which they allocate capital. Classified as an alternative investment, art possesses several defining characteristics, including longevity, risk, potential returnin some cases, value, and aesthetic appreciation.

Key determinants of an artwork’s value include the cost of materials, the aesthetic and creative merit, rarity, the authenticity and reputation of the artist, and the sales history. Importantly, art investment is also distinguished by its capacity to offer visual and emotional satisfaction((Jurevičienė, Daiva, Jekaterina Savičenko, and Algita Miečinskienė. “Art as a Diversification Tool of Investment Portfolios.” The 7th International Scientific Conference “Business and Management 2012”, doi:10.3846/bm.2012.012)).

Investment migration programs, such as those implemented in Portugal, Malta, and Greece, have historically emphasized real estate as the principal asset class, owing to its perceived stability and tangible nature. In recent years, however, there has been a notable trend toward diversifying eligible investment categories, with increased attention to art and cultural heritage funds as alternative methods.

Diversifying investment migration programs to include cultural heritage projects provides a valuable alternative, redirecting capital toward underfunded sectors such as historic preservation, museums, and artistic initiatives. These investments not only protect cultural assets and stimulate creative economies but also align with the growing demand for environmentally and socially responsible investment opportunities. Furthermore, cultural investment route allows for redistribution of wealth into cultural and research and development (R&D) ecosystems.

For a growing number of investors, particularly within the context of sustainability, capital allocation decisions are increasingly influenced by ethical, environmental, and social considerations in addition to financial performance. Approximately 38% of investors in North America and the Asia-Pacific region cite a desire to generate measurable environmental and social impact alongside competitive returns. This trend is especially pronounced among younger generations: 99% of Generation Z and 97% of Millennials express interest in sustainable investing, with a substantial share of their portfolios directed toward sustainability-oriented assets((The ESG Institute. “The Sustainable Finance Boom. 88% of Investors Say They Are All In.” The ESG Institute, 2 May 2025, www.the-esg-institute.org/blog/the-sustainable-finance-boom-88-percent-of-investors-say-they-are-all-in.)).

Looking globally, Bloomberg Intelligence((Bloomberg Intelligence. “Global ESG Assets Predicted to Hit $40 Trillion by 2030, Despite Challenging Environment, Forecasts Bloomberg Intelligence.” Bloomberg, 8 Feb. 2024, www.bloomberg.com/company/press/global-esg-assets-predicted-to-hit-40-trillion-by-2030-despite-challenging-environment-forecasts-bloomberg-intelligence/.)) data shows that global ESG assets surpassed US $30 trillion in 2022 and are expected to exceed US $40 trillion by 2030, representing over 25% of the projected US $140 trillion in global assets under management. This forecast further underscores the rapid integration of sustainability considerations into mainstream finance and reflects growing investor confidence in the long‑term value of ESG‑aligned investment methods.

Rather than suggesting increased financial returns, this growth highlights a broader shift toward purpose-driven decision-making, where individuals and institutions increasingly value social, cultural, and environmental impact alongside traditional financial considerations.

In this context, cultural investment within Portugal’s Golden Visa framework has a distinct space: it is not an investment vehicle but a donation model. It appeals to a different segment of individuals, those who prioritize cultural preservation, civic contribution, and philanthropic engagement.

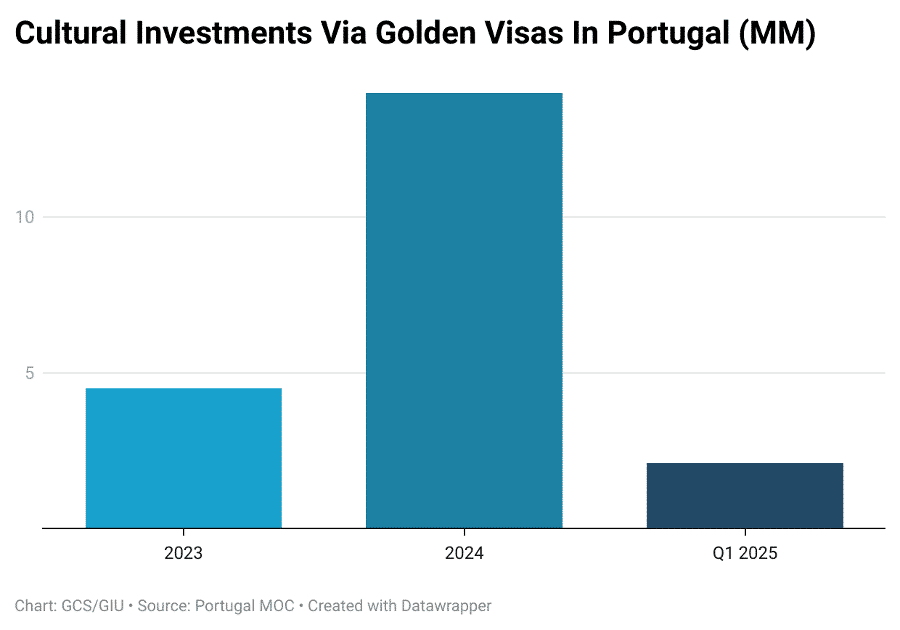

According to data from Portugal’s Ministry of Culture, more than 100 golden visas have been granted through cultural investment contributions, generating over €25.6 million by early 2025. Annual cultural investment experienced a substantial increase, rising from €4.5 million in 2023 to €14 million in 2024, as investors increasingly turned to this alternative route. Notably, during the first quarter of 2025 alone, an additional €2.1 million was directed toward cultural initiatives.

This funding has been distributed broadly across the Portuguese cultural sector. To date, 38 projects have received financial backing under the scheme. Of these, 23 projects focus on the restoration or preservation of national heritage sites, while the remaining 15 support various forms of artistic production. Prominent cultural institutions have played a central role in the implementation of these projects. For instance, the Serralves Foundation in Porto has sponsored 18 initiatives under the program. Every month, new projects are approved and integrated into the program.

The investor demographic for Portugal’s cultural visa pathway is notably diverse. U.S. nationals account for the largest share, with 49 approvals, followed by investors from China, India, the United Kingdom, and other countries. This case exemplifies how a strategically designed cultural investment route can effectively channel foreign capital into the arts and heritage sectors, particularly in contexts where other investment avenues are limited or restricted6.

When it comes to further benefits of cultural investment route, an astonishing example is the Museu do Caramulo in Portugal which transformed from a modest regional institution into a growing cultural hub. All thanks to €14.6 million in Golden Visa donations from 73 investors, with €6.8 million more pledged, funding projects like a new toy museum and preservation of its vintage vehicle collections7.

The Portugal Cultural Golden Visa offers non-EU citizens residency through a minimum investment of €250,000 (or €200,000 in low-density areas) in artistic production or cultural heritage preservation, such as funding theater, concerts, exhibitions, or restoring historical landmarks, museums, and archives. Approved by the Directorate-General for the Arts or the Institute of Museums and Conservation, this investment supports Portugal’s cultural landscape while granting benefits like visa-free Schengen Area travel, family inclusion (spouse, dependent children, and parents over 65), and a pathway to permanent residency or citizenship after five years with a minimal stay requirement of seven days per year. Additional perks include potential patron-level benefits, film producer credits for certain projects, and contributing to Portugal’s cultural and economic growth, making it an affordable and socially impactful option compared to other Golden Visa routes.

Beyond Portugal, other European countries have also incorporated cultural investment options into their residency programs, each tailored to national priorities. In Italy, the Investor Visa program introduced in 2017 includes a philanthropic pathway allowing residency through a minimum €1 million donation to public-interest initiatives, such as cultural or educational projects.

Malta, through its National Development and Social Fund (NDSF), channels a portion of citizenship and residency investment proceeds into heritage and cultural initiatives. In 2021, the NDSF financed a €1 million project to illuminate the historic city of Mdina, enhancing both its preservation and nighttime tourism appeal((Ellul, Raymond Andrew. “Investing in Our Heritage.” Times of Malta, 25 July 2021, https://timesofmalta.com/article/investing-in-our-heritage.888913.

Most recently, Hungary has introduced a cultural investment dimension under its new Guest Investor Program. The program, relaunched in 2024, allows non-EU nationals to obtain a 10-year residence permit by donating €1 million to public interest trust foundations supporting higher education, scientific research, or artistic activities, reflecting a strategic emphasis on cultural capital within migration frameworks.

Investment in art offers a unique combination of ethical contribution and personal satisfaction, appealing to investors who value both capital appreciation and cultural enrichment. By incorporating cultural heritage into investment migration programs, as demonstrated in Portugal, capital is redirected to vital yet often overlooked areas such as historic preservation, artistic production, and museums. This approach resonates strongly with younger investors, particularly Gen Z and Millennials, who increasingly seek investments aligned with environmental and social values.

Portugal’s success highlights how cultural investment routes can effectively attract foreign capital, especially when traditional avenues are limited. The emotional and aesthetic satisfaction derived from supporting the arts further enhances the appeal of these programs. Similar initiatives in Italy, Malta, and Hungary reinforce the growing recognition of culture as a meaningful and impactful area for investment. These models not only promote national cultural development but also offer investors a fulfilling and socially responsible alternative.