Global Residency and Citizenship by Investment Report

Foreword from the CEO

At Global Citizen Solutions, we believe that global mobility is not just about access. It’s about possibility! Possibility for families to build better futures, for entrepreneurs to unlock opportunity, and for individuals to find security in an uncertain world. As CEO, I’ve had the privilege of watching the Residence and Citizenship by Investment (RCBI) space evolve from a quiet legal niche into a dynamic global ecosystem. But with growth comes complexity. That’s why I’m proud to introduce the Global RCBI Report 2025, a tool designed not just to rank programs, but to help people make informed, strategic, and values-aligned decisions.

We live in a time of tremendous flux, geopolitical instability, economic headwinds, shifting regulations. In this context, RCBI has become much more than a mobility solution. For many, it’s a lifeline, a way to protect assets, ensure personal safety, access better healthcare or education, or simply gain the freedom to move. And yet, despite its growing relevance, the RCBI landscape remains fragmented and complex: 36 programs across 35 countries, each with their own rules, timelines, benefits, and risks. Comparing them fairly is no easy task.

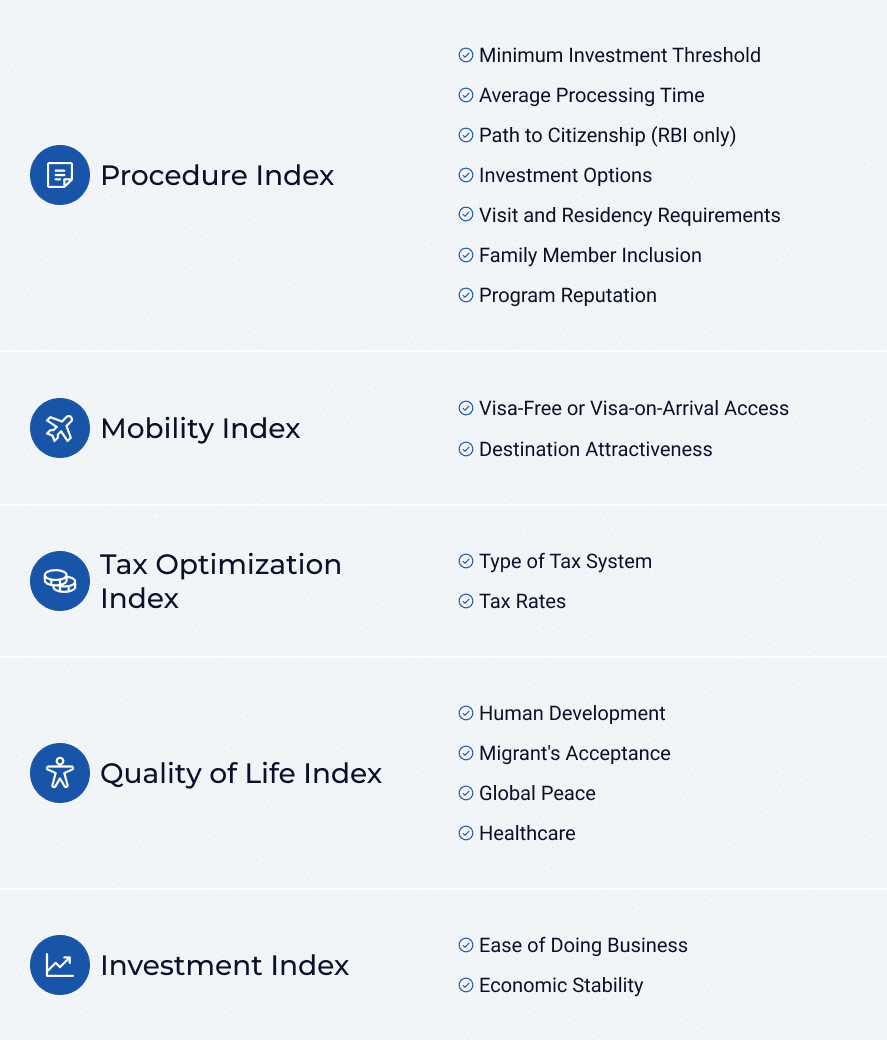

That’s where this report comes in. Backed by months of research, data analysis, and industry engagement, it delivers the most comprehensive and balanced comparison of global RCBI options to date. Our methodology looks beyond superficial markers like minimum investment or passport count. Instead, we evaluate each program across 18 indicators, grouped into five dimensions that truly matter to investors: Procedure, Mobility, Tax Optimization, Quality of Life, and Investment Environment. It’s a holistic approach designed to reflect what people care about when choosing a second residence or citizenship, not just what’s legally available, but what’s strategically meaningful.

We’ve also separated the rankings into two clear tracks: CBI for those seeking immediate nationality, and RBI for those preferring a long-term residence route. This distinction matters. It empowers users to understand the difference between access and integration, between short-term flexibility and long-term belonging.

The findings are fascinating. Caribbean countries like Antigua and Barbuda, St. Kitts and Nevis, and Grenada continue to excel in the CBI space, showing how small nations can compete globally through efficient, investor-friendly policies. On the RBI side, countries like Portugal, Greece, and Switzerland remain top choices, but we’re also seeing the rise of new contenders like Singapore, Luxembourg, and the UAE, whose programs increasingly blend investment with innovation, sustainability, and national development goals.

Importantly, this report goes beyond rankings. It explores the broader trends shaping investment migration in 2025: growing compliance and transparency measures from CBI programs, the rise of hybrid talent-investment visas, and the alignment of RCBI with national strategies around tech, climate, and resilience. These are not just immigration programs, they’re tools of diplomacy, development, and human mobility.

For me, the Global RCBI Report is personal. It’s a reflection of what our clients face every day: difficult decisions, high stakes, and a desire to do what’s best for themselves and their loved ones. It’s also a reminder that citizenship and residency are not abstract legal statuses, they are rights, protections, and possibilities. Our mission at Global Citizen Solutions is to make these possibilities visible, accessible, and meaningful.

I hope it gives you confidence to navigate the RCBI space with purpose, strategy, and trust.

Patricia Casaburi

CEO, Global Citizen Solutions

Methodology

Read MoreThe Global RCBI Report 2025 offers the most comprehensive, data-driven assessment of the global Residence and Citizenship by Investment (RCBI) landscape to date. Analyzing 36 programs across 35 countries, the report ranks both Citizenship by Investment (CBI) and Residence by Investment (RBI) schemes using a rigorous methodology built on 18 targeted indicators, grouped into five thematic sub-indexes or dimensions: Procedure Index, Mobility Index, Tax Optimization Index, Quality of Life Index, and Investment Environment Index.

Each program is scored using a mix of quantitative and qualitative data, standardized and normalized for cross-country comparability. The result is a dual index (one for CBI and one for RBI) that reflects not only the legal and administrative structure of each program, but also its broader appeal to global investors, entrepreneurs, and relocating families.

Constructing the rankings for the five dimensions for the Global RCBI Report required a rigorous multi-step methodology that combines normalization techniques, comparative policy analysis, and expert calibration. Each sub-index – Procedure, Mobility, Tax Optimization, Quality of Life, and Investment Environment – is weighted and rated on a standardized scale from 0 to 10. These scores are derived from a synthesis of multiple quantitative indicators and qualitative variables, carefully selected to reflect both investor priorities and policy design dimensions.

We welcome journalists and content creators to use insights from Global Citizen Solutions in your articles and publications. Please credit Global Citizen Solutions as the source and include a link to our website so readers can explore our research, data, and global mobility tools in more detail.

Full Report

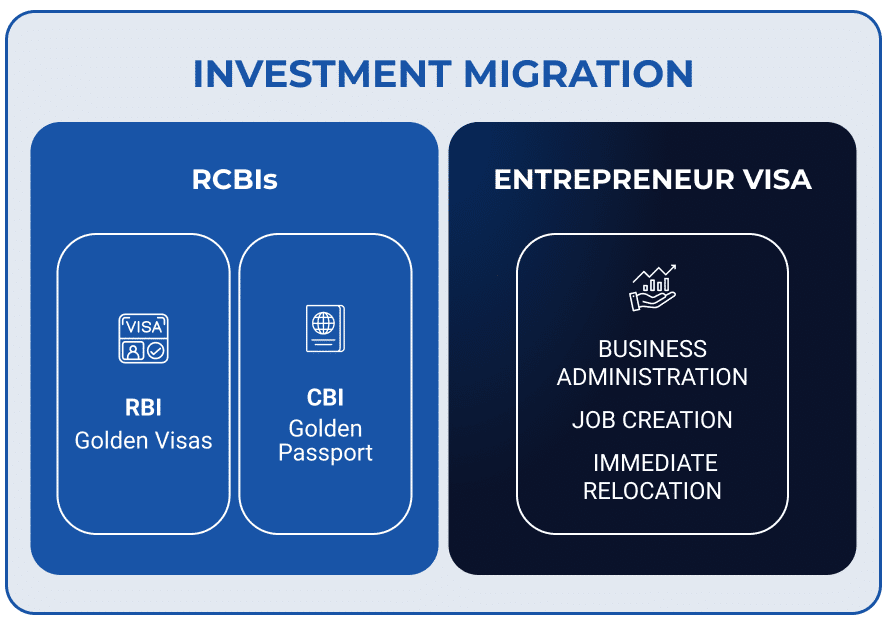

Read Full ReportInvestment migration serves as an umbrella term encompassing a range of programs that enable individuals to acquire residence or citizenship rights through economic contributions. It includes Residence by Investment (RBI) schemes (commonly known as Golden Visas) which offer legal residency in exchange for qualifying investments, as well as Entrepreneurial Visas that require active business engagement, job creation, and immediate relocation. On the other hand, Citizenship by Investment (CBI) programs, often referred to as Golden Passports, grant citizenship directly through capital contributions without the need for prior residence. Together, these pathways reflect the diversity of state strategies in leveraging migration channels to attract foreign capital, talent, and entrepreneurship, while maintaining differentiated levels of integration and mobility rights.

The Global RCBI Report provides insights into the shifting landscape of investment migration, highlighting the adaptive strategies employed by Citizenship by Investment (CBI) and Residence by Investment (RBI) programs amid evolving global trends. Caribbean countries such as Antigua and Barbuda, St. Kitts and Nevis, and Grenada continue to dominate the CBI market by offering streamlined application processes, advantageous tax structures, and extensive global mobility benefits, positioning themselves effectively to attract international investors. Their success illustrates how smaller nations can significantly enhance their global presence through carefully structured, strategically targeted programs.

In the realm of RBI programs, established destinations like Greece, Malta, Portugal, and Switzerland retain their attractiveness due to reliable legal frameworks and superior residency benefits. Concurrently, newer participants including Latvia, Luxembourg, Singapore, and the UAE are transforming the RBI landscape by aligning their residency schemes with innovative and sustainable economic growth initiatives. Through its comparative analysis of these varied approaches, the report sheds essential light on emerging trends and competitive dynamics shaping the future of the RCBI sector.

CBI Rankings

| Ranking | Country | Score | Full Detail |

|---|---|---|---|

|

1

st

|

Antigua and Barbuda

|

94.3 | Learn More |

|

2

nd

|

St. Kitts and Nevis

|

93.6 | Learn More |

|

3

rd

|

Grenada

|

93.2 | Learn More |

|

4

th

|

Dominica

|

90.5 | Learn More |

|

5

th

|

St. Lucia

|

89.8 | Learn More |

|

6

th

|

Malta

|

88.0 | Learn More |

|

7

th

|

Nauru

|

87.4 | Learn More |

| Ranking | Country | Score | Full Detail |

|---|---|---|---|

|

8

th

|

Austria

|

85.9 | Learn More |

|

9

th

|

North Macedonia

|

84.8 | Learn More |

|

10

th

|

Vanuatu

|

84.4 | Learn More |

|

11

th

|

Türkiye

|

83.9 | Learn More |

|

12

th

|

Jordan

|

83.6 | Learn More |

|

13

th

|

Egypt

|

80.9 | Learn More |

|

14

th

|

Cambodia

|

80.6 | Learn More |

| Ranking | Country | Score | Full Detail |

|---|---|---|---|

|

1

st

|

Antigua and Barbuda

|

95.7 | Learn More |

|

2

nd

|

St. Kitts and Nevis

|

95.0 | Learn More |

|

3

rd

|

Grenada

|

91.6 | Learn More |

|

4

th

|

Dominica

|

90.8 | Learn More |

|

5

th

|

St. Lucia

|

88.5 | Learn More |

|

6

th

|

North Macedonia

|

87.7 | Learn More |

|

7

th

|

Nauru

|

87.6 | Learn More |

| Ranking | Country | Score | Full Detail |

|---|---|---|---|

|

8

th

|

Malta

|

86.6 | Learn More |

|

9

th

|

Austria

|

85.3 | Learn More |

|

10

th

|

Türkiye

|

84.9 | Learn More |

|

11

th

|

Cambodia

|

83.8 | Learn More |

|

12

th

|

Egypt

|

83.4 | Learn More |

|

13

th

|

Jordan

|

83.3 | Learn More |

|

14

th

|

Vanuatu

|

82.8 | Learn More |

| Ranking | Country | Score | Full Detail |

|---|---|---|---|

|

1

st

|

Austria

|

100.0 | Learn More |

|

2

nd

|

Malta

|

96.5 | Learn More |

|

3

rd

|

North Macedonia

|

83.9 | Learn More |

|

4

th

|

St. Lucia

|

79.2 | Learn More |

|

5

th

|

St. Kitts and Nevis

|

78.6 | Learn More |

|

6

th

|

Dominica

|

74.8 | Learn More |

|

7

th

|

Antigua and Barbuda

|

73.7 | Learn More |

| Ranking | Country | Score | Full Detail |

|---|---|---|---|

|

8

th

|

Türkiye

|

73.2 | Learn More |

|

9

th

|

Grenada

|

72.7 | Learn More |

|

10

th

|

Nauru

|

61.4 | Learn More |

|

11

th

|

Egypt

|

55.7 | Learn More |

|

12

th

|

Vanuatu

|

50.7 | Learn More |

|

13

th

|

Jordan

|

50.5 | Learn More |

|

14

th

|

Cambodia

|

50.0 | Learn More |

| Ranking | Country | Score | Full Detail |

|---|---|---|---|

|

1

st

|

Grenada

|

100.0 | Learn More |

|

1

st

|

St. Kitts and Nevis

|

100.0 | Learn More |

|

2

nd

|

Dominica

|

93.8 | Learn More |

|

2

nd

|

St. Lucia

|

93.8 | Learn More |

|

2

nd

|

Nauru

|

93.8 | Learn More |

|

3

rd

|

Antigua and Barbuda

|

87.5 | Learn More |

|

3

rd

|

Malta

|

87.5 | Learn More |

| Ranking | Country | Score | Full Detail |

|---|---|---|---|

|

3

rd

|

Vanuatu

|

87.5 | Learn More |

|

3

rd

|

Cambodia

|

87.5 | Learn More |

|

3

rd

|

Egypt

|

87.5 | Learn More |

|

4

th

|

North Macedonia

|

81.3 | Learn More |

|

4

th

|

Jordan

|

81.3 | Learn More |

|

5

th

|

Austria

|

75.0 | Learn More |

|

5

th

|

Türkiye

|

75.0 | Learn More |

| Ranking | Country | Score | Full Detail |

|---|---|---|---|

|

1

st

|

Austria

|

96.5 | Learn More |

|

2

nd

|

Malta

|

91.4 | Learn More |

|

3

rd

|

St. Kitts and Nevis

|

86.3 | Learn More |

|

4

th

|

Grenada

|

84.8 | Learn More |

|

5

th

|

Antigua and Barbuda

|

83.7 | Learn More |

|

6

th

|

Türkiye

|

82.0 | Learn More |

|

7

th

|

Dominica

|

77.3 | Learn More |

| Ranking | Country | Score | Full Detail |

|---|---|---|---|

|

8

th

|

North Macedonia

|

75.3 | Learn More |

|

9

th

|

St. Lucia

|

74.7 | Learn More |

|

10

th

|

Nauru

|

72.8 | Learn More |

|

11

th

|

Jordan

|

70.5 | Learn More |

|

12

th

|

Egypt

|

64.9 | Learn More |

|

13

th

|

Vanuatu

|

63.0 | Learn More |

|

14

th

|

Cambodia

|

57.8 | Learn More |

| Ranking | Country | Score | Full Detail |

|---|---|---|---|

|

1

st

|

St. Kitts and Nevis

|

94.42 | Learn More |

|

2

nd

|

Austria

|

92.87 | Learn More |

|

3

rd

|

Antigua and Barbuda

|

91.66 | Learn More |

|

4

th

|

Malta

|

91.39 | Learn More |

|

5

th

|

North Macedonia

|

78.92 | Learn More |

|

6

th

|

St. Lucia

|

73.37 | Learn More |

|

7

th

|

Grenada

|

70.72 | Learn More |

| Ranking | Country | Score | Full Detail |

|---|---|---|---|

|

8

th

|

Nauru

|

70.37 | Learn More |

|

9

th

|

Türkiye

|

70.09 | Learn More |

|

10

th

|

Dominica

|

69.23 | Learn More |

|

11

th

|

Vanuatu

|

68.87 | Learn More |

|

12

th

|

Jordan

|

63.51 | Learn More |

|

13

th

|

Cambodia

|

58.32 | Learn More |

|

14

th

|

Egypt

|

54.96 | Learn More |

RBI Rankings

| Ranking | Country | Score | Full Detail |

|---|---|---|---|

|

1

st

|

Greece

|

91.47 | Learn More |

|

2

nd

|

Malta

|

89.97 | Learn More |

|

3

rd

|

Switzerland

|

89.94 | Learn More |

|

4

th

|

Luxembourg

|

89.26 | Learn More |

|

5

th

|

Portugal

|

89.20 | Learn More |

|

6

th

|

Italy

|

89.10 | Learn More |

|

7

th

|

United Arab Emirates

|

88.84 | Learn More |

|

8

th

|

Cyprus

|

88.79 | Learn More |

| Ranking | Country | Score | Full Detail |

|---|---|---|---|

|

9

th

|

Costa Rica

|

88.37 | Learn More |

|

10

th

|

New Zealand

|

88.03 | Learn More |

|

11

th

|

Jersey

|

87.93 | Learn More |

|

12

th

|

Canada

|

85.91 | Learn More |

|

13

th

|

Hungary

|

84.78 | Learn More |

|

14

th

|

Mauritius

|

84.77 | Learn More |

|

15

th

|

Monaco

|

84.59 | Learn More |

|

16

th

|

Montenegro

|

84.32 | Learn More |

| Ranking | Country | Score | Full Detail |

|---|---|---|---|

|

17

th

|

Singapore

|

84.15 | Learn More |

|

18

th

|

United States

|

83.38 | Learn More |

|

19

th

|

Hong Kong

|

83.15 | Learn More |

|

20

th

|

Latvia

|

82.94 | Learn More |

|

21

st

|

Panama

|

81.58 | Learn More |

|

22

nd

|

Thailand

|

79.38 | Learn More |

|

23

rd

|

Malaysia

|

78.76 | Learn More |

| Ranking | Country | Score | Full Detail |

|---|

| Ranking | Country | Score | Full Detail |

|---|---|---|---|

|

1

st

|

Greece

|

91.86 | Learn More |

|

2

nd

|

Cyprus

|

88.49 | Learn More |

|

3

rd

|

Italy

|

87.64 | Learn More |

|

4

th

|

Jersey

|

86.50 | Learn More |

|

5

th

|

Luxembourg

|

85.78 | Learn More |

|

6

th

|

United Arab Emirates

|

85.65 | Learn More |

|

7

th

|

Portugal

|

85.53 | Learn More |

|

8

th

|

Switzerland

|

85.20 | Learn More |

| Ranking | Country | Score | Full Detail |

|---|---|---|---|

|

9

th

|

Malta

|

85.16 | Learn More |

|

10

th

|

Thailand

|

84.94 | Learn More |

|

11

th

|

United States

|

84.80 | Learn More |

|

12

th

|

Panama

|

84.79 | Learn More |

|

13

th

|

Hungary

|

84.69 | Learn More |

|

14

th

|

Latvia

|

83.98 | Learn More |

|

15

th

|

Costa Rica

|

83.90 | Learn More |

|

16

th

|

Montenegro

|

82.51 | Learn More |

| Ranking | Country | Score | Full Detail |

|---|---|---|---|

|

17

th

|

Hong Kong

|

82.11 | Learn More |

|

18

th

|

New Zealand

|

81.55 | Learn More |

|

19

th

|

Mauritius

|

80.80 | Learn More |

|

20

th

|

Monaco

|

80.41 | Learn More |

|

21

st

|

Canada

|

78.04 | Learn More |

|

22

nd

|

Malaysia

|

77.82 | Learn More |

|

23

rd

|

Singapore

|

75.01 | Learn More |

| Ranking | Country | Score | Full Detail |

|---|

| Ranking | Country | Score | Full Detail |

|---|---|---|---|

|

1

st

|

Italy

|

96.77 | Learn More |

|

2

nd

|

Greece

|

91.94 | Learn More |

|

3

rd

|

Hungary

|

90.32 | Learn More |

|

4

th

|

Luxembourg

|

88.71 | Learn More |

|

5

th

|

Portugal

|

87.10 | Learn More |

|

6

th

|

Switzerland

|

85.48 | Learn More |

|

7

th

|

United Arab Emirates

|

83.87 | Learn More |

|

8

th

|

Singapore

|

82.26 | Learn More |

| Ranking | Country | Score | Full Detail |

|---|---|---|---|

|

9

th

|

New Zealand

|

79.03 | Learn More |

|

10

th

|

Malaysia

|

75.81 | Learn More |

|

11

th

|

Canada

|

74.19 | Learn More |

|

12

th

|

United States

|

70.97 | Learn More |

|

13

th

|

Cyprus

|

69.35 | Learn More |

|

14

th

|

Malta

|

67.74 | Learn More |

|

15

th

|

Latvia

|

66.13 | Learn More |

|

16

th

|

Monaco

|

64.52 | Learn More |

| Ranking | Country | Score | Full Detail |

|---|---|---|---|

|

17

th

|

Hong Kong

|

62.90 | Learn More |

|

18

th

|

Jersey

|

61.29 | Learn More |

|

19

th

|

Montenegro

|

59.68 | Learn More |

|

20

th

|

Costa Rica

|

58.06 | Learn More |

|

21

st

|

Mauritius

|

56.45 | Learn More |

|

22

nd

|

Panama

|

54.84 | Learn More |

|

23

rd

|

Thailand

|

51.61 | Learn More |

| Ranking | Country | Score | Full Detail |

|---|

| Ranking | Country | Score | Full Detail |

|---|---|---|---|

|

1

st

|

United Arab Emirates

|

100.0 | Learn More |

|

2

nd

|

Costa Rica

|

91.67 | Learn More |

|

2

nd

|

Panama

|

91.67 | Learn More |

|

2

nd

|

Singapore

|

91.67 | Learn More |

|

3

rd

|

Portugal

|

89.58 | Learn More |

|

3

rd

|

Switzerland

|

89.58 | Learn More |

|

4

th

|

Jersey

|

85.42 | Learn More |

|

4

th

|

New Zealand

|

85.42 | Learn More |

| Ranking | Country | Score | Full Detail |

|---|---|---|---|

|

5

th

|

Hong Kong

|

83.33 | Learn More |

|

5

th

|

Malaysia

|

83.33 | Learn More |

|

5

th

|

Thailand

|

83.33 | Learn More |

|

6

th

|

Cyprus

|

77.08 | Learn More |

|

6

th

|

Hungary

|

77.08 | Learn More |

|

6

th

|

Latvia

|

77.08 | Learn More |

|

6

th

|

Malta

|

77.08 | Learn More |

|

6

th

|

Monaco

|

77.08 | Learn More |

| Ranking | Country | Score | Full Detail |

|---|---|---|---|

|

6

th

|

Montenegro

|

77.08 | Learn More |

|

6

th

|

Luxembourg

|

77.08 | Learn More |

|

6

th

|

Mauritius

|

77.08 | Learn More |

|

7

th

|

Greece

|

68.75 | Learn More |

|

7

th

|

Italy

|

68.75 | Learn More |

|

7

th

|

Canada

|

68.75 | Learn More |

|

8

th

|

United States

|

58.33 | Learn More |

| Ranking | Country | Score | Full Detail |

|---|

| Ranking | Country | Score | Full Detail |

|---|---|---|---|

|

1

st

|

Canada

|

96.64 | Learn More |

|

2

nd

|

New Zealand

|

93.76 | Learn More |

|

3

rd

|

Switzerland

|

93.12 | Learn More |

|

4

th

|

Singapore

|

90.80 | Learn More |

|

5

th

|

Portugal

|

90.17 | Learn More |

|

6

th

|

Luxembourg

|

89.34 | Learn More |

|

7

th

|

Jersey

|

87.63 | Learn More |

|

8

th

|

Malta

|

86.70 | Learn More |

| Ranking | Country | Score | Full Detail |

|---|---|---|---|

|

9

th

|

Monaco

|

86.24 | Learn More |

|

10

th

|

Italy

|

86.22 | Learn More |

|

11

th

|

United Arab Emirates

|

83.88 | Learn More |

|

12

th

|

Hong Kong

|

82.34 | Learn More |

|

13

th

|

Costa Rica

|

80.43 | Learn More |

|

14

th

|

Mauritius

|

80.07 | Learn More |

|

15

th

|

Cyprus

|

79.73 | Learn More |

|

16

th

|

Greece

|

79.40 | Learn More |

| Ranking | Country | Score | Full Detail |

|---|---|---|---|

|

17

th

|

United States

|

78.70 | Learn More |

|

18

th

|

Hungary

|

78.62 | Learn More |

|

19

th

|

Latvia

|

78.34 | Learn More |

|

20

th

|

Malaysia

|

77.67 | Learn More |

|

21

st

|

Montenegro

|

73.90 | Learn More |

|

22

nd

|

Panama

|

73.81 | Learn More |

|

23

rd

|

Thailand

|

70.97 | Learn More |

| Ranking | Country | Score | Full Detail |

|---|

| Ranking | Country | Score | Full Detail |

|---|---|---|---|

|

1

st

|

New Zealand

|

80.31 | Learn More |

|

2

nd

|

Singapore

|

79.96 | Learn More |

|

3

rd

|

Hong Kong

|

79.24 | Learn More |

|

4

th

|

United States

|

78.14 | Learn More |

|

5

th

|

Mauritius

|

76.39 | Learn More |

|

6

th

|

Monaco

|

76.30 | Learn More |

|

7

th

|

Malaysia

|

76.26 | Learn More |

|

8

th

|

United Arab Emirates

|

75.90 | Learn More |

| Ranking | Country | Score | Full Detail |

|---|---|---|---|

|

9

th

|

Thailand

|

75.14 | Learn More |

|

10

th

|

Canada

|

75.01 | Learn More |

|

11

th

|

Switzerland

|

72.95 | Learn More |

|

12

th

|

Portugal

|

72.67 | Learn More |

|

13

th

|

Malta

|

71.88 | Learn More |

|

14

th

|

Italy

|

70.57 | Learn More |

|

14

th

|

Greece

|

70.57 | Learn More |

|

15

th

|

Jersey

|

68.56 | Learn More |

| Ranking | Country | Score | Full Detail |

|---|---|---|---|

|

16

th

|

Costa Rica

|

67.31 | Learn More |

|

17

th

|

Luxembourg

|

66.39 | Learn More |

|

18

th

|

Panama

|

65.36 | Learn More |

|

19

th

|

Hungary

|

61.87 | Learn More |

|

20

th

|

Cyprus

|

60.23 | Learn More |

|

21

st

|

Latvia

|

55.67 | Learn More |

|

22

nd

|

Montenegro

|

50.66 | Learn More |

| Ranking | Country | Score | Full Detail |

|---|

Insights

The Rise of Dual Citizenship: Between Statecraft and Insurance Policy

Over the past three decades, d ual citizenship has transformed from a rare legal anomaly into a mainstream global practice. For most of the 19th and 20th centuries, dual citizens were objects of suspicion, derided for what was often called “political bigamy.” Nowadays, the majority of countries in Europe and the Americas, as well as many in Asia, allow their citizens to hold more than one nationality.({Harpaz, Yossi. 2019. Citizenship 2.0: Dual Nationality as a Global Asset. Princeton, NJ: Princeton University Press.}) This shift reflects a broader transformation in the way citizenship is understood and used by states as well as individuals. On both sides, the acceptance of dual citizenship is creating new options for strategic and flexible behavior. States increasingly view citizenship as a policy tool for pursuing economic, demographic, and geopolitical objectives. Meanwhile, individuals—especially those outside the West—approach citizenship as a strategic asset: a means of securing mobility, opportunity, and protection in an uncertain world.

Read More

Investment Migration, Global Development, and the Economic Potential of New Generations

After three to four decades of globalization that brought about new wealth creation, global mobility and a few crises, things are changing and now the world faces the risks of continued armed confrontations, trade wars, political polarization in big countries and policy unpredictability. All these factors are leading to an increase in the insurance value of investment migration that attracts High-Net-Worth Individuals (HNWI)({A wealthy person or HNWI is often defined as individuals with investable (liquid) wealth over U$ 1 million (some use a higher threshold of investable wealth of over U$ 3 million), see Solimano (2024).}), professionals, entrepreneurs, and other talented people. Global solutions for this pool of internationally mobile people are, certainly, needed. In addition, new topics are emerging such as the growing portance of the youth as a very relevant actor in the process of wealth accumulation and international mobility, but challenges also exist in this area.

Read More

From Economic Necessity to Global Leadership: Caribbean Citizenship by Investment (CBI) Programs

Citizenship by Investment (CBI) programs in the Caribbean have emerged as a strategic economic tool for small island nations navigating the post-independence landscape. In the wake of British colonial rule, many of these countries faced limited natural resources and economic dependence in on vulnerable sectors such as agriculture and tourism. To address these challenges and attract much-needed foreign capital, several Caribbean states introduced CBI programs—offering citizenship in exchange for substantial investments in areas such as real estate or government funds. More than just a financial mechanism, CBI programs have become a cornerstone of economic diversification and resilience across the region.

Read More

DISCLAIMER

© 2025 Global Citizen Solutions. All rights reserved. The information presented in this report is based on sources deemed reliable. However, no guarantees are made regarding its accuracy or completeness. This report provides general information and educational material, and should not be interpreted as legal, tax, accounting, or investment advice. Nor should this information be considered as professional recommendations of any kind. For specialized advice, always consult a legal representative or specialist.

The contents of this report are general and abstract, and do not eliminate the need for specific case analysis. This report does not constitute an offer to buy or sell investment products. Global Citizen Solutions is not responsible for external content referenced in this report. Information is accurate as of the publication date but subject to change at the full discretion of Global Citizen Solutions. Global Citizen Solutions and its affiliates, employees, and agents are not liable for any damages arising from the use or reliance on this report. The report is provided “as is,” without any warranties regarding its completeness, accuracy, reliability, or suitability for any purpose.

Other trademarks in this report belong to their respective owners. No part of this report may be reproduced without prior written consent from Global Citizen Solutions.

For more information, click here.

previous

previous