Global Residency and Citizenship by Investment Report: Full Report

Table of Contents

- Introduction

- Investment Migration at a Glance

- Residency and Citizenship as Instruments to Global Mobility

- Redesigning Borders: The Past, the Present and Future of Investment Migration in a Changing Global Landscape

- The CBI Index: Where to Secure a Second Citizenship

- The RBI Index: A Global Analysis on the Best countries to Secure Residence

- RCBI Schemes Mapped: a comparative analysis

- Conclusion

Introduction

In a time marked by geopolitical instability, economic uncertainty, and shifting regulatory environments, the Global RCBI Report 2025 emerges as an essential tool for understanding and navigating the complex world of Residence and Citizenship by Investment (RCBI) programs. As nations compete to attract global capital, skilled individuals, and international families, investment migration has transformed from a niche legal practice into a mainstream strategic instrument for wealth planning, mobility enhancement, and global risk mitigation. With 37 active programs across 36 countries, the RCBI landscape has matured into a dynamic ecosystem. Yet one that remains difficult to compare due to its diversity in legal frameworks, investment thresholds, and long-term outcomes.

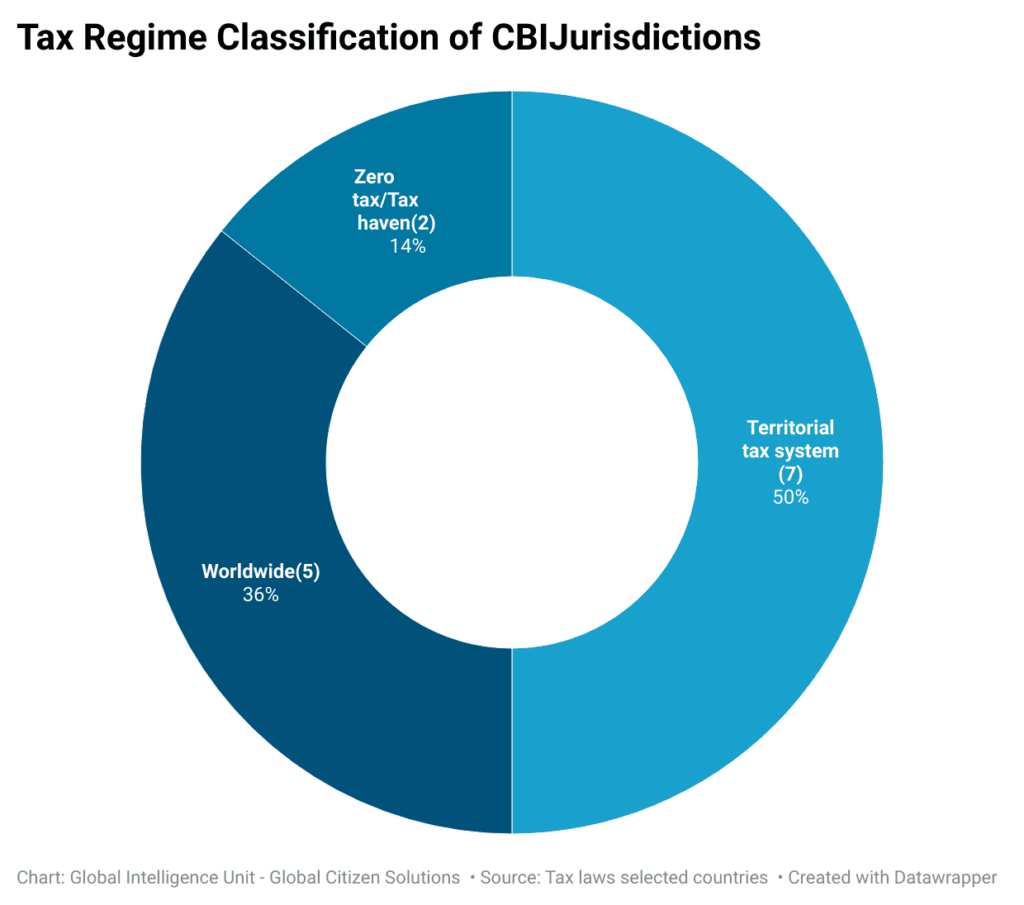

This report presents the most comprehensive, data-driven assessment of global RCBI options to date. It ranks both Citizenship by Investment (CBI) and Residence by Investment (RBI) programs through a robust methodology that goes beyond just passport power or minimal investment thresholds. Instead, it applies a multi-dimensional evaluation model grounded in 18 performance indicators, distributed across five key thematic dimensions: Procedure, Mobility, Tax Optimization, Quality of Life, and Investment Environment. These dimensions reflect the real concerns of investors, entrepreneurs, and global families seeking both access and stability.

Each country’s program is evaluated using a combination of standardized quantitative data and calibrated qualitative insights. This ensures that cross-country comparisons are both rigorous and fair. The resulting index structure allows for dual rankings (one focused on CBI programs and the other on RBI schemes) giving readers the ability to differentiate between jurisdictions that offer immediate nationality and those that offer long-term residence pathways. Crucially, the indexes don’t just measure what each program offers, but how well it aligns with the motivations and needs of international investors in 2025.

The Global RCBI Report highlights the evolving dynamics of investment migration, showcasing how both CBI and Residence by Investment RBI programs are adapting to global trends. Caribbean nations such as Antigua and Barbuda, St. Kitts and Nevis, and Grenada continue to lead in the CBI space, leveraging efficient application processes, favorable tax regimes, and extensive global mobility to attract international investors. Their success underscores the potential for smaller states to assert a strong presence on the global stage through well-structured and strategically positioned programs. On the RBI front, countries like Greece, Malta 1For more details, refer to the Country Overview section on the ECJ’s 29 April 2025 judgment in Case C-181/23 (Commission v. Malta) regarding the Maltese Exceptional Investor Naturalisation scheme.), Portugal and Switzerland maintain their appeal with robust legal systems and high-quality residency rights, while emerging players such as Latvia, Luxembourg, Singapore and the UAE are reshaping the landscape by aligning residence programs with innovation-driven, sustainable economic growth. The report’s comparative analysis of these diverse models offers critical insights into the future direction and competitive dynamics of the RCBI sector.

Beyond the rankings themselves, the report delves into emerging trends shaping the future of investment migration. These include the evolution of CBI schemes amidst international regulatory scrutiny, the rise of hybrid talent-investment pathways in Oceania, Asia and the Middle East, and the increasing convergence of RCBI programs with broader state-building objectives, such as climate resilience, tech innovation, and regional development. In sum, the Global RCBI Report 2025 is more than a ranking, it is a strategic guide for investors, policymakers, and advisors navigating a world in flux.

Investment Migration at a Glance

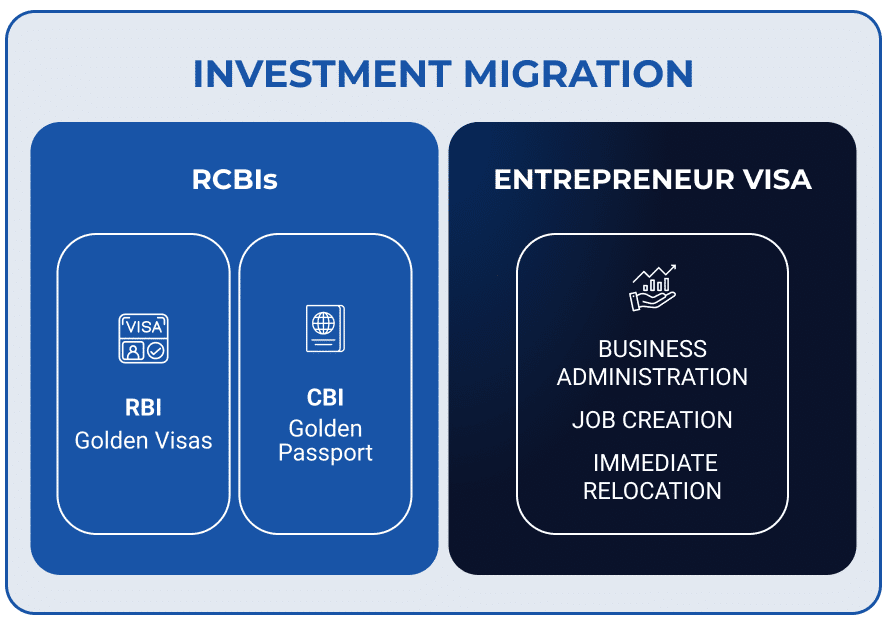

The world today is defined by globalization and elite mobility, states have increasingly leveraged their sovereign authority to capitalize on access to legal residency and citizenship through formalized investment migration programs. These schemes (offering either residence or nationality in exchange for financial contribution) have grown in both scale and complexity. This phenomenon is under the realm of Investment Migration.

Investment migration refers to legal frameworks through which individuals acquire residency or citizenship rights in exchange for a defined economic contribution to a host state (see fig. below). According to sociologist Kristin Surak (2021), it constitutes “a legal regime whereby states grant residence or citizenship rights in return for a specified economic contribution,” often with minimal or no settlement obligations.2Surak’s analysis reveals how these programs have transformed from niche offerings into a significant industry, with over a dozen countries participating and issuing approximately 50,000 passports annually. Surak, K. (2021). Migration industries and the global passport market. Migration Studies, 9(3), 428–448. https://doi.org/10.1093/migration/mnaa022.

As a policy category, investment migration brings together diverse state practices aimed at attracting foreign capital, talent, or both, through migration channels.3Strumia, F. (2016). New-generation skilled migration policies and the changing fabric of membership: Talent as output and the headhunting state. Investment Migration Council Research Paper 2016/4; and Green, A. E., & Hogarth, T. (2017). Attracting the best talent in the context of migration policy changes. Journal of Ethnic and Migration Studies, 43(13), 2183–2199. Under this umbrella, two primary models have emerged: Residence by Investment (RBI) and Citizenship by Investment (CBI).

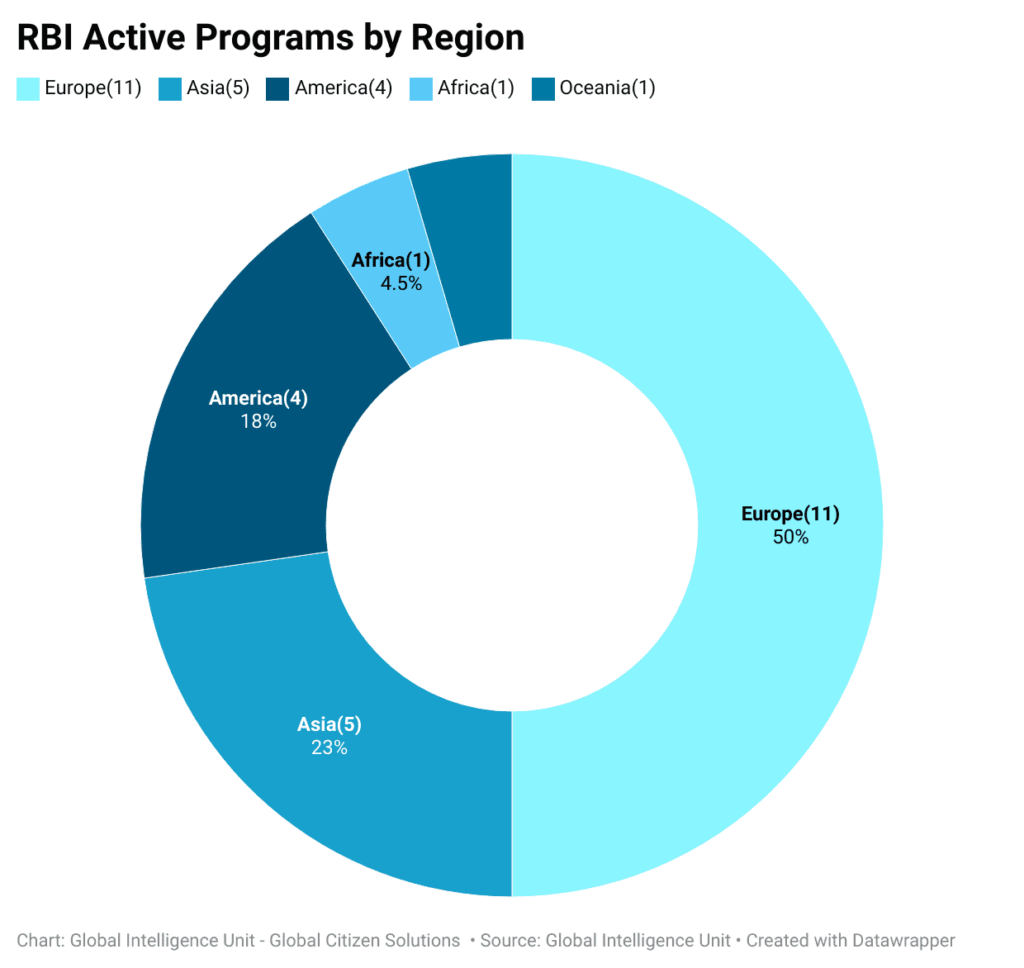

RBI programs (commonly referred to as “golden visas”) allow foreign nationals to obtain a legal right to reside in a country through qualifying investments. These typically include real estate purchases, capital transfers such as bank deposits or investments in government bonds and venture funds, and business or entrepreneurial ventures that stimulate economic activity or create jobs. Some programs also accept philanthropic donations or require a combination of contributions, such as in Malta. Investment thresholds vary by country, as do additional requirements like minimum holding periods, physical presence, family inclusion and pathways to citizenship, making each program uniquely tailored to national policy goals. In general, RBI schemes are strategically designed to facilitate capital inflow while maintaining state control over long-term integration and nationality outcomes.4Adim, L. (2021). Residence by investment migration schemes and state sovereignty: Strategic inclusion without settlement. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3904473

Golden Visa programs emerged prominently in the 2010s, particularly in Southern Europe, during and after the Eurozone financial crisis.5Surak, K., & Tsuzuki, Y. (2021). Are golden visas a golden opportunity? Assessing the economic origins and outcomes of residence by investment programmes in the EU. Journal of Ethnic and Migration Studies, 47(13), 2979–2995. Countries like Portugal (2012), Greece (2013), and Spain (2013) introduced RBI schemes to attract capital inflows, boost real estate markets, and stimulate foreign investment without increasing immigration in a traditional sense. As of 2024, Portugal’s Golden Visa program alone has attracted over €7.3 billion in investment since inception.6Agência para a Imigração e Mobilidade (AIMA). (2024, February). Estatísticas ARI – Autorização de Residência para Investimento. Retrieved from https://aima.gov.pt/pt

In Spain, the Golden Visa initiated in 2013, allowed non-EU investors to obtain residency by investing in real estate or other economic activities. Since its inception in 2013, Spain’s Golden Visa program has generated over €10 billion in real estate investment, contributing to the country’s post-crisis economic recovery.7Ministerio de Vivienda y Agenda Urbana (MIVAU). (2024, January 31). Visados para inversores: Estadísticas 2016–2024. Retrieved from https://www.mivau.gob.es/portal-web/estadisticas/mercado-alquiler-compra-vivienda/visados-inversores.htmlDespite this substantial inflow of foreign capital, the program accounted for only 0.3% of all real estate transactions in Spain over the same period, highlighting its relatively limited influence on the broader housing market.8Idealista. (2025, April 4). End of an era: Spain shuts down Golden Visa scheme after 12 years. https://www.idealista.com/en/news/property-for-sale-in-spain/2025/04/04/838966-end-of-an-era-spain-shuts-down-golden-visa-scheme-after-12-years As of April 2025, the Spanish government has officially ended the program, citing concerns over housing affordability and its minimal impact on the overall economy.9Global Citizen Solutions. (2025, April 15). Spain Golden Visa Ending: Major 2025 Update. https://www.globalcitizensolutions.com/spain-golden-visa-ending/ This suggests that the rationale behind phasing out the scheme lacks empirical support, as the scale of Golden Visa investments appears too marginal to have significantly influenced housing prices or availability across Spain.10Read more at: Global Intelligence Unit. Global Citizen Solutions (2024, November 13). Why the Golden Visa presents an opportunity to solve the housing crisis in Spain and Portugal. Global Citizen Solutions. https://www.globalcitizensolutions.com/intelligence-unit/briefings/why-the-golden-visa-presents-an-opportunity-to-solve-the-housing-crisis-in-spain-and-portugal/

Entrepeneur Visas (EVs), on the other hand, have a longer history tied to economic migration policy.11Dheer, R. J. S. (2018). Entrepreneurship by immigrants: A review of existing literature and directions for future research. International Entrepreneurship and Management Journal, 14(3), 555–614. https://doi.org/10.1007/s11365-018-0506-7:contentReference[oaicite:0]{index=0}The U.S. EB-5 Immigrant Investor Program, established in 1990, requires a more substantial minimum investment and mandates the creation of at least 10 full-time jobs.12U.S. Citizenship and Immigration Services (USCIS). (2023). EB-5 Immigrant Investor Program. Retrieved from https://www.uscis.gov/working-in-the-united-states/permanent-workers/eb-5-immigrant-investor-program Canada’s former Federal Immigrant Investor Program (IIP), terminated in 2014, required a passive loan to the government.13Immigration, Refugees and Citizenship Canada. (2014, February 11). Terminating the Federal Immigrant Investor and Entrepreneur Programs. Government of Canada. https://www.canada.ca/en/news/archive/2014/02/terminating-federal-immigrant-investor-entrepreneur-programs Today, the Start-Up Visa Program, launched in 2013 and made permanent in 2018, focuses on entrepreneurial innovation, with no minimum investment but support from designated incubators or investors.14Immigration, Refugees and Citizenship Canada. (2025, February 24). Start-up Visa Program. Government of Canada. https://www.canada.ca/en/immigration-refugees-citizenship/services/immigrate-canada/start-visa

The key policy distinction lies in the role of physical presence and economic activity. Golden Visas tend to decouple residence rights from actual residency, allowing investors to remain outside the country for most of the year while retaining legal status. Investor Visas, conversely, generally require residence, business management, or economic participation. This dichotomy reflects divergent goals: Golden Visas prioritize capital inflows, while Entrepreneur Visas, in general, emphasize long-term integration and contribution.

Empirical data underscores this divergence. According to the Investment Migration Council’s 2023 Yearbook, over 80% of RBI applicants in Europe choose real estate investment routes15Investment Migration Council. (2023). Investment Migration Yearbook 2023 (5th ed.). Investment Migration Council. https://investmentmigration.org/im-yearbook/, while Investor Visa programs in North America and Oceania favor business activity or innovation-based metrics.

In contrast, CBI programs provide a more direct path: full legal citizenship granted in exchange for a qualifying investment, often within a short timeframe and often without a prolonged residence period. This legal status includes all the rights and responsibilities of nationality, including access to a passport and political participation. According to Surak, CBI schemes represent a reconfiguration of citizenship as a transactional asset, “a form of state membership traded on global markets”.16Surak, K. (2020). Who wants to buy a visa? Comparing the uptake of residence by investment programs in the European Union. Journal of Ethnic and Migration Studies, 47(11), 2629–2654. https://doi.org/10.1080/1369183X.2020.1713343 CBI programs are most commonly found in small or economically specialized states where the market for citizenship is integrated into national development strategies.

While RBI, EVsand CBI differ in terms of rights granted and timelines, both are part of the same conceptual framework: investment migration. They represent two distinct modalities within a shared logic of exchanging economic value for legal mobility and state membership. As Shachar and Hirschl argue, such programs reflect the emergence of a new political economy of belonging, where traditional boundaries of nationhood are being reshaped by instrumental mechanisms.17Shachar, A., & Hirschl, R. (2014). On citizenship, states, and markets. The American Journal of Comparative Law, 62(1), 231–257. https://doi.org/10.5131/AJCL.2013.0023

Investment migration is not a one-size-fits-all policy but rather a spectrum of state-driven mechanismsthat exchange capital for legal access. At one end of this spectrum are EVs, which typically involve active investment (such as launching or managing a business) and often require relocation and physical presence. In the middle are RBI programs, offering long-term stay rights through more passive investments, often with minimal physical presence requirements. At the other end are CBI schemes, which grant immediate nationality and mobility rights, usually with limited or no residency obligations.

In sum, investment migration serves as an umbrella term encompassing a range of programs that enable individuals to acquire residence or citizenship rights through economic contributions. It includes RBI schemes, commonly known as Golden Visas, which offer legal residency in exchange for qualifying investments, as well as Entrepreneurial Visas that require active business engagement, job creation, and immediate relocation. On the other hand, CBI programs (often referred to as Golden Passports) grant citizenship directly through capital contributions without the need for prior residence. Together, these pathways reflect the diversity of state strategies in leveraging migration channels to attract foreign capital, talent, and entrepreneurship, while maintaining differentiated levels of integration and mobility rights.

Residency and Citizenship as Instruments to Global Mobility

In 2025, global mobility is no longer governed solely by geography or nationality, but increasingly by access to legal instruments such as residency and citizenship. These once-static legal statuses have evolved into strategic assets for individuals seeking stability, security, and opportunity in an uncertain world. As governments respond to growing inequality, geopolitical instability, and shifting migration flows, CBI and RBI programs have emerged as pivotal tools, both for individual empowerment and for national development strategies.With over 304 million international migrants as of 2024, according to the United Nations Department of Economic and Social Affairs (2024)18United Nations Department of Economic and Social Affairs. (2024). International Migration Report. https://www.un.org/development/desa/pd/, migration today encompasses not only displacement and economic migration but also the rise of “strategic migration” through investment, skilled relocation, and second citizenship acquisition. For states, these instruments are not only channels of foreign direct investment and talent attraction but also policy levers to reposition themselves within the global economic system.

The 2024 UNDESA report highlights that international migration has nearly doubled since 1990, with voluntary migrants driven increasingly by geopolitical instability, wealth protection, education access, and global market participation. Among HNWIs, the pursuit of a second citizenship or residency is often tied to asset diversification, tax efficiency, and long-term security planning.19Knight Frank. (2024). The wealth report 2024. Knight Frank LLP. https://content.knightfrank.com/resources/knightfrank.com/wealthreport/the-wealth-report-2024.pdf Political uncertainty, restrictive regimes, and economic volatility (especially in regions such as Sub-Saharan Africa, the Middle East, and South Asia) have reinforced the appeal of alternative citizenships as insurance against instability. Access to quality education and healthcare, lifestyle upgrades, and global business opportunities are now primary incentives behind strategic migration decisions.

Governments are increasingly leveraging RBI and CBI programs to boost national revenue, create jobs, and channel capital into strategic sectors. In Europe, Portugal’s Golden Visa attracted over €6.8 billion between 2012 and 202220Agência para a Imigração e Mobilidade (AIMA). (2024, February). Estatísticas ARI – Autorização de Residência para Investimento. Retrieved from https://aima.gov.pt/pt, while Greece and Spain have reported billions in real estate-driven FDI21Ministerio de Vivienda y Agenda Urbana (MIVAU). (2024, January 31). Visados para inversores: Estadísticas 2016–2024. Retrieved from https://www.mivau.gob.es/portal-web/estadisticas/mercado-alquiler-compra-vivienda/visados-inversores.html. In the Caribbean, CBI programs contribute up to 40% of GDP in some states, such as Dominica and Saint Kitts and Nevis 22International Monetary Fund. (2023). Investment migration: Macroeconomic effects and governance challenges (IMF Working Paper No. 2023/259). https://www.elibrary.imf.org/view/journals/001/2023/259/article-A001-en.xml. The IMF underscores that when properly regulated, investment migration can generate broad economic benefits, especially when linked to infrastructure development and local employment. However, it also cautions that weak governance and lack of oversight can lead to reputational damage, regulatory backlash, or even sanctions.

The Global Citizen Solutions Passport Index (2024) and the International Organization for Migration’s World Migration Report (2024) reveal stark mobility asymmetries between Global North and Global South citizens23International Organization for Migration. (2024). World Migration Report. https://www.iom.int. While Swedish, German, and Finish passports offer visa-free or visa-on-arrival access to over 180 destinations, passports from countries like Pakistan, Nigeria, and Syria often grant access to fewer than 80, mostly within neighboring or lower-opportunity regions. This disparity reinforces a global mobility hierarchy, one which scholars such as Shachar describe as a “birthright lottery”24Shachar, A. (2009). The birthright lottery: Citizenship and global inequality. Harvard University Press.. In this sense, Strategic citizenship acquisition serves as a corrective mechanism. According to sociologist Yossi Harpaz , such mobility-enhancing passports act as a form of “compensatory citizenship”, enabling access to systems otherwise gated by geography and class.25Harpaz, Y. (2019). Citizenship 2.0: Dual nationality as a global asset. Princeton University Press. Caribbean CBI programs have become particularly attractive to professionals and entrepreneurs from the Global South, offering access to the Schengen Area, the UK, Hong Kong, and more than 140 countries, at a fraction of the cost of OECD options. According to Harpaz interviews, Caribbean passports offer a unique strategic value. He states that for many of the middle-class professionals he interviewed in West Africa and South Asia, these programs were less about migration and more about accessing the world on better terms, getting visas faster, attending conferences, or opening bank accounts abroad. 26Harpaz, Y. (2019). Citizenship 2.0: Dual nationality as a global asset. Princeton University Press.

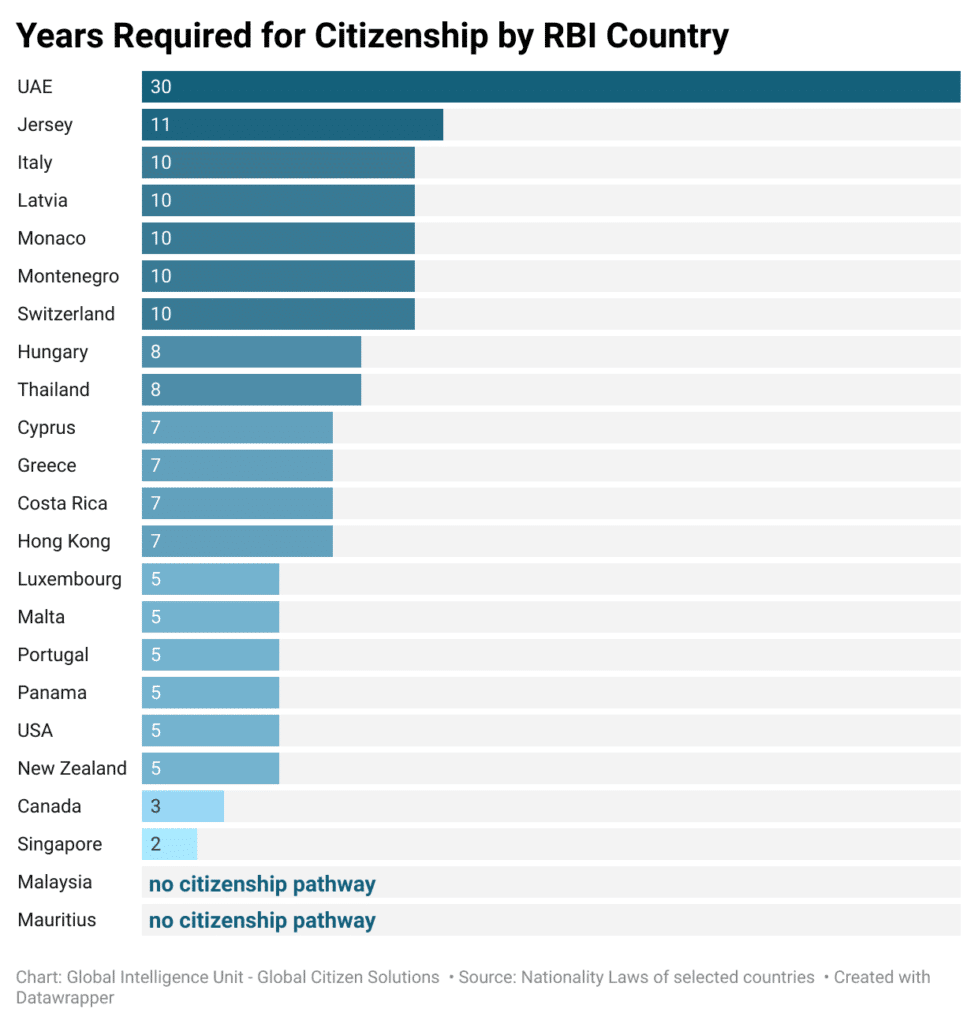

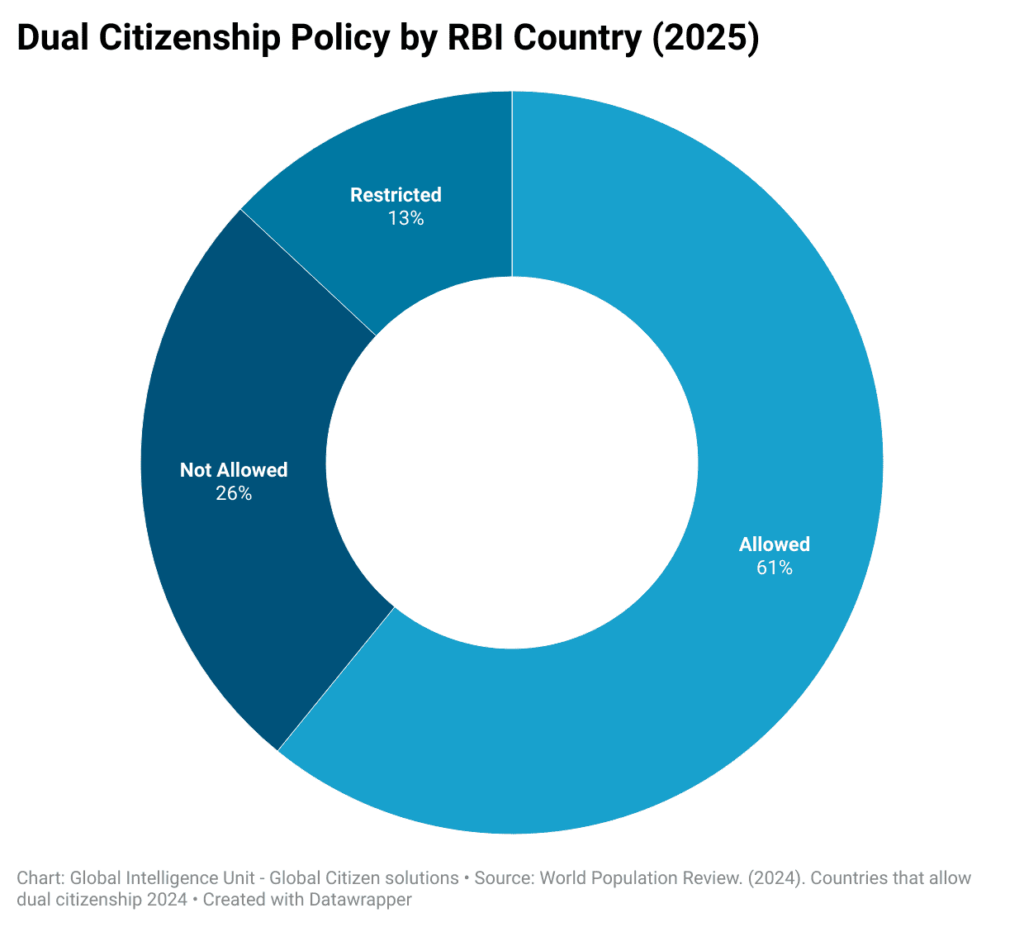

As countries liberalize their nationality laws, dual and multiple citizenships have become more widely accepted. The Global Citizenship Observatory reports that over 75% of countries now permit some form of dual citizenship, up from 50% two decades ago27Global Citizenship Observatory. (2023). Global Dual Citizenship Database. https://globalcitizenshipobservatory.org/. This has enabled individuals to maintain economic, social, and political ties across borders while expanding their mobility and opportunity sets.

As a consequence, we can now say that citizenship is no longer solely a marker of belonging to a nation-state; it has become an instrumental mechanism, a passport to participation in a complex web of global regimes governing investment, education, security, and digital innovation. It determines not only where a person can reside or travel, but also which financial systems they can access, what legal protections they can invoke, and where they can build institutions, invest capital, or educate their children.

This instrumental function of citizenship is increasingly reflected in how advanced economies structure their residency and citizenship regimes, not around traditional notions of assimilation, but around strategic alignment with national development priorities. The Singapore Global Investor Programme (GIP) is a case in point. In its 2023–2024 reforms, Singapore redefined investor eligibility to prioritize deep-tech founders, venture capitalists, and high-growth entrepreneurs, requiring active operational involvement rather than passive capital deployment 28Singapore Economic Development Board. (2025). Global Investor Programme (GIP). https://www.edb.gov.sg/en/how-we-help/incentives-and-schemes/global-investor-programme.html. Applicants must now establish a registered business with a proven innovation component, employ local talent, and maintain economic presence, directly contributing to Singapore’s long-term strategic goals in advanced manufacturing, biotech, fintech, and digital services. This shift embodies what political economist Kristin Surak describes as “residency regimes as economic instruments of statecraft”, tools that not only bring in capital, but help sculpt a country’s human capital and innovation landscape 29Surak, K. (2021). Who wants to buy a visa? Comparing the uptake of residence by investment programs in the European Union. Migration Studies, 9(3), 431–452..

Similarly, the United Arab Emirates, through its expanded Golden Visa program, has transitioned from primarily investor-focused selection to targeting highly skilled human capital, including scientists, engineers, top-performing students, and specialists in fields like artificial intelligence, space research, and medicine. The UAE’s Golden Visa now includes 10-year residency options for those who contribute to its “knowledge-based economy” 30Government of the United Arab Emirates. (n.d.). Golden visa. The Official Portal of the UAE Government. Retrieved April 29, 2025, from https://u.ae/en/information-and-services/visa-and-emirates-id/residence-visas/golden-visa. This move aligns with the country’s Vision 2031 plan, which explicitly aims to transform the UAE into a global hub for innovation and digital infrastructure. By broadening eligibility beyond financial capacity to include intellectual capital and technical expertise, the UAE signals that modern residency frameworks are tools of national competitiveness, designed to attract and retain those who drive long-term societal value.

This evolution reflects a broader pattern: as countries enter geopolitical competition for talent, investment, and innovation, they are re-engineering their legal gateways—not just to attract wealth, but to shape their future economic and technological identities. Citizenship and residency have thus become filters for global relevance, allowing states to curate who gets access to their institutions and who contributes to their national development.

Investment migration must be understood not only as a private strategy but as a governance tool. Countries designing these frameworks must ensure that due diligence, anti-money laundering (AML) compliance, and long-term integration strategies are embedded in law and practice. As the ECJ ruling against Malta’s MEIN program in 2025 illustrates, legal legitimacy and sovereignty boundaries are increasingly tested. As of 2025, around 37 countries operate active investment migration schemes. The future of these programs will depend on their ability to withstand international scrutiny while demonstrating tangible socio-economic benefits. For policymakers, the challenge lies in balancing openness with oversight, and individual mobility rights with the integrity of national and regional legal orders.

Redesigning Borders: The Past, the Present and Future of Investment Migration in a Changing Global Landscape

As mentioned, the role of RCBI programs is evolving rapidly lately. The modern investment migration industry began in the late 1980s and early 1990s with small‐scale CBI initiatives. St Kitts and Nevis pioneered the first formal CBI program in 1984, and by 2000 roughly 15 countries had launched similar schemes.31Surak, K. (2023). The golden passport: Global mobility for millionaires. Harvard University Press. Yet until the early 2000s the sector remained relatively niche and lightly regulated. Since then, the number of RCBI programs has expanded markedly as such schemes have become a strategic tool for global risk mitigation, mobility planning, and economic diversification.

Assessing the exact number of RCBI programs is challenging, as definitions vary across jurisdictions (from “cash-for-citizenship” schemes to property-based golden visas and entrepeneurs visas). However, the landscape has proliferated from roughly 15 schemes in 2000 to around forty active programs in by 2025. During this period, several programs were created and later phased out, such as Australia’s Business Innovation and Investment Program (BIIP), which closed to new applications in July32Department of Home Affairs. (2024, July 31). BIIP closure and refunds. Australian Government Department of Home Affairs. https://immi.homeaffairs.gov.au/visas/getting-a-visa/biip-closure-and-refunds, Cyprus’s Citizenship by Investment Program, terminated on November 1, 202033Global Citizen Solutions. (2025, March 24). Cyprus citizenship by investment suspended. https://www.globalcitizensolutions.com/cyprus-ends-citizenship-investment-program/, and more recently Spain’s Golden Visa, which officially ended on April 3, 2025.34Gobierno de España. (2024, April 9). El Consejo de Ministros aprueba la eliminación de la concesión de visados de residencia por inversión inmobiliaria [Press release]. La Moncloa. https://www.lamoncloa.gob.es/consejodeministros/Paginas/enlaces/090424-enlace-goldenvisa.aspx In any case, capital deployed through investment migration has grown exponentially: between 2011 and 2017, investments in just eleven major programs jumped from US $2.86 billion to US $12.4 billion, a compound annual growth rate of 23.4%, effectively doubling the market every three years. 35IMI Daily. (2018, June 6). Investment migration market would reach US$100 bn in revenue by 2025 if 23 % CAGR trend persists. https://www.imidaily.com/editors-picks/investment-migration-market-would-reach-us100bn-in-revenue-by-2025-if-23-cagr-trend-persists/Today, the global industry is conservatively valued at around US $20 billion per year.36IMI Daily. (2018, June 6). Investment migration market would reach US$100 bn in revenue by 2025 if 23 % CAGR trend persists. https://www.imidaily.com/editors-picks/investment-migration-market-would-reach-us100bn-in-revenue-by-2025-if-23-cagr-trend-persists/

Geopolitical instability has become a recurring feature of the international landscape, from the Russia-Ukraine war and the Israel-Gaza conflict to growing tensions between the U.S. and China. These events have not only triggered humanitarian crises and disrupted global markets but have also pushed many individuals to seek exit strategies from volatile regions. Investment migration offers a legal and structured pathway to achieve that, providing access to safer jurisdictions, economic opportunities, and more predictable rule of law.

As instability intensifies, demand for RCBI programs is expanding beyond traditional motivations like tax optimization or travel convenience. Increasingly, families seek second residencies or citizenships as a “Plan B” for physical safety, healthcare access, and educational continuity. In the super-election year of 2024, at Global Citizen Solutions we noted a double-digit surge in demand from nationals of politically and economically unstable countries, alongside a broader uptake from citizens of developed nations grappling with internal polarization.

Regarding the demographics of ultra-high-net-worth individuals (UHNWIs), the period between 2018 and 2024 witnessed a significant increase in the desire to acquire a second passport across several regions. Africa experienced one of the most notable surges, with interest rising from 27% in 2018 to 38% in 2024. This surge in wealth generation complemented the rising demand for alternative citizenship options, as affluent Africans sought to hedge against regional instability and mobility limitations. This upward trend can be attributed to persistent political instability, security concerns, and economic challenges across parts of Sub-Saharan Africa, compounded by increasingly restrictive mobility conditions for African passport holders. At the same time, the wealth held by UHNWIs in Africa grew by approximately 30% between 2018 and 2024, expanding the pool of individuals with sufficient resources to allocate toward acquiring a second citizenship.37Knight Frank. (2024). The wealth report 2024. Knight Frank LLP. https://content.knightfrank.com/resources/knightfrank.com/wealthreport/the-wealth-report-2024.pdf

Latin America maintained consistently high levels of interest, fluctuating slightly from 45% to 43%, reflecting ongoing structural issues such as economic volatility, high inflation, governance crises (particularly in countries like Venezuela and Argentina), and rising insecurity, all of which continue to drive demand for greater mobility and asset protection. In North America, interest nearly doubled over the same period, climbing from 16% to 26%, largely fueled by growing domestic polarization, political uncertainty, and apprehensions over potential tax policy shifts in the United States and Canada. The turbulence associated with election cycles, heightened social unrest, and debates around wealth taxation and regulatory changes have reinforced the perception among wealthy individuals that securing alternative citizenship offers a crucial safeguard against emerging risks.38Knight Frank. (2024). The wealth report 2024. Knight Frank LLP. https://content.knightfrank.com/resources/knightfrank.com/wealthreport/the-wealth-report-2024.pdf

At the same time, the RCBI industry is under unprecedented international scrutiny. The European Union suspended visa-free access for Vanuatu passport holders in 2022, citing weak due diligence.39Council of the European Union. (2022, March 3). Council Decision (EU) 2022/366 on the partial suspension of the application of the Agreement between the European Union and the Republic of Vanuatu on the short-stay visa waiver[Official Journal L 69, 105–106]. https://eur-lex.europa.eu/eli/dec/2022/366/oj Caribbean countries, long-time CBI pioneers, are now negotiating with the U.S. to strengthen screening standards or risk diplomatic repercussions.40Citizens International. (2024, September 10). Caribbean nations to establish joint CBI regulator following US Treasury talks. https://citizensinternational.com/caribbean-nations-to-establish-joint-cbi-regulator-following-us-treasury-talks These developments highlight the growing expectation that RCBI programs align with international norms on security, transparency, and anti-money laundering (AML) compliance.41Financial Action Task Force & Organisation for Economic Co-operation and Development. (2023). Misuse of citizenship and residency by investment programmes. https://www.oecd.org/els/misuse-of-citizenship-and-residency-by-investment-programmes-ae7ce5fb-en.htm

Yet this pressure is also pushing innovation. In response to mounting international pressure for greater transparency and security, several key investment migration jurisdictions have introduced substantial reforms. In July 2023, St. Kitts & Nevis established a new Citizenship by Investment Board of Governors to provide independent oversight and enhance due diligence within its CBI process, a move largely driven by demands from the U.S. and the European Union.42Citizenship by Investment Unit of St. Kitts and Nevis. (2023). Introduction of the Board of Governors for Citizenship by Investment oversight. Government of St. Kitts and Nevis. Similarly, Portugal restructured its Golden Visa program in October 2023, eliminating most residential real estate investment options and redirecting eligibility toward productive sectors such as technology startups, research and development, and green affordable housing projects.43Government of Portugal. (2023). Amendments to Law 23/2007: Changes to the Golden Visa program. Diário da República.

Malta, throughout 2023 and early 2024, tightened its due diligence protocols for the its scheme, introducing multi-tier vetting, mandatory third-party compliance verification, and reinforcing transparency standards in line with international best practices.44Malta Individual Investor Programme Agency. (2023). Reforms in due diligence procedures for Maltese citizenship by investment. Government of Malta. This vision was reflected in Malta’s MEIN program, which, in full alignment with the European Commission’s earlier recommendations, implemented a new legal and procedural framework precisely to foster genuine connections between applicants and the state.

Nevertheless, on April 29th, in an unexpected and significant departure from the Advocate General’s opinion, the European Court of Justice ruled against Malta, holding that even when robust due diligence and genuine links are established, a citizenship-by-investment scheme offering naturalization primarily on the basis of financial contributions infringes upon the principle of sincere cooperation and undermines the integrity of Union citizenship. The Court’s reasoning centered on the view that the grant of nationality, when decoupled from a deeper bond of integration and belonging beyond mere formalities, risks compromising the mutual trust among Member States essential for the functioning of the EU legal order.45Court of Justice of the European Union. (2024, April 29). Judgment of the Court (Grand Chamber) of 29 April 2024, European Commission v Republic of Malta, Case C-715/21. Curia Europa. https://curia.europa.eu/juris/document/document.jsf?text=&docid=298576&pageIndex=0&doclang=en&mode=lst&dir=&occ=first&part=1&cid=16942863 The impact of this judgment extends far beyond Malta or Europe alone; analysts are still actively assessing the broader constitutional, political, and commercial consequences this decision may trigger across global investment migration markets.

Also, in 2023, five Caribbean nations signed a Memorandum of Understanding (MoU) committing to minimum investment thresholds, mandatory applicant interviews, and harmonized vetting standards, under significant diplomatic encouragement from the United States.46Caribbean Community (CARICOM). (2023). MoU on Standards for Citizenship by Investment Programs. CARICOM Secretariat.

Another critical shift is the merging of RCBI with broader mobility and talent strategies. While investment migration schemes were initially designed primarily to attract passive FDI, currently RCBI programs are increasingly converging with broader global talent and mobility strategies. Countries such as the United Arab Emirates, Singapore and Canada are now pioneering hybrid schemes that blend traditional investment pathways with startup and innovation. For example, the UAE expanded its Golden Visaprogram in 2022–2023 to include not only investors but also entrepreneurs, scientists, outstanding students, and tech professionals47Government of the United Arab Emirates. (n.d.). Golden visa. The Official Portal of the UAE Government. Retrieved April 29, 2025, from https://u.ae/en/information-and-services/visa-and-emirates-id/residence-visas/golden-visa. Similarly, Singapore’s Global Investor Programme (GIP) now places greater emphasis on startup founders and deep-tech investors, requiring active operational commitments rather than merely passive financial placements.48Singapore Economic Development Board. (n.d.). Global Investor Programme (GIP). Retrieved April 29, 2025, from https://www.edb.gov.sg/en/how-we-help/incentives-and-schemes/global-investor-programme.html

RCBI is also being shaped by macroeconomic forces. As interest rates and inflation remain volatile in the post-COVID world, real estate-based investment routes are being reassessed for sustainability. Simultaneously, governments facing fiscal shortfalls are increasingly viewing RCBI as a legitimate way to raise revenue, provided the programs are credible, transparent, and politically defensible. Academic research reinforces the trend. A 2023 IMF working paper noted that investment migration can have positive effects on host economies if linked to public investment, job creation, and regional development. However, the same paper warned that poor governance and weak oversight could backfire, eroding international trust and leading to sanctions or restrictions.49Dziwok, C., & Gaspar, V. (2023). Investment migration: Macroeconomic effects and governance challenges (IMF Working Paper No. 2023/259). International Monetary Fund. https://www.elibrary.imf.org/view/journals/001/2023/259/article-A001-en.xml

Looking ahead, the future of RCBI lies in balancing opportunity with integrity. Programs that adopt rigorous due diligence, align with global frameworks, and prioritize long-term value over short-term gain will continue to thrive, even in a more fragmented world order. As global instability increases, the desire for safety, mobility, and sovereignty will only grow, making investment migration an enduring, if evolving, feature of the 21st-century global system.

Reflecting on the future of investment migration, Patricia Casaburi, CEO at Global Citizen Solutions, noted:“The future looks very promising. People are more mobile than ever. As we become increasingly interconnected as a global society, the desire to move flexibly across borders also increases. Amidst this, we are seeing more and more individuals actively seeking Plan B strategies that take into account combined opportunities. In other words, people are increasingly mixing and matching citizenship and residency solutions to fit their versatile needs.”

To fit individuals increasingly versatile needs, they are no longer seeking one-dimensional solutions but instead crafting personalized mobility portfolios that combine citizenship, residence, and even digital access rights across multiple jurisdictions. This evolving behavior reflects broader shifts in how wealth, security, and opportunity are conceptualized in a volatile global environment.

RCBI schemes are not disappearing; rather, they are evolving in response to the growing global desire for mobility and autonomy. As individuals seek greater flexibility in where they live, work, and invest, these programs are adapting to meet increasingly complex and personalized demands. The next generation of programs will be defined by their ability to offer not only personal security and enhanced mobility for individuals but also strategic, long-term value for host nations. Jurisdictions that design schemes aligning with broader national objectives (such as talent attraction, innovation ecosystems, regional development, and fiscal resilience) will position themselves to thrive. The freedom to choose where to live, work, and invest is no longer a luxury reserved for a few; it has become an existential necessity for globally minded individuals.

The CBI Index: Where to Secure a Second Citizenship

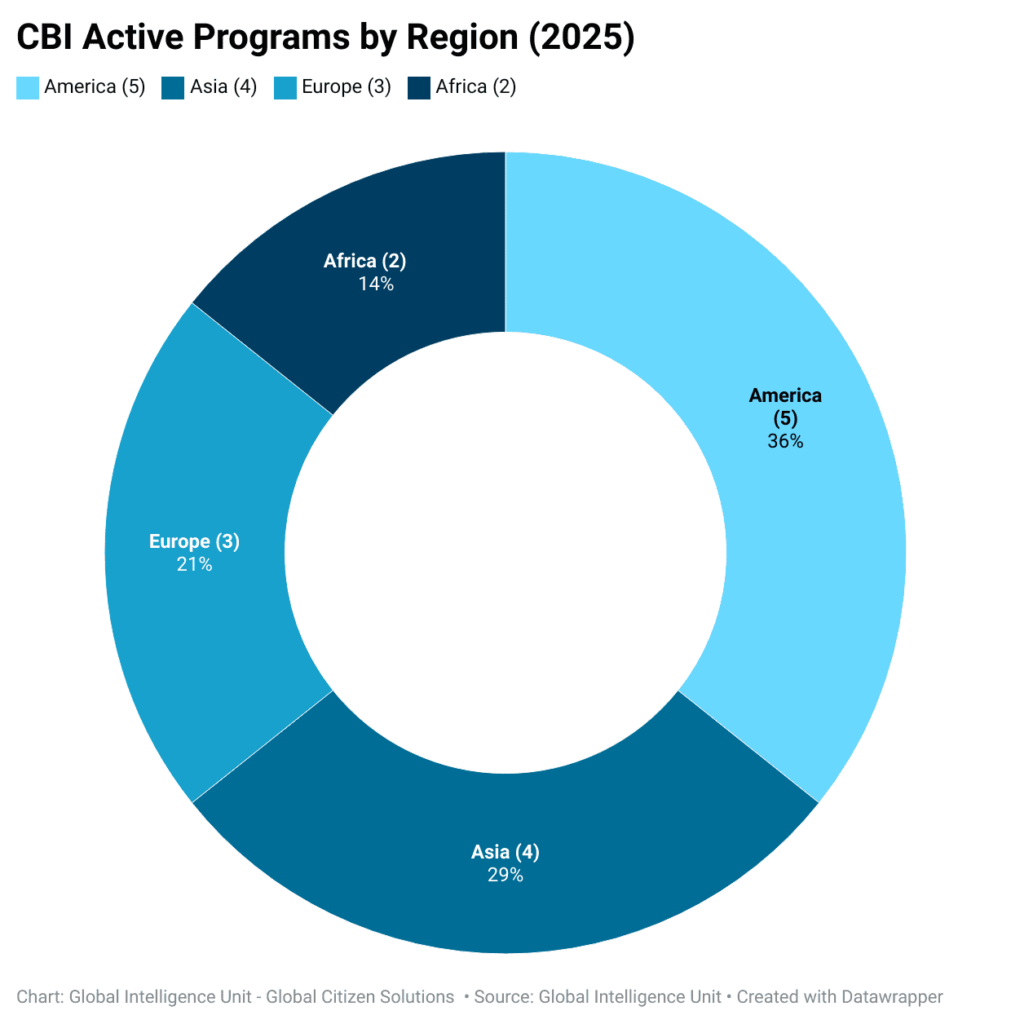

The CBI landscape in 2025 continues to evolve, offering investors a unique blend of opportunity, legal security, and global mobility. This report focuses on the 14 active programs ranked by their procedures and benefits, as captured in the Global Intelligence Unit RCBI Report. The ranking measures ease of application, efficiency, regulatory clarity, and inclusivity of family members, among other dimensions and well as quality of life, tax optimization, investment landscape and global mobility in each of the countries that offer a CBI option.

Regional Overview and Investment Profiles

- Caribbean Region: Known for its flexible investment options, moderate cost of living, and efficient processing timelines, Caribbean programs such as Antigua and Barbuda, St. Kitts and Nevis, Grenada, Dominica, and St. Lucia provide optimal family-friendly solutions. The best investment profile in this region suits individulas and families seeking fast-track citizenship with moderate investments and no residency requirements. The 2023 Memorandum of Agreement (MoA) among these nations has strengthened transparency and harmonized standards.

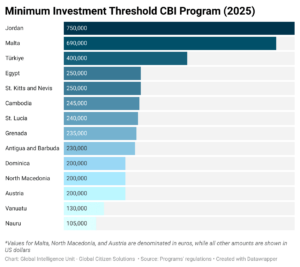

- Europe: Comprising Malta and Austria, European CBI programs offer access to the European Union and high-quality healthcare, education, and lifestyle. However, they come with significantly higher investment thresholds and processing times. Austria targets ultra-HNWIs with economic contributions of €3–10 million and exceptional merit, while Malta provides a structured three-tier model (see our assessment about the ECJ’s decision on Malta’s MEIN below). The ideal investment profile in Europe suits affluent investors prioritizing global mobility and EU access over speed.

- Other Regions (Asia, Oceania, Middle East, Africa): Countries such as Türkiye, Jordan, Egypt, Cambodia, Vanuatu, and Nauru form a diverse group with mixed entry points and regulatory environments. These programs often have lower entry thresholds and faster timelines. Ideal for cost-conscious investors seeking quick access and flexible requirements.

Country Overview

1st – Antigua and Barbuda

Quality of Life | Political Stability | Cost of Living | Investment Options | Minimum Investment |

Good | Very Safe | Moderate | 4 | US$230,000 |

Ranked 1st in the CBI Index and scoring 94.33 overall, Antigua and Barbuda remains a model of efficiency. Its Citizenship by Investment Act allows for four routes: donation to the National Development Fund (NDF), real estate acquisition, business investment, or contribution to the University of the West Indies (UWI) Fund. With a processing time of 6-9 months and a requirement to spend just five days in the country over five years, this program is both flexible and family-friendly. Spouses, children (including those under 30 or with disabilities), parents, grandparents, and siblings can all be included. The passport provides visa-free access to 148 countries.

Antigua and Barbuda’s top position is driven by stronger due diligence measures, including the introduction of mandatory interviews. It also saw gains in Certainty of Product due to adherence to the 2023 Memorandum of Agreement (MoA) among Caribbean nations.50In 2023, several Caribbean nations operating Citizenship by Investment (CBI) programs signed a Memorandum of Agreement (MoA) aimed at enhancing regional cooperation, transparency, and standardization. The agreement—initially signed by Antigua and Barbuda, Dominica, Grenada, and St. Kitts and Nevis, with Saint Lucia joining in 2024—commits participating countries to a minimum investment threshold of US$200,000, prohibits discounting, mandates enhanced due diligence and information sharing, and sets the foundation for a regional regulatory body to oversee compliance. These measures seek to improve the credibility and sustainability of CBI programs across the region and address growing concerns from international partners about program integrity and security. Organisation of Eastern Caribbean States. (2024, March 14). Caribbean countries pressing forward with the implementation of the Memorandum of Agreement on Citizenship by Investment Programmes. https://pressroom.oecs.int/caribbean-countries-pressing-forward-with-the-implementation-of-the-memorandum-of-agreement-on-citizenship-by-investment-programmes Antigua and Barbuda has embraced these principles, further reinforcing investor’s confidence.

2nd – St. Kitts and Nevis

Quality of Life | Political Stability | Cost of Living | Investment Options | Minimum Investment |

Good | Very Safe | Moderate | 4 | US$250,000 |

As the world’s oldest CBI program, established in 1984, St. Kitts and Nevis has long been a benchmark for quality and adaptability in the investment migration industry. Its program stands out for its multi-tiered investment flexibility, including the flagship Sustainable Island State Contribution (SISC), investments in public benefit projects, and government-approved real estate acquisitions. The country has taken a leadership role in implementing the MoA, reinforcing its reputation for robust due diligence, regional cooperation, and regulatory maturity.

Processing typically takes between 3 to 6 months, and applicants are not required to be physically present in the country at any point, making the program appealing to time-sensitive investors. The St. Kitts and Nevis passport offers visa-free access to over 160 countries, including the Schengen Area and the United Kingdom, making it one of the most powerful travel documents in the region. Its family-friendly policy, including eligibility for spouses and dependent children, further enhances its attractiveness among global investors seeking security, legacy planning, and international opportunity.

3rd – Grenada

Quality of Life | Political Stability | Cost of Living | Investment Options | Minimum Investment |

Good | Safe | Moderate | 2 | US$235,000 |

Grenada’s CBI program, restructured in 2024 under the Investment Migration Agency (IMA) and regulated by the Grenada Citizenship by Investment Act, offers a clean and simplified two-route structure: a donation to the National Transformation Fund (NTF) or investment in approved real estate developments. Known for its environmental consciousness and rigorous due diligence, Grenada also permits a broad definition of dependents, including siblings and unmarried children up to age 30.

What sets Grenada apart is its geopolitical reach. It is the only Caribbean CBI nation with visa-free access to China, and it maintains a bilateral investment treaty with the United States, enabling citizens to apply for the U.S. E-2 Investor Visa—a significant advantage for those seeking U.S. market access without going through traditional immigration channels. Although the application timeline is longer—6 to 9 months on average—the program does not require any physical presence, and the passport grants access to more than 140 countries worldwide. Grenada’s positioning appeals strongly to business-minded investors and high-net-worth individuals from the Middle East, Asia, and Africa.

4th – Dominica

Quality of Life | Political Stability | Cost of Living | Investment Options | Minimum Investment |

Good | Safe | Moderate | 2 | US$200,000 |

Dominica has earned global recognition for offering one of the fastest and most transparent CBI programs in the Caribbean. In operation since 1993, the program is widely praised for its speed, with processing timelines as short as 90 days, and for its commitment to sustainable national development. Investors can contribute to the Economic Diversification Fund (EDF) or invest in government-approved real estate. Revenues from the EDF have supported social infrastructure, climate resilience projects, and hurricane recovery—giving the program a development-oriented identity.

Applicants are required to undergo interviews and pass a multi-layered background check, reinforcing Dominica’s standing in the post-MoA era of enhanced due diligence. The program welcomes spouses, dependent children, and elderly parents/grandparents, offering a wide scope for family inclusion. Dual citizenship is allowed, and there are no residency requirements, making the process smooth for mobile families. The Dominica passport provides visa-free or visa-on-arrival access to 138 countries, making it a strong choice for applicants who value efficiency, transparency, and social responsibility.

5th – St. Lucia

Quality of Life | Political Stability | Cost of Living | Investment Options | Minimum Investment |

Good | Safe | Moderate | 4 | US$240,000 |

Launched in 2016, St. Lucia’s CBI program is the youngest among the major Caribbean offerings but has quickly distinguished itself through regulatory responsiveness and flexible structuring. Investors can choose from four routes: a donation to the National Economic Fund (NEF), investment in real estate, government bonds, or enterprise projects. The minimum qualifying threshold starts at US$240,000, making it one of the more competitive options in the region.

A standout feature of St. Lucia’s program is the inclusion of mandatory applicant interviews, a measure that strengthens its commitment to high due diligence standards in line with the 2023 MoA. Family eligibility is also generous, covering children up to age 30, spouses, and parents over 55. Processing takes between 3 to 6 months, and there is no requirement to reside or travel to the country. The St. Lucian passport grants visa-free access to 142 countries, including key financial and commercial hubs such as the Schengen Area, the UK, Singapore, and Hong Kong. Its blend of mobility, regulatory integrity, and modern administration makes it a strong contender for globally mobile professionals and international entrepreneurs.

6th – Malta

Quality of Life | Political Stability | Cost of Living | Investment Options | Minimum Investment |

Very Good | Safe | High | 3 | €600,000 - €750,000 |

Malta’s program, officially known as MEIN (Malta’s Exceptional Investor Naturalisation), has long stood as one of the most robust, transparent, and stringently regulated investment migration programs in the world. Applicants are required to obtain Maltese residency for a minimum of 12 to 36 months, depending on their investment level, before even becoming eligible to apply for citizenship. The program mandates a €600,000–€750,000 government contribution, a €700,000 real estate purchase or five-year lease at €16,000 per annum, and a €10,000 philanthropic donation to an approved NGO.

Regulated under Legal Notice 437 of 2020, MEIN permits the granting of citizenship to foreign nationals and their families who demonstrate a genuine connection to Malta through substantial economic contribution, verified physical presence, and a multi-tiered due diligence process that exceeds international anti-money laundering standards. With an annual cap of 400 naturalisation certificates and a lifetime ceiling of 1,500 (excluding dependants), the framework is both selective and highly controlled. Successful applicants are also subject to transparency rules, including publication in the Government Gazette. It is even challenging to categorize Malta’s MEIN as a classical CBI program, as the commitments required from applicants extend well beyond financial contributions. Instead, participants establish genuine and tangible connections to the country, reinforcing meaningful social and economic ties.

The program primarily targets both UHNWIs and HNWIs seeking EU citizenship. Processing takes approximately 24–36 months, and the program allows inclusion of spouses, dependent children, and parents. Malta’s passport provides visa-free access to 172 destinations, including full EU rights.

Yet despite these high standards, and the program’s clear effort to foster civic integration through economic and social ties, the European Court of Justice (ECJ) on April 29 delivered a ruling that declared MEIN incompatible with EU law. The Court argued that Malta’s exercise of sovereign discretion over nationality infringed upon the principles of mutual trust and sincere cooperation among Member States.

This judgment reflects a troubling shift in the EU’s constitutional order. By placing abstract and undefined conceptslike “genuine connection” and “mutual trust” above clearly enshrined individual rights and the sovereign authority of Member States, the ECJ has effectively reinterpreted the EU Treaties without democratic process or treaty reform. The ruling contradicted the opinion of Advocate General Collins, who had explicitly reaffirmed that nationality lies within the exclusive competence of Member States.

What we are witnessing is the quiet rise of silent federalism, a gradual yet profound shift in power where EU institutions extend their reach into areas like nationality, long held as sacrosanct by national constitutions. This ruling represents a stealth transfer of constitutional authority, sidestepping Member State consent and public deliberation. If citizenship policies, the ultimate expression of national sovereignty, can now be overridden at the Union level, the foundational balance between EU and national powers is at risk.

Furthermore, the ECJ’s ruling ignores fundamental principles of EU law: namely, legal certainty, legitimate expectations, and proportionality. Individuals who applied under the MEIN program did so in good faith, relying on the lawful and transparent framework established by Malta. The EU now risks breaching Articles 41 and 47 of the Charter of Fundamental Rights, which guarantee fair administration and effective access to legal remedies. Sweeping invalidation of these rights undermines public trust in both EU governance and Member State institutions.

While the Malta Permanent Residence Programme (MPRP) – referred to in the RBI section of the Global RCBI Report – remains unaffected by this ruling, the wider implications for Member States are significant. The decision sets a precedent where the EU may increasingly encroach on national competencies without formal treaty changes, deepening constitutional uncertainty and threatening the democratic legitimacy of Union law.

The ECJ’s ruling, far from promoting integration, risks destabilizing it by undermining sovereign prerogatives, setting aside legal precedent, and expanding EU jurisdiction through judicial interpretation. This is not just a court decision, it is a constitutional inflection point that challenges the boundaries of Union power and redefines the future of state sovereignty within the European project.

7th – Nauru

Quality of Life | Political Stability | Cost of Living | Investment Options | Minimum Investment |

Moderate | Moderate | Moderate | 1 | US$105,000 |

Launched in 2025, Nauru’s Economic and Climate Resilience Citizenship Program offers one of the most affordable and fastest options in the world. For a non-refundable donation of $105,000 to the Treasury Fund, applicants can obtain citizenship within 3–4 months. The program includes spouses, children, elderly parents, and siblings, with no residency or interview requirements.

While Nauru’s passport allows access to 94 countries, the country’s geographic isolation may make it less attractive some investors. Nevertheless, it remains a viable entry-level option for those seeking mobility and backup citizenship.

8th – Austria

Quality of Life | Political Stability | Cost of Living | Investment Options | Minimum Investment |

Very Good | Very Safe | High | Case by case | €3 - 10 million |

Unlike most Citizenship by Investment (CBI) programs, Austria’s pathway under Article 10(6) of its Citizenship Act is entirely discretionary, with no standardized investment route, no prior residence, and no language or civic integration requirements. Each application is evaluated case by case, based on the applicant’s exceptional economic contributions and the perceived benefit to the Austrian state, such as job creation or export growth. This highly selective and confidential model contrasts sharply with more structured programs like Malta’s MEIN or the Caribbean CBI schemes, which offer clear investment thresholds, defined timelines, and predictable application procedures. Austria’s model caters to ultra-high-net-worth individuals with strategic business influence rather than passive investors, making it arguably the most exclusive and opaque CBI program in Europe.

A key hallmark of Austria’s CBI program is its discretionary and confidential process. Applications are handled quietly, with no public disclosure of applicants or approvals, and decisions require ministerial-level authorization. The entire process is shrouded in confidentiality and involves extensive due diligence, including security, financial, and reputational checks. Because approvals are political in nature and based on perceived national interest, the pathway is inaccessible without high-level guidance and government support, adding to its exclusivity.

While Austria traditionally maintains a strict policy against dual citizenship, it makes explicit exceptions under Article 10(6). Individuals granted citizenship under this provision are typically allowed to retain their original nationality, a significant legal concession not commonly available through standard naturalization routes. This flexibility enhances the program’s appeal to global elites who wish to gain EU citizenship without forfeiting their original passports, particularly valuable given Austria’s strong passport and its rights within the European Union.

Austrian citizenship confers one of the most powerful passports globally, offering visa-free or visa-on-arrival access to 181 countries and full EU citizenship rights, including the ability to live, work, and study in any EU Member State. Beyond mobility, it provides access to Austria’s stable political and financial system, world-class healthcare, education, and legal protections. The passport’s strategic value, combined with Austria’s discretion-based granting of nationality, ensures that only a handful of highly qualified individuals obtain it each year, reinforcing its exclusivity and prestige.

9th – North Macedonia

Quality of Life | Political Stability | Cost of Living | Investment Options | Minimum Investment |

Good | Moderate | Low | 2 | €200,000 |

North Macedonia has emerged as a compelling option for global investors seeking a cost-effective and strategically positioned second citizenship. While not part of the European Union (EU), the country’s EU candidate status, competitive pricing, and straightforward process make its Citizenship by Investment (CBI) program an increasingly popular choice for high-net-worth individuals and entrepreneurs. The program is legally grounded in North Macedonia’s National Citizenship Law, and implementation is overseen by the Agency for Foreign Investments and Export Promotion, in collaboration with the Ministry of Interior and the Office of the President. All successful applicants receive citizenship by presidential decree, ensuring a formal constitutional basis for their new status.

The program offers foreign nationals the opportunity to acquire citizenship through an investment in either a government-approved development fund or a direct business venture that creates jobs for local citizens. This scheme requires no physical residence, language proficiency, or cultural integration requirements are imposed.

The program is remarkably efficient, with average processing times ranging from four to six months, and spouses and dependent children under 18 may be included under a single application. This accessibility, combined with speed and simplicity, positions North Macedonia as one of the most straightforward CBI options in Europe.

Citizenship confers access to the North Macedonian passport, which currently provides visa-free or visa-on-arrival access to 146 countries, including the Schengen Area, Japan, Turkey, Hong Kong, and most of Latin America. Though the passport does not match the power of EU Member States like Austria or Portugal, it remains a solid mobility tool, especially for individuals from countries with more restricted travel options.

Importantly, North Macedonia is a candidate for future EU membership, and its continued alignment with European Union standards adds a layer of long-term strategic value. While no specific date is set for accession, citizenship acquired today could position holders to benefit from increased rights and mobility in the event of EU entry.

10th – Vanuatu

Quality of Life | Political Stability | Cost of Living | Investment Options | Minimum Investment |

Moderate | Moderate | High | 2 | US$130,000 |

Vanuatu, a remote Pacific island nation known for its natural beauty and reliance on offshore services, has operated one of the world’s fastest and most affordable CBI programs. Administered primarily through the Development Support Program (DSP) and the Capital Investment Immigration Plan (CIIP), the initiative has historically appealed to individuals from emerging markets seeking quick, uncomplicated access to a second citizenship. With a minimum contribution of just $130,000 and processing times of one to two months, it quickly became a favorite among time-sensitive applicants. However, recent international scrutiny (particularly from the European Union) has forced Vanuatu to reevaluate the integrity and sustainability of its program.

In 2022, the European Union suspended Vanuatu’s visa-free agreement with the Schengen Area due to serious concerns over the country’s lax due diligence practices, minimal transparency, and a high approval rate for applicants with questionable backgrounds. In response to these pressures, the government of Vanuatu introduced a series of reforms in 2024 aimed at rebuilding international trust and aligning the program with global standards. Chief among these reforms is the introduction of biometric passports with advanced security features, designed to counter identity fraud and reassure foreign authorities. The country also established a national security vetting unit to implement more robust applicant screening protocols. These measures bring Vanuatu’s vetting procedures closer to compliance with the recommendations of the Financial Action Task Force (FATF) and the OECD, particularly with regard to anti-money laundering (AML) obligations and the handling of politically exposed persons. The country’s heavy financial reliance on the CBI program (reportedly contributing up to 40% of national revenue) has created an incentive structure for development.

The profile of applicants currently interested in Vanuatu’s CBI program has also shifted in light of the program’s reduced mobility value after the EU restrictions. While it once appealed to a broad swath of high-net-worth individuals from various regions, it now primarily attracts entrepreneurs, professionals, and politically exposed individuals from jurisdictions with limited passport strength. These applicants typically seek a strategic backup plan, asset protection, or fast mobility in non-Schengen destinations. Wealthier investors who once considered Vanuatu as a stepping-stone to global mobility have largely turned their attention to Caribbean programs with stronger reputations and wider travel benefits.

Despite these challenges, Vanuatu’s CBI program is not without potential. Its rapid processing, low cost, and inclusion of family members continue to make it attractive to a niche group of applicants. The 2024 reforms could serve as a turning point if implemented transparently and coupled with sustained engagement with international partners. Restoring visa-free access to the Schengen Area would be a game-changer, but achieving that will require not just policy adjustments but a fundamental shift in how the program is administered and perceived.

11th – Türkiye

Quality of Life | Political Stability | Cost of Living | Investment Options | Minimum Investment |

Good | Moderate | Low | 7 | US$400,000 |

Türkiye has positioned itself as one of the most flexible and strategically appealing destinations for individuals seeking a second citizenship. Since the launch of its CBI program in 2017, Türkiye has attracted thousands of applicants with its diverse range of qualifying investment routes, moderate entry thresholds, and relatively swift processing times. Designed to stimulate foreign direct investment and boost economic growth, the program has become particularly popular among investors from the Middle East, Central Asia, and parts of Africa.

Türkiye’s program distinguishes itself through the breadth of its investment options. Unlike many countries that restrict applicants to one or two predefined routes, Türkiye allows qualifying investments across real estate, capital markets, and entrepreneurship. The most common pathway involves the purchase of real estate with a minimum value of $400,000, which must be held for at least three years. However, applicants may also qualify by depositing funds into a Turkish bank, investing in government bonds or private pension funds, or launching a business that creates jobs for Turkish citizens. This array of choices offers flexibility for investors with varying financial profiles and risk appetites, making Türkiye’s program one of the most accessible among major economies.

The application process typically takes between 3 to 6 months, and citizenship is granted by presidential decree. There is no requirement to reside in Türkiye before or after obtaining citizenship, and the program allows the inclusion of the applicant’s spouse and minor children. For many, this ease of entry, combined with the country’s relatively low cost of living and dynamic real estate market, makes Türkiye an attractive alternative to more restrictive or expensive European schemes.

In terms of mobility, the Turkish passport offers visa-free or visa-on-arrival access to 134 countries, including Japan, South Korea, and much of Latin America. While it does not currently grant visa-free access to the European Union or the United Kingdom, Turkish citizens are eligible to apply for the U.S. E-2 Investor Visa, which allows for the establishment and operation of a business in the United States. This feature adds strategic appeal for business-minded applicants seeking access to the U.S. market.

The popularity of Türkiye’s CBI program has surged in recent years, particularly among applicants from Iran, Iraq, Russia, Pakistan, and various Gulf states. These individuals are often motivated by the desire for geopolitical stability, greater travel mobility, or access to Türkiye’s robust healthcare and education systems. In many cases, Türkiye is also seen as a cultural and linguistic bridge between East and West, a factor that resonates strongly with applicants from Muslim-majority countries.

Overall, Türkiye’s CBI program continues to offer a compelling mix of flexibility, speed, and affordability. It appeals to a broad demographic of investors looking for a second citizenship that delivers not only mobility, but also economic and strategic benefits. As global interest in alternative citizenship continues to rise, Türkiye’s model (grounded in economic pragmatism and geopolitical reach) remains one of the most competitive and adaptable programs in the investment migration landscape.

12th – Jordan

Quality of Life | Political Stability | Cost of Living | Investment Options | Minimum Investment |

Good | Moderate | Moderate | 3 | US$750,000 |

Launched in 2018, Jordan’s CBI program stands as a relatively low-profile but carefully structured offering in the global investment migration landscape. Designed to attract high-value investors while safeguarding national interests, the program provides a route to Jordanian citizenship through financial contributions that directly support the country’s economic development. Unlike many Western or Caribbean alternatives, but similar to Austrian CBI, Jordan’s model is characterized by its selective approach, higher entry thresholds, and emphasis on national security and political neutrality.

Under the terms of the program, foreign nationals may qualify for citizenship by making one of several qualifying investments. These include placing a non-interest-bearing deposit of at least $1 million with the Central Bank of Jordan for a minimum of three years, purchasing treasury bonds of equal value with a holding period of six years, or investing a minimum of $750,000 in an enterprise that creates at least ten jobs for Jordanian citizens. The investment options reflect a deliberate national strategy aimed at supporting fiscal stability, stimulating job creation, and reinforcing local entrepreneurship. The processing timeline is relatively efficient, averaging around 3 months, and the program allows for the inclusion of the main applicant’s spouse and dependent children.

Jordan requires applicants to physically visit the country to complete certain procedural and legal steps. This requirement underscores the government’s intent to ensure a minimum level of engagement and transparency throughout the process. Moreover, successful applicants are subject to certain legal restrictions, most notably a prohibition on holding political or public office for a defined period following naturalization. This provision is a unique safeguard within the CBI landscape and reflects Jordan’s commitment to maintaining political sovereignty and institutional integrity.

The Jordanian passport offers relatively modest mobility, granting visa-free or visa-on-arrival access to 85 destinations, including several Middle Eastern, Asian, and African countries. While it does not rival the travel freedom provided by European or Caribbean passports, it offers regional advantages and practical utility for individuals from neighboring countries where travel and personal security are more restricted. Moreover, Jordan’s longstanding political stability, close ties with Western powers, and reputation for moderate diplomacy add a layer of strategic value for those seeking safe haven in a volatile region.

Jordan’s CBI program has garnered interest primarily from investors across the Middle East, particularly from Iraq, Syria, and the Palestinian territories, as well as from diaspora communities with historical, cultural, or familial ties to the country. For many of these applicants, the appeal lies not in mobility but in access to a stable jurisdiction with rule of law, functioning institutions, and a business environment that (while still developing) offers growth opportunities in sectors such as technology, tourism, and healthcare.

Despite its relatively limited visibility on the global stage, Jordan’s CBI program represents a pragmatic and security-conscious model. It prioritizes economic substance, personal accountability, and national interest over speed and convenience. For investors who are less concerned with global mobility and more interested in regional access, legacy planning, and business integration, Jordan offers a citizenship path that is both respectable and grounded in long-term national development goals.

13th – Egypt

Quality of Life | Political Stability | Cost of Living | Investment Options | Minimum Investment |

Moderate | Less Safe | Low | 4 | US$250,000 |

Since its introduction in 2019 and subsequent revision in 2023, Egypt’s CBI program has quietly positioned itself as a pragmatic and flexible alternative in the competitive landscape of economic migration. Aimed at attracting much-needed foreign capital while strengthening Egypt’s geopolitical and economic ties, the program offers multiple investment pathways, moderate processing times, and access to one of the most influential cultural and commercial hubs in the Arab world. While it does not promise extensive visa-free mobility or swift family naturalization, the program provides unique regional value and long-term strategic potential.

Egypt’s CBI framework offers four qualifying investment routes. The first is a non-refundable contribution of $250,000 to the state treasury. The second option involves the purchase of state-approved real estate with a minimum value of $300,000. The third allows investors to start or fund a business in Egypt with a capital investment of at least $350,000, provided an additional $100,000 is contributed to the treasury. The final option, considered the most conservative, requires a $500,000 deposit into an Egyptian bank, refundable after three years without interest.

The program’s application process typically takes between 3 to six 6. While Egypt does not require permanent residency or cultural integration, all applicants must travel to the country at least once to complete the national identification process and biometric registration. This adds a layer of administrative engagement, signaling a desire for minimal physical ties without imposing long-term residency obligations. Once approved, applicants receive full Egyptian citizenship and access to services and protections offered to nationals.

One of the program’s key features is its generous family inclusion policy. Spouses and dependent children can be included in the application, and extended family members such as parents may also be eligible under certain conditions. However, there is an important caveat: while the main applicant is granted citizenship upon approval, family members are subject to a two-year waiting period before their status is finalized. This phased approach to naturalization is intended to strengthen security vetting and prevent misuse, though it may present a hurdle for applicants prioritizing immediate family migration.

Egyptian citizenship offers visa-free or visa-on-arrival access to approximately 97 countries. While the passport does not offer the same mobility as European or Caribbean equivalents, it includes access to several Middle Eastern, Asian, and African nations. More importantly, Egyptian citizens are eligible to apply for a U.S. E-2 Investor Visa, thanks to a bilateral treaty with the United States. This provision is a significant draw for applicants seeking commercial entry into the U.S. market, especially from countries not party to the E-2 agreement themselves.

The applicant pool for Egypt’s CBI program has largely been regional, with interest from Gulf countries, North Africa, and parts of South Asia. Many applicants are attracted not only by the affordable investment thresholds, but also by Egypt’s strategic location, growing economy, and access to regional markets. For diaspora communities and politically sensitive populations, the program also offers a viable exit route that remains culturally familiar and economically promising.

14th – Cambodia

Quality of Life | Political Stability | Cost of Living | Investment Options | Minimum Investment |

Moderate | Less Safe | Low | 2 | US$245,000 |

In a region where most nations avoid direct economic citizenship offerings, Cambodia’s CBI program stands out as one of Asia’s few formalized and enduring pathways to citizenship through capital contributions. Launched in 1996 and grounded in royal authority, the program provides a legal avenue for foreigners to acquire Cambodian nationality through state-approved investment or donation. Though its mobility benefits are modest compared to Western alternatives, Cambodia’s offering appeals to a unique subset of applicants seeking residence and integration in Southeast Asia through a long-established legal framework.

The program offers two qualifying options. The first is a non-refundable donation of US$245,000 to the national budget. The second route involves an investment of at least US$305,000 into a government-approved development project, typically in areas such as infrastructure, industry, or tourism. Both pathways must meet strict regulatory compliance and receive formal approval from Cambodian authorities. Once accepted, applicants are granted citizenship by royal decree, an honor reflecting the country’s monarchical tradition and sovereign control over nationality.

Cambodia’s program emphasizes cultural assimilation and physical presence. Applicants are required to travel to the country, register a local residence, and successfully complete tests in language, Cambodian history, and basic health screening. These measures underscore the government’s intent to ensure that new citizens possess a meaningful connection to the country, even if only at a basic level. While such requirements may be seen as barriers by some, they align with Cambodia’s national values and policy emphasis on integration over mere transactional benefit.

Processing times typically range up to six 6, and dual citizenship is legally permitted. This makes Cambodia an exception in Southeast Asia, where many countries restrict or prohibit multiple nationalities. The ability to retain one’s original citizenship while acquiring Cambodian nationality is particularly attractive to investors from countries with limited regional access or those looking to establish business or lifestyle footholds in the Mekong subregion.