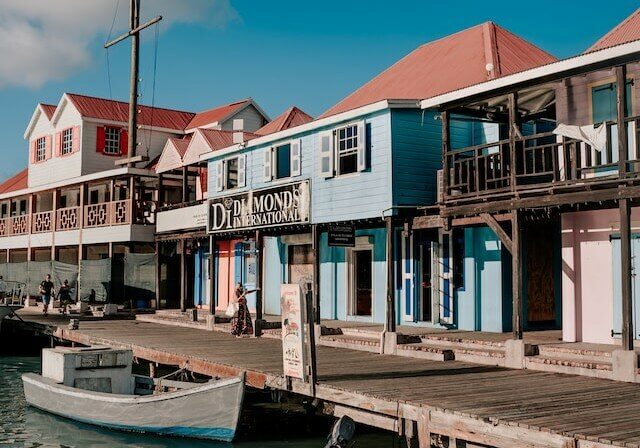

Antigua and Barbuda has caught the eyes of foreign investors, retirees, and remote workers with two advantageous visas to obtain residency in the country. Foreign nationals have the option of acquiring a permanent residency certificate by becoming Antigua and Barbuda tax residents with a $20,000 flat annual tax or obtaining digital nomad-based resident permits through an overseas annual income of at least $50,000.

This article will break down the requirements to obtain Antigua residency through the Permanent Residency Program and the Digital Nomad Visa, as well as list the benefits of holding a permanent residence permit in Antigua and Barbuda, including no income tax, inheritance, wealth, or capital gains taxes.

Antigua and Barbuda Residency Visas

When it comes to immigrating to Antigua and Barbuda, immigrants have few options to pick from, depending on their unique situation, of course. Whether your aim is to visit, relocate, or invest, the good news is it’s incredibly straightforward to immigrate to this gorgeous Caribbean island nation.

Antigua Tax Residency Program

The requirements to establish tax residency are:

- Maintain a residential address in Antigua and Barbuda

- Spend a minimum of 30 days each year in the country

- Have a minimum annual income of $100,000

- Payment of a flat tax of $20,000 per annum

The flat tax of $20,000 is all the taxation you will have to pay. Antiguan citizens and residents do not pay taxes on personal income, capital gains tax, or inheritance tax, making it an excellent permanent residence for investors looking to limit the necessary taxes they have to pay.

Required documents:

- Passport-size photograph

- Valid passport

- Medical insurance certificate

- Police certificate for each applicant over 16

- Proof of an annual income of at least $100,000

- $20,000 annual flat tax receipt

- Proof of relationship to dependents, such as a birth or marriage certificate

Antigua and Barbuda Nomad Digital Residence Program

The nomad residency program requirements are:

- Be 18 years or older

- Be employed outside of Antigua and Barbuda and be able to work remotely

- Have an annual income of at least $50,000

- Have a clean criminal record

Required documents:

- Passport-size photograph

- Valid passport

- Medical insurance certificate

- Police certificate for each applicant over 16

- Proof of an annual income from overseas of at least $50,000

- Proof of relationship to dependents, such as a marriage or birth certificate

Antigua and Barbuda citizenship

Besides these residency options, you may prefer to acquire Antiguan citizenship. If that’s the case, the Antigua and Barbuda Citizenship by Investment Unit runs an attractive immigration investment program for foreign nationals to obtain citizenship in the Caribbean community and asecond passport.

The Antigua and Barbuda Citizenship by Investment Program, one of five offered by Eastern Caribbean states, aims to draw foreign direct investment and promote economic growth. Applicants have a chance to obtain citizenship and an Antigua passport by either making a non-refundable contribution to the National Development Fund, purchasing real estate, establishing a business, or donating to theUniversity of the West Indies Fund.

You can either obtain Antigua citizenship as a single applicant for $100,000 or as a family unit, enabling you to relocate with your family and maintain permanent residence in the country. Antigua and Barbuda citizenship offers wealthy individuals and expat families increased security and visa free access to over 150 countries worldwide.

Feature | Antigua Tax Residency Program | Antigua Nomad Digital Residence Program | Antigua Citizenship by Investment Program |

Tax Identification Number | Yes | No | Yes |

Right to work in Antigua | Yes | No | Yes |

Antigua and Barbuda passport | No | No | Yes |

Right to live in other OECS member states | No | No | Yes |

Minimum residency | 30 days annually | No | 5 days within first 5 years |

Minimum income or investment requirement | $100,000 annual income plus annual tax fee of $20,000 | $50,000 annual income | $100,000 investment or more |

Validity period | Permanent, provided the program requirements are maintained | A maximum of two years | Permanent |

Application processing time | Two months | Five to seven working days | Three to six months |

Why Antigua and Barbuda permanent residency?

Expats enjoy the following benefits of Antigua permanent residency:

Tourism-based economy with numerous investment opportunities, including boutique resorts and luxury yachting

Good air connections with direct flights to London, New York, Miami, and Toronto

Obtain citizenship through a real estate purchase

Citizenship by investment program providing an Antigua and Barbuda passport in three to four months

Antigua and Barbuda passport unlocks visa free travel access to over 150 countries worldwide

A safe environment for family members in a secure and politically stable Caribbean country

Tax haven with no local or worldwide income tax, inheritance, capital gains, or wealth tax

Benefits of Obtaining Antigua and Barbuda Tax Residency

Obtaining Antigua and Barbuda tax residency lifts the burden of paying income, wealth, and inheritance tax.Antigua and Barbuda taxes include property tax, sales tax, and real estate transfer tax, but citizens and residents with an Antigua Tax Identification Number are not required to pay primary income taxes to the country’s Inland Revenue Department.

Obtaining an Antigua and Barbuda Tax Identification Number

The Antigua Tax Residency Program grants successful applicants Antigua permanent residency and a Tax Identification Number simultaneously. One you receive your permanent residency card, you can apply for a Tax Identification Number through the Inland Revenue Department.

Frequently Asked Questions about Antigua and Barbuda Residency Programs

Can I immigrate to Antigua?

You can immigrate to Antigua through the Antigua and Barbuda Permanent Residency Program or Nomad Digital Program. Alternatively, you caninvest in Antigua and Barbuda and obtain citizenship to move there permanently.

How do I become a resident of Antigua?

Expats who don’t plan to become Antigua and Barbuda citizens have two resident programs to choose from: The Permanent Residency Program (known as tax residency) and the Nomad Digital Residence Program. The Permanent Residency Program requires an annual income of at least $100,000 and a flat annual tax payment of $20,000. The Nomad Digital Residence Program requires a foreign-earned income of at least $50,000 per annum.

Is Antigua tax-free?

There are some taxes to pay in Antigua and Barbuda, but they tend to be low compared to the United States and other countries in the region. As a citizen or Antigua tax resident, you won’t have to pay worldwide income tax, inheritance tax, wealth tax, or capital gains tax. Antigua tax residents, under the Antigua and Barbuda Tax Residency Program, pay a $20,000 flat tax annually, regardless of the total income earned, either worldwide or locally generated.

Why do people migrate to Antigua?

People migrate to Antigua for a slower, relaxed pace of living, a safe environment with low crime rates, and a favorable tax regime, including no worldwide income, inheritance, or wealth tax. With the living costs being so low in Antigua compared to the US, it’s also easy to live a high standard of living at a lower cost.

A large number of investors purchasing Antigua or are setting up business headquarters on the island, thanks to numerous investment options as well as the opportunity to obtain citizenship in return.

Can US citizens live in Antigua?

Americans can live in Antigua and Barbuda if they have an annual income of $100,000 to qualify for the Permanent Residency Program or work remotely and earn at least $50,000 per year to qualify for the Nomad Digital Program. The Antigua economic citizenship also allows US citizens to permanently live in the country by purchasing Antigua real estate for at least $200,000 or donating $100,000 to the National Development Fund.

How do you qualify for PR in Antigua?

To qualify for an Antigua Permanent Residency Certificate, you must earn at least $100,000 annually, maintain a residential address in the country, spend at least 30 days per year in the country, and pay an annual flat tax fee of $20,000.