Crypto, Compliance, and Citizenship: Where digital assets meet residency planning

In the rapidly evolving world of cryptocurrency, digital assets are reshaping not only the financial ecosystem but also the landscape of global mobility. Investors are offered financial flexibility through cryptocurrencies; however, this innovation brings with it a complex regulatory environment, with significant variations in tax treatment, reporting obligations, and rigorous anti-money laundering (AML) and know-your-customer (KYC) requirements imposed by both governments and centralized exchanges.

Jurisdictions such as the United Arab Emirates, Singapore, Switzerland have gained attention for their crypto-friendly policies and countries such as El Salvador, are open to crypto as part of citizenship and residency by investment scheme. This article examines the countries that are most open to crypto investors, focusing on those that allow cryptocurrencies to be used as part of the application process for residency or citizenship by investment programs.

Evolving Definitions of Money and Ownership

The concept of currency has long been integral to human society, traditionally governed through centralized systems via fiat money issued and regulated by state authorities. Fiat currency functions as a stable, widely accepted medium of exchange and store of value, reinforced by governmental trust and economic policy.

In contrast, the emergence of cryptocurrency has introduced decentralized digital assets like Bitcoin and Ethereum, which leverage blockchain technology to ensure secure, transparent, and peer-to-peer transactions without central oversight. While cryptocurrencies offer enhanced privacy, rapid cross-border transaction capabilities, and technological innovation, they also present challenges in volatility, regulatory uncertainty, and limited mainstream adoption. Key distinctions between the two forms of currency lie in their governance models, technological infrastructure, regulatory frameworks, price stability, and usability1Hinton, Caleb. “Cryptocurrency vs. Traditional Currency: Key Differences Explained.” CurrencyTransfer, 2025, www.currencytransfer.com/blog/expert-analysis/cryptocurrency-vs-traditional-currency..

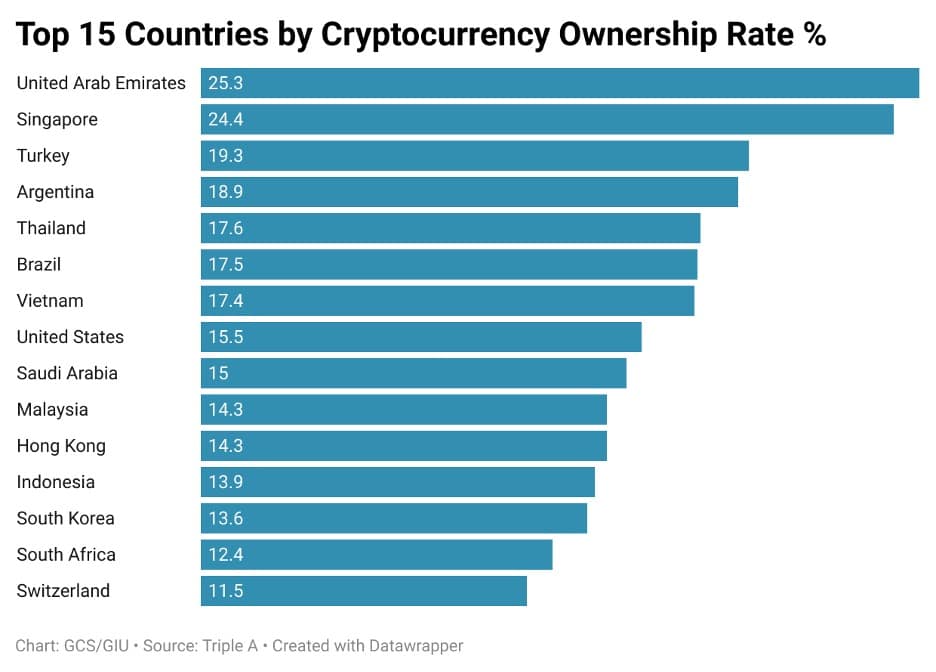

Currently there are over 560+ million cryptocurrency owners worldwide. Cryptocurrency ownership reflects a diverse yet distinct demographic profile, with 61% of owners being male and 39% female. Notably, 34% of crypto users fall within the 25-34 age range, underscoring the appeal of digital currencies among younger, tech-savvy individuals2“Cryptocurrency Ownership Data.” Triple A Technologies Pte. Ltd., 2024, www.triple-a.io/cryptocurrency-ownership-data..

Most Crypto-friendly Countries

According to Global Citizen Solutions Global Crypto-Friendly Nations Report, the following are top ten crypto-friendly countries:

The ranking is based on a set of indicators that assess each country’s approach to cryptocurrency across multiple dimensions. These include the regulatory landscape, economic environment, public adoption, technological innovation, environmental sustainability, and governance standards.

While countries such as the United States, India, Hong Kong, Malaysia and the Philippines rank high in terms of crypto adoption, this alone does not indicate a crypto-friendly ecosystem. In many of these jurisdictions, adoption is driven more by necessity, such as limited access to traditional financial systems or inflationary pressures, rather than by regulatory support. A crypto-friendly country not only demonstrates high usage rates but also offers a clear legal framework, favorable tax treatment, and government initiatives that support blockchain development. For example, India, despite its strong user base, continues to face challenges related to tax policies, bureaucratic barriers, energy infrastructure, and mining regulation.

The report evaluates 75 jurisdictions and finds that in 76 percent of them; the use of crypto assets is currently legal. However, 23 percent maintain some form of restriction or outright ban on cryptocurrencies, whether partial or total. These legal limitations often leave individuals and investors operating in uncertain or restrictive environments. Consequently, many choose to establish fiscal residency in more favorable jurisdictions that provide legal clarity and support for digital asset ownership. This trend underscores the growing importance of regulatory alignment in shaping the global movement of crypto investors and innovators.

Overview of Countries Accepting Cryptocurrencies for Citizenship or Residency Investment

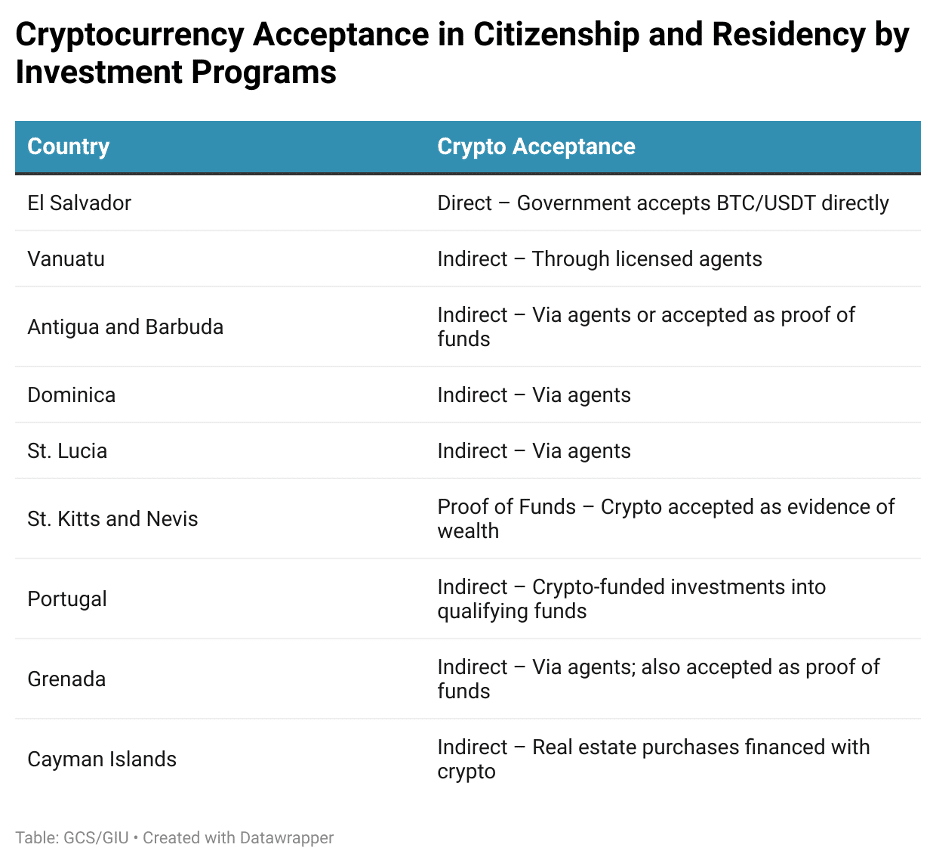

An emerging concept within the intersection of digital finance and global mobility is crypto citizenship. This term refers to the ability of individuals to obtain legal residency or citizenship in a country using wealth derived from cryptocurrencies. In practice, this usually occurs through a formal residency or citizenship by investment (RCBI) program, where applicants can either invest directly with crypto assets, use them as proof of funds, or convert them through licensed agents to meet the program’s requirements. Crypto citizenship reflects a broader shift in how nations adapt their immigration policies to accommodate new forms of digital wealth.

Below is a detailed exploration of these countries, their programs, and the specific details of crypto acceptance, based on the latest available data.

Among all reviewed residency and citizenship by investment (RCBI) programs, El Salvador stands out as the only country that accepts cryptocurrency directly for its government-managed “Freedom Visa,” allowing investments in Bitcoin or USDT without fiat conversion. In contrast, most other jurisdictions, including Vanuatu, Dominica, St. Lucia, Antigua and Barbuda, Grenada, and the Cayman Islands, facilitate crypto-funded investments via licensed agents, where the digital assets are converted to fiat before being remitted to the state. Additionally, programs like those in St. Kitts and Nevis recognize cryptocurrency as proof of funds, though direct payments are not accepted. Portugal, while not accepting crypto itself, permits investments into approved funds that may have crypto exposure, allowing crypto wealth to be deployed indirectly. This reflects a cautious but growing alignment between digital assets and global mobility frameworks.

Compliance and Due Diligence

As demonstrated above, cryptocurrencies’ decentralized and borderless nature makes them an attractive asset for global investors, but their integration into citizenship by investment (CBI) and golden visa programs is complex. Most countries require thorough due diligence to verify the legality of crypto-derived wealth, often necessitating proof of funds through blockchain analytics or exchange transaction records. While some jurisdictions, such as El Salvador, permit direct crypto payments, others require conversion to fiat currency for the actual investment, reflecting more cautious and regulated approaches.

Compliance remains central to these frameworks. Even where crypto is formally accepted, applicants are typically required to convert it into fiat via regulated financial intermediaries and provide verifiable documentation of the assets’ origin. Rigorous know-your-customer (KYC) and anti-money-laundering (AML) checks are standard to ensure legitimacy, as highlighted in Global Citizen Solutions’ Global Crypto-Friendly Nations Report. At the same time, attracting younger, crypto-native investors, particularly Millennials and Gen Z, requires regulatory clarity and ethical alignment, both of which are essential to ensure the long-term integrity and growth of crypto-integrated migration pathways.

Conclusion

Thus, the intersection of cryptocurrency, compliance, and citizenship reflects a significant shift in how global wealth and mobility converge. While cryptocurrencies offer flexibility and financial autonomy, their incorporation into residency and citizenship by investment programs remains dependent on legal clarity and regulatory oversight. Countries like El Salvador accept crypto directly, but most require conversion to fiat or use it only as proof of funds, ensuring compliance through strict KYC and AML procedures. Overall, crypto-friendliness relies not only on adoption rates but also on clear legal frameworks, supportive policies, and robust oversight, all of which are essential to attract and safeguard crypto-native investors.