Saudi Arabia is currently undertaking one of the most ambitious economic and social transformations globally. Formerly reliant almost exclusively on oil revenues and characterized by a relatively closed investment environment, the kingdom is now positioning itself as a leading destination for foreign direct investment (FDI), real estate development, and long-term residency programs. According to the General Authority for Statistics (GASTAT)((General Authority for Statistics. “News.” General Authority for Statistics, www.stats.gov.sa/en/w/news/57.)), net FDI inflows in the first quarter of 2025 increased by 44% compared with the same period in the previous year, reaching SAR 22.2 billion. These advancements, driven by the strategic framework of Vision 2030, are reshaping Saudi Arabia’s role in the global economic order.

Oil constitutes a fundamental pillar of the Saudi Arabian economy, serving as the foundation for domestic development and the principal source of national revenue. According to the International Monetary Fund (IMF)((To create an MLA citation for the provided webpage, we follow the MLA format for citing a webpage or online report. This includes the author (if available), the title of the document, the title of the website, the publisher, the publication date, the URL, and the access date. Based on the URL, we can extract relevant details.)), in 2016 oil revenues accounted for approximately 75% of the country’s exports and 72% of its fiscal income, while the oil sector contributed more than 40% to the kingdom’s gross domestic product. The sharp decline in global oil prices in 2014 exposed the kingdom’s excessive reliance on this single resource.

In response to these challenges, the Saudi government implemented various measures, including the introduction of the Vision 2030 program. This initiative seeks to reorient the Saudi economy away from its dependence on oil through measures such as rationalizing public expenditure, expanding non-oil revenue streams, diversifying economic activities, and, crucially, increasing the private sector’s contribution to gross domestic product to roughly two-thirds.

As reported by The Guardian((Saudi Arabia to Offer Tourist Visas for First Time.” The Guardian, Guardian News and Media, 27 Sept. 2019, www.theguardian.com/world/2019/sep/27/saudi-arabia-offer-tourist-visas-for-first-time.)), Saudi Arabia opened its doors to non-religious tourists for the first time in 2019. Prior to the introduction of tourist visas that year, leisure tourism was almost non-existent, with the country welcoming only the millions of religious pilgrims who travelled annually to perform Hajj or Umrah.

Overall, Saudi Arabia in the 2010s was characterized by a conservative, oil-dependent economy, vulnerable to fluctuations in global oil prices and largely insulated from international investment. This was the image that Vision 2030 was explicitly designed to transform.

By 2024, there were already significant alterations in the country’s economy. The kingdom’s GDP per capita reached USD 35,057.2, placing it 35th globally in nominal terms and between 15th and 17th in purchasing power parity (USD 62,677–70,333). The inflation rate stood at 1.7%, a level regarded as low and sustainable by international benchmarks. Unemployment declined to 5.1% in 2023, reflecting the combined effects of labor market reforms and the expansion of the non-oil economy. Collectively, these indicators point to a climate of macroeconomic stability, which enhances the kingdom’s appeal as a destination for both residency and investment((“Saudi Arabia.” World Bank Data, The World Bank, data.worldbank.org/country/saudi-arabia)).

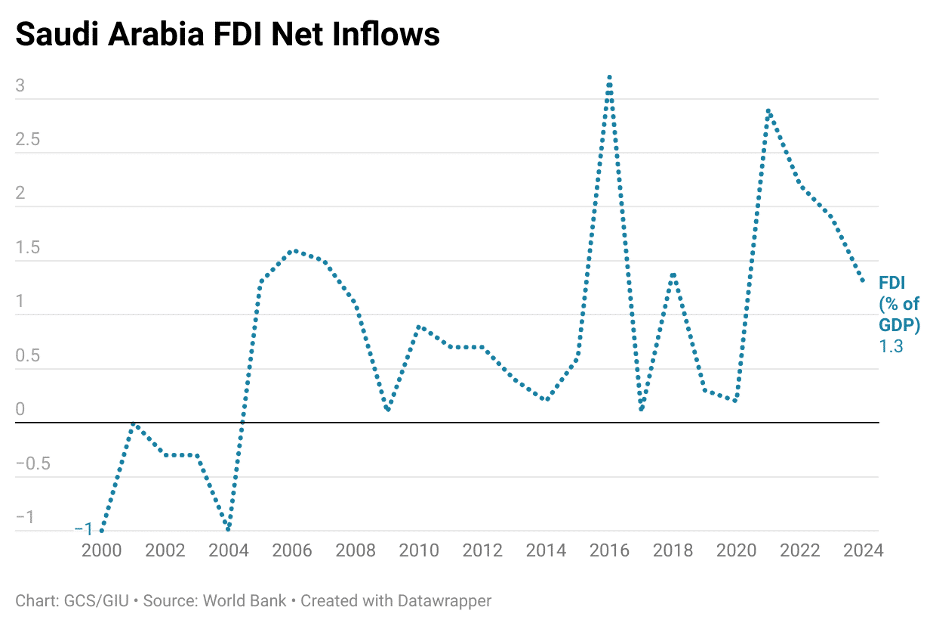

Foreign direct investment (FDI) is one of the main pillars in the Kingdom’s transformation. Vision 2030((Saudi Vision 2030. Kingdom of Saudi Arabia, www.vision2030.gov.sa/en.)) aims to diversify the national economy by promoting investment across a range of non-oil sectors, including tourism, entertainment, healthcare, and renewable energy.

The country’s program of strategic reforms, substantial infrastructure development, and regulatory liberalization is deliberately structured to embed FDI as a principal engine of diversification, thereby fostering sustained and inclusive economic growth((Elimam, H., and H. Alattas. “Foreign Direct Investment: A Strategic Approach towards Sustainable Economic Growth in Saudi Arabia.” Cogent Economics & Finance, vol. 13, no. 1, 2025, doi:10.1080/23322039.2025.2492203.)).

Saudi Arabia is also directing substantial investment toward strengthening its logistics and digital infrastructure. Geographically situated at the crossroads of three continents, the kingdom benefits from a strategic location that facilitates global trade. Its largest seaport on the Red Sea handles nearly 80% of regional maritime flows, underscoring its central role in shipping and commerce. Domestically, the transport network is becoming increasingly integrated, while partnerships with the private sector are accelerating the development of advanced digital infrastructure((Why Saudi Arabia? Invest Saudi, investsaudi.sa/medias/why-saudi-english.pdf.)).

Other structural factors reinforcing Saudi Arabia’s appeal:

- Mega-Project Pipeline: Under Vision 2030, SAR 4.9 trillion has been allocated to infrastructure and real estate initiatives, driving the transformation of urban planning, housing supply, and tourism infrastructure.

- Strong Performance Indicators: In Riyadh, sales prices increased by 10% and rental yields by 9% in the first half of 2024. Jeddah recorded respective increases of 5% and 4%. Nationally, transaction volumes rose by 38%, while the total value of transactions surged by 50% to SAR 127.3 billion((Saudi Residential Real Estate Market Is Booming, Says S&P.” Gulf Construction Online, Gulf Construction, www.gulfconstructiononline.com/ArticleTA/428206.)).

- Tax Efficiency: The absence of personal income tax, capital gains tax, and inheritance tax further enhances net yield potential and reinforces the kingdom’s competitive positioning as an investment destination.

Among the most consequential policy changes is the introduction of the foreign ownership law, scheduled to take effect in January 2026. This legislation permits foreign individuals and companies to acquire property within designated zones, marking a significant liberalization of the real estate market((“Saudi Arabia Opens Property Market to Foreigners in 2026.” Gulf News, Gulf News, 27 Feb. 2024, gulfnews.com/business/property/saudi-arabia-opens-property-market-to-foreigners-in-2026-1.500192024.)). The reform is expected to lower investment thresholds, enhance liquidity in secondary markets, and introduce residency programs linked to real estate ownership.

In contrast to the previous framework, the new law removes religious restrictions in most areas, enabling foreign buyers, regardless of faith, to purchase property in Riyadh and Jeddah, with exclusions applying only to Makkah and Madinah. Analysts regard this development as an important step toward aligning Saudi Arabia’s property market with leading global hubs. The scale of opportunity is substantial: of the USD 1.68 trillion in planned and ongoing real estate projects across the Middle East, Saudi Arabia accounts for USD 1.06 trillion – representing 63.1% of the regional total and far surpassing the United Arab Emirates at 24.4%((“Saudi Arabia Commands over 60% of $1.68 Trillion Gulf Real Estate Projects Pipeline: Report.” Arabian Business, Arabian Business Publishing, 7 Mar. 2024, www.arabianbusiness.com/industries/real-estate/saudi-arabia-commands-over-60-of-1-68-trillion-gulf-real-estate-projects-pipeline-report)).

Residency policy constitutes another core element of Saudi Arabia’s investment appeal. The Premium Residency Program, introduced in 2019 and informally referred to as the “Saudi Green Card,” grants expatriates the right to live, work, and own property in the kingdom without the requirement of a local sponsor.

Key features include:

- Investment threshold: Minimum SAR 4 million.

- Long-term security: Renewable residency options ranging from 20 to 50 years.

- Family inclusion: Elite-tier applicants may include up to 50 family members across three generations.

- Comprehensive benefits: Access to public services, eligibility to own property, and participation in government-led investment opportunities.

The program is particularly attractive to ultra-high-net-worth individuals (UHNWIs) and family offices seeking multigenerational wealth preservation, portfolio diversification, and strategic relocation.

When considering the program’s appeal to ultra-high-net-worth individuals (UHNWIs) and family offices, its combination of family inclusivity, cost efficiency, and lifestyle enhancement is particularly noteworthy. The Premium Residency framework allows holders to relocate with spouses, children, and in some cases parents, without the need for sponsorship or the payment of dependent fees—an arrangement that significantly reduces administrative and financial burdens. Exemption from expatriate levy fees further lowers long-term living costs, while streamlined travel privileges, including visa-free re-entry and access to priority airport lanes, provide a level of mobility and convenience highly valued by globally mobile investors. These practical benefits are complemented by the Kingdom’s rapidly expanding luxury sector, with the personal luxury market forecast to double from €3 billion in 2023 to approximately €6 billion by 2030, driven by an annual growth rate of 10–12%((Istituto Marangoni. “Why Dubai and Riyadh Are the Fashion Capitals of 2025.” Maze35, 2025, www.istitutomarangoni.com/en/maze35/industry/why-dubai-and-riyadh-are-the-fashion-capitals-of-2025.)). Together, these factors position Saudi Arabia as an increasingly attractive jurisdiction for UHNWIs seeking both economic efficiency and access to a sophisticated, evolving luxury lifestyle.

Further, evaluating other Middle Eastern countries, the United Arab Emirates’ Residency by Investment (RBI) programs stand out for their wide-ranging appeal, attracting high-net-worth individuals, investors, entrepreneurs, scientists, artists, healthcare professionals, and technology specialists. These initiatives are a key part of the UAE’s long-term vision to establish itself as a global hub for business, innovation, and cultural exchange, offering a structured and attractive pathway to long-term residency for diverse applicant profiles.

Available in both Dubai and Abu Dhabi, these programs grant renewable five- or ten-year residencies and extend substantial benefits beyond legal stay. They provide a highly favorable tax environment. The most important benefits to be considered are the absence of personal income tax alongside world-class infrastructure, political stability, and family-friendly provisions such as access to premium healthcare and education. From an economic perspective, the programs channel significant capital inflows into real estate, public projects, and entrepreneurial ventures, helping to diversify the economy and stimulate key growth sectors. The long-term stability offered by these residencies encourages deeper integration of investors and skilled professionals into the local economy, fostering innovation, knowledge transfer, and sustainable development. This combination of investor security and strategic economic benefit ensures the UAE remains a highly competitive and influential player in the Middle East’s RBI landscape((Global Citizen Solutions. “How Are Dubai and Abu Dhabi Attracting Foreign Direct Investment?” Global Citizen Solutions, 2024, www.globalcitizensolutions.com/intelligence-unit/briefings/how-are-uae-attracting-fdi/.)).

Saudi Arabia’s Vision 2030 represents a decisive transition from an oil-dependent economy to a diversified and internationally competitive investment hub. By maintaining low inflation, reducing unemployment, and expanding non-oil sectors, the kingdom has built a foundation of macroeconomic stability that supports sustained growth. Strategic investments in logistics, digital infrastructure, and key industries, alongside strong real estate performance and tax advantages, have further strengthened its position as an attractive destination for global capital.

Reforms such as the forthcoming foreign ownership law and the Premium Residency Program expand opportunities for foreign participation in the property market while offering long-term security for investors and residents. The program’s appeal to UHNWIs is enhanced by family inclusion without sponsorship or dependent fees, exemption from expatriate levies, and streamlined travel privileges. These benefits are well-suited to globally mobile investors seeking stability, efficiency, and access to a luxury market set to double by 2030.

Combined with its strategic geographic location and strategic projects, these measures underscore Saudi Arabia’s commitment to aligning with global investment standards and securing a more prominent role in the world economy.