This article serves as a comprehensive guide to Portugal’s Golden Visa Program. Here, you’ll learn about the scheme’s top advantages, the criteria for eligibility, and Portugal’s Golden Visa application process.

Whether you’re interested in European living, robust investment opportunities, or a combination of both, this ultimate guide will navigate you through the core aspects of the Golden Visa program in Portugal, equipping you with the knowledge needed to make an informed decision.

Some of the Golden Visa Portugal highlights include:

- Relatively affordable investment options to choose from (cultural and artistic donations, investment funds, business set-up)

- Minimum investment requirements starting from €250,000

- A requirement to spend a minimum period of seven days in the first year in Portugal, then a subsequent 14 days for every two-year period

- Family members included in the application (including spouse, dependent children, and parents)

- A pathway to become a Portuguese citizen after the fifth year

- Visa exemption to travel within the Schengen area

- Live in a safe country with affordable living costs and a high quality of life

In this Portugal Golden Visa – A Complete Step-by-Step Guide 2024, you’ll learn more about:

- What the Portugal Golden Visa is

- Key benefits of the program

- How to get the Portugal Golden Visa

- Documents required

- Application and renewal process

- Program costs

- Plus, much more.

March Update 2024: Portugal Announces Residency Waiting Time Now Counts Towards Nationality

In January 2024, the Portuguese parliament approved crucial changes to the nationality law, bringing relief to thousands of applicants affected by delays in residency application processing by SEF, now AIMA. This major revision addresses the waiting period required for Portuguese nationality applications.

The law was published on 5 March 2024 and will come into force on 1 April 2024.

What are the modifications to the nationality law?

Previously, under Article 6, Paragraph 1 of the nationality law, individuals looking to secure Portuguese nationality through naturalization were required to hold residency in Portugal for a minimum of five years, among other requirements. The initiation of the five-year period for nationality application was contingent upon the issuance of the initial residency permit.

Under this new legislative development, the amended Article 15, now incorporating Paragraph 1 of the nationality law, explicitly states that the time between the submission of the temporary residency permit application and its final approval will be taken into account when calculating the required legal residency period for nationality, as long as the residency permit is granted.

Positive Shift for Portugal Golden Visa Applicants

The significant changes to Portugal’s nationality law add a layer of anticipation to the positive changes for Golden Visa applicants.

Previously, applicants faced the stringent requirement of a minimum five-year residency period commencing from the issuance of the initial residency permit. This often translated to lengthy waiting times, with candidates enduring delays attributed to processing backlogs at the former SEF.

This means that those who have faced delays in residency approvals due to factors such as COVID-19, the Ukranian War, and the restructuring of the Portuguese immigration department will now have their waiting period considered, allowing them to apply for Portuguese nationality sooner. For example, individuals wishing to apply for Portuguese residency in 2024 would fulfill the five-year residency requirement for citizenship by 2029, irrespective of potential delays in the processing of the residency application.

This change is a key step towards enhancing the overall experience of individuals seeking to move to Portugal or those looking to secure Portuguese citizenship by naturalization.

Portugal Golden Visa: November Update 2023

Portugal’s Golden Visa Program went through significant changes, and the program no longer accepts the purchase of real estate or real-estate-related funds as qualifying investments.

While purchasing real estate is not available for Golden Visa investors, there are many other investment options that will continue to be eligible for the program. You can read more about the remaining Golden Visa investment routes in this guide.

Portugal Golden Visa Program: An Overview

What is the Portugal Golden Visa Program?

The Golden Visa, also known as the residence permit for investment activity (ARI), is a five-year residency-by-investment scheme for non-EU nationals. The scheme was introduced by the government in 2012 as part of Portugal’s immigration move to boost foreign investment and benefit the Portuguese economy.

The Golden Visa investment program is one of the most popular of its kind, with investors from across the world seeking residency through the scheme. Since the inception of the scheme, over 20,000 Golden Visas have been awarded to families from across the world, and over €4 billion in funds have been raised, making it one of the most popular investor programs in the world.

A highlight of the Portugal Golden Visa is that the program grants qualifying investors and their family members the right to live, work, and study in Portugal and allows for free movement in Europe’s Schengen Area.

From its mesmerizing Atlantic coastline and luscious landscapes to its year-round sunshine, Portugal is one of the most coveted countries in Europe. So, the Golden Visa stands as an attractive program, especially for Americans moving to Portugal.

Opportunities to become a permanent resident or Portuguese citizen are possible, provided that the qualifying investment is kept for at least five years and that all requirements set forth by the Portuguese immigration and nationality laws are obeyed.

Portugal Golden Visa 2024: What to expect?

The Portugal Golden Visa 2024 is poised to shift its focus towards investment funds, with a diverse array of sectors offering distinct investment mandates. This change is likely to open up new opportunities for Golden Visa investors seeking a more varied portfolio within the program. Furthermore, 2024 is expected to create fresh pathways within the cultural and arts category, providing applicants with alternative routes to obtain the highly sought-after residency permit.

The Key Benefits of Portugal's Golden Visa Program

The benefits of the Portugal Golden Visa are one of the main reasons why foreign investors are so vested in applying for and seeking residency in Portugal.

Some top benefits of the Portuguese Golden Visa program include:

Access to 27 nations in the EU and visa-free travel to 172 nations | |

Affordable investment options starting from €250,000 | |

Five-years until you qualify for a European passport | |

A sound investment in a buoyant market that can lead to real returns | |

Option to become a non-habitual resident and pay little to no tax for 10 years | |

Short stay requirement |

Family reunification

A winning benefit of the Golden Visa Program is that your dependent family can be included in the application. This means that your family can also enjoy the same freedom of opportunities and a second residence in a safe and stable country.

The following family members can be included in the Golden Visa application:

- Spouse or legal partner

- Children under 18 years of age

- Children of age provided that they are single, financially dependent, and enrolled as full-time students

- Parents of the main applicant or their spouse/partner, who, if under 65 years of age, must be financially dependent

Exceptional travel mobility

Holders of the Golden Visa enjoy visa-free travel within the Schengen Area, comprising 27 European countries. This facilitates easy exploration and business travel across a significant part of Europe.

The right to live, work, and study in Portugal

The Golden Visa grants residency to investors and their families, allowing them to live in Portugal.

Golden Visa holders have access to Portugal’s public services, including healthcare and education, similar to other residents.

Living in Portugal provides the opportunity for cultural immersion, language learning, and integration into the local community.

Pathway to European Citizenship and Passport

After five years of legal residency in Portugal, Golden Visa holders can apply for Portuguese citizenship (provided they meet the requirements).

After acquiring Portuguese citizenship through the Golden Visa, foreigners become eligible to obtain a Portuguese passport.

Portuguese citizenship grants foreigners the benefits of being a European Union (EU) citizen, including the ability to live and work in any EU member state. Moreover, the Portuguese passport offers visa-free access to 188 countries worldwide.

Attractive investment opportunities

Portugal’s stable and dynamic economy and exciting startup and tech scene make it an ideal destination for profitable investments with real returns.

The country has implemented structural reforms and developed various incentives, including tax benefits, subsidies, and alluring programs, such as the Golden Visa, making it an attractive destination for global investors.

Short stay requirement

The Portugal Golden Visa program is known for its low stay requirement. Investors are only required to spend a minimum of seven days annually in the country. This flexibility is a significant advantage for individuals who maintain global business commitments or travel frequently.

This feature accommodates individuals who may need to travel extensively for work or personal reasons while still enjoying the benefits of Portuguese residence.

Tax benefits

Portugal’s Golden Visa income tax benefits are a big draw for foreign investors looking to get the most out of their financial contributions.

Golden Visa holders don’t need to pay extra taxes on income produced outside of Portugal.

There’s also an option to register as a fiscal resident for tax purposes in Portugal. This is a fantastic option as it’ll allow you to directly benefit from Portugal’s Non-Habitual Tax (NHR) Regime. The NHR is a generous tax program with numerous benefits pertaining to your global income. It offers tax-free incentives on certain categories for a period of up to ten years.

- Dividends

- Real estate income

- Capital gains from the disposal of real estate

- Occupational pensions

- Royalties

- Business and self-employment profits derived from eligible occupations (but be mindful of relevant double taxation agreements)

Additionally, any Portuguese-sourced income would be taxed at a flat rate of 20 percent during the first ten years, and there is also the ability to pass on your wealth to a spouse or dependent without incurring inheritance or gift taxes.

Find out more in our complete guide to Portugal’s Non-Habitual Resident Tax Regime and the Portuguese Golden Visa tax benefits.

Is NHR ending?

The State Budget Law for 2024 determined the end of the NHR regime from 1st January 2024. However, certain individuals can still apply up until 31st March 2025, and the scheme is being replaced by the Tax Incentive for Scientific Research and Innovation, which has now been implemented. To learn more, please refer to Is The Portugal NHR Ending?

Eligibility: Who Is Eligible for a Golden Visa in Portugal?

Portugal Golden Visa eligibility criteria

To qualify for the program, you must fulfill the following Golden Visa requirements for Portugal:

- Have a clean criminal record. If you don’t have a clean criminal record, a lawyer should analyze your case.

- Be either non-EU, non-Swiss, or non-EEA national

- Minimum investment of €250,000, with a range of investment routes to choose from

- Spend an average of 7 days per year in Portugal, guaranteeing a total of 14 days during the validity of each residence card (issued with a validity of 2 years)

Golden Visa Portugal For US Citizens

As non EU citizens, US nationals are eligible to apply for the Golden Visa. Whether they want to enjoy the benefits of living in Portugal full-time or simply secure a profitable investment in the country, the program is particularly attractive for them.

Portugal is often praised for its affordable cost of living, especially when compared to US cities such as New York, San Francisco, and Chicago. This makes moving to the country as a US citizen extremely advantageous.

Not to mention that there are attractive tax incentives for foreign income, making Portugal an alluring place to move to.

Golden Visa Portugal For UK Citizens

Following Brexit, the UK is no longer a member of the EU, and UK citizens are now considered third-country nationals. In the context of the Golden Visa program, they would be treated similarly to citizens of other non-EU countries.

So, as the UK is no longer a member of the EU following Brexit, UK citizens are eligible to apply for the Golden Visa Portugal.

The program is also attractive for UK nationals, as it offers them the opportunity to enjoy Portugal’s high quality of life, beautiful landscapes, mild climate, and a relaxed pace of living.

Compared to some other Western European countries, Portugal is often considered more affordable, both in terms of living costs and property prices. This can be particularly appealing for UK citizens looking for a change in lifestyle or considering a second home.

While the Golden Visa program itself doesn’t guarantee citizenship, Portugal offers a pathway to citizenship for individuals who meet certain residency requirements. This can be advantageous for UK citizens seeking to maintain ties with Europe post-Brexit.

Investment Options for Portugal Golden Visa

Portugal’s stable and dynamic economy and exciting startup and tech scene make it an ideal destination for businesses looking to set up operations in the European Union.

The investment must be made before the application can be filed to get the Golden Visa permit.

In brief, here are the Portugal Golden Visa investment options:

- Fund subscription: Make a contribution to a qualified investment fund (such as private equity funds or venture capital funds) worth at least €500,000

- Investment or donation in the arts or reconstruction of national cultural heritage with a donation of at least €250,000

- Scientific research: Science or Technology research contribution of at least €500,000

- Creation of ten jobs: Creation and maintenance of ten jobs during the required period

- Share capital and job creation: Incorporation of a commercial company in the national territory or reinforcement of a company’s share capital (this company must have its head office in the national territory), in either case with an investment of €500,000, combined with the creation of five or maintaining ten jobs (five of them permanent)

- Real estate investment: Acquire a real estate property worth more than €500,000 in Portugal (NO LONGER ELIGIBLE).

- Real estate purchase: Buy real estate property, with construction dating back more than 30 years or located in urban regeneration areas, for refurbishing for a total value equal to or above €350,000 (NO LONGER ELIGIBLE).

- Capital transfer: Make a transfer of a value equal to or above €1.5 million (NO LONGER ELIGIBLE).

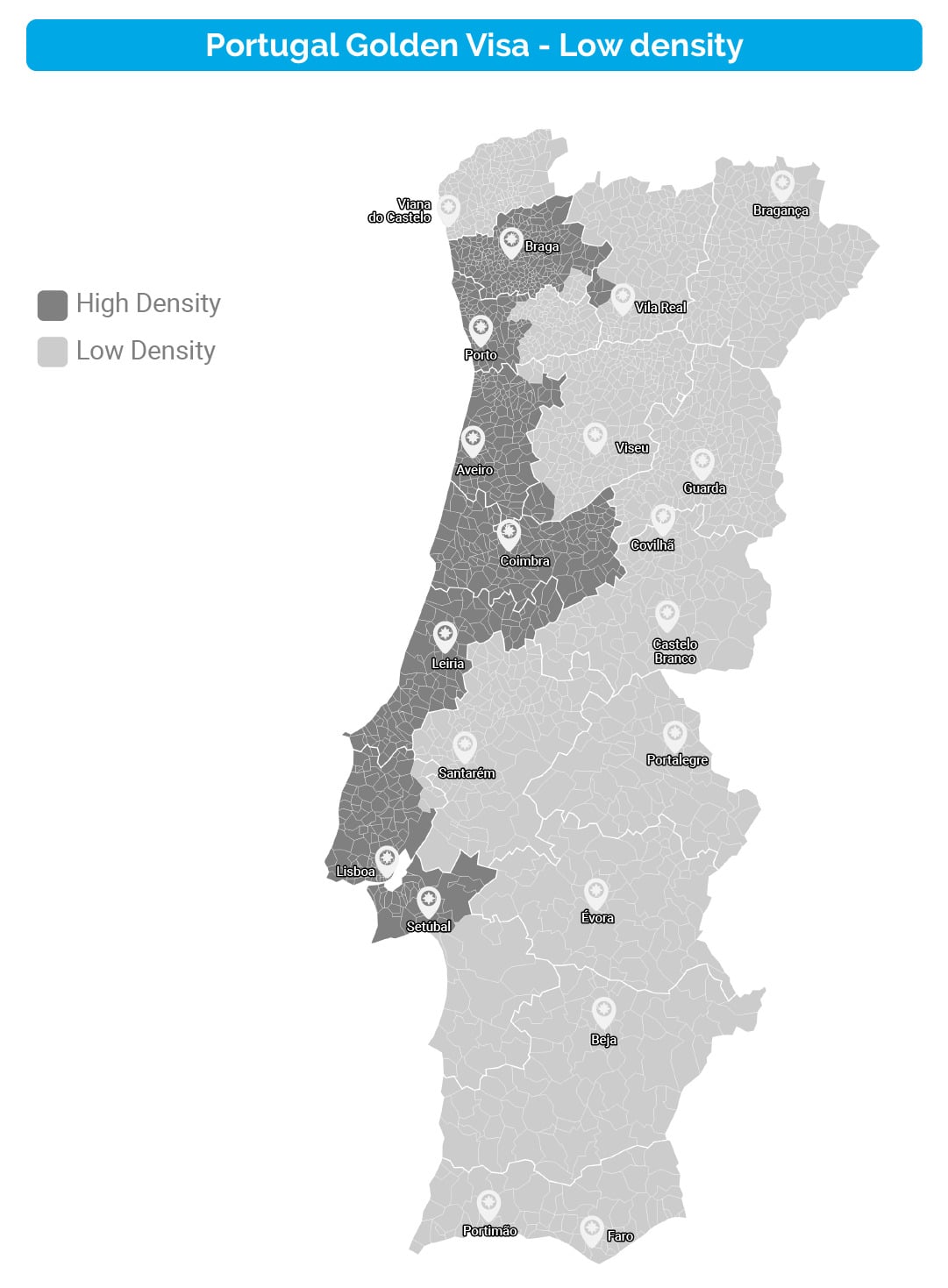

Please note that the minimum investment amounts for options 2 and 3 may be reduced by 20% when the investment activity is carried out in low-density areas, which are regions with fewer than 100 inhabitants per square kilometer or GDP per capita of under 75% of the national average.

See the Portugal Golden Visa map below for reference.

About the Portugal Golden Visa investment fund option

Investing in private equity funds or the Portuguese Golden Visa venture capital fund is a good option for acquiring residency in Portugal. The funds are managed by fund managers who are accredited by the Portuguese Securities Market Commission (CMVM), which is Portugal’s regulatory body. Your dedicated fund manager ensures that the Portuguese Golden Visa fund investments are appropriately managed within the eligibility scope of the Golden Visa.

For the Portugal Golden Visa fund investment route, you can choose from sectors such as energy, industry, and technology.

Keep in mind that the Golden Visa investment funds cannot directly or indirectly pursue real estate activities.

About the Golden Visa arts and culture option

Donating or investing a minimum of €250,000 into qualified projects in Portuguese Arts, National Heritage, or Culture.

For this Golden Visa route, please note that you will need to make a qualifying investment in an eligible project, which will need to be pre-approved by the Portuguese government through GEPAC.

Read: Portugal’s Cultural Production Golden Visa

About the company set-up option

Foreign entrepreneurs and investors can establish or invest in an existing Portuguese business. This investment may involve creating new jobs.

There are two investment options in this category:

- Incorporate a company in Portugal, with a share capital of €500,000 plus creating five permanent jobs

- Increase the share capital of an existing Portuguese company by €500,000 and fulfill the job requirements as stipulated by the Portuguese Government.

About the scientific research option

Golden Visa investors can also make a capital transfer equal to or more than €500,000 in research activities conducted by public or private scientific research institutions involved in the national scientific or technologic system.

About the creation of 10 jobs option

Under the Portuguese Golden Visa program, investors are obligated to create at least ten full-time jobs. In Low Density population areas, this number is reduced to eight. All these positions must be in line with Portugal’s labor and social security standards.

About the real estate option (NO LONGER ELIGIBLE)

- Purchasing real estate property with a value equal to or above €500,000.

For property investment through the acquisition of real estate with a value equal to or greater than €500,000, this investment can be reduced by 20% when carried out in low-lying areas in Portugal (NUT III level with less than 100 inhabitants per km2 or GDP per capita less than 75% of the average national).

- The purchase of real estate property that is 30 years old or more, located in urban regeneration areas, for refurbishing, for a total value equal to or above €350,000.

The value of this investment can be reduced by 20% when made in a low-density area (of Portugal).

Please note that only residential properties in the Azores and Madeira, as well as interior territories, are now eligible for the Golden Visa through residential real estate investment.

About the capital transfer option (NO LONGER ELIGIBLE)

Investment via capital transfer in an amount equal to or greater than €1.5 million to Portugal.

Chat with One of Our Golden Visa Consultants

Lifestyle choices vary, which is why we take the time to learn about your individual situation and requirements. We can simplify access to investments, provide local insights, help with legal assistance, tax planning, and more — all while ensuring an efficient, personalized, and confidential service.

Portugal Golden Visa Requirements

Minimum Stay Requirement

The Portugal Golden Visa requires you to spend an average of 7 days per year in Portugal, guaranteeing a total of 14 days during the validity of each residence card (issued with a validity of 2 years).

Golden Visa Investment Requirement

You are required to present supporting evidence that you have made the investment of the minimum amount required. A declaration of honor compromising to maintain the investment for five years is also needed.

Required documents for the Portugal Golden Visa

Important information about your documentation

The following Golden Visa Portugal documents required can change at the discretion of the Portuguese government. Also, the documents must be submitted by Golden Visa applicants for the initial application and each renewal.

The following documents are required to apply for the Golden Visa Portugal:

- Golden Visa application form

- Copy of a valid passport and travel documents

- Declaration from your bank in Portugal confirming the transfer of funds from abroad

- Proof of health insurance in Portugal (only required if the investor resides in Portugal)

- A background check or a police clearance letter from your country of origin

- A declaration of honor compromising to maintain the investment for five years

- Documents showing a good standing with the Portuguese Tax and Customs Authority

- Document showing non-enrollment or a good standing with the Social Security

- A receipt showing that you already paid the application processing fee

- Note that the certificates of criminal records or police clearance letters must have been issued no more than 90 days before submitting your application.

Legalizing documents

Portugal Golden Visa documents and the Portugal Golden Visa application form must be legalized and translated into Portuguese and then certified.

Note that documents can be legalized by the Portuguese Consulate or apostilled according to The Hague Apostille Convention, where applicable.

Translating Portugal Golden Visa documents

Original documents must be accompanied by a translation in Portuguese, certified by one of the three agents:

- A Portuguese Consulate

- A Portuguese lawyer

- An official notary

The Global Citizen Solution has a team of legal experts who can translate your Golden Visa documents.

Getting a Portuguese NIF Number

The NIF (Número de Identificação Fiscal) is your tax identification number in Portugal. It is a unique identifier assigned by the Portuguese tax authorities and is essential for several transactions in Portugal, such as opening a bank account, buying property, signing a contract, and paying taxes.

As your taxpayer ID, the NIF is a crucial piece of identification for anyone living or doing business in Portugal.

You can apply for a NIF by:

- Attending an appointment at the local tax office (Finanças), Citizen Shop, or at a counter that provides the Citizen Card

- Appointing a legal representative, such as a lawyer or an accountant to apply for it on your behalf

- Applying through a third-party provider that handles the entire NIF application on your behalf

In practice, it can be tricky to get an appointment to request the NIF number in Portugal, as most tax offices have a long queue for their NIF services that often start early in the morning, before opening hours.

Read this guide to getting a NIF Number in Portugal to learn more about this essential Golden Visa document.

Opening a Portuguese bank account

You’ll also need to open a Portuguese bank account for the Golden Visa.

To open a Portuguese bank account, Global Citizen Solutions can introduce you to a competent English-speaking banker in Portugal who can open a bank account before you even come to Portugal.

How to Get the Golden Visa in Portugal: A Step-by-Step Guide

To obtain the Golden Visa in Portugal, you must make a qualifying investment and keep the respective investment for five years. To submit your application, it is advised to consult with a Portugal Golden Visa lawyer or a Golden Visa consultant to see what documentation you need on top of your investment.

While the Golden Visa application is relatively straightforward, there are quite a few steps to take toward a successful Golden Visa process.

1. Onboarding: Initial discussions with the onboarding and legal teams covering the process as a whole and answering questions. Collect the necessary documents and ensure the correct paperwork. |

2. Bank account and NIF: In order to obtain the tax identification number (NIF) in Portugal, we will appoint a fiscal representative for you. After obtaining your NIF, we can help you open a bank account in Portugal. This can be done by us remotely and the Global Citizen Solutions will help you. |

3. Make the investment: We can begin securing your investment and will guide you through the necessary paperwork required to ensure a successful investment. |

4. Online application: Lodge your application online. |

5. Pre-approval: Your application will be pre-approved on the basis that you fulfill the necessary requirements. |

6. Biometrics visit: From the time you book your interview, it takes around two months until you can attend a biometrics collection session in person. |

7. Golden Visa issuance: After your biometrics, it takes around six months for your Golden Visa to be approved by AIMA (which replaced SEF as the Portuguese Immigration and Border Service). Pay the government permit issue fee. We'll then collect the residence cards on your behalf and send them to you. |

Portugal Golden Visa Processing Time

Year 0

The Golden Visa application and the supporting documents are submitted online to AIMA (former Serviço de Fronteiras e Estrangeiros – SEF). Once they approve your application, you then need to appear for an interview in person, in AIMA. As the main applicant, you and all your dependents can book the AIMA appointment simultaneously.

You’ll then need to wait between 9-12 months before your residence permit is issued. Once granted, the initial permit is valid for two years.

Year 2

After the two years are up, the residence permit must be renewed. The second permit is valid for two more years.

Year 4

The residence permit will be up for renewal at the end of year four. This can be renewed for another two years.

Year 5

You can apply for permanent residence and/or Portuguese citizenship at the end of the fifth year if you meet the requirements. Once the citizenship is granted, you can obtain a Portuguese passport.

Year 0

Golden Visa issued, now valid for 2 years

Year 2

Residency permit needs to be renewed. Valid for 2 years.

Year 4

Residency permit needs to be renewed. Valid for 2 years.

Year 5

Both permanent and residency citizenship my be requested otherwise GV will need to be renewed in year 6.

Portuguese Golden Visa Cost

| Application | Permit Issuance | Per Renewal *Expect to renew twice in a five-year period |

Total Over 5 Years | |

| Single Applicant | €773.74 | €7,730.10 | €3,865.79 | €16,235.42 |

| Couple | €1,547.48 | €15,460.20 | €7,731.58 | €32,470.84 |

| Family of Four | €3,094.96 | €30,920.40 | €15,463.16 | €64,941.68 |

Government application fees

The new Government Fees involved with the submission, granting, and renewal of the residence permit is, valid since the 29th of October, as follows:

- Online application submission – € 773.74

- Granting the permit – € 7,730.10

- Per renewal – € 3,865.79

All Government fees listed above are payable per person, whether a main applicant or a family member. There will be a discount on the amounts indicated above if the acts are done online.

Application legal fees

- Golden Visa application legal fees: Range from €5,000 to €8,000 for single applicants. Dependents younger than 18 years old can be included in the application free of charge.

- Additional Portugal Golden Visa application fees: For dependents aged 18 years and older, this will cost between €500 to €2,000. Note that children are free of charge.

Golden Visa renewal legal fees

- Renewal legal costs: For a single applicant: €1,000 to €2,500.

- Additional fees: For dependents aged 18 and above: €500-€2,000. Children are free of charge.

Note: Additional fees may apply depending on the investment you wish to make

Can I pay for the Portugal Golden Visa with cryptocurrency?

Global Citizen Solutions is a crypto-friendly company. We now accept cryptocurrency as payment for our services through the Coingate portal. While we do not have a point of sale directly set up on our website, payment with crypto, including Bitcoin, Ethereum, and Ripple, can be arranged by contacting us.

Global Citizen Solutions has already helped many crypto investors in acquiring their Golden Visa in Portugal and other citizenship-by-investment programs. We are happy to assist you every step of the way.

Also read: Portugal Crypto Tax and Cryptocurrency Ultimate Guide

Portugal Golden Visa Mortgage: Can you take out a loan or mortgage to pay for your investment?

A common question is if you can use a loan or a mortgage to secure your Golden Visa investment in Portugal.

You cannot take out a loan or mortgage from a Portuguese financial institution to pay for your investment. However, you can take out a loan from a bank outside of Portugal.

Portugal Golden Visa Renewal Process

Golden Visas can now be renewed on the AIMA website.

A temporary law was introduced to simplify the procedure for processing requests for renewals of residence permits for investment, including Golden Visas.

According to Article 207.º of the Portuguese State Budget for 2023 (Law number 24-D/2022), the simplified procedure predicts the following due diligence:

- Check the relevant databases to see if the person has been convicted of a crime that would make them ineligible for renewal.

- Check the relevant databases to see if the person is up to date on their taxes and social security payments

The new online system significantly speeds up the process for Golden Visa applicants to renew their visas while reducing the backlog of renewal applications that have built up in the last couple of years.

For new clients that are considering applying for the Portugal Golden Visa, this new development with the introduction of the online portal is a positive development. When it comes to the time for new investors to renew their visas, hopefully, the online renewal service will be an engrained feature in the Golden Visa processing procedure.

Golden Visa renewals are processing very fast, but there are still delays

Golden Visas could be renewed online until 31 December 2023. While this is no longer possible, the automatic online renewal process introduced by the former SEF has been reported to be quick at the time. Some of the first applicants who renewed their Golden Visa through this means reported receiving their new residency cards less than two weeks later. At the time when online renewals were available, a great advantage was that there did not seem to be a requirement to submit documents that SEF already had access to as part of the initial application.

While the initial Golden Visa application still includes an in-person biometrics visit and there remains a considerable application backlog, the fact that SEF now has less to do in terms of renewing existing applications can hopefully help clear the backlog at a quicker pace.

As part of the Golden Visa process, applicants need to attend an appointment at SEF to provide the required legal documents and for SEF to collect their biometric data. Once the Golden Visa application is analyzed by SEF and receives the go-ahead, SEF then indicates the dates available to schedule the appointment.

Many investors have taken cases relating to delays in obtaining a Golden Visa to court to speed up the process, with reports stating that, to date, SEF has lost hundreds of cases. It is this deadline provided in the law for appointments that the courts have made favorable decisions for foreign investors, whereby the delays in the process are not legal.

You can read more in our article: Portugal Golden Visa Delays Causing Applicants to Take SEF to Court to Speed Up the Process.

Portugal Golden Visa to Citizenship

Please note that if you want to get Portuguese citizenship after your five-year investment is up, you must fulfill the requirement of having a basic understanding of the Portuguese language (A2 level), either through a language course or the Portuguese language test.

You must also have a clean criminal record.

With citizenship under your belt, you can enjoy the right to live, work, and study anywhere in the EU and travel visa-free to 174 destinations.

Portugal Golden Visa News & Latest Updates

Is the Portugal Golden Visa Program ending?

No. The Portugal Golden Visa Program is not ending.

Despite the Portuguese Government announcing on 16 February 2023 that it would end its Golden Visa Program, the program is not going to come to an end.

On 19 July 2023, the Portuguese parliament voted to restructure the program. There will simply be changes to what type of investment will qualify for the scheme – namely, real estate investments will no longer be eligible for the program.

For more information, including continuous updates on the topic, please consult our articles: Portugal Golden Visa Changes and Portugal Golden Visa Ending: Everything We Know So Far

Portugal Golden Visa Updates: October 2023

The Portugal Golden Visa Program is experiencing significant transformations. With the implementation of the new legislation, real estate choices and capital transfers no longer serve as qualifying investment avenues within the program.

Nevertheless, numerous alternative investment pathways will remain eligible for participation.

Changes to investment options

When the new Golden Visa legislation is enacted, real estate options will no longer be an option. However, the program will continue to exist with the following investment options.

- Fund Subscription: Make a contribution to a qualified investment fund (such as a venture capital fund or private equity) worth at least €500,000

- Investment or donation in the arts or preserving national heritage with a donation of at least €250,000

- Scientific Research: Science or Technology research contribution of at least €500,000

- Creation of ten jobs: Creation and maintenance of ten jobs during the required period

- Share capital and job creation: Incorporation of a company or reinforcement of a company’s share capital, in either case with an investment of €500,000, combined with the creation of five or maintaining ten jobs (5 of them permanent)

To note

In addition to the specified investment avenues, the main consequences of this legislation encompass:

- Pending AIMA applications will be assessed in accordance with the laws at the time of submission.

- The minimum residency requirement for sustaining residence permits remains at an average of 7 days annually.

- The renewal process for residence permits will adhere to the original regulations.

- Family reunification is guaranteed under the same conditions as primary applications.

- Investment routes related to real estate and capital transfers will no longer qualify.

- The law will become effective the day after its official publication.

Portuguese Golden Visa Funds See Major Foreign Investment Boost

In 2023, foreign investment in Portuguese funds for Golden Visas surged, with over 125 million euros invested from January to September, marking a significant increase from previous years. Notably, 30% of golden visas issued in 2023 were linked to national funds. This investment trend saw a 45.4% increase compared to 2022 and was 2.6 times more than the combined investment of the previous three years. Sara Sousa Rebolo, president of PAIIR, highlighted the appeal of venture capital funds and the trend of diversification among investors. Legislative changes in 2023 further encouraged investment through collective investment instruments, driving growth in Portugal’s investment fund industry.

Portugal Golden Visa Statistics

Here, you can find the overall statistics for the Golden Visa from October 2012 until August 2023. In total, 12,396 investors and 20,000 family members have benefited from the Portugal Golden Visa during this time period.

Investment type

For the total number of Golden Visa applications, the investment types were as follows from October 2012 to August 2023.

- Real estate acquisition: 12,561 residence permits

- Real estate acquisition at a minimum value of €500,000: 9,454 residence permits

- Real estate rehabilitation at a minimum value of €350,000: 1,830 residence permits

- Capital transfer: 1,255 residence permits

- Capital transfer into a Portuguese bank: 555 residence permits

- Capital transfer into an investment Fund: 673 residence permits

- Capital transfer and the creation of jobs: 13 residence permits

- A donation into cultural heritage in Portugal: 8 residence permits

- A donation into research activities in Portugal: 6 residence permits

- The creation of ten full-time jobs: 22 applications

The Portugal Golden Visa Versus the Spain Golden Visa

With golden beaches, enticing foods, and excellent weather, both Spain and Portugal offer safe and stable lifestyles in the heart of Europe and straightforward ways to obtain temporary residence permits. However, key differences between the two programs exist, and it’s important to know what these differences are.

The main benefit of the Portuguese Golden Visa program in comparison to the Spanish one is that investments can be made for a lower amount, €250,000. Investors for the Golden Visa can also obtain a European passport in five years, whereas investors for the Spanish Golden Visa must wait ten years.

Check out our Portugal versus Spain Golden Visa comparison guide for more information.

Successful Golden Visa Journey: How We Can Help

Global Citizen Solutions is a boutique consultancy firm with years of experience delivering bespoke residence and citizenship-by-investment solutions for international clients.

With offices worldwide and an experienced, hands-on team, we help clients from around the world acquire Portuguese Golden Visas or homes while diversifying their portfolio with robust investments.

Here’s what we offer you:

- Global approach by local experts: A team of experienced local case executives, immigration lawyers, and investment specialists based in Portugal.

- Independent service: We are not a marketing agency for any projects. You will access all eligible routes for the Golden Visa so you can decide on the best option, and your investment will benefit from the legal, due diligence services of a reputable Portuguese Law Firm.

- 100% approval rate: We have the unique distinction of never having had a Golden Visa case rejected and have helped hundreds of clients from more than 35 countries.

- All-encompassing solution: Our dedicated onboarding and immigration teams will assist you throughout the process and beyond with a single channel of communication.

- Transparency: Our fees are clear and detailed, covering the entire process with no hidden costs.

- Privacy: Your personal data is stored within a GDPR-compliant database on a secure SSL-encrypted server.

Contact us today for a free consultation to see how we can understand your objectives and help you move towards becoming a global citizen.

If you want to invest or move to another country, our pioneering Global Passport Index is worth reading. Here, we analyze the strongest passports in the world, based not only on their visa-free travel to other countries but also on investment opportunities and quality of life. These factors are extremely relevant when considering second citizenship options.

You can read the full story here: Global Passport Index: Where Can Your Passport Take You?

Frequently asked questions about Portugal Golden Visa

What is the Portugal Golden Visa?

The Golden Visa in Portugal is a program that awards investors with residence permits in Portugal, provided that a qualifying investment is made in the country.

Is the Portugal Golden Visa still available?

Yes, you can still apply for the program, and the program will not end. However, the real estate and capital transfer investment options are no longer eligible.

Is Portugal going to scrap its Golden Visa scheme?

The Golden Visa will remain open for applications, and it will not be discontinued. Nevertheless, the new law came into effect, eliminating real estate and capital transfers as eligible investment pathways.

Are there any Portuguese Golden Visa new rules I should be aware of?

As of October 2023, the new law has passed redefining the qualifying routes for investment.

Find out more by visiting our article on the Portuguese Golden Visa changes.

How much do I need to invest for the Portugal investment fund Golden Visa?

To invest in the Portugal investment fund Golden Visa, you must contribute at least €500,000. There are different sectors that you can invest in, such as energy, industry, and technology.

Can I renew the Golden Visa online?

The online renewal process for the Golden Visa is no longer available.

The online renewal was introduced on January 2023 by article 207.º of the Portuguese State Budget for 2023 (Law number 24-D/2023), which stated that there would be a simplified procedure for processing requests for renewals of residence permits for investment, including Golden Visas, whereby visas and documents related to staying in the Portugal territory could be renewed online on the SEF website.

The introduction of the new online portal allowed Golden Visa holders to renew their residency permits online.

The new online system will significantly speed up the process for Golden Visa applicants to renew their visas while reducing the backlog of renewal applications that have built up in the last couple of years.

Do dependents qualify for the Portuguese Golden Visa?

Yes, Portugal Golden Visa dependents are also eligible to be part of your Golden Visa application for a fee.

Spain versus Portugal Golden Visa: Which program is better?

When comparing the Spanish versus Portugal Golden Visa, the better program will depend on what you’re looking for and how fast you want to get citizenship. For the Portuguese Golden Visa, investments start from €250,000, whereas for the Spain Golden Visa, investments start from €500,000. After five years with the Portuguese Golden Visa, you can get permanent residency and citizenship, but for the Spain Golden Visa, you must wait five years for permanent residency and ten years for citizenship.

Cyprus versus Portugal Golden Visa: Which program is better?

When comparing the Cyprus Golden Visa against the Portugal Golden Visa, the better program will depend on what you’re after. For Cyprus, qualifying individuals will need to make a minimum investment of €300,000 in the Republic’s economy. This investment must be placed in appropriate investment options that are stipulated by the Cypriot government. The timeline to citizenship is seven years.

The Portuguese Golden Visa investment threshold starts from €250,000, but the timeline to citizenship takes five years at least. There are also several investment options open to investors with the Portuguese Golden Visa.

What are the benefits of Portugal's Golden Visa?

There are many benefits to Portugal’s Golden Visa program. You have permanent free entry and movement throughout the Schengen Area (27 European countries). After five years, you can apply for Portuguese citizenship if you meet all the requirements under Portuguese Nationality Law. Also, your dependent children and dependent parents qualify for the same benefits as you.

What are the tax benefits of Portugal's Golden Visa?

There are many tax benefits to Portugal’s Golden Visa. These include investors only getting taxed on their worldwide income if they reside in Portugal for more than 183 days in any given year. Portugal also offers the NHR scheme, an attractive tax program providing tax-free incentives for up to ten years, depending on your income bracket.

What's the Portuguese Golden Visa business investment option?

The Portuguese Golden Visa business investment option offers investors the opportunity to generate ten jobs for a Portuguese business or single-member company. The Portuguese business investment can be reduced to generating eight positions if it’s located in a low-density area.

What are the Portuguese Golden Visa healthcare benefits?

There are many Portuguese Golden Visa healthcare benefits. If you are a holder of the Golden Visa in Portugal and are residing in the country (i.e., where you spend more than 183 days every year in the country), you are covered by Portugal’s healthcare system, with amazing discount rates. You will need to register at your local health center (Centro de Saúde). If you aren’t living in Portugal, you will need private health insurance in Portugal to cover you.

Do I need to do the Portuguese Golden Visa language test?

Portuguese Golden Visa applicants do not have to take the Portuguese Golden Visa language test to obtain a residency permit, although they must complete the test to gain citizenship. The test can be adapted for those under the age of ten and those with learning difficulties. Alternatively, you can take a Portuguese language course and get a certificate.

What's the Portuguese Golden Visa minimum investment?

The Portuguese Golden Visa minimum investment is €250,000 (investment into the arts), and you can choose from a range of investment routes.

How to obtain a Portuguese Golden Visa permanent residence?

To obtain the Portuguese Golden Visa permanent residency, you must make and maintain your qualifying investment for a minimum of five years. You must also spend a minimum of seven days in Portugal for the first year, then no less than 14 days each subsequent two-year period (this is called the stay requirement). You must also have a clean criminal record to get the Portuguese Golden Visa permanent residence card. You must also take the Portuguese Golden Visa language test to obtain a residency permit. The test can be adapted for those under the age of ten and those with learning difficulties. Alternatively, you can take a Portuguese language course and get a certificate.

Can I obtain citizenship with a Golden Visa in Portugal?

Yes, you can get both permanent residency and citizenship with a Golden Visa in Portugal after holding your investment for five years. You will need to ensure that you fulfill all the requirements set out under Portuguese nationality law.

What's the Portugal Golden Visa processing time?

The Portugal Golden Visa processing times usually take between 12 to 24 months for the approval and issuance of your residence card.

What are the Portuguese Golden Visa requirements?

The Portuguese Golden Visa requirements are straightforward. To qualify for the program, you must fulfill the following:

- Be either non-EU, non-Swiss, or non-EEA national

- Minimum investment of €250,000, with a range of investment routes to choose from, including arts and cultural donations, investment funds, and company creation

- Have a clean criminal record

- Spend an average of 7 days per year in Portugal, guaranteeing a total of 14 days during the validity of each residence card (issued with a validity of 2 years)

What is the SEF agency?

The SEF agency was the Portuguese Immigration and Borders Service. They were a security service within the Ministry of Internal Affairs responsible for documenting foreigners in Portugal, including issuing residence permits, residency renewals, and extending visas to foreign nationals in Portugal. SEF was recently extinguished and replaced by AIMA.

Should I consult a Portugal Golden Visa lawyer for the application?

Working with a Portugal Golden Visa lawyer is mandatory. This is because they know the rules and regulations inside out and can support you from the beginning to the end of your Golden Visa application.

What are the Portugal Golden Visa fees?

The new Government Fees involved with the submission, granting, and renewal of the residence permit is valid since the 29th of October, as follows:

- Online application submission – € 773,74

- Granting the permit – € 7730,10

- Per renewal – € 3.865,79

All Government fees listed above are payable per person, whether a main applicant or a family member.

What are the Portugal Golden Visa minimum stay requirements?

The Portugal Golden Visa requires you to spend an average of 7 days per year in Portugal, guaranteeing a total of 14 days during the validity of each residence card (issued with a validity of 2 years).

Is there a Portugal Golden Visa language requirement?

No, there is no language test requirement for the Portugal Golden Visa program.

What are the Portugal Golden Visa benefits and drawbacks?

One of the top benefits of the Golden Visa Program is having the right to live and work in Portugal. As a Golden Visa holder, you can enjoy visa-free within the Schengen Area. In addition, after holding the Golden Visa for a certain period, you can apply for permanent residency in Portugal. Not to mention that Golden Visa holders are not required to spend a specific amount of time in Portugal each year, making it flexible for those who want to maintain residency without extensive physical presence.

On the contrary, one of the biggest drawbacks of the Portuguese Golden Visa program is the cost. The visa has minimum investment requirements, which can be substantial.

Is it possible to get a Golden Visa Property in Portugal without a down payment?

No, it’s not possible to acquire a Golden Visa property in Portugal without a down payment because real estate investments are no longer eligible for the Golden Visa program in Portugal.

Is the Portugal HQA Visa Better than the Golden Visa?

Comparing the Portugal HQA Visa (Highly Qualified Activity Visa) to the Golden Visa involves assessing different residency pathways and eligibility criteria. The HQA Visa is intended for individuals engaged in highly qualified activities, such as employment or entrepreneurship, while the Golden Visa offers residency through investment in Portugal. Determining which visa is preferable depends on factors such as employment opportunities, investment capabilities, and long-term residency objectives.

Golden Visa, D2 Visa, or D7 Visa, which one to pick?

Choosing between the Golden Visa, D2 Visa, and D7 Visa depends on individual circumstances and goals. The Golden Visa offers residency through investment, the D2 Visa is for entrepreneurs establishing businesses in Portugal, and the D7 Visa is for individuals with sufficient passive income seeking residency. Deciding which visa to pick requires consideration of factors such as investment capabilities, entrepreneurial aspirations, passive income sources, and residency requirements. Consulting with immigration experts can help determine the most suitable option based on your specific situation and objectives.

Is it possible to get your money back with the Portuguese Golden Visa?