The Appeal of Retiring Abroad: Passive Income Visas in Europe

This article examines international retirement migration through the lens of passive income visas in Europe, which offer retirees a route to residency abroad without requiring local employment. It also presents a comparative analysis of income thresholds, living costs, healthcare and taxation policies across select European countries offering passive income visas.

Understanding Passive Income Visas

A passive income visa is a residency permit that allows individuals to live in a foreign country by demonstrating a stable, sufficient income from non-employment sources, such as pensions, rental income, dividends, interest, or royalties. These visas are designed to attract financially independent individuals who contribute to the local economy through spending without competing for jobs. While they appeal to a broad audience, including digital nomads and semi-retired individuals, passive income visas are particularly attractive to retirees seeking to stretch their savings in countries with lower living costs or more favorable climates.

Interestingly, states have also initiated specific frameworks for digital nomads including Digital Nomad visas, 91 % of which were created after the pandemic as revealed in recent GCS Digital Nomad Report1.

Visa requirements vary significantly by country. For example, Portugal’s D7 Visa is flexible, allowing remote work and requiring a modest monthly income of €860, making it suitable for both retirees and younger individuals. In contrast, Spain’s Non-Lucrative Visa, with a higher income threshold of €2,400 per month and a prohibition on work, caters specifically to fully retired individuals. These differences highlight the importance of aligning visa options with personal retirement goals2.

As of 2022, approximately 5.1 million U.S. citizens lived abroad, with 38% of those retiring overseas choosing Europe as their destination3. Moreover, in Spain, 41% of British residents are aged 65 and over, indicating a significant retiree population. Similarly, Portugal has 39% of its British population in the same age bracket 4.

International Retirement Migration

International retirement migration (IRM) emerged more recently, gaining momentum after the post-war tourism boom of the 1960s and 70s. Beyond lifestyle motivations, its growth has been driven by structural factors such as population ageing, longer life expectancy, and the accumulation of personal wealth—especially among baby boomers and younger generations approaching retirement. Once seen as an elite pursuit, IRM now includes wealthy retirees, particularly in destinations like southern Spain, where affordable housing developments have expanded access. At the same time, geoarbitrage allows retirees to stretch their pensions in lower-income countries of the global South—often shaped by colonial and capitalist histories—enabling lifestyles that surpass what would be possible at home5.

IRM is driven by retirees seeking a higher quality of life through economic, environmental, and personal benefits. Many from high-income countries, like the U.S., are drawn to more affordable destinations such as Mexico, Thailand, or Spain, where lower costs and warmer climates support active, fulfilling lifestyles. For Baby Boomers especially, retirement is seen as an opportunity for growth and adventure—enabled by global mobility, digital connectivity, and favorable visa policies—though success also depends on adapting to cultural and financial complexities6. While separation from family can lead to isolation, modern communication tools and increased mobility help maintain connections. Many retirees build social networks with fellow expatriates, as seen in communities in Spain and Bonaire, where shared experiences foster a sense of belonging7. Furthermore, Hutchinson and Ausman (2024) highlight that retirement satisfaction is most strongly linked to lifestyle planning rather than financial preparation. Engaging in meaningful activities—like travel, hobbies, volunteering, or creative pursuits—proved to be the key factor in retirees’ enjoyment. Those who thoughtfully planned how to spend their time reported the highest levels of fulfillment8.

Comparative Analysis of Countries Offering Passive Income Visa

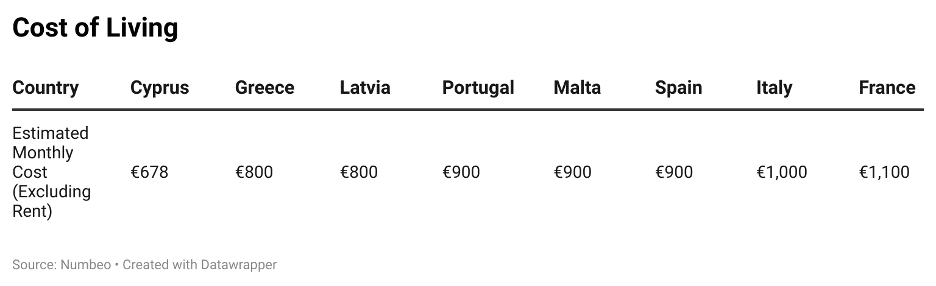

Numerous European countries provide retirement visas tailored for retirees, each with distinct income requirements:

- Spain – Non-Lucrative Visa: Requires a minimum monthly income of €2,400 (or €28,800 annually).

- Italy – Elective Residency Visa: Requires €31,000 annually for individuals or €38,000 for couples.

- Malta – Retirement Program: Requires at least €10,000 annually, plus property investment or rental.

- Cyprus – Category F Visa: Requires €797 per month.

- Latvia – Retirement Visa: Requires €680 per month (for applicants aged 65+).

- Portugal – D7 Visa: Requires €860 per month.

- Greece – Financially Independent Person (FIP) Visa: Requires €3,500 per month.

- France – Long-Stay Visa: Typically requires around €1,500 per month.

When considering where to retire, significant determining factors are taxation policies and healthcare system. Global Citizen Solutions (GCS) retirement Guide for US Citizens provides a comprehensive analysis of various European and non-European countries, some of which are listed below9:

Healthcare

Spain: Spain’s healthcare framework encompasses a public system, accessible through social security contributions for employed or self-employed individuals, and a private sector. For retirees over 60, private health insurance premiums range from $55 to $325 monthly, contingent on coverage scope.

Portugal: Portugal’s private health insurance facilitates expedited access to medical facilities and English-speaking practitioners, particularly in expatriate-dense regions. For individuals over 65, basic private plans are priced between $50 and $100 per month.

France: France’s universally lauded healthcare system, financed through taxation, mandates private insurance for the initial three-month residency period. The average cost of private health insurance approximates $45 monthly, varying by coverage extent.

Italy: Italy’s Servizio Sanitario Nazionale (SSN) extends comprehensive public healthcare to legal residents, with non-EU expatriates requiring private insurance until residency is secured. Annual private insurance costs range from $120 to over $350, depending on coverage.

Greece: Private health insurance is favored by expatriates for its superior service quality, though accessibility differs markedly between urban centers and rural islands. Basic to mid-level plans for retirees cost between $200 and $600 monthly, often with higher deductibles.

Malta: Malta’s healthcare system integrates high-standard public and private sectors, with private options offering reduced waiting times and English-speaking professionals. For retirees over 65, private insurance costs span $200 to $400 for basic coverage, $400 to $800 for mid-level plans, and $800 to $1,500+ for comprehensive packages.

Taxation Policies

Spain: Spain imposes taxation on worldwide income for residents but mitigates double taxation through a bilateral treaty with the United States. The Beckham Law permits expatriates to opt for non-resident tax status for six years, incurring a 24% flat rate on income up to €600,000.

Portugal: As of 2024, pensioners are subject to progressive taxation under Portugal’s general tax regime. A double taxation treaty with the United States precludes dual taxation.

France: Taxation in France is determined by residency status and global income, with a double taxation treaty ensuring no dual taxation for US retirees.

Italy: Italian tax residents, defined as individuals residing over 183 days annually, are liable for taxes on worldwide income, including foreign pensions, subject to double taxation agreements.

Greece: Greece offers a 7% flat tax rate on foreign pension income for new tax residents who have not been tax-resident in Greece for five of the prior six years, applicable to pensions from countries with a tax treaty.

Malta: Foreign pensions remitted to Malta are taxed at a 15% flat rate, provided they exceed a stipulated minimum annual threshold, offering a favorable fiscal concession for qualifying retirees.

Cost of Living and Quality of Life

The table below illustrates the cost of living in the select European countries offering passive income visas followed by information on quality of life.

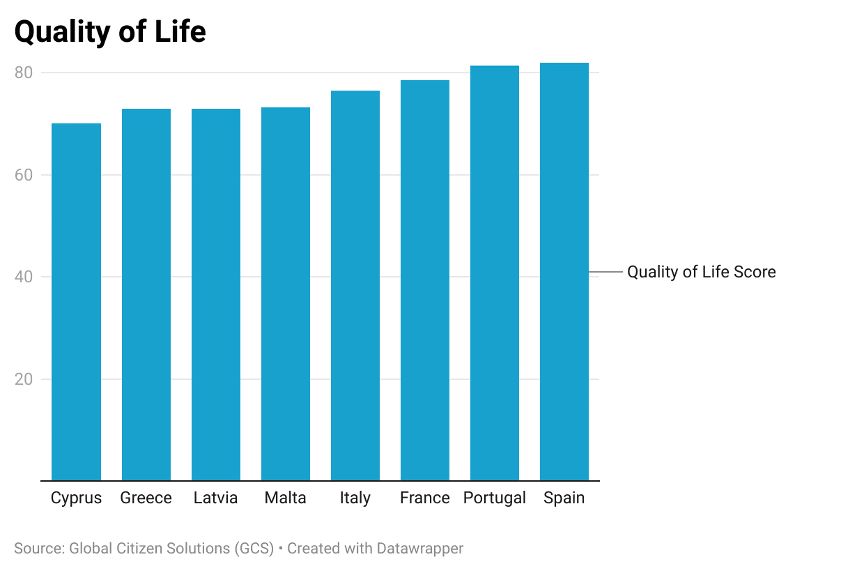

Quality of Life scores are derived from Global Citizen Solutions Global Passport Index that uses metrics like environmental sustainability, the cost of living, infrastructure, and personal and political freedoms to determine a passport’s power10.

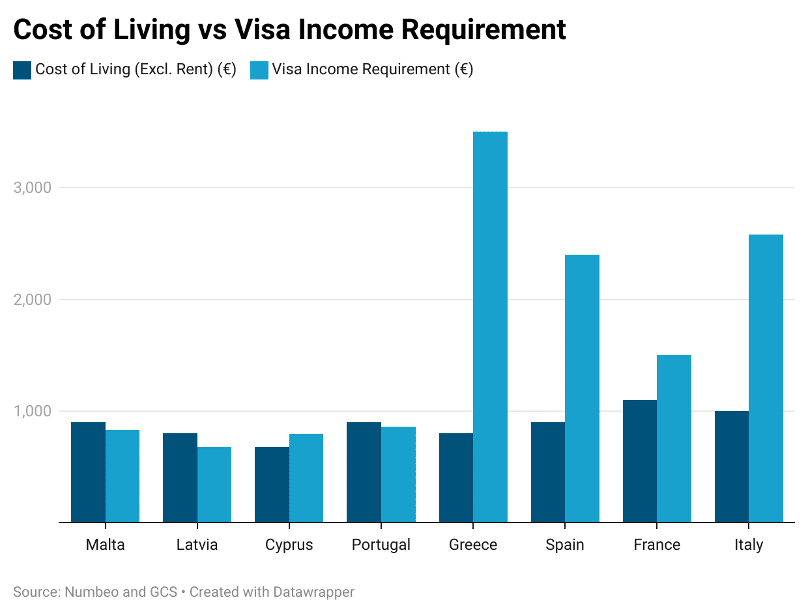

Below is a comparative analysis of the cost of living in the listed European countries relative to the income requirements of the specified visas, tailored for retirees and individuals with passive income.

Overall, for most of these countries, the visa passive-income requirements are relatively close to and in some cases even lower than the estimated monthly living costs excluding rent. This alignment suggests that qualifying financially for a visa is generally attainable for most applicants. However, Greece, Spain, and Italy notably diverge from this trend. Greece imposes an exceptionally high-income requirement, exceeding typical living costs. Spain and Italy also require substantially more than local living expenses, though less dramatically than Greece. These disparities highlight different national strategies with some countries prioritizing accessibility and others emphasizing financial security.

Conclusion

As more retirees seek fulfilling, affordable lifestyles abroad, passive income visas offer a practical pathway to international retirement. These visas allow financially independent individuals to live overseas while enjoying cultural experiences, better climates, and a potentially higher quality of life. In most cases, the required income threshold for the visas is lower than typical monthly living expenses, making eligibility more attainable than the actual cost of living. This article offered valuable insights into the key motivations that influence retirees in selecting the ideal destination and visa options. It aims to empower retirees to make informed decisions and transform their retirement into a fulfilling new chapter abroad.

Bibliography

- Global Citizen Solutions. Global Digital Nomad Report 2024. Global Citizen Solutions, 2024, www.globalcitizensolutions.com/intelligence-unit/reports/global-digital-nomad-report/global-digital-nomad-full-report/.

- Global Citizen Solutions. “Portugal D7 Visa or Spain Non-Lucrative Visa – Which Is Better?” Global Citizen Solutions, 2 Feb. 2024, www.globalcitizensolutions.com/portugal-d7-visa-or-spain-non-lucrative-visa/.

- Unbiased. Retire Abroad Statistics. Unbiased, 2025, www.unbiased.com/discover/retirement/retire-abroad-statistics/

- Office for National Statistics. “Living Abroad: British Residents Living in the EU: April 2018.” ONS.gov.uk, Apr. 2018, www.ons.gov.uk/peoplepopulationandcommunity/populationandmigration/internationalmigration/articles/livingabroad/april2018.

- King, Russell, Eralba Cela, and Tineke Fokkema. “New Frontiers in International Retirement Migration.” Ageing and Society, vol. 41, no. 6, 2021, pp. 1205–1220. Cambridge University Press, https://doi.org/10.1017/S0144686X21000179.

- Tang, Yuan, and Tara Rava Zolnikov. “Examining Opportunities, Challenges and Quality of Life in International Retirement Migration.” International Journal of Environmental Research and Public Health, vol. 18, no. 22, 2021, p. 12093, https://www.mdpi.com/1660-4601/18/22/12093.

- NIDI. “The Risks and Rewards of International Retirement Migration.” Demos, Netherlands Interdisciplinary Demographic Institute, https://nidi.nl/demos/the-risks-and-rewards-of-international-retirement-migration/.

- Hutchinson, Sandra L., and Corey W. Ausman. “Retirement Satisfaction: The Importance of Planning How to Spend One’s Time.” Journal of Aging and Social Policy, 2024, https://www.sciencedirect.com/science/article/pii/S2534773X2400048X?via%3Dihub.

- Global Citizen Solutions. Retirement Guide for US Citizens. Global Citizen Solutions, 2024, www.globalcitizensolutions.com/intelligence-unit/reports/retirement-guide-for-us-citizens/#retirement-rankings.

- Global Citizen Solutions. Quality of Life Index. Global Citizen Solutions, 2024, www.globalcitizensolutions.com/passport-index/quality-of-life-index/.