- Limited Global Mobility Risks: The COVID-19 pandemic exposed the limitations of wealth without mobility, as travel bans and border closures left many HNWIs stranded and unable to access their assets or preferred locations. This experience underscored the importance of having alternative residencies or citizenships, which can provide vital options for relocation and continuity during global disruptions.

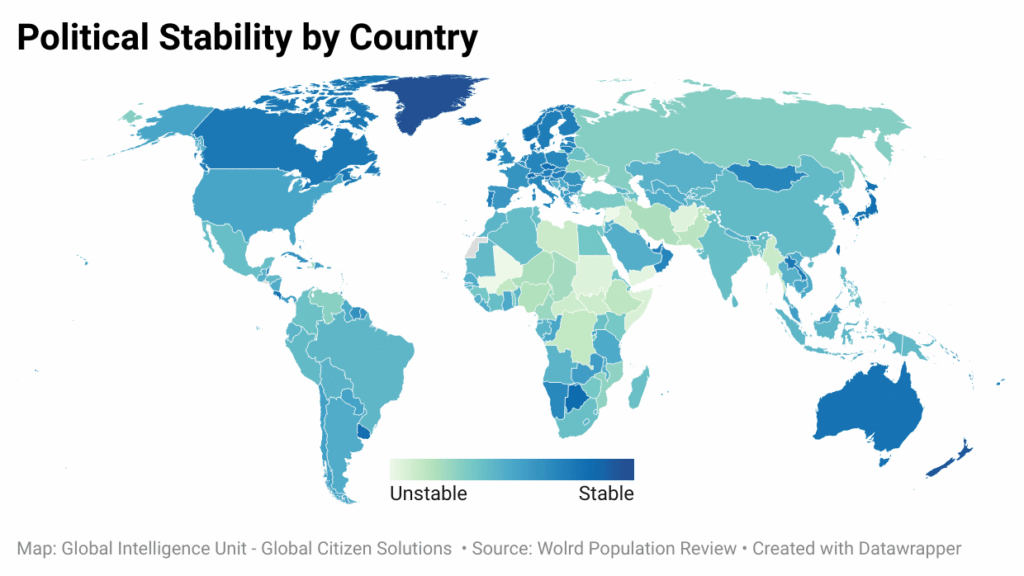

- Geopolitical Risks: events such as wars, sanctions, and abrupt regulatory shifts can result in asset freezes, property seizures, and restricted financial access. These risks highlight the need for HNWIs to structure their wealth in ways that minimize exposure to political action.

- Financial Risks and Tax Exposure: Financial institutions are adopting stricter compliance measures, often closing or rejecting accounts from nationals of high-risk countries beyond what regulations require. This “compliance overreach” has led to account closures for HNWIs from places like Russia, Venezuela, and Hong Kong, making it even more important for the wealthy to maintain diversified banking relationships and jurisdictions.

- Geographical asset diversification: Is key to preserve and transfer wealth. In doing so, HNWIs can reduce exposure to localized risks and benefit from growth opportunities in different regions.

- Recommendation for cross-jurisdictional diversification: International organizations and wealth advisors increasingly recommend cross-jurisdictional diversification as a way to achieve sustainable growth and reduce reliance on any single government or economy.

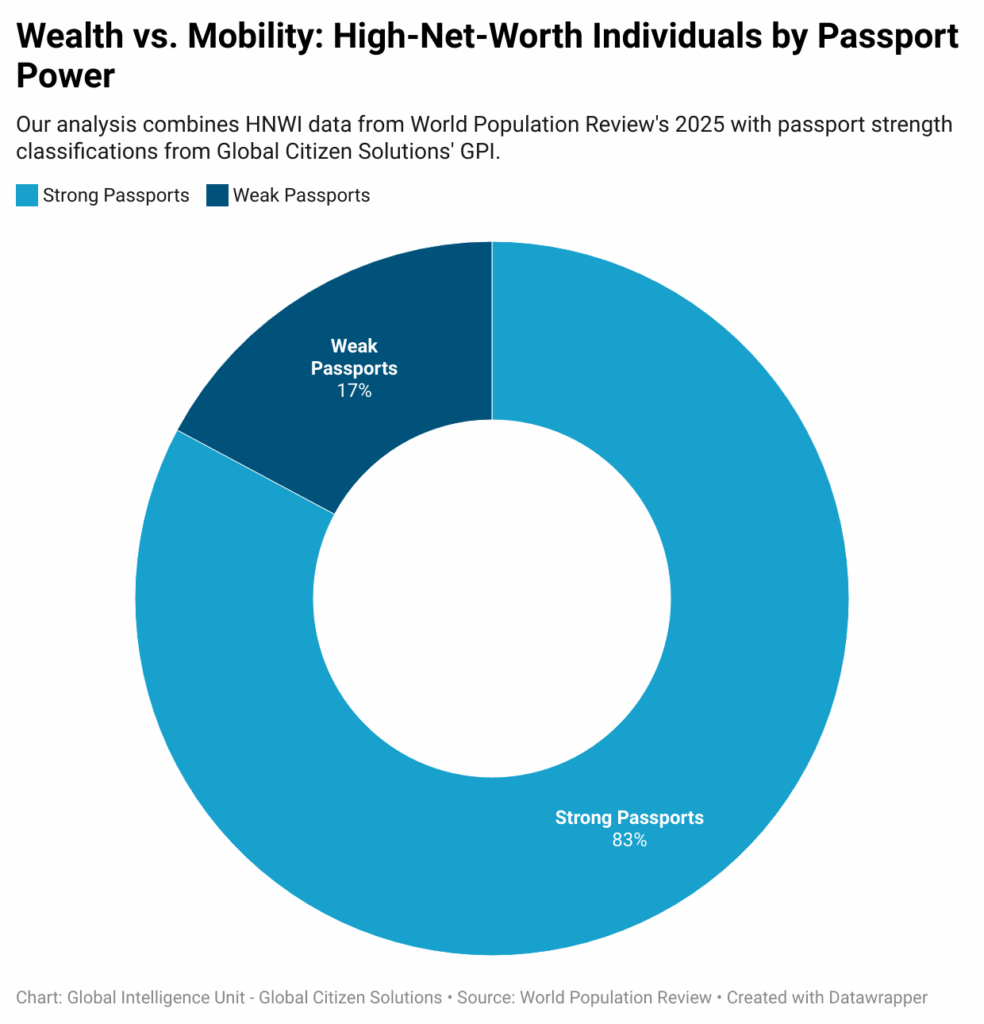

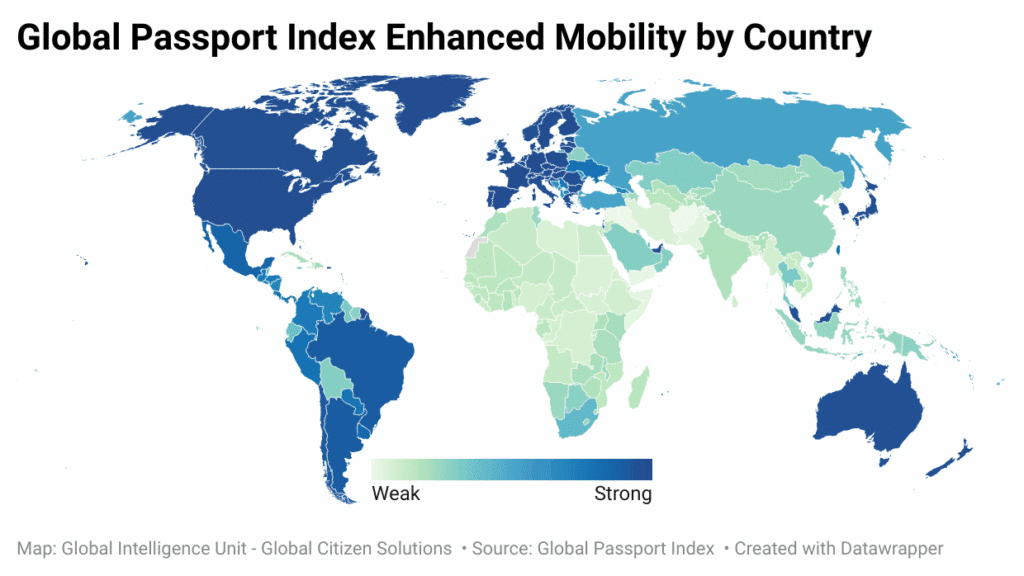

- The Universal Appeal for a Global Mobility Portfolio: The appetite for alternative residencies and citizenships is not limited to those from countries with “weak passports.” Increasingly, HNWIs from stable nations like the US are also seeking global mobility for reasons such as risk management, tax planning, and lifestyle flexibility. In regions like Latin America, economic and political instability is further accelerating demand for EU residencies among the wealthy.

- Global mobility is the foundation of resilience: Mobility is no longer a luxury but a necessity for HNWIs seeking to safeguard their assets and access opportunities worldwide. Second citizenships, alternative residencies, and diversified portfolios enable individuals to respond swiftly to political or regulatory changes, ensuring both personal and financial security.

The world today is marked by volatility and constant transformation, with wealth mobility becoming a cornerstone of sophisticated financial planning for high-net-worth individuals (HNWIs) and families. As geopolitical risks, regulatory shifts, and economic uncertainties proliferate, investors are no longer content to concentrate their assets in a single jurisdiction. Instead, they are embracing strategies that diversify both geography and asset classes, not merely to enhance returns, but to build resilience against systemic shocks.

The last decade has highlighted how overreliance on one market or currency can expose investors to profound disruptions, from political upheaval to fiscal policy reversals . Russian and Venezuelan investors are some examples of this fragile framework. Modern wealth preservation increasingly involves spreading risk across continents and industries, encompassing real estate, private equity, public markets, and alternative investments. This shift is also shaped by the global footprint of affluent families, whose members often live, work, and invest in multiple countries, making cross-border wealth structuring and succession planning more important than ever.

In response, a growing number of governments have expanded residence and citizenship by investment (RCBI) programs, offering international mobility in exchange for capital inflows. Countries such as Portugal, Malta, Greece, and the UAE have become magnets for global investors seeking greater personal security, tax efficiency, and unrestricted access to global markets. According to Global Citizen Solutions, demand for such programs has surged dramatically, with US applications alone increasing by over 900% between 2019 and 2024.

For international investors, geographic mobility provides a hedge against political and regulatory volatility, while enabling participation in new markets and asset ecosystems. Whether through second citizenships, alternative residency schemes or globally diversified portfolios, mobile investors are better equipped to seize emerging opportunities, protect their capital, and secure their legacy in an era defined by uncertainty.

This article explores how investment migration can serve as a vital tool for reducing personal and financial exposure to risk in an increasingly unpredictable global landscape. By examining how RCBI programs enable individuals to diversify their geopolitical footprint, the article highlights how strategic mobility empowers investors to preserve wealth, enhance security, and maintain flexibility amid shifting global dynamics.

The globalization of finance has fundamentally transformed the landscape of wealth creation, empowering individuals and families to access a broader spectrum of investment opportunities across borders. As of 2025, global net wealth has reached approximately $477 trillion USD, marking a 4.3% increase in 2023((Boston Consulting Group. (2024). Global wealth report 2024: The GenAI era unfolds. https://web-assets.bcg.com/0c/b4/1e8b9a66409a8deae6fc166aa26e/2024-global-wealth-report-july-2024-edit-02.pdf)). And according to Credit Suisse’s Global Wealth Report 2024, the number of millionaires worldwide is expected to climb from 59 million to 85 million by 2027((Credit Suisse. (2023). Global wealth report 2023. https://www.credit-suisse.com/about-us/en/reports-research/global-wealth-report.html)). In 2025, the number of billionaires worldwide has increased to 3,028, with a combined net worth of $16.1 trillion USD. This marks a significant rise from 2024, which had 2,781 billionaires with a total net worth of $14.2 trillion USD((Forbes. (2025, April 1). Forbes World’s Billionaires List 2025: The top 200 [Archived version]. https://www.forbes.com)). This remarkable growth is underpinned by advances in technology, the liberalization of financial markets, and the ease of cross-border trade. Yet, the same interconnectedness that fuels opportunity also amplifies risk: political upheaval, economic downturns, or regulatory shifts in one region can have swift and far-reaching effects on asset values and investor sentiment worldwide.

The growing trend of wealth mobility among HNWIs is closely tied to a confluence of strict regulations, geopolitical uncertainty, and deteriorating quality of life in their home countries. In Russia, the 2022 invasion of Ukraine triggered capital sanctions and severe banking instability, prompting over 15,000 wealthy individuals to relocate their assets or families to more politically neutral jurisdictions like the UAE and Armenia((The Moscow Times. (2023, March 14). Russia’s rich are on the move. https://www.themoscowtimes.com/2023/03/14/russias-rich-are-on-the-move-a80560 and Forbes Russia. (2022). Kuda uekhali bogatye rossiyane posle fevralya 2022 goda [Where did wealthy Russians go after February 2022?]. https://www.forbes.ru/newsroom/finansy-i-investicii/476303-kuda-uehali-bogatyie-rossiane-posle-fevrala-2022-goda)). Similarly, China’s tightening capital controls and concerns over air quality and education standards have led more than a third of its millionaires to consider emigration, according to the Hurun Research Institute((Hurun Research Institute. (2022). Hurun China HNWI migration report. https://www.hurun.net/en-US/Info/Detail?num=O5UTCCY5Y57W and Nikkei Asia. (2023). China HNWI flight: Tracking capital and talent outflow. https://asia.nikkei.com/Business/Markets/China-HNWI-flight)). In South Africa, a 28% rise in emigration applications between 2020 and 2023 reflects deeper anxieties over violent crime, rolling blackouts, and fiscal erosion((Statistics South Africa. (n.d.). Migration dynamics and population trends. https://www.statssa.gov.za/?p=15457; South African Reserve Bank. (n.d.). Statistical releases. https://www.resbank.co.za/en/home/publications/statistical-releases and Daily Maverick. (2023, February 27). South Africa’s elite seeking second passports and exit options. https://www.dailymaverick.co.za/article/2023-02-27-south-africas-elite-seeking-second-passports-and-exit-options/)). Meanwhile, Turkey’s lira devaluation and soaring inflation surpassed 50% in 2023, prompting outbound capital flight and increased demand for investor visa programs in Europe and the Gulf((Turkish Statistical Institute. (n.d.). Price statistics and economic indicators. https://data.tuik.gov.tr/Kategori/GetKategori?p=Prices-106 and Reuters. (2023, June 9). Wealthy Turks flee lira, inflation, and seek investment citizenship. https://www.reuters.com/world/middle-east/wealthy-turks-flee-lira-inflation-investment-citizenship-2023-06-09/)).

To mitigate these risks, HNWIs are increasingly embracing wealth mobility and global diversification strategies. Some examples that showcase this trend is India’s sharp increase in renunciations of citizenship (over 8,000 in 2022) was driven in part by wealthy individuals seeking more stable and globally connected regimes((Ministry of Home Affairs (India). (n.d.). Annual reports on renunciation of Indian citizenship. https://www.mha.gov.in/document/annual-reports; Lok Sabha. (2023). Parliamentary question AU1414: Renunciation of Indian citizenship by HNWIs. https://pqals.nic.in/annex/1711/AU1414.pdf and The Economic Times. (2023). Wealthy Indians continue to apply for investment-linked visas. https://economictimes.indiatimes.com/nri/migrate/wealthy-indians-continue-to-apply-for-investment-linked-visas/articleshow/102785172.cms)). In the same vein, in 2024, 4,820 individuals formally renounced their US citizenship, marking a 48% increase from 2023 and representing the third-highest annual total on record((Outbound Investment. (2024). Record number of wealthy Americans renounce citizenship in 2024. https://outboundinvestment.com/record-number-of-wealthy-americans-renounce-citizenship-in-2024; The Sun. (2024). Americans consider move to Ireland as passport applications surge post-election. https://www.thesun.ie/travel/15155253/americans-consider-move-ireland-passport-applications-donald-trump and VisaVerge. (2024). Why more Americans are seeking foreign residency after the 2024 election. https://www.visaverge.com/news/why-more-americans-are-seeking-foreign-residency-in-certain-countries)). The motivations behind this trend are multifaceted. A survey conducted by Greenback Expat Tax Services revealed that one in ten American expats intended to renounce their citizenship following the 2024 presidential election. Among those planning to renounce, 38% were Gen Z, and 36% were millennials. The primary reasons cited included political dissatisfaction, concerns over social policies, and the financial burden of US tax obligations((Greenback Tax Services. (2024). Renouncing American citizenship post-election: Expats voice their reasons. https://www.greenbacktaxservices.com/blog/renouncing-american-citizenship-post-election.)).

Countries such as Portugal, Australia, Singapore, and the United Arab Emirates have become appealing for international investors, offering political stability, attractive tax regimes, sophisticated financial infrastructures and well-established investment migration schemes. The explosive growth of the investment migration industry since the 2000s, now valued at over $100 billion((Global Citizen Solutions. (2024). Global RCBI report. https://www.globalcitizensolutions.com/intelligence-unit/reports/global-rcbi-report/)), reflects this trend. Demand for residence and citizenship by investment (RCBI) programs has reached unprecedented levels, as more investors seek the flexibility and security that come with holding multiple residencies or passports. Since St. Kitts and Nevis pioneered the world’s first CBI program in 1984, the concept of residency and citizenship by investment has expanded significantly worldwide. By 2000, roughly 15 countries had launched similar schemes, but the sector remained relatively niche and lightly regulated. Over the next two decades, the number of RCBI programs grew rapidly, with about 40 active programs across 36 countries by 2025((Investment Migration Council. (2023). The state of the investment migration industry: Annual report. https://investmentmigration.org/research-publications/)), reflecting a dynamic and maturing industry. Such programs are available not only in the Caribbean region (St. Kitts and Nevis, Antigua and Barbuda, Dominica, Grenada, and Saint Lucia), but also in countries in Europe, Asia, Africa, and Oceania.

From the individual’s perspective, geographical diversification is particularly vital in reducing exposure to localized risks. The allocation of assets across various countries and regions can shield investors’ portfolios from the adverse impacts of market volatility, currency fluctuations, and country-specific crises. J.P. Morgan Private Bank’s 2023 report((J.P. Morgan Private Bank. (2023). Global investment strategy: Mid-year outlook 2023. https://privatebank.jpmorgan.com/gl/en/insights/investments/global-investment-strategy-mid-year-outlook-2023)) underscores that portfolios diversified across geographies and asset classes consistently outperform those concentrated in a single market, especially during periods of global stress such as the COVID-19 pandemic or inflationary shocks. Supporting this, Knight Frank’s 2024 Wealth Report((Knight Frank. (2024). The wealth report 2024. https://www.knightfrank.com/research/article/2024-wealth-report)) reveals that, as of 2023, about 25% of HNWIs hold significant assets outside their home country, a figure that rises to 41% among Middle Eastern UHNWIs, who are particularly proactive in pursuing international diversification as a risk management strategy. Increasingly, international organizations and leading advisory firms strongly advocate for cross-jurisdictional diversification. The Organisation for Economic Co-operation and Development (OECD), in its 2024 Wealth and Asset Management Outlook, emphasizes that spreading investments across borders is key to mitigating country-specific risks and achieving sustainable long-term growth((Organisation for Economic Co-operation and Development. (2024). Wealth and asset management outlook 2024. https://www.oecd.org/finance/wealth-and-asset-management-outlook-2024.htm)).

Crucially, international mobility enables access to these diversified opportunities, allowing individuals to move assets efficiently and relocate to more favorable jurisdictions when regulatory or political conditions deteriorate. It also empowers investors to target high-performing sectors unique to each region, such as tech and private equity in the US, luxury real estate and green bonds in Europe, and early-stage venture capital in Southeast Asia, often under more favorable tax regimes or legal protections. In many cases, this mobility can reduce investment risk by offering legal recourse, investor protections, or a more stable monetary policy.

Importantly, the appeal of alternative citizenship and residency is not limited to those with weak passports. In recent years, a growing number of wealthy Americans, despite holding one of the world’s strongest passports, have sought second citizenships or residencies as part of broader geopolitical risk management and tax planning strategies. According to Global Citizen Solutions, US demand for investment migration surged by over 900% between 2019 and 2024. This trend is driven not by passport access per se, but by concerns over domestic political polarization, rising tax scrutiny, and a desire for lifestyle flexibility or potential expatriation. Countries like Portugal, Italy, and Greece (offering RCBIs programs, retirement visas and favorable tax regimes) have become popular among US nationals seeking EU footholds.

Among Latin American HNWIs, demand for European (especially Schengen Area) residencies and citizenships has become particularly pronounced. Citizens from countries like Venezuela, Brazil, Mexico, Argentina, and Colombia are increasingly pursuing residency-by-investment programs in Spain, Portugal, Italy and Malta to mitigate risks from currency instability, fluctuating governance, and growing concerns over personal security. For many, EU residency not only offers broader travel freedom and business access but also a backup plan for family relocation, education, and wealth preservation in the face of ongoing regional uncertainty.

This broader shift signals a global understanding of investment migration as an essential element of modern wealth management. While motivations may differ (from tax optimization and lifestyle enhancement to geopolitical insurance and intergenerational planning) the underlying goal remains the same: resilience. Whether from emerging markets with passport constraints or advanced economies facing internal pressures, HNWIs increasingly recognize that mobility and legal flexibility are foundational to global wealth preservation. Ultimately, HNWIs relying solely on one citizenship face acute vulnerabilities during global disruptions, particularly concerning mobility restrictions and emergency relocation. Without alternative legal statuses abroad, even the wealthiest individuals found themselves unable to leave, relocate, or reunite with family.

The appeal of investment migration is further reinforced by macroeconomic headwinds such as trade wars and domestic polarization. “Friendshoring” policies, where countries prioritize trade alliances with political partners, have fragmented global commerce and driven capital away from less aligned markets, disrupting investment pipelines and limiting innovation transfer((Góes, C., & Bekkers, E. (2022). The impact of geoeconomic fragmentation on trade and growth. World Trade Organization Staff Working Paper ERSD-2022-12. https://doi.org/10.30875/12345678)). At the same time, rising political polarization in major economies has introduced legislative gridlock and regulatory uncertainty. Research by Azzimonti links a one standard deviation increase in polarization to a 1% drop in firm-level investment, this effect is comparable to the impact of a 2-point rise in interest rates on corporate investment, a substantial impact in real terms((Azzimonti, M. (2018). The political polarization index. Federal Reserve Bank of Philadelphia Working Paper No. 18-19. https://doi.org/10.21799/frbp.wp.2018.19)). Combined with economic policy uncertainty, these domestic tensions are pushing HNWIs to jurisdictions with more stable political and legal environments.

Concurrently, OECD data shows a 20% surge in offshore asset holdings among HNWIs in high-risk jurisdictions since 2022, highlighting the intensifying reliance on jurisdictional diversification. The nature of wealth planning is shifting from static portfolio allocation to dynamic jurisdictional resilience, where citizenship and legal domicile are considered as vital to financial security as asset selection. Regulatory developments, such as global minimum tax standards and expanded beneficial ownership disclosure rules, only add urgency to this trend. The tools of wealth protection today include not just tax optimization, but legal flexibility and geopolitical foresight.

In conclusion, the evolving global order compels HNWIs to think beyond traditional asset management. Geographic mobility, enabled through second residencies, alternative citizenships, and international legal structures, now plays a central role in securing personal safety, family security, and investment freedom. Whether facing direct political risk or indirect regulatory fallout, globally mobile investors are better positioned to navigate volatility, seize emerging opportunities, and protect their legacy in a fractured world.

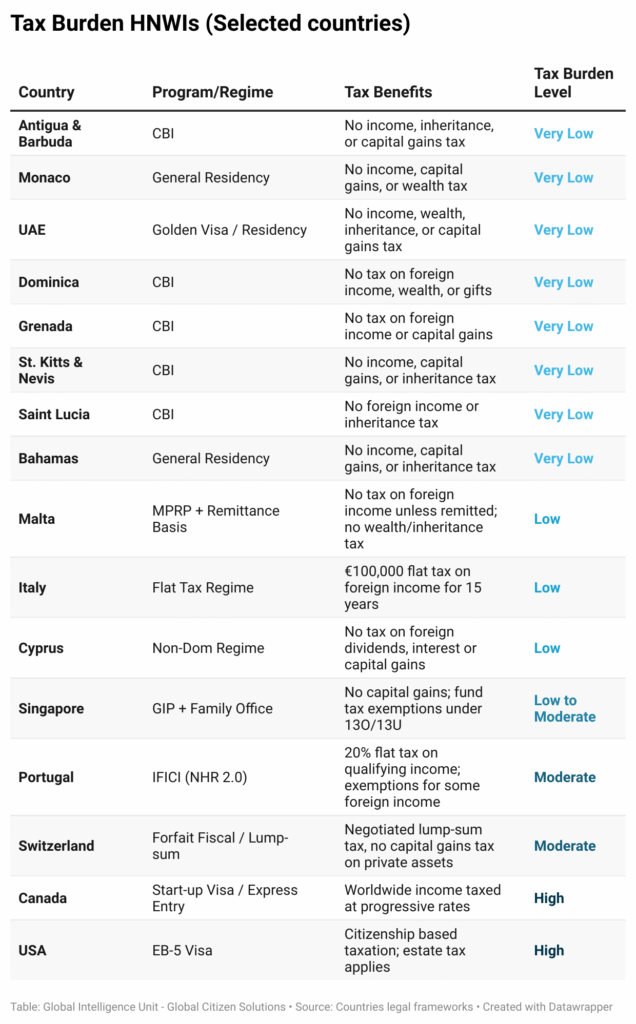

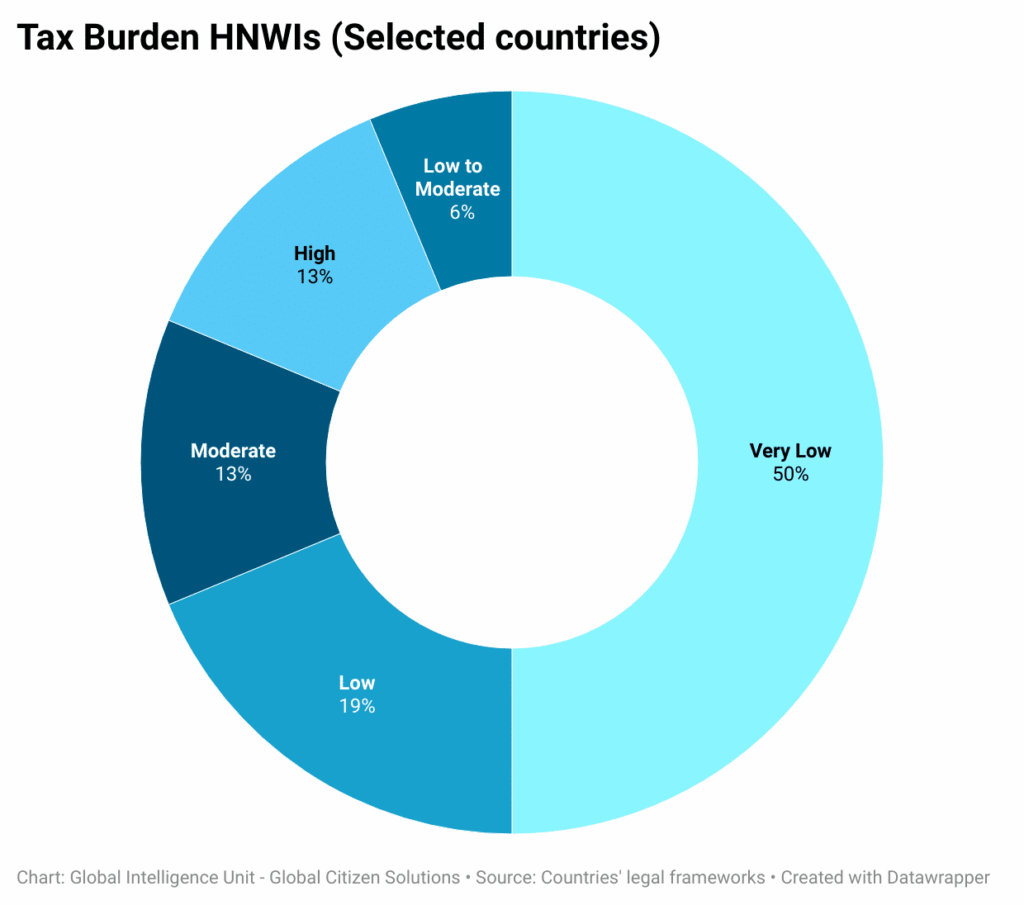

A striking 50% of jurisdictions fall into the “Very Low” tax burden category, highlighting a strong global trend toward accommodating wealthy individuals through minimal or no taxation on income, capital gains, or inheritance. An additional 19% offer “Low” tax environments, often through non-domicile regimes or flat-rate taxation on foreign income.

Also relevant to mention that many countries impose exit taxes (or departure levies) to preserve domestic tax revenue. These taxes aim to capture unrealized capital gains accrued during residency, treating emigration as a taxable event. The rationale is that individuals who have benefited from a country’s infrastructure, institutions, and services should not be able to permanently relocate and avoid taxation on their accumulated wealth. While the specifics of exit tax regimes vary, the common principle is that departure should not provide a loophole for tax deferral or avoidance.

In the United States, individuals who renounce their citizenship or give up long-term residency and meet certain thresholds, such as a net worth of $2 million or an average tax liability over approximately $190,000 for the past five years, face what is known as the exit tax under the Internal Revenue Code (IRC Section 877A). This rule treats all assets as if they were sold the day before expatriation, and taxes are levied on the unrealized capital gains, subject to an exclusion amount (about $821,000 for 2024, adjusted annually). Similarly, Canada imposes a departure tax that considers most assets as having been sold at fair market value when tax residency ends, triggering capital gains tax. Some assets, like Canadian real estate or registered retirement accounts, are exempted, but the principle remains consistent: capital gains accrued during residency must be taxed before exiting.

Across Europe, similar mechanisms are in place. France levies an exit tax on individuals who have been tax residents for at least six of the past ten years and own shares exceeding €800,000 or control more than 50% of a company’s profits. Tax is assessed on the latent gains of these shares, though deferrals and potential cancellations are available if the person moves within the EU/EEA or returns to France within 15 years. In Germany, individuals who have been residents for at least seven of the previous twelve years and hold 1% or more of a company are deemed to have disposed of those shares upon emigration, incurring tax on unrealized gains. Likewise, the Netherlands taxes substantial shareholders (with a minimum of 5% equity) upon emigration, although deferments are common when relocating within the EU. These regimes reflect a shared concern: to ensure that emigration does not undermine national tax bases, especially when it involves mobile capital and wealthy individuals.((Global Citizen Solutions. (n.d.). Analyzing global shifts and practical challenges of wealth and exit taxes. Global Citizen Solutions. https://www.globalcitizensolutions.com/intelligence-unit/analyses/analyzing-global-shifts-and-practical-challenges-of-wealth-and-exit-taxes/))

It is relevant to highlight that tax optimization must be distinguished from tax evasion on both legal and normative grounds. According to the OECD (2021)((OECD. (2021). Tax administration 2021: Comparative information on OECD and other advanced and emerging economies. OECD Publishing. https://doi.org/10.1787/2fea6fce-en)), tax optimization refers to the use of lawful arrangements within the framework of the tax law to minimize tax liability, whereas tax evasion involves illegal actions such as deliberately misreporting income or hiding assets to reduce tax obligations. While aggressive tax planning can test the boundaries of acceptability, most jurisdictions differentiate between compliant tax mitigation and fraudulent behavior, particularly in light of global transparency standards((OECD. (2021). Tax administration 2021: Comparative information on OECD and other advanced and emerging economies. OECD Publishing. https://doi.org/10.1787/2fea6fce-en)). Ultimately, lawful strategies enable HNWIs to align fiscal obligations with long-term financial and estate planning goals, while remaining compliant with global regulatory standards.

In 2024 alone, applications for European residency permits and citizenship-by-investment programs rose between 35% and 50%, with nearly half of applicants citing geopolitical instability as a primary motivator (Investment Migration Insider, 2025). HNWIs, often managing assets across multiple jurisdictions, face mounting challenges related to geopolitical instability, regulatory unpredictability, and rising tax scrutiny. In this context, the strategic acquisition of second citizenships or alternative residencies has emerged as a powerful instrument not merely for enhancing personal mobility, but for facilitating broad-based portfolio((Knight Frank. (2024). The Wealth Report 2024. Retrieved from https://www.knightfrank.com/research/wealth-report)).

Second citizenship or residency provides legal access to new jurisdictions, which in turn unlocks participation in regional markets, banking systems, and asset classes otherwise inaccessible to individuals confined to a single national identity. This access is not simply symbolic; it confers the legal right to own property, open accounts, invest in public and private markets, and even structure wealth more efficiently in line with local regulatory environments. For example, a holder of a Portuguese Golden Visa gains not only legal residence in Portugal but also the ability to operate across the European Union((European Commission. (2023). Portugal – Golden Visa scheme overview and legal context. Retrieved from https://commission.europa.eu/)). In contrast, an individual solely holding a Venezuelan passport may encounter significant limitations, including currency controls, sanctions, and restricted access to global financial services((IMF (International Monetary Fund). (2024). Global financial stability report: Navigating geopolitical fragmentation. Retrieved from https://www.imf.org/en/Publications/GFSR)).

The role of second legal status becomes especially critical when evaluating the impact of investment restrictions and capital mobility constraints. In jurisdictions such as China and India, residents face regulatory frameworks that limit outbound capital flows. China’s SAFE regulations cap personal overseas remittances at $50,000 per year((SAFE (State Administration of Foreign Exchange). (2022). China’s individual foreign exchange management rules and limits. Retrieved from https://www.safe.gov.cn)), while Indian residents are bound by the Reserve Bank’s $250,000 annual limit under the Liberalized Remittance Scheme((Reserve Bank of India. (2023). Liberalised Remittance Scheme (LRS) – Guidelines and FAQs. Retrieved from https://rbi.org.in)). Brazil taxes residents on worldwide income and imposes complex compliance obligations((Receita Federal. (2023). Tributação sobre rendimentos no exterior para pessoas físicas residentes no Brasil. Retrieved from https://www.gov.br/receitafederal/)). These limitations significantly reduce the ability of HNWIs to diversify geographically. By contrast, acquiring a second citizenship (via any Caribbean CBI) allows HNWIs to circumvent such barriers legally and sustainably((Investment Migration Council. (2023). Investment migration: Trends, policies and market updates. Retrieved from https://investmentmigration.org/)).

The use of second citizenship also extends to regulatory arbitrage and tax efficiency. Countries such as Italy, Malta, Portugal, and the United Arab Emirates offer attractive regimes for new residents, including flat taxes on foreign-sourced income or exemptions on capital gains((EY (Ernst & Young). (2024). Worldwide personal tax and immigration guide. Retrieved from https://www.ey.com/en_gl/tax-guides/worldwide-personal-tax-and-immigration-guide)). These jurisdictions have designed their policies to attract foreign capital and human talent, enabling mobile investors to align their fiscal exposure with long-term strategic objectives. Conversely, investors anchored to a single country (particularly one with aggressive taxation policies or low treaty network coverage) may find themselves unable to optimize wealth preservation or legacy planning((OECD. (2024). Taxation and inequality. OECD Publishing. https://doi.org/10.1787/taxation-inequality-2024-en)).

Beyond regulatory advantages, second citizenship often serves as a hedge against political or financial instability. COVID-19 pandemic disproportionately affected individuals with limited legal mobility, exposing the vulnerability of relying solely on one passport. According to the World Bank, more than 90% of countries had implemented travel bans by April 2020. In times of crisis, having access to alternative legal status can determine whether an individual is able to relocate assets, access healthcare, or even join family members across borders. The added benefit of portfolio flexibility, such as relocating businesses or real estate investments to more stable jurisdictions, further enhances the resilience that second citizenship brings to wealth management strategies((J.P. Morgan Private Bank. (2023). The role of mobility in portfolio resilience: Private wealth strategies post-COVID. Retrieved from https://privatebank.jpmorgan.com)).

As emphasized by global mobility experts at Global Citizen Solutions, HNWIs with second residencies or passports benefit from stronger geopolitical insulation and greater access to regulated investment environments. Legal mobility enables participation in high-value sectors (such as venture capital in Europe, real estate in the UAE, and tech in Southeast Asia) without encountering many of the regulatory and compliance hurdles that restrict individuals from countries with less favorable reputations or passport power. Our internal data supports the notion that citizenship status directly impacts onboarding times, regulatory acceptance, and market access across multiple jurisdictions.

Through several interactions with family offices and wealth managers globally, Global Citizen Solutions has also observed a consistent trend: while most advisors acknowledge the growing relevance of second citizenship and residency options, many are still unfamiliar with the operational aspects of investment migration. Despite a clear uptick in client inquiries regarding these pathways, advisors often feel underprepared to offer guidance. According to GCS’s experts, this knowledge gap stems from a combination of limited understanding of the sector, lack of reliable institutional partners, and hesitation to engage in strategies that fall outside traditional investment paradigms. As awareness increases, early-adopting wealth managers and family offices are expected to be better positioned to deliver high-value, mobility-focused support in areas such as tax optimization, succession planning, and lifestyle flexibility.

As the landscape of risk continues to evolve, from inflationary shocks and tax exposure to geopolitical tension and climate disruption, the ability to legally shift capital, domicile, and operations becomes indispensable. Second citizenship and residency thus serve not only as enablers of diversification but as foundational tools for building and preserving global wealth in the 21st century.

It is prudent for investors to hold assets across different regions to reduce exposure to localized political, economic, or regulatory shocks. Countries with robust legal systems and stable governance, such as Portugal, Singapore, Switzerland or Australia, are often viewed as suitable anchors for capital diversification.

Evaluating Alternative Citizenship or Residency Options

Multiple citizenships or residency-by-investment programs can provide additional flexibility in times of crisis. These programs can offer legal pathways to enhanced mobility, personal security, and participation in favorable business or tax environments.

Assessing the Limitations of One’s Primary Passport

Even holders of high-mobility passports may benefit from additional legal statuses. These can serve as safeguards during travel bans, political unrest, or domestic policy shifts that could restrict freedom of movement or financial planning options.

Exploring Legal Structures for International Tax Efficiency

Tax optimization may be pursued through compliant structures such as flat-tax regimes, non-domicile programs, and treaty-based holding entities. Advisors often recommend exploring locations like Italy, Malta, or the UAE, where foreign-sourced income might be treated favorably under specific legal frameworks.

Factoring Climate Resilience into Location and Asset Planning

As climate-related risks increase, individuals and companies are favoring environmental stability into decisions about investment and relocation. Jurisdictions with sustainable infrastructure and lower exposure to environmental volatility (such as a Scandinavian nation or inland New Zealand) are increasingly part of forward-looking asset protection strategies.

Staying Informed on Transparency and Regulatory Trends

HNWIs might benefit from staying ahead of evolving global standards such as the OECD’s Common Reporting Standard and G20 tax initiatives. Compliance with increasing transparency demands can reduce legal exposure and ensure sustainable wealth strategies.

Incorporating Jurisdictional Diversification into Legacy Planning

For families with cross-border interests, enabling next-generation members to live, study, or work in multiple jurisdictions may support continuity and long-term opportunity. Jurisdictional diversification can complement traditional estate planning by increasing global access and legal flexibility.

Engaging Political and Regulatory Risk Forecasting in Financial Planning

Many investors are turning to geopolitical risk analysts and macroeconomic consultants to inform their jurisdictional decisions. Incorporating scenario-based planning, such as modeling the effects of sanctions, tax changes, or authoritarian shifts—may support capital preservation and compliance. Institutions like the IMF and OECD now recognize non-market risks as critical variables in wealth strategy formulation.

Integrating Investment Migration: A Strategic Imperative for Future-Ready Wealth Advisory

Wealth managers and family offices should proactively incorporate investment migration expertise into their advisory toolkit by partnering with trusted firms specializing in global mobility. Doing so can enhance their ability to respond to increasing client demand for second citizenship and residency options, while also equipping them to navigate the complex regulatory, tax, and compliance landscapes associated with these pathways. Early adoption of mobility-informed strategies can position advisors to deliver higher-value, future-ready guidance in areas such as asset protection, cross-border succession planning, and access to high-growth international sectors.

The ability to relocate, restructure, and reinvest across borders is emerging as a defining pillar of long-term financial strategy for HNWIs. Traditional asset allocation, once centered around domestic markets and regulatory predictability, is increasingly being complemented by jurisdictional diversification. The rise in global disruptions (whether through political instability, economic downturns, pandemics, or environmental threats) has emphasized that where one holds assets and legal status is just as important as what one holds.

Investment migration and cross-border planning are no longer fringe strategies but have entered the mainstream of wealth management. As countries compete to attract capital through residence and citizenship by investment programs, HNWIs have unprecedented opportunities to enhance their mobility, gain access to favorable tax regimes, and safeguard personal freedoms. These options are especially critical for those from politically or economically unstable regions, but the growing interest among investors in advanced economies suggests that legal and geographic flexibility is becoming a universal wealth planning priority.

What the COVID-19 crisis, the Russia–Ukraine war, and tightening global compliance regimes have revealed is that wealth, when confined to a single jurisdiction, can become a vulnerability. In contrast, those with alternative residencies, offshore banking relationships, and diversified portfolios have demonstrated greater agility in responding to crises. This resilience extends beyond personal safety, it encompasses the ability to continue business operations, secure family welfare, and capitalize on new opportunities during periods of global flux.

Ultimately, strategic mobility represents a shift from static wealth preservation to dynamic resilience-building. It is not merely about mitigating threats, but about enabling freedom of movement, enhancing investment versatility, and future-proofing legacy planning. In this evolving landscape, globally minded HNWIs would do well to integrate mobility, diversification, and regulatory foresight into their core financial strategies, positioning themselves not just to weather the storm, but to navigate it from a place of strength.