After the COVID-19 pandemic, the global economy contracted by 3.4% in 2020((International Monetary Fund. “World Economic Outlook: Managing Divergent Recoveries.” IMF, 23 Mar. 2021, www.imf.org/en/Publications/WEO/Issues/2021/03/23/world-economic-outlook-april-2021)) leading governments to reassess their fiscal strategies and explore various recovery paths. In this evolving landscape, increasing attention was directed toward wealth and exit taxes as instruments for revenue generation and redistribution. This article examines recent developments in the design and implementation of these taxes, bearing in mind the historical context and the associated practical challenges.

Net wealth taxes are recurrent taxes on the net wealth (assets minus liabilities) of individuals. These taxes are typically levied annually and apply to a wide range of assets including real estate, bank deposits, shares, and business assets.

In general, the tax base for wealth-related taxes may encompass the worldwide net assets owned, transferred, received, or gifted by a taxpayer, provided there is a sufficient connection between the taxpayer and the taxing jurisdiction. The tax base may consist of assets physically located within the jurisdiction, irrespective of the taxpayer’s connection to it ((Rudnick, Rebecca S., and Richard K. Gordon. “Taxation of Wealth.” Tax Law Design and Drafting, edited by Victor Thuronyi, vol. 1, International Monetary Fund, 1996, pp. 285–308. https://www.imf.org/external/pubs/nft/1998/tlaw/eng/ch10.pdf.

Conversely, exit taxes are designed to capture capital gains that have accrued during an individual’s period of residence in a given country. These taxes typically operate by treating the individual as having disposed of their assets at market value immediately prior to a change in tax residency, thereby ensuring such gains are subject to taxation before departure ((Hourani, Diana, and Sarah Perret. Taxing Capital Gains: Country Experiences and Challenges. OECD Taxation Working Papers No. 72, Organisation for Economic Co-operation and Development, 2025. https://www.oecd.org/content/dam/oecd/en/publications/reports/2025/02/taxing-capital-gains_76a32327/9e33bd2b-en.pdf.)).

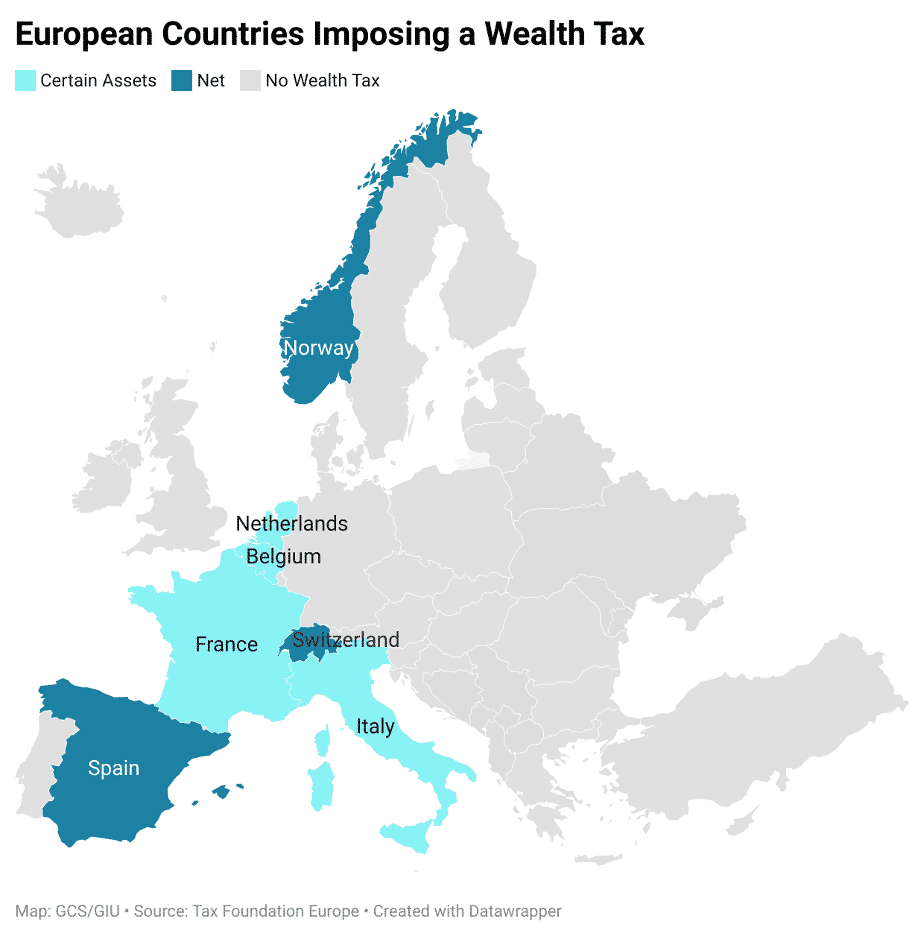

As of 2025, only three European countries Norway, Spain, and Switzerland levy a comprehensive net wealth tax.

Other jurisdictions such as France, Italy, Belgium, and the Netherlands impose taxes on specific categories of assets, but do not implement a general tax on net wealth in the broader sense((Enache, Cristina. Wealth Taxes in Europe, 2025. Tax Foundation Europe, 25 Feb. 2025, https://taxfoundation.org/data/all/eu/wealth-taxes-europe/.))

It is also worth considering that in France, while the tax bands for the Impôt sur la Fortune Immobilière (IFI) begin at €800,000, the tax is only triggered when total net real estate assets exceed €1.3 million. In the case of Italy, the IVAFE includes a flat annual tax of €34.20 on foreign bank accounts, though this is waived if the average balance remains below €5,000. Turning to Belgium, once a securities account exceeds the €1 million threshold, the entire account value becomes subject to the 0.15 percent tax, rather than just the amount above the threshold.

As presented below, an examination of the 2025 policy adjustments reveals a trend toward increased regulations for high-net-worth individuals (HNWIs), as evidenced by recent developments in the United Kingdom, the United States, and other global jurisdictions.

Effective from April 2025, the United Kingdom officially ended its long-standing non-domicile tax regime and introduced a new system based on tax residence. Under this new framework, the widely used remittance basis will be abolished for all newly arising foreign income and gains. Only individuals who become UK tax residents after spending at least 10 years outside the UK will qualify for a four-year exemption on foreign income and gains. Previous users of the remittance basis who no longer meet the criteria will now be fully taxed in the UK on all new foreign income and gains. In addition, trust protections will be considerably reduced, increasing the exposure of offshore assets to UK taxation. A Temporary Repatriation Facility has been introduced, providing a limited window to remit previously untaxed foreign income at reduced rates of 12 to 15 percent.

The UK will also move to a residence-based Inheritance Tax system, which will apply to the global estates of individuals who have been UK tax residents for at least 10 out of the last 20 years. These reforms mark a major shift in the UK’s tax landscape, significantly increasing the tax exposure of internationally mobile high net worth individuals ((Reforming the Taxation of Non-UK Domiciled Individuals. HM Treasury, Government of the United Kingdom, 30 Oct. 2024, https://www.gov.uk/government/publications/reforming-the-taxation-of-non-uk-domiciled-individuals.)). With these changes in place, a long-term UK resident who previously utilized the remittance basis to manage the tax treatment of foreign investment income held in offshore trusts will, from April 2025, become subject to full UK taxation on those assets. With the abolition of the remittance basis and reduced trust protections, this individual will become liable for income, gains, and potentially inheritance tax on global holdings, significantly altering their effective tax burden. However, the government introduced the Foreign Income and Gains (FIG) regime, which still ensures certain exemptions.

When it comes to the United States, beginning January 1, 2025, U.S. individuals who receive gifts or bequests from covered expatriates are required to report them using IRS Form 708, in accordance with IRC §2801. These transfers may be subject to a 40 percent tax, which can be reduced by any foreign taxes paid. This tax is distinct from the expatriation tax imposed at the time of renunciation((Expatriation Tax. Internal Revenue Service, U.S. Department of the Treasury, https://www.irs.gov/individuals/international-taxpayers/expatriation-tax.)) .

There were also evolving debates over wealth taxation in connection with President Biden’s Fiscal Year 2025 budget proposal, which included a provision for a “Billionaire Minimum Tax.” This measure aimed to impose a 25 percent minimum tax on total income, including unrealized capital gains, for households with net worth exceeding $100 million ((U.S. Department of the Treasury Outlines Tax Proposals to Reduce the Deficit, Lower Costs for Working Families, and Ensure the Wealthy and Large Corporations Pay Their Fair Share. U.S. Department of the Treasury, 11 Mar. 2024, https://home.treasury.gov/news/press-releases/jy2169. Although it was only a proposal, it signaled the administration’s broader intent to address perceived tax avoidance among the ultra-wealthy. However, as of 2025, no federal wealth tax has been enacted, and the chances of this specific measure advancing have declined in light of the most recent election outcomes.

Thus, a U.S. citizen who renounced their citizenship prior to 2025 and subsequently made a gift to a U.S.-based child would now trigger a reporting obligation under IRS Form 708. The recipient may be liable for a 40 percent tax on the gifted amount, creating a substantial fiscal impact that did not exist under the prior reporting regime.

In 2025, the Spanish government made the Solidarity Tax on Large Fortunes permanent. That applies to individuals with net wealth exceeding €3 million, with marginal rates reaching up to 3.5 percent. Firstly, it was introduced as a temporary measure to address fiscal pressures arising from inflation and the energy crisis. In December 2023, following a Constitutional Court ruling upholding the tax’s legality, the government extended it indefinitely, thereby formalizing its permanent status from 2025 onward ((Enache, Cristina. Wealth Taxes in Europe, 2025. Tax Foundation Europe, 25 Feb. 2025, https://taxfoundation.org/data/all/eu/wealth-taxes-europe/.)).

For example, a high-net-worth individual residing in Madrid with a net wealth of €4 million previously benefited from generous regional deductions that nearly nullified wealth taxation. However, with the Solidarity Tax on Large Fortunes now made permanent and applicable nationally, this individual is subject to a direct tax liability of up to 3.5 percent annually on their excess net wealth.

Similarly, Colombia’s 2022 tax reform (Law 2277((Colombia. Ley 2277 de 2022. Función Pública, 13 Dec. 2022, www.funcionpublica.gov.co/eva/gestornormativo/norma.php?i=199883.)) of 2022, effective as of 2023) reintroduced a permanent, progressive annual wealth tax, replacing a temporary version that had expired in 2022. The tax applies to both residents and non-residents with assets located in Colombia and is assessed based on net wealth as of January 1 each year. A potential case study to illustrate this is that a Colombian expatriate who owns a portfolio of commercial properties in Bogotá previously faced no wealth taxation after the 2022 expiration of the temporary tax regime. With the 2023 reintroduction of a permanent and progressive wealth tax on domestic assets held by both residents and non-residents, this individual now incurs annual tax obligations based on the net appraised value of their real estate.

At a broader international level, the EU Tax Observatory has proposed a global 2 percent tax on billionaires, which could potentially generate hundreds of billions of euros annually. This initiative was supported by the finance ministers of Spain, Germany, France, and South Africa, and was formally discussed at G20 meetings in 2024. According to the discussions, the proposal is partly driven by the urgent need to finance climate crisis solutions ((Limb, Lottie. “‘A Good Start’: Germany, Spain and France Propose Billionaire Tax to Help Tackle Climate Crisis.” Euronews, 25 Apr. 2024, https://www.euronews.com/green/2024/04/25/a-good-start-germany-spain-and-france-propose-billionaire-tax-to-help-tackle-climate-crisi.)).

Overall, the number of OECD countries levying net wealth taxes declined significantly from 12 in 1990 to just 4 in 2017 ((The Role and Design of Net Wealth Taxes in the OECD. OECD Tax Policy Studies No. 26, Organisation for Economic Co-operation and Development, 2018, https://www.oecd.org/content/dam/oecd/en/topics/policy-issues/tax-policy/role-and-design-of-net-wealth-taxes-in-the-oecd-summary.pdf.)). There can be numerous reasons for this decline:

High administrative and compliance costs relative to their limited revenue have discouraged their implementation, while the risks of capital flight and asset protection further undermine their effectiveness. Additionally, narrow tax bases and a prevailing political unwillingness to enforce complex wealth taxes have contributed to their decline.

Furthermore, the flawed design of these taxes has created significant issues in the countries that have attempted to implement them. For instance, in 1997, the German Constitutional Court declared the wealth tax unconstitutional, and in the Netherlands, the Dutch Supreme Court ruled in 2021 that the wealth tax violates European law regarding property rights and non-discrimination. Additionally, if an individual’s wealth does not grow at a rate exceeding the tax rate, the wealth tax will ultimately diminish that individual’s capital over time. Even a small increase in the wealth tax rate can prompt capital flight, resulting in wealthy individuals relocating to neighboring jurisdictions, as evidenced in analyses such as that provided by the Tax Foundation ((Enache, Cristina. Wealth Taxes in Europe, 2025. Tax Foundation Europe, 25 Feb. 2025, https://taxfoundation.org/data/all/eu/wealth-taxes-europe/.)).

A significant concern is the issue of double taxation, which in this context can be understood in two distinct forms: economic double taxation and jurisdictional double taxation. Economic double taxation arises when the same income or asset is subjected to multiple layers of taxation through different tax mechanisms. Jurisdictional double taxation, on the other hand, occurs when two separate countries impose tax on the same asset or taxable event. Wealth taxes are frequently criticized on the grounds of economic double taxation, as accumulated wealth is often derived from income that has already been subject to taxation such as salaries taxed under personal income tax regimes or returns on investment taxed through capital gains levies ((UN Handbook on Wealth and Solidarity Taxes. United Nations Department of Economic and Social Affairs, 2024, https://financing.desa.un.org/sites/default/files/2024-07/UN%20Handbok%20Wealth%20and%20Solidarity%20Taxes%20%20.pdf.)).

Despite the challenges mentioned above, there is a renewed interest in wealth taxation, which can be seen from the above-mentioned country examples and other contributing factors.

The marked increase in wealth inequality observed across most countries over the past three decades has intensified the economic divide between high-income groups, middle class, and lower-income populations. The COVID-19 pandemic has further amplified this trend, resulting in a notable rise in extreme poverty and a widening of gender disparities in labor market participation. These developments have collectively contributed to the deepening of wealth inequality within nations ((UN Handbook on Wealth and Solidarity Taxes. United Nations Department of Economic and Social Affairs, 2024, https://financing.desa.un.org/sites/default/files/2024-07/UN%20Handbok%20Wealth%20and%20Solidarity%20Taxes%20%20.pdf.)). This renewed interest in wealth-based taxation is further reflected in recent initiatives by the United Nations, which has facilitated discussions on “wealth and solidarity taxes” as part of broader efforts to finance sustainable development and support economic recovery in the aftermath of the COVID-19 pandemic ((The Role and Design of Net Wealth Taxes in the OECD. OECD Tax Policy Studies No. 26, Organisation for Economic Co-operation and Development, 2018, https://www.oecd.org/content/dam/oecd/en/topics/policy-issues/tax-policy/role-and-design-of-net-wealth-taxes-in-the-oecd-summary.pdf.)).

High-net-worth individuals frequently adapt their financial behavior in response to changes in certain tax policies. One notable pattern is the acceleration of wealth transfers in anticipation of fiscal reforms. Furthermore, these policies lead HNWI-s toward strategic countermeasures such as diversifying investments, relocating to tax-friendly jurisdictions, etc. These measures are taken to optimize wealth preservation and mobility. This trend reflects a shift in how citizenship and residency are viewed, being not only as a national affiliation but a strategic tool for financial and lifestyle optimization ((Global Intelligence Unit. “The Transformation of Citizenship: From Political Identity to Strategic Mobility Tool.” Global Citizen Solutions, www.globalcitizensolutions.com/intelligence-unit/briefings/the-transformation-of-citizenship-from-political-identity-to-strategic-mobility-tool/.)). Moreover, investment migration programs, such as Golden Visas and Citizenship by Investment (CBI) schemes, enable HNWIs to access new markets, enhance global mobility, and mitigate risks associated with political or economic instability.

In conclusion, the increased interest in wealth and exit taxes reflects a broader international effort to address post-pandemic fiscal pressures and deepening wealth inequality. Legislative developments in countries such as the United Kingdom, the United States, Spain, etc. underscore a change toward more rigorous taxation of affluent individuals. However, despite their redistributive intentions, wealth taxes raise critical concerns about their practical implications. Issues of double taxation persist, as wealth is often taxed repeatedly across different mechanisms, and the deterrence of skilled migration remains a significant consequence, potentially limiting a country’s long-term economic competitiveness.

Moreover, the fiscal impact of wealth taxes remains modest, while their implementation often involves disproportionately high administrative and compliance costs. These increases in tax rates signal HNWI-s to implement countermeasures by relocating to jurisdictions with more favorable tax environments. These factors underscore that, although wealth and exit taxes are gaining renewed policy attention, they remain structurally flawed and risk producing adverse economic effects.

- International Monetary Fund. “World Economic Outlook: Managing Divergent Recoveries.” IMF, 23 Mar. 2021, www.imf.org/en/Publications/WEO/Issues/2021/03/23/world-economic-outlook-april-2021

- Rudnick, Rebecca S., and Richard K. Gordon. “Taxation of Wealth.” Tax Law Design and Drafting, edited by Victor Thuronyi, vol. 1, International Monetary Fund, 1996, pp. 285–308. https://www.imf.org/external/pubs/nft/1998/tlaw/eng/ch10.pdf.

- Hourani, Diana, and Sarah Perret. Taxing Capital Gains: Country Experiences and Challenges. OECD Taxation Working Papers No. 72, Organisation for Economic Co-operation and Development, 2025. https://www.oecd.org/content/dam/oecd/en/publications/reports/2025/02/taxing-capital-gains_76a32327/9e33bd2b-en.pdf.

- Enache, Cristina. Wealth Taxes in Europe, 2025. Tax Foundation Europe, 25 Feb. 2025, https://taxfoundation.org/data/all/eu/wealth-taxes-europe/.

- Reforming the Taxation of Non-UK Domiciled Individuals. HM Treasury, Government of the United Kingdom, 30 Oct. 2024, https://www.gov.uk/government/publications/reforming-the-taxation-of-non-uk-domiciled-individuals.

- Expatriation Tax. Internal Revenue Service, U.S. Department of the Treasury, https://www.irs.gov/individuals/international-taxpayers/expatriation-tax.

- U.S. Department of the Treasury Outlines Tax Proposals to Reduce the Deficit, Lower Costs for Working Families, and Ensure the Wealthy and Large Corporations Pay Their Fair Share. U.S. Department of the Treasury, 11 Mar. 2024, https://home.treasury.gov/news/press-releases/jy2169.

- Colombia. Ley 2277 de 2022. Función Pública, 13 Dec. 2022, www.funcionpublica.gov.co/eva/gestornormativo/norma.php?i=199883.

- Limb, Lottie. “‘A Good Start’: Germany, Spain and France Propose Billionaire Tax to Help Tackle Climate Crisis.” Euronews, 25 Apr. 2024, https://www.euronews.com/green/2024/04/25/a-good-start-germany-spain-and-france-propose-billionaire-tax-to-help-tackle-climate-crisi.

- The Role and Design of Net Wealth Taxes in the OECD. OECD Tax Policy Studies No. 26, Organisation for Economic Co-operation and Development, 2018, https://www.oecd.org/content/dam/oecd/en/topics/policy-issues/tax-policy/role-and-design-of-net-wealth-taxes-in-the-oecd-summary.pdf.

- UN Handbook on Wealth and Solidarity Taxes. United Nations Department of Economic and Social Affairs, 2024, https://financing.desa.un.org/sites/default/files/2024-07/UN%20Handbok%20Wealth%20and%20Solidarity%20Taxes%20%20.pdf.

- Global Intelligence Unit. “The Transformation of Citizenship: From Political Identity to Strategic Mobility Tool.” Global Citizen Solutions, www.globalcitizensolutions.com/intelligence-unit/briefings/the-transformation-of-citizenship-from-political-identity-to-strategic-mobility-tool/.